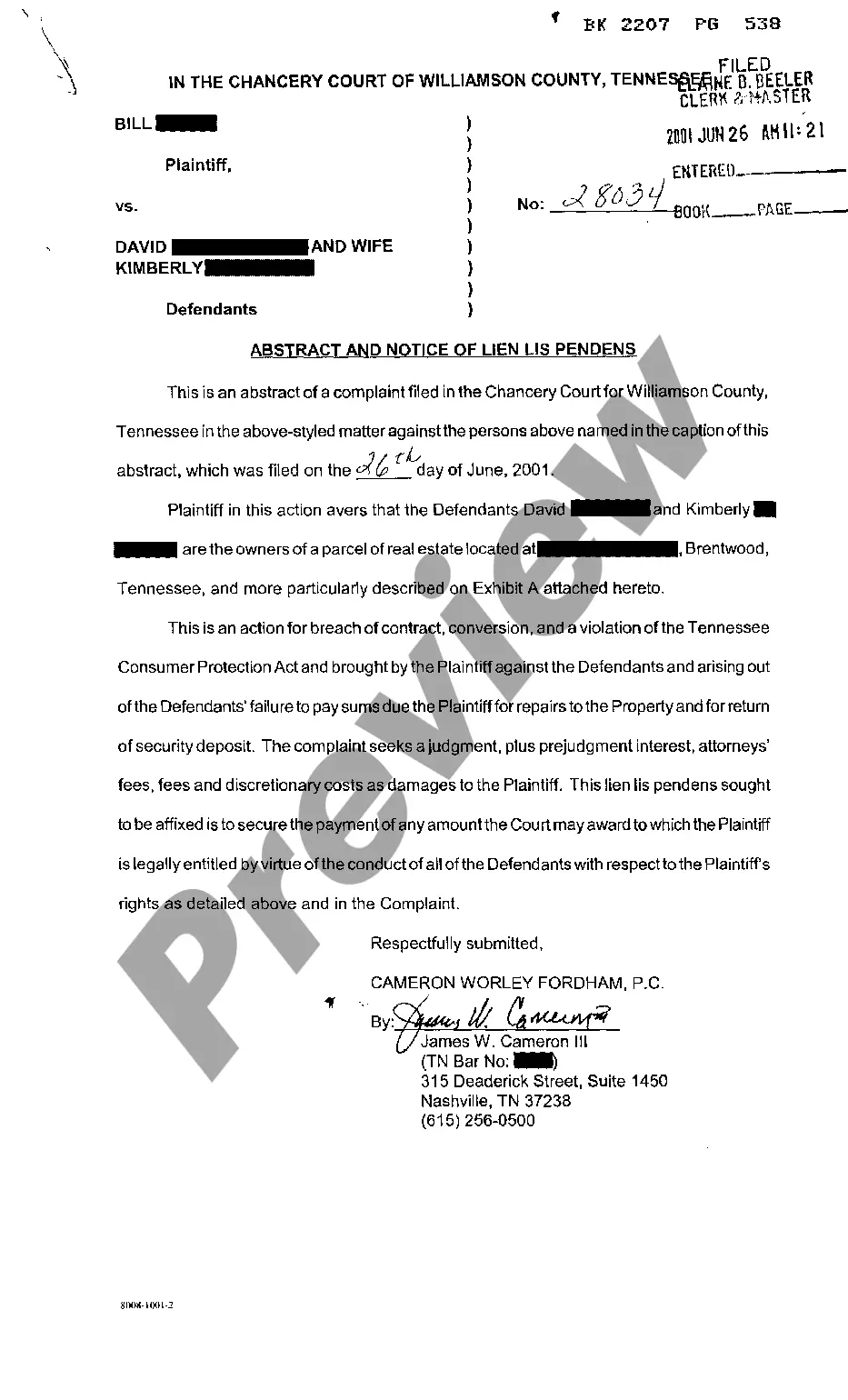

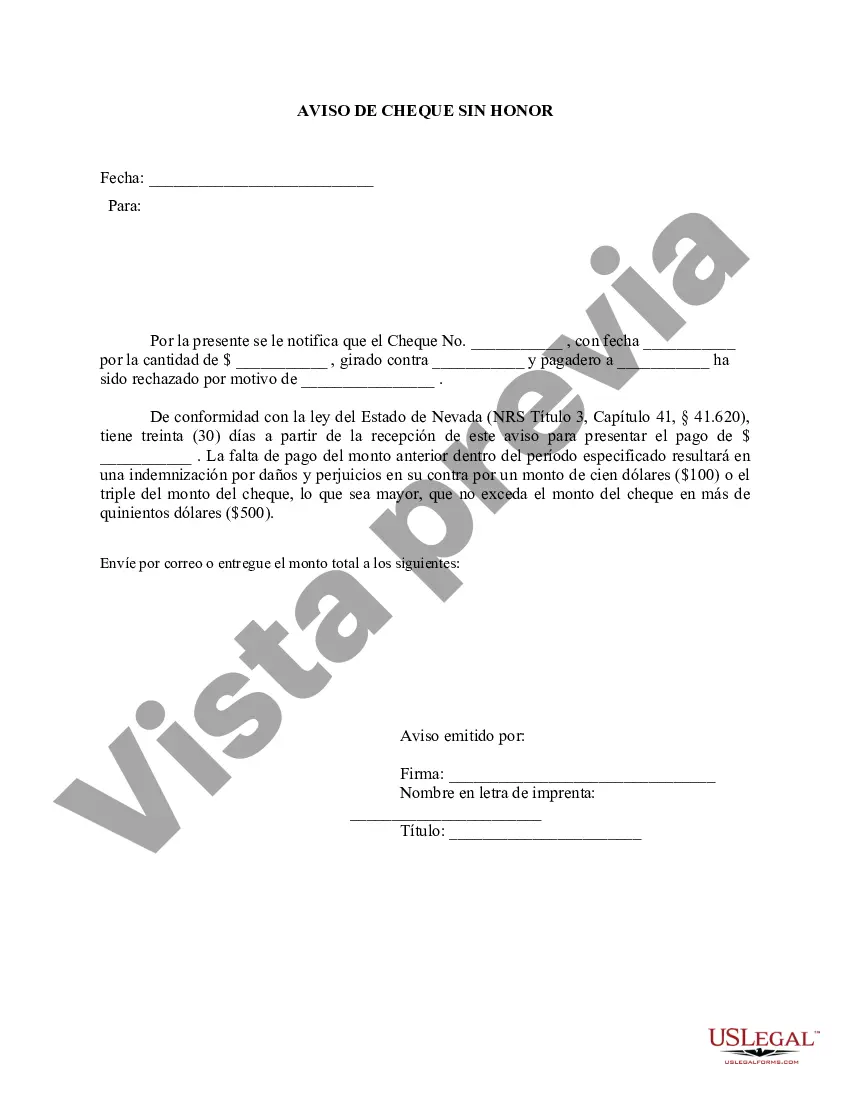

Las Vegas, Nevada Notice of Dishonored Check — Civil Overview and Types In Las Vegas, Nevada, individuals and businesses utilize the Notice of Dishonored Check — Civil procedure to address the issue of bad or bounced checks. When a check is dishonored, it means that the bank has rejected its payment due to insufficient funds in the payer's account or other related reasons. The Notice of Dishonored Check — Civil is a legal notice sent to the check issuer, informing them of the situation and demanding payment to resolve the matter. Types of Notice of Dishonored Check — Civil in Las Vegas, Nevada: 1. Bad Check: A bad check refers to a check that has been dishonored due to various reasons such as insufficient funds, closed accounts, or a stop payment request from the account holder. When a person or business receives a bad check, they have the legal right to pursue action through the Notice of Dishonored Check — Civil procedure. 2. Bounced Check: A bounced check indicates that the check issuer's bank has declined the payment due to insufficient funds in the account. This often happens when the payer writes a check without having enough money to cover the amount. To address this issue, the recipient can initiate the Notice of Dishonored Check — Civil process. The purpose of the Las Vegas, Nevada Notice of Dishonored Check — Civil is to provide a fair opportunity for the check issuer to rectify the situation before further legal action is taken. It allows the recipient to formally notify the issuer of the dishonored check and provide them with a chance to make the payment in full, including any fees or penalties associated with the bounced check. Key Steps in the Las Vegas, Nevada Notice of Dishonored Check — Civil process: 1. Collection Attempts: Prior to initiating legal action, the recipient may make reasonable efforts to collect the payment by contacting the check issuer directly, sending reminders, or pursuing alternative resolution methods. 2. Drafting the Notice: The Notice of Dishonored Check — Civil should include specific details such as the check issuer's name, the check number, the amount of the dishonored check, the date it was issued, and the reason for its dishonor. Additionally, the notice must state the deadline by which the payment should be made to avoid further consequences. 