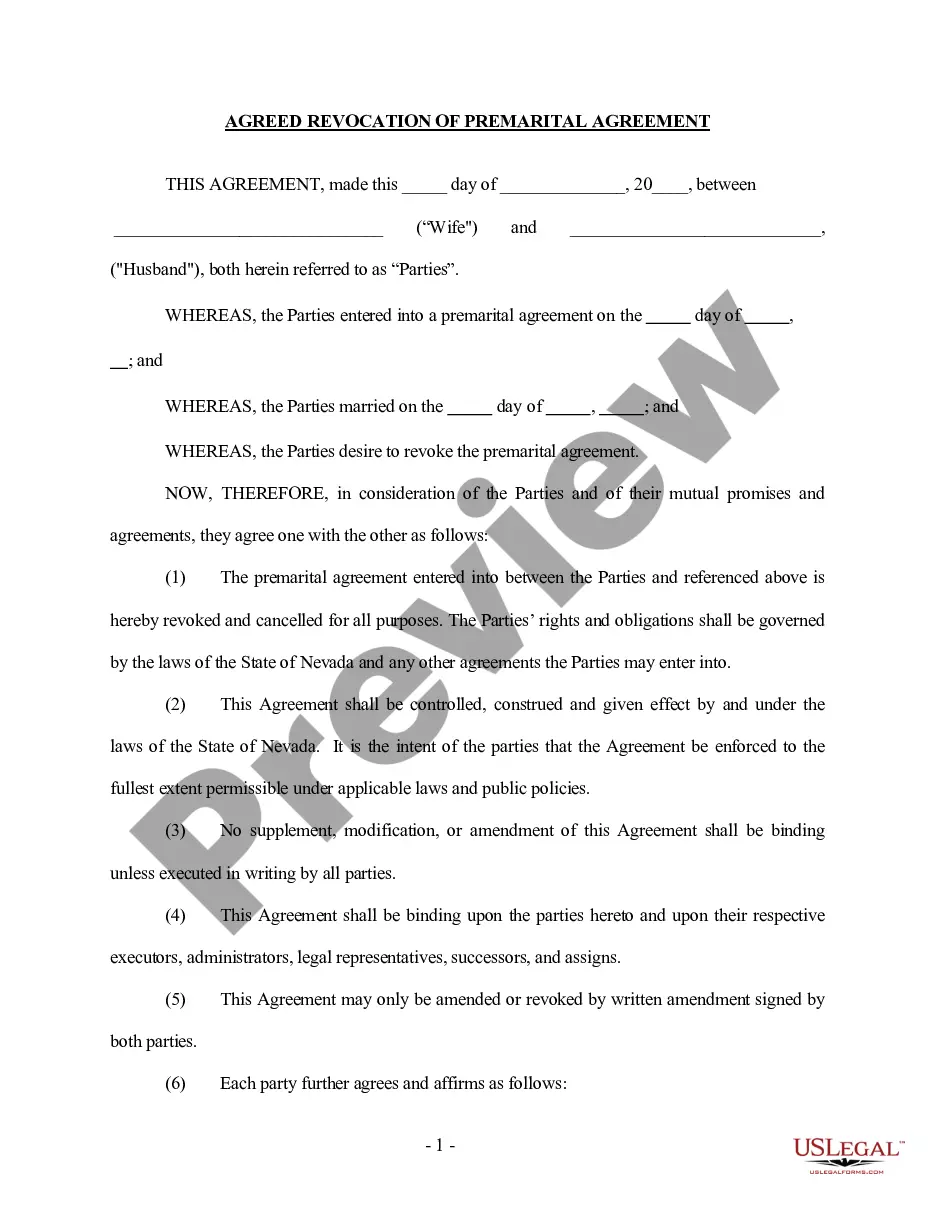

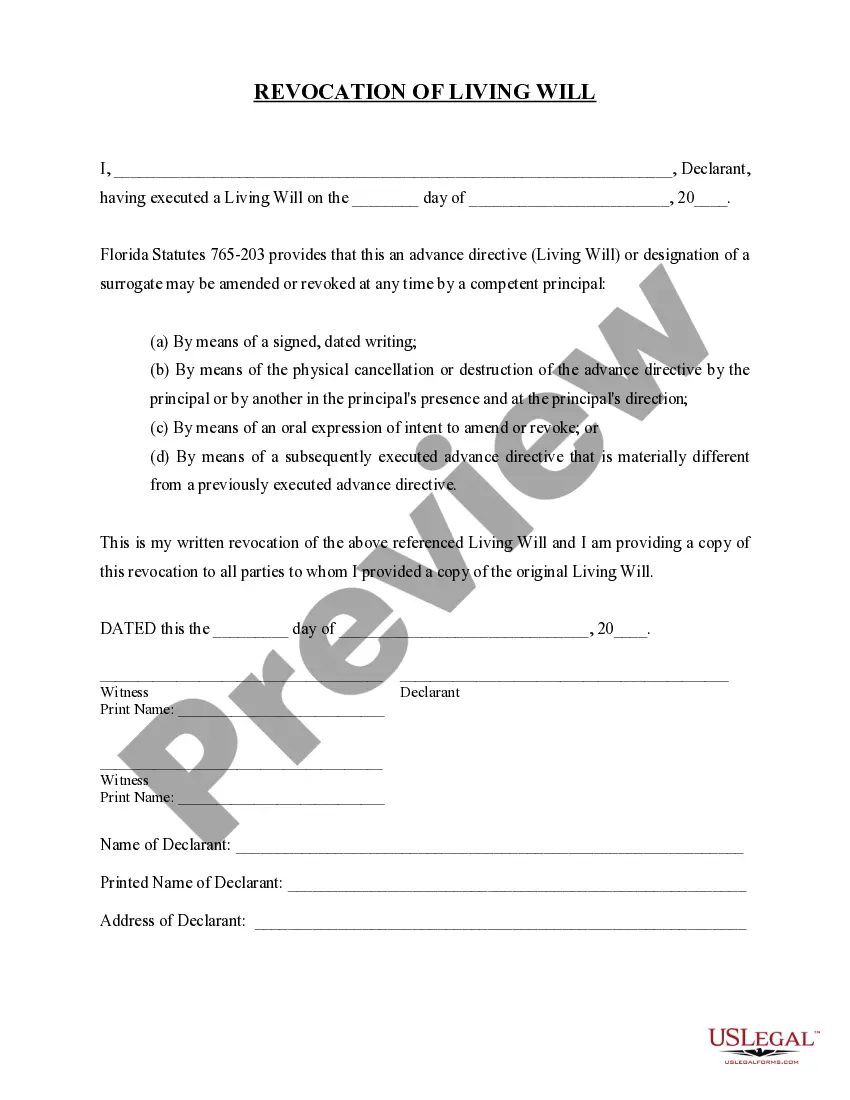

Las Vegas Nevada Prenuptial Premarital Agreement without Financial Statements is a legal document that outlines the terms and conditions of a prenuptial agreement in the state of Nevada, specifically in Las Vegas. This type of agreement is crucial for couples who wish to protect their assets and financial interests before entering into marriage. By incorporating crucial keywords, this content aims to provide a comprehensive understanding of this particular agreement. A Las Vegas Nevada Prenuptial Premarital Agreement without Financial Statements is designed for couples who want to establish guidelines for the division of assets, debts, and other financial matters in the event of a divorce or separation. It allows individuals to protect their individual assets and property acquired before and during the marriage, ensuring a fair and equitable distribution during the dissolution of the marriage. The absence of financial statements in this specific type of prenuptial agreement means that the agreement does not require the couples to disclose their respective financial information, such as income, investments, or debts. However, it is important to note that even without financial statements, both parties should still provide a complete and honest disclosure of their assets and debts to maintain the validity of the agreement. This type of prenuptial agreement helps establish clear expectations and safeguards for both parties, controlling potential disputes and ensuring a smoother and less contentious separation process. It is particularly significant for individuals with substantial assets, business interests, or those