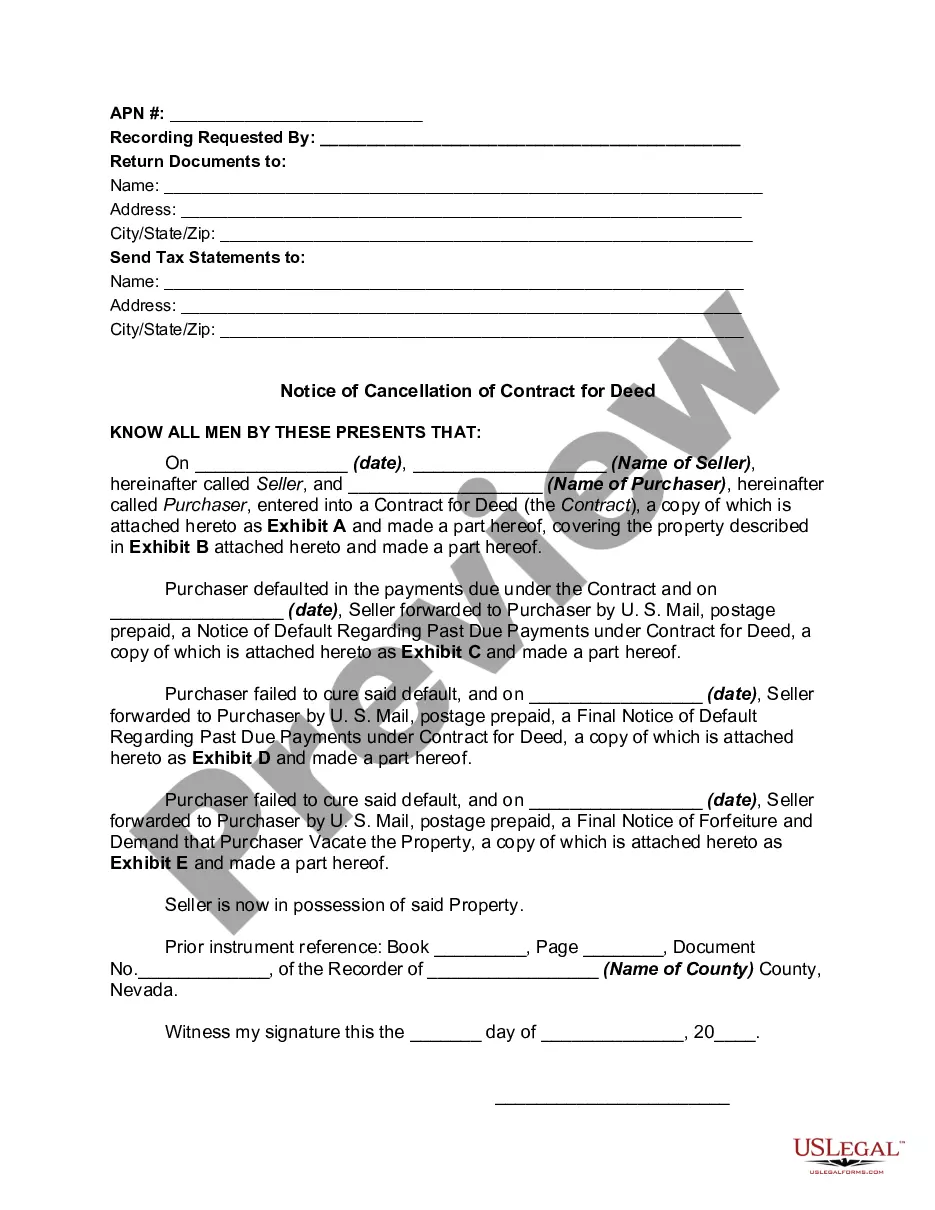

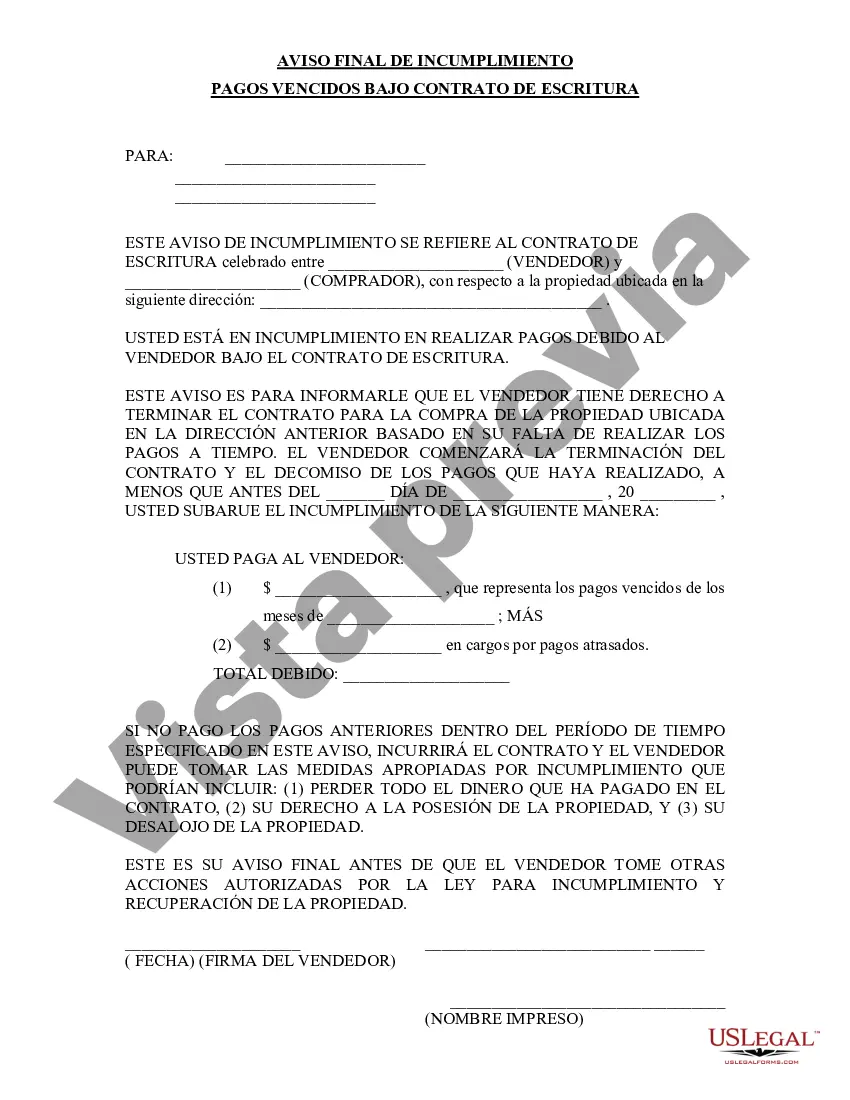

North Las Vegas Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed is an important legal document that notifies the parties involved about the impending consequences of failing to make timely payments as per the contractual agreement. This notice serves as an official notification that the debtor's payment obligations under the Contract for Deed have not been met, and immediate action is required to rectify the default. Keywords: North Las Vegas Nevada, Final Notice of Default, Past Due Payments, Contract for Deed. Types of North Las Vegas Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. North Las Vegas Nevada Final Notice of Default for Late Payments: This notice is prepared and issued when the debtor fails to make payments within the specified grace period or permitted late payment period mentioned in the Contract for Deed. 2. North Las Vegas Nevada Final Notice of Default for Non-Payment: This notice is generated when the debtor completely fails to make any payments as agreed upon in the Contract for Deed. It signifies a serious breach of the contractual obligations. 3. North Las Vegas Nevada Final Notice of Default for Partial Payments: This notice is issued when the debtor fails to remit the full payment amount due under the Contract for Deed, either consistently or intermittently, resulting in a partial default. 4. North Las Vegas Nevada Final Notice of Default for Default of Other Contractual Terms: In some cases, default notice may be generated due to violations of other terms within the Contract for Deed, such as failure to maintain the property, pay property taxes or insurance, or any other obligations specified in the agreement. The notice will outline the specific terms that have been breached. It is essential for both parties involved, the lender and the debtor, to pay close attention to the North Las Vegas Nevada Final Notice of Default for Past Due Payments, as it serves as a warning of severe consequences that may follow if the debtor fails to cure the default within the specified time frame. These consequences may include foreclosure proceedings, legal actions, or potential damage to the debtor's credit score. It is strongly recommended consulting legal counsel to understand the best