3. Delivery: The notice can be sent by certified mail with return receipt requested to provide proof of delivery. Alternatively, it can be delivered in-person or through a reputable courier service to ensure its safe and prompt arrival. 4. Resolution and Consequences: Once the notice has been received by the check issuer, they have a set time period to make the payment in full. Failure to comply may result in the recipient pursuing further legal action, such as filing a lawsuit or involving debt collection agencies. Additionally, the dishonored check incident may be reported to relevant credit bureaus, potentially impacting the check issuer's credit history. In summary, the Las Vegas, Nevada Notice of Dishonored Check — Civil is a legal procedure used to address the issue of bad or bounced checks. By following the appropriate steps outlined in the process, individuals and businesses can seek resolution and potential compensation for the dishonored check.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Las Vegas Nevada Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Nevada Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Las Vegas Nevada Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

We consistently aim to reduce or avert legal complications when engaging with intricate legal or financial issues.

To achieve this, we seek out lawyer options that are often quite pricey.

However, not every legal situation is equally convoluted. Many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents encompassing everything from wills and powers of attorney to incorporation articles and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you misplace the form, you can always download it again in the My documents section.

- Our collection empowers you to handle your affairs without resorting to legal advice.

- We provide access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you need to acquire and download the Las Vegas Nevada Notice of Dishonored Check - Civil - Keywords: bad check, bounced check, or any other document conveniently and securely.