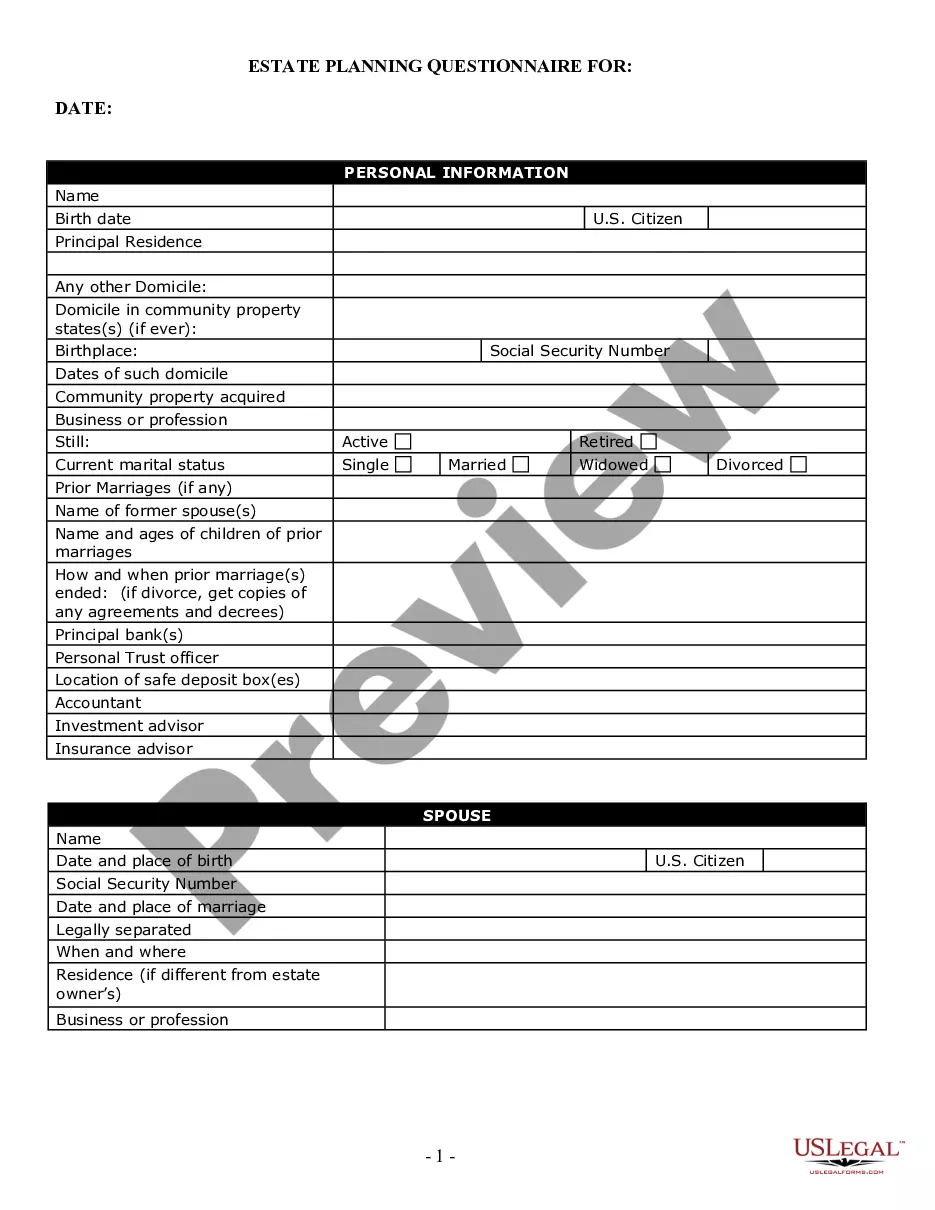

Paterson, New Jersey Estate Planning Questionnaire and Worksheets serve as indispensable tools for individuals seeking to plan their estate effectively. These comprehensive forms gather essential information, allowing individuals to outline their desires and preferences regarding asset distribution, guardianship decisions, healthcare directives, and other crucial aspects of their estate plan. By using these questionnaires and worksheets, residents of Paterson, New Jersey can ensure that their estate planning documents align with their wishes and comply with the state's legal requirements. The Paterson New Jersey Estate Planning Questionnaire and Worksheets encompass various sections, each focusing on different areas of estate planning. These encompass: 1. Personal Information: This section collects vital details such as the individual's full name, contact information, marital status, and family members' information. The questionnaire may also include questions related to any previous marriages or children from previous relationships. 2. Assets and Debts: Here, one can list their assets, including real estate, bank accounts, investments, retirement accounts, and personal belongings, along with corresponding details such as account numbers, approximate values, and ownership documentation. Debts such as mortgages, loans, credit card balances, and other liabilities will also be recorded. 3. Beneficiary Designations: In this section, individuals can specify the beneficiaries for their assets, including family members, friends, charitable organizations, and any specific bequests they wish to make. 4. Guardianship: This section is particularly important for parents with minor children. It allows individuals to designate a guardian who will care for their children if they were to pass away or become unable to fulfill their parental obligations. 5. Healthcare Directives: Individuals can express their preferences regarding medical decisions and end-of-life care in this section. It usually includes a healthcare proxy or power of attorney designation, living will, and instructions for organ donation or other medical-related wishes. 6. Executor and Trustee Nominations: Here, individuals can name the person(s) they trust to oversee the administration of their estate, distribute assets, pay debts, and fulfill various other responsibilities. 7. Miscellaneous: This section covers additional elements, such as funeral arrangements, digital asset management, and instructions for the disposition of sentimental or valuable personal items. By utilizing these Paterson New Jersey Estate Planning Questionnaire and Worksheets, individuals can ensure their estate plan is thorough, comprehensive, and tailored to their specific circumstances. It is recommended to consult with an experienced estate planning attorney or financial professional during the completion of these forms to ensure legal compliance and receive personalized guidance.

