Las Cruces New Mexico Legal Last Will and Testament Form for Single Person with Adult Children is a legally binding document that enables individuals to outline their wishes regarding the distribution of their assets and property after their passing. This form is specifically designed for single individuals who have adult children and want to ensure that their estate is divided according to their desires. These Last Will and Testament Forms are customizable based on the unique circumstances and preferences of the individual filling out the document. Here are some relevant keywords associated with Las Cruces New Mexico Legal Last Will and Testament Form for Single Person with Adult Children: 1. Last Will and Testament: The formal declaration of an individual's wishes regarding the distribution of their assets and property after death. 2. Las Cruces: Refers to the location where the will is being executed, specifically Las Cruces, New Mexico. 3. Legal Document: A legally binding and enforceable form that ensures the testator's wishes are carried out in accordance with state laws. 4. Single Person: Indicates that the will is intended for individuals who are not married or in a legally recognized partnership. 5. Adult Children: Refers to the children of the testator who have reached the age of majority, typically 18 years or older. 6. Estate: The total sum of an individual's assets, including property, investments, bank accounts, and personal belongings. 7. Beneficiaries: The individuals or organizations named in the will who will receive specific assets or property from the estate. 8. Executor/Executrix: The person designated by the testator to manage and distribute their estate as outlined in the will. 9. Guardian: If applicable, the person named in the will who will have custody of any minor children or dependents. 10. Witnesses: Individuals who must sign the will in the presence of the testator to validate its authenticity. Some potential different types of Las Cruces New Mexico Legal Last Will and Testament Form for Single Person with Adult Children may include: 1. Simple Last Will and Testament: A basic form that outlines the distribution of assets among adult children, without any complex provisions or special conditions. 2. Contingent Last Will and Testament: Includes instructions for the distribution of assets and property based on specific conditions or events, such as if a certain beneficiary predeceases the testator. 3. Testamentary Trust Last Will: Establishes a trust as part of the will, allowing for greater control over asset distribution and potential tax benefits. This trust is typically set up for the benefit of adult children. 4. Living Will and Testament: A more comprehensive document that not only outlines asset distribution but also includes provisions for healthcare decisions and end-of-life wishes. It is crucial to consult with an attorney or legal professional when creating a Last Will and Testament to ensure that it adheres to state laws and accurately reflects the testator's intentions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Las Cruces New Mexico Formulario Legal de Última Voluntad y Testamento para Persona Soltera con Hijos Adultos - New Mexico Last Will and Testament for Single Person with Adult Children

Description

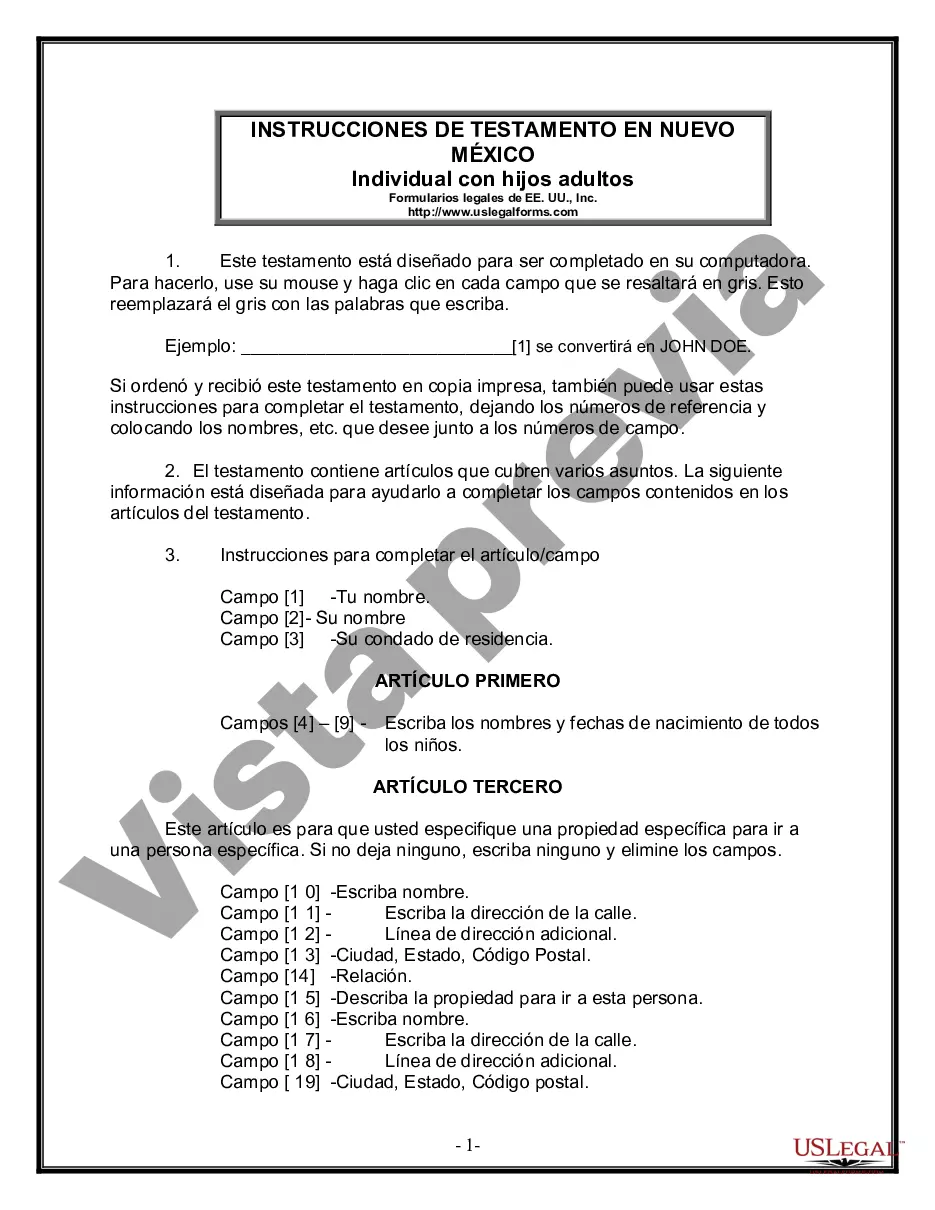

How to fill out Las Cruces New Mexico Formulario Legal De Última Voluntad Y Testamento Para Persona Soltera Con Hijos Adultos?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for legal solutions that, usually, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to an attorney. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Las Cruces New Mexico Legal Last Will and Testament Form for Single Person with Adult Children or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Las Cruces New Mexico Legal Last Will and Testament Form for Single Person with Adult Children adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Las Cruces New Mexico Legal Last Will and Testament Form for Single Person with Adult Children would work for your case, you can select the subscription option and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!