who wish to protect inheritances or family property. Different scenarios might warrant the use of Las Vegas Nevada Prenuptial Premarital Agreements without Financial Statements, including: 1. Protecting separate property: This agreement allows individuals to retain ownership and control over assets they acquired before the marriage, such as real estate properties, vehicles, or investments. It ensures that these assets remain separate and not subject to division in the event of divorce. 2. Division of debts: Couples can establish guidelines for dividing existing debts, including mortgages, loans, or credit card debts. This prevents one party from assuming responsibility for the other's financial obligations acquired prior to the marriage. 3. Business interests: Individuals who own businesses or have ownership stakes in companies can protect their business assets and profits through a prenuptial agreement. This ensures that the business remains separate from marital assets, reducing the risk of interference or division during a divorce. 4. Inheritance and family assets: A prenuptial agreement can protect assets received through inheritance or family trusts, ensuring they remain with the intended recipient and not subject to division. It is important to consult an experienced family law attorney in Las Vegas, Nevada, when drafting a Prenuptial Premarital Agreement without Financial Statements. These attorneys can provide guidance, review the agreement, and ensure its compliance with Nevada state laws. Overall, having a comprehensive prenuptial agreement can offer peace of mind and financial security for both parties involved, promoting a foundation of trust and transparency within the marriage.

