Albuquerque, New Mexico Individual Credit Application is a comprehensive form used by residents in Albuquerque to apply for credit from various financial institutions and lenders. Whether you're looking to secure a personal loan, credit card, mortgage, or any other type of credit, this application serves as a crucial step in the process. The Albuquerque Individual Credit Application captures essential information required by lenders to assess an individual's creditworthiness. It includes personal details such as the applicant's full name, current address, contact information, social security number, and employment history. Additionally, it requests information on the applicant's income sources, monthly expenses, and existing debts. To ensure accuracy, individuals need to provide supporting documentation along with their credit application. This may include recent pay stubs, tax returns, bank statements, and proof of residency. These documents help verify the applicant's income, stability, and financial situation. It's essential to mention that there might be different types of Individual Credit Applications available in Albuquerque, New Mexico, catering to specific credit needs: 1. Personal Loan Application: This type of credit application is designed for individuals seeking a lump sum loan for personal reasons like debt consolidation, home improvements, or unforeseen expenses. 2. Credit Card Application: With this application, individuals apply for a credit card, allowing them to make purchases on credit within a predetermined limit. Credit card applications often require additional information, such as employment details and the applicant's credit history. 3. Mortgage Loan Application: Those interested in buying a home or refinancing an existing mortgage can use this specific application. It delves deeper into the applicant's financial profile, addressing factors like income stability, assets, and debt-to-income ratio. 4. Auto Loan Application: This application is tailored for individuals looking to finance a new or used vehicle purchase. Lenders typically consider factors such as credit score, employment history, and the value of the car being financed. By accurately completing an Albuquerque, New Mexico Individual Credit Application, applicants provide lenders with all the necessary information to assess their creditworthiness and determine whether they qualify for the credit they are seeking. It's crucial to provide truthful and up-to-date information to increase the chances of approval and secure favorable credit terms.

Albuquerque New Mexico Individual Credit Application

State:

New Mexico

City:

Albuquerque

Control #:

NM-21-CR

Format:

Word;

Rich Text

Instant download

Description

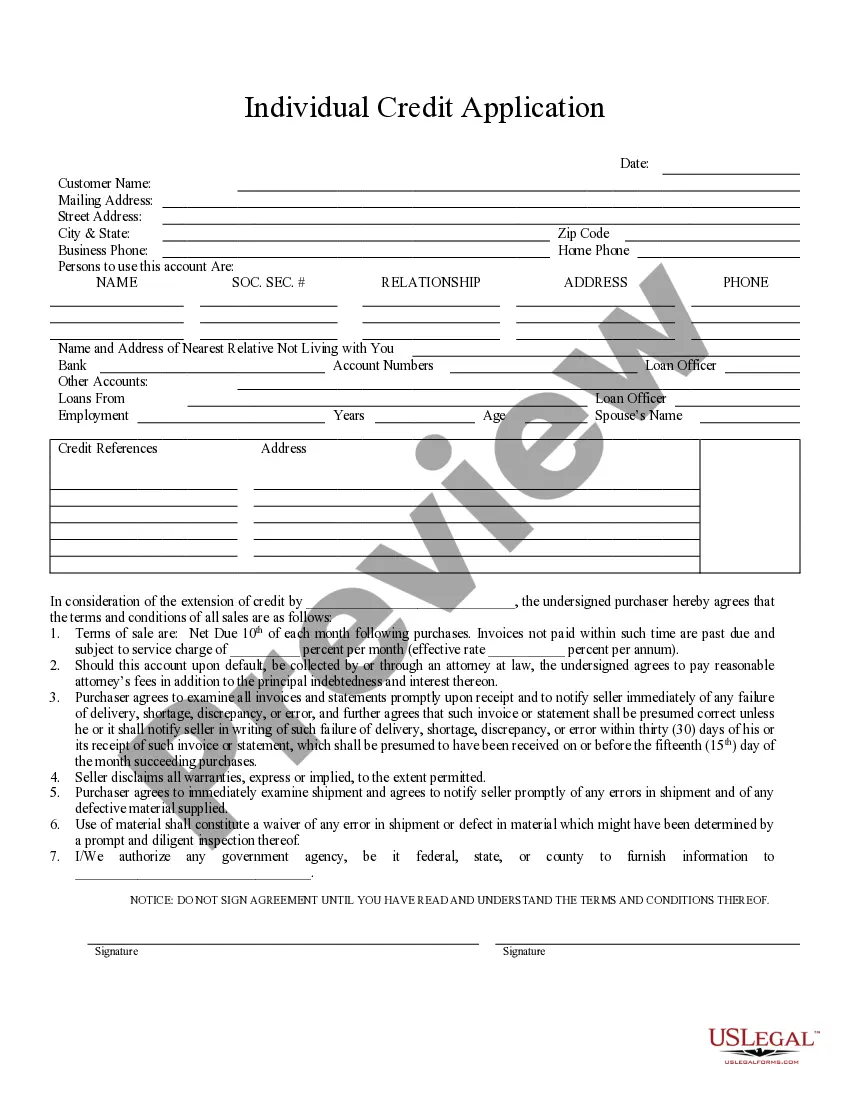

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Albuquerque, New Mexico Individual Credit Application is a comprehensive form used by residents in Albuquerque to apply for credit from various financial institutions and lenders. Whether you're looking to secure a personal loan, credit card, mortgage, or any other type of credit, this application serves as a crucial step in the process. The Albuquerque Individual Credit Application captures essential information required by lenders to assess an individual's creditworthiness. It includes personal details such as the applicant's full name, current address, contact information, social security number, and employment history. Additionally, it requests information on the applicant's income sources, monthly expenses, and existing debts. To ensure accuracy, individuals need to provide supporting documentation along with their credit application. This may include recent pay stubs, tax returns, bank statements, and proof of residency. These documents help verify the applicant's income, stability, and financial situation. It's essential to mention that there might be different types of Individual Credit Applications available in Albuquerque, New Mexico, catering to specific credit needs: 1. Personal Loan Application: This type of credit application is designed for individuals seeking a lump sum loan for personal reasons like debt consolidation, home improvements, or unforeseen expenses. 2. Credit Card Application: With this application, individuals apply for a credit card, allowing them to make purchases on credit within a predetermined limit. Credit card applications often require additional information, such as employment details and the applicant's credit history. 3. Mortgage Loan Application: Those interested in buying a home or refinancing an existing mortgage can use this specific application. It delves deeper into the applicant's financial profile, addressing factors like income stability, assets, and debt-to-income ratio. 4. Auto Loan Application: This application is tailored for individuals looking to finance a new or used vehicle purchase. Lenders typically consider factors such as credit score, employment history, and the value of the car being financed. By accurately completing an Albuquerque, New Mexico Individual Credit Application, applicants provide lenders with all the necessary information to assess their creditworthiness and determine whether they qualify for the credit they are seeking. It's crucial to provide truthful and up-to-date information to increase the chances of approval and secure favorable credit terms.

How to fill out Albuquerque New Mexico Individual Credit Application?

If you’ve already utilized our service before, log in to your account and download the Albuquerque New Mexico Individual Credit Application on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Albuquerque New Mexico Individual Credit Application. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!