Title: Understanding North Las Vegas Nevada Notice of Dishonored Check — Civil Proceedings Introduction: In North Las Vegas, Nevada, when a check issued by an individual or business is returned by the bank due to insufficient funds or other reasons, it is considered a dishonored or bounced check. The recipient of such a check has the right to take legal action against the issuer, typically by filing a civil case known as the Notice of Dishonored Check. This article aims to provide you with a detailed description of what this legal process entails, highlighting various types of dishonored checks that may lead to civil proceedings, using relevant keywords such as bad check and bounced check. Types of Dishonored Checks: 1. Insufficient Funds Check: The most common type of dishonored check is one that bounces due to the issuer having insufficient funds in their bank account. This occurs when the check amount exceeds the available balance, causing the bank to decline payment. 2. Account Closed Check: In cases where the issuer closes their bank account before the recipient deposits the check, the check will be considered dishonored. A closed account prevents the bank from honoring the payment, leading to potential civil actions. 3. Post-Dated Check: A post-dated check is one that bears a future date when it is issued. If the recipient tries to cash or deposit the check before the designated date, it can result in a dishonored check case if the check bounces due to insufficient funds or an account closure. 4. Forgery or Fraudulent Check: If an individual intentionally issues a check without sufficient funds or writes a check without having the authority to do so, it falls under the category of a fraudulent or forged check. This illegal action can lead to severe consequences for the issuer, including civil penalties. 5. Stolen Check: In cases where a check is stolen, forged, and then cashed by someone other than the intended recipient, it is considered a stolen check. When the rightful owner of the check realizes the act, they can take legal action against the issuer. North Las Vegas Nevada Notice of Dishonored Check — Civil: Once a check has been dishonored by the bank, the recipient has the option to initiate legal proceedings against the issuer by filing a Notice of Dishonored Check — Civil. This civil notice notifies the issuer of the dishonored check and provides them with a specific time frame to rectify the situation by paying the outstanding amount, including any associated fees. If the issuer fails to make the payment within the stipulated time period or fails to respond to the notice, the recipient can pursue legal action against them. This may include filing a lawsuit in a small claims court, seeking compensation for the dishonored check amount, associated fees, and legal expenses. Conclusion: Understanding the implications and legal processes surrounding dishonored checks in North Las Vegas, Nevada is essential for both recipients and issuers. Cases involving bad checks and bounced checks can result in civil proceedings, potentially leading to financial penalties for the issuer. By familiarizing oneself with the various types of dishonored checks and the proper legal steps involved, individuals can navigate such situations effectively and seek appropriate resolution.

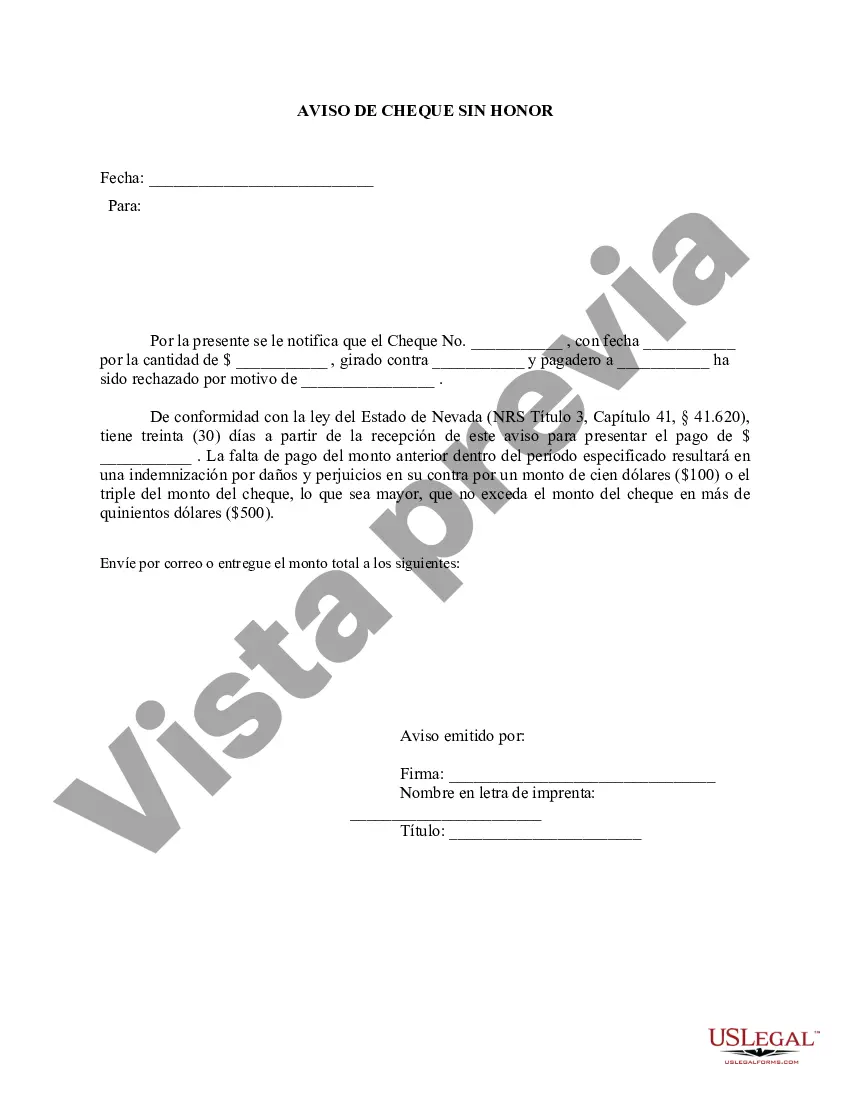

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Las Vegas Nevada Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Nevada Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out North Las Vegas Nevada Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone without any law education to draft this sort of papers cfrom the ground up, mainly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the North Las Vegas Nevada Notice of Dishonored Check - Civil - Keywords: bad check, bounced check or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the North Las Vegas Nevada Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in minutes employing our reliable platform. In case you are already a subscriber, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, if you are new to our library, make sure to follow these steps prior to obtaining the North Las Vegas Nevada Notice of Dishonored Check - Civil - Keywords: bad check, bounced check:

- Ensure the template you have chosen is good for your location considering that the regulations of one state or area do not work for another state or area.

- Preview the form and go through a quick description (if provided) of cases the paper can be used for.

- If the one you selected doesn’t meet your needs, you can start over and search for the necessary document.

- Click Buy now and choose the subscription option that suits you the best.

- Log in to your account login information or register for one from scratch.

- Pick the payment method and proceed to download the North Las Vegas Nevada Notice of Dishonored Check - Civil - Keywords: bad check, bounced check once the payment is done.

You’re all set! Now you can go ahead and print out the form or complete it online. If you have any problems locating your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.