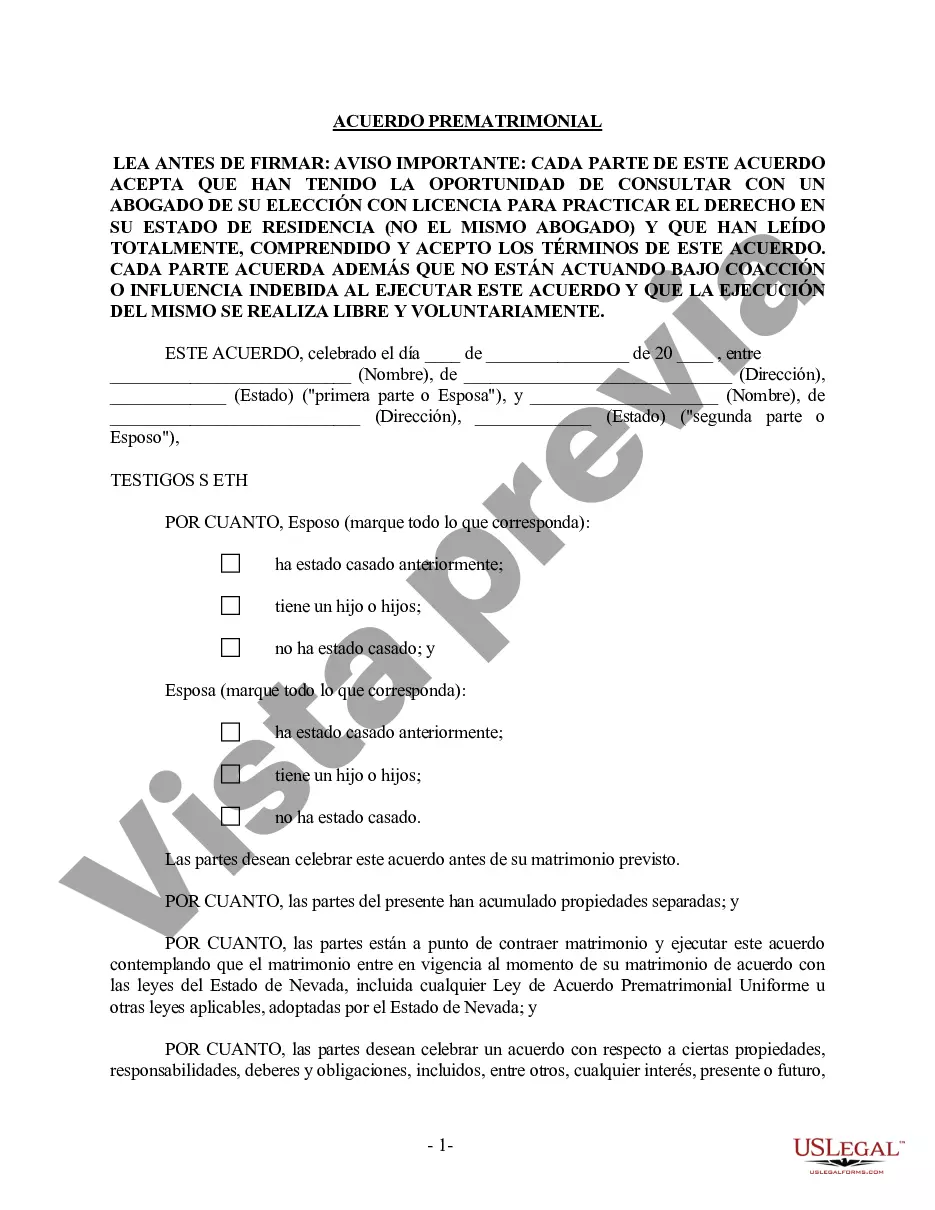

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Las Vegas Acuerdo prematrimonial prenupcial de Nevada sin estados financieros - Nevada Prenuptial Premarital Agreement without Financial Statements

State:

Nevada

City:

Las Vegas

Control #:

NV-00590-B

Format:

Word

Instant download

Description

Acuerdo sin estados financieros.

Las Vegas Nevada Prenuptial Premarital Agreement without Financial Statements is a legal document that outlines the terms and conditions of a prenuptial agreement in the state of Nevada, specifically in Las Vegas. This type of agreement is crucial for couples who wish to protect their assets and financial interests before entering into marriage. By incorporating crucial keywords, this content aims to provide a comprehensive understanding of this particular agreement. A Las Vegas Nevada Prenuptial Premarital Agreement without Financial Statements is designed for couples who want to establish guidelines for the division of assets, debts, and other financial matters in the event of a divorce or separation. It allows individuals to protect their individual assets and property acquired before and during the marriage, ensuring a fair and equitable distribution during the dissolution of the marriage. The absence of financial statements in this specific type of prenuptial agreement means that the agreement does not require the couples to disclose their respective financial information, such as income, investments, or debts. However, it is important to note that even without financial statements, both parties should still provide a complete and honest disclosure of their assets and debts to maintain the validity of the agreement. This type of prenuptial agreement helps establish clear expectations and safeguards for both parties, controlling potential disputes and ensuring a