Paterson New Jersey Estate Planning Questionnaire and Worksheets

Description

How to fill out New Jersey Estate Planning Questionnaire And Worksheets?

Regardless of social standing or career position, completing legal documents is an unfortunate requirement in today's work environment.

Frequently, it’s nearly impossible for individuals lacking legal education to generate such documents from the ground up, primarily due to the intricate terminology and legal subtleties involved.

This is where US Legal Forms proves to be useful.

Ensure that the document you select is appropriate for your location, as the regulations of one state may not apply to another.

Examine the document and review a brief description (if available) regarding the instances for which the document can be utilized.

- Our platform offers an extensive collection with over 85,000 state-specific documents that cater to almost any legal scenario.

- US Legal Forms is also a valuable resource for associates or legal advisors seeking to enhance their efficiency by utilizing our DIY paperwork.

- Whether you need the Paterson New Jersey Estate Planning Questionnaire and Worksheets or any other relevant paperwork for your region, US Legal Forms has everything readily available.

- Here’s how you can quickly obtain the Paterson New Jersey Estate Planning Questionnaire and Worksheets using our dependable platform.

- If you’re already a subscriber, feel free to Log In to access the necessary form.

- However, if you are not familiar with our library, make sure to follow these steps prior to acquiring the Paterson New Jersey Estate Planning Questionnaire and Worksheets.

Form popularity

FAQ

Filling out an estate planning questionnaire involves gathering important information about your assets and beneficiaries. Start with the Paterson New Jersey Estate Planning Questionnaire and Worksheets, which guide you through essential questions about your property, family members, and any specific wishes you may have. Take your time to answer thoroughly, as this will help create a comprehensive estate plan that reflects your desires. If you need assistance, consider using platforms like uslegalforms to ensure every detail is captured accurately.

The 5 by 5 rule refers to a straightforward strategy for organizing your estate planning documents. It suggests that you should identify five key assets and five individuals who will help manage those assets after your passing. Using the Paterson New Jersey Estate Planning Questionnaire and Worksheets, you can easily outline this information and ensure that your wishes are clear. This approach simplifies your planning process and helps your loved ones understand your intentions.

The 5 by 5 rule in estate planning refers to a strategy that allows a beneficiary to withdraw up to $5,000 per year from an estate without incurring gift taxes. This provision can facilitate the transfer of wealth over time, making it easier for individuals to manage their inheritance. By understanding this rule, you can effectively use the Paterson New Jersey Estate Planning Questionnaire and Worksheets to tailor your estate planning strategy for maximum benefit. It’s essential to consider this rule when discussing your estate planning needs with professionals, ensuring efficient distribution of your assets.

An estate planning questionnaire is a vital tool that helps you organize your thoughts and information regarding your estate. This document typically prompts you to consider your assets, beneficiaries, and specific wishes for your estate. Comprehensively filling out a questionnaire can simplify the conversation with your attorney and streamline the planning process. Using the Paterson New Jersey Estate Planning Questionnaire and Worksheets can provide clarity and ensure you cover all important aspects of your estate plan.

In New Jersey, several key documents are essential for estate planning. You will need a legally binding will to articulate how you wish to distribute your property. A living will can provide directives regarding healthcare decisions, while a power of attorney will empower someone to act on your behalf in financial matters. Utilizing the Paterson New Jersey Estate Planning Questionnaire and Worksheets will help you identify and prepare these necessary documents tailored to New Jersey laws.

Estate planning requires several critical documents to ensure your wishes are honored. Key documents include a will, which specifies how your assets will be distributed, and a power of attorney that allows someone to make decisions on your behalf. Additionally, you might need a healthcare proxy to guide medical decisions if you become unable to communicate. To create a comprehensive plan, consider using the Paterson New Jersey Estate Planning Questionnaire and Worksheets to identify the best documents for your particular situation.

The estate planning process generally involves seven key steps that guide you towards effective planning. First, you should gather all relevant financial documents and information. Next, identify your goals regarding assets and beneficiaries. After that, evaluate your current estate plan, if you have one, and consider your tax implications. Then, choose appropriate legal structures, like trusts or wills, to meet your goals. Finally, implement your plan and regularly review it to ensure it aligns with any changes in circumstances. By utilizing the Paterson New Jersey Estate Planning Questionnaire and Worksheets, you can streamline this process.

The 5 or 5 rule indicates that a beneficiary may withdraw amounts from a trust that sum up to $5,000 per year or 5% of the trust’s value, whichever is greater. This rule is designed to provide flexible access to trust funds while still respecting the terms of the estate planning. For those utilizing the Paterson New Jersey Estate Planning Questionnaire and Worksheets, understanding this rule is crucial for effective financial planning.

One significant mistake parents often make is failing to clearly outline their intentions in the trust documents. Without precise guidance, beneficiaries may misunderstand their roles or the distribution of assets. Utilizing the Paterson New Jersey Estate Planning Questionnaire and Worksheets can help clarify these intentions and prevent potential family disputes later.

The 5 and 5 limitation is a key rule in estate planning that relates to gift tax exclusions. It allows individuals to withdraw from a trust up to the annual exclusion amount, which is currently $15,000, for five years. This means that someone can access a total of $75,000 without incurring gift taxes. Understanding this limitation is essential when working with Paterson New Jersey Estate Planning Questionnaire and Worksheets.