course of action to resolve the default and prevent further complications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Las Vegas Nevada Aviso final de incumplimiento de pagos vencidos en relación con el contrato de escritura - Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out North Las Vegas Nevada Aviso Final De Incumplimiento De Pagos Vencidos En Relación Con El Contrato De Escritura?

If you are looking for a valid form, it’s impossible to choose a more convenient platform than the US Legal Forms website – probably the most extensive online libraries. With this library, you can find a large number of document samples for company and personal purposes by categories and states, or keywords. Using our high-quality search function, getting the latest North Las Vegas Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed is as elementary as 1-2-3. Furthermore, the relevance of every document is verified by a team of expert attorneys that on a regular basis check the templates on our platform and revise them in accordance with the latest state and county requirements.

If you already know about our platform and have a registered account, all you need to receive the North Las Vegas Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have chosen the sample you require. Read its information and make use of the Preview function (if available) to check its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to get the proper file.

- Confirm your choice. Click the Buy now button. Following that, pick your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the template. Pick the file format and save it on your device.

- Make adjustments. Fill out, modify, print, and sign the received North Las Vegas Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed.

Every template you save in your user profile does not have an expiration date and is yours forever. It is possible to access them via the My Forms menu, so if you want to get an extra duplicate for editing or creating a hard copy, you can return and download it once again at any time.

Make use of the US Legal Forms professional collection to get access to the North Las Vegas Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed you were looking for and a large number of other professional and state-specific samples in a single place!