smoother and less contentious separation process. It is particularly significant for individuals with substantial assets, business interests, or those who wish to protect inheritances or family property. Different scenarios might warrant the use of Las Vegas Nevada Prenuptial Premarital Agreements without Financial Statements, including: 1. Protecting separate property: This agreement allows individuals to retain ownership and control over assets they acquired before the marriage, such as real estate properties, vehicles, or investments. It ensures that these assets remain separate and not subject to division in the event of divorce. 2. Division of debts: Couples can establish guidelines for dividing existing debts, including mortgages, loans, or credit card debts. This prevents one party from assuming responsibility for the other's financial obligations acquired prior to the marriage. 3. Business interests: Individuals who own businesses or have ownership stakes in companies can protect their business assets and profits through a prenuptial agreement. This ensures that the business remains separate from marital assets, reducing the risk of interference or division during a divorce. 4. Inheritance and family assets: A prenuptial agreement can protect assets received through inheritance or family trusts, ensuring they remain with the intended recipient and not subject to division. It is important to consult an experienced family law attorney in Las Vegas, Nevada, when drafting a Prenuptial Premarital Agreement without Financial Statements. These attorneys can provide guidance, review the agreement, and ensure its compliance with Nevada state laws. Overall, having a comprehensive prenuptial agreement can offer peace of mind and financial security for both parties involved, promoting a foundation of trust and transparency within the marriage.

