Clark Nevada Financial Statements are specific types of financial statements that are used in the context of a prenuptial or premarital agreement. These statements provide a comprehensive overview of an individual's financial situation, ensuring full transparency and disclosure between parties entering into a marriage contract. The Clark Nevada Financial Statements are composed of various key components, including but not limited to the following: 1. Income Statement: This statement outlines an individual's sources of income, including salaries, investments, rental income, or any other relevant revenue streams. It provides a clear understanding of their financial earnings. 2. Balance Sheet: The balance sheet encompasses an individual's assets, liabilities, and net worth. It includes details about real estate properties, vehicles, bank accounts, investments, loans, credit card debts, and any other financial obligations. 3. Tax Returns: These documents provide a comprehensive overview of an individual's tax obligations, both at the federal and state levels. They disclose income sources, deductions, and credits, ensuring transparency in a person's financial position. 4. Bank Statements: Bank statements exhibit an individual's financial activities, including deposits, withdrawals, transfers, and any significant transactions. They help provide a clear understanding of an individual's cash flow and overall financial stability. 5. Investment Statements: Investment statements detail an individual's holdings in stocks, bonds, mutual funds, retirement accounts, or any other investments. They provide insight into an individual's portfolio and long-term financial planning strategies. 6. Debt Statements: These statements outline the individual's obligations such as mortgages, personal loans, credit card debts, or any other outstanding liabilities. They provide transparency on existing debts and repayment obligations. 7. Business Statements: If an individual owns a business, relevant financial statements such as profit and loss statements or cash flow statements must be included. These statements reflect the financial health of the business and its potential impact on an individual's personal finances. It is important to note that while the above components are commonly included in Clark Nevada Financial Statements for prenuptial or premarital agreements, the specific requirements may vary depending on the individual circumstances and the laws governing prenuptial agreements in Clark County, Nevada. By disclosing and documenting these financial aspects, Clark Nevada Financial Statements aim to ensure transparency, prevent disputes, and protect the interests of both parties involved in a prenuptial or premarital agreement. They provide a clear picture of each individual's financial situation and form a basis for determining the division of assets, liabilities, and potential spousal support in the event of a divorce or separation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement

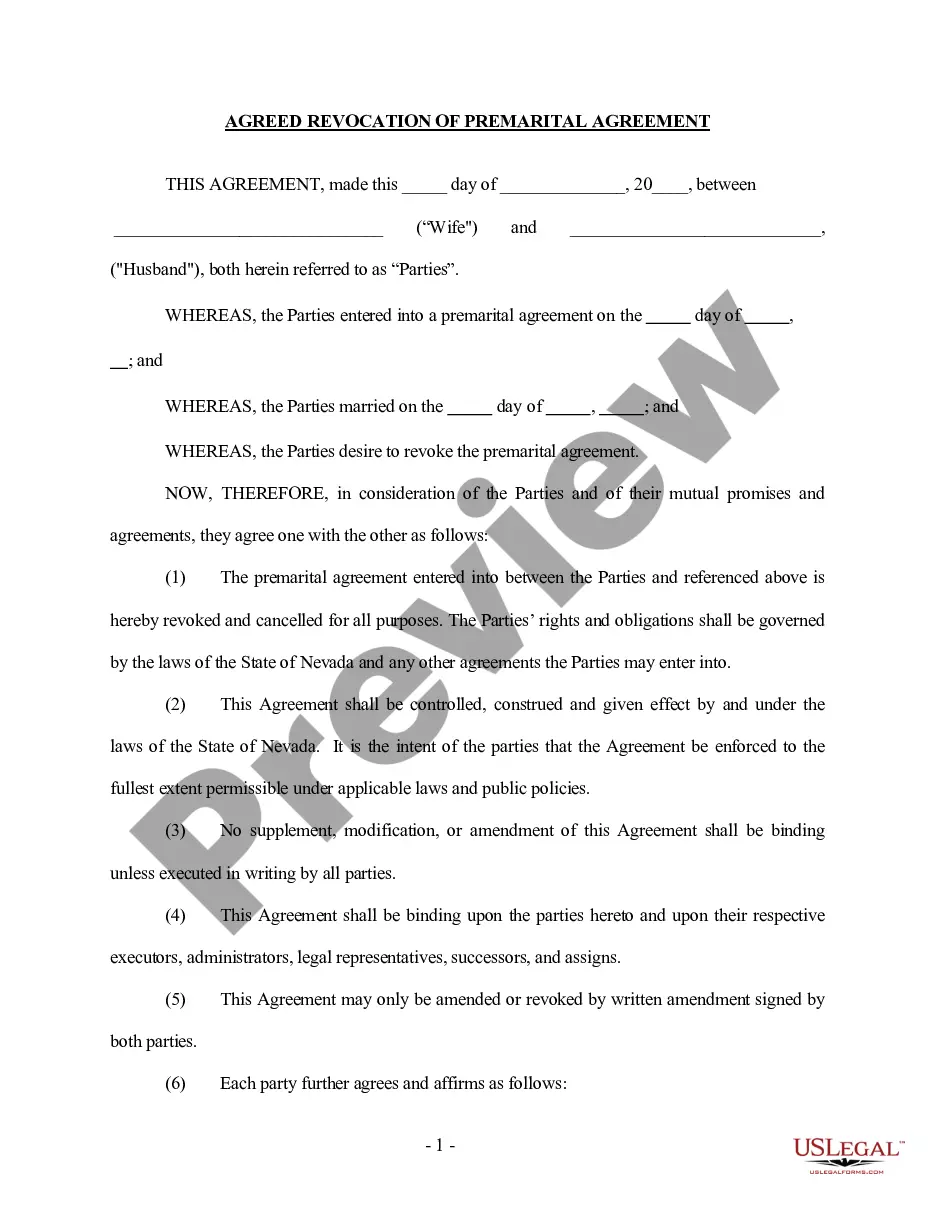

Description

How to fill out Clark Nevada Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

We always want to reduce or avoid legal issues when dealing with nuanced legal or financial matters. To do so, we sign up for legal solutions that, usually, are very costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Clark Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Clark Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Clark Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement is proper for your case, you can pick the subscription option and make a payment.

- Then you can download the form in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!