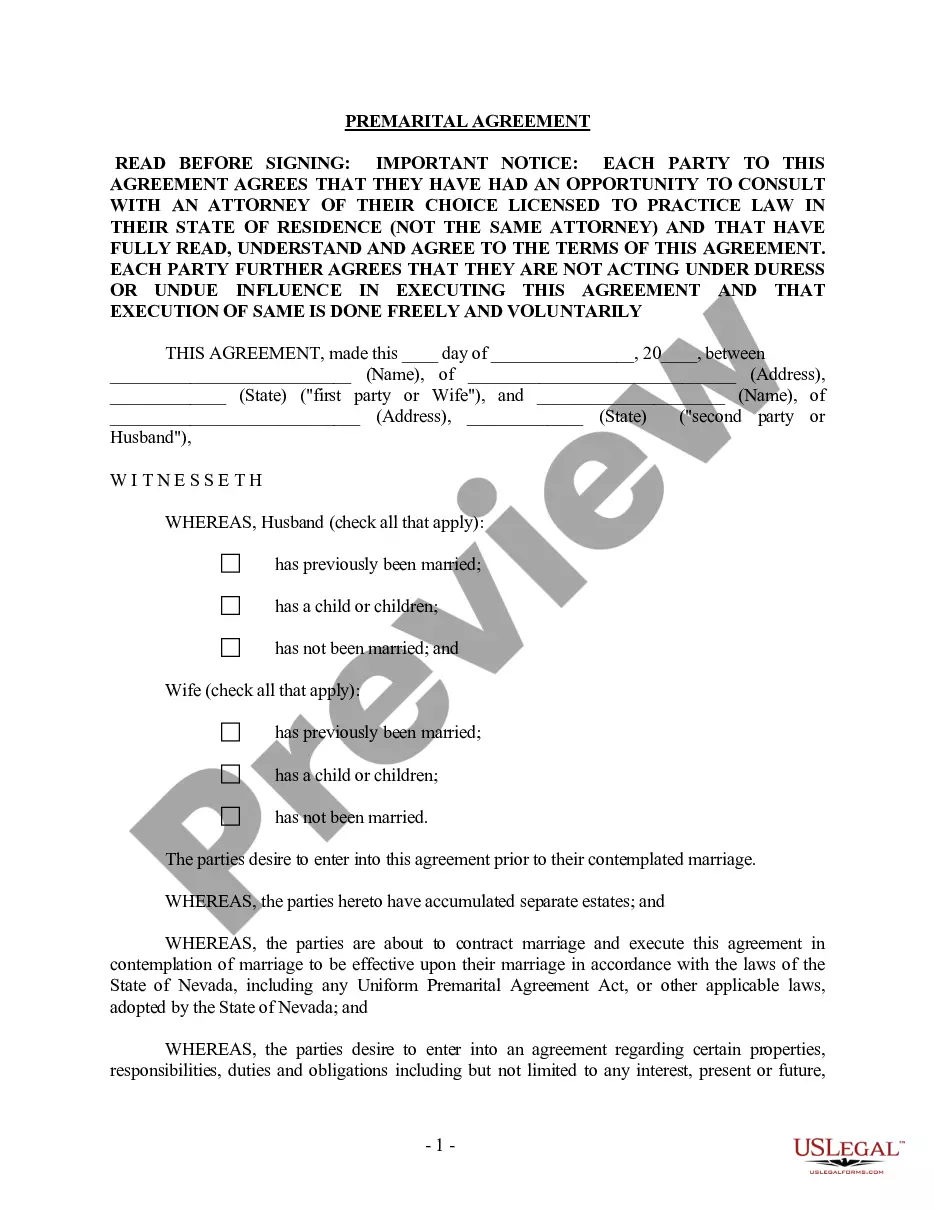

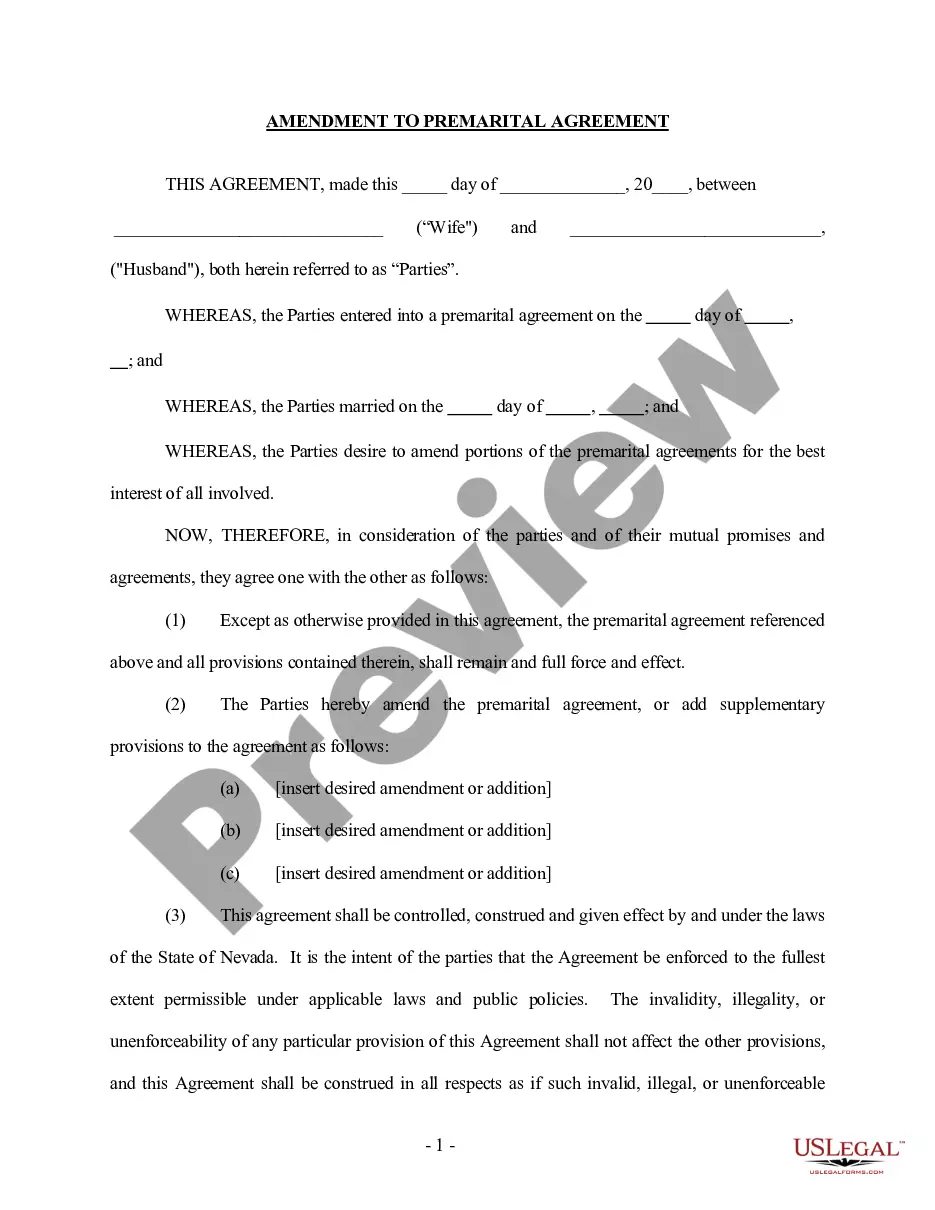

Free preview

How to fill out Las Vegas Acuerdo Prematrimonial Prenupcial De Nevada Sin Estados Financieros?

If you’ve already used our service before, log in to your account and save the Las Vegas Nevada Prenuptial Premarital Agreement without Financial Statements on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Las Vegas Nevada Prenuptial Premarital Agreement without Financial Statements. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!