The Sparks Nevada Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is a legal document that outlines the transfer of ownership of a business from one party to another. This document serves as proof of the transaction and provides important details about the sale. It is essential for both the buyer and seller to have a written record of the transaction to avoid any disputes in the future. A Sparks Nevada Bill of Sale includes various key elements necessary to ensure a smooth transfer of ownership. These elements may include: 1. Identification of parties: The document clearly identifies the individuals or corporate entities involved in the sale. This includes the legal names, addresses, and contact information of both the seller and the buyer. 2. Business description: The bill of sale provides a comprehensive description of the business being sold. This may include the business name, address, nature of operations, assets included in the sale, and any intellectual property rights associated with the business. 3. Purchase price and payment terms: The document specifies the agreed-upon purchase price for the business, including the currency and any down payments or installment terms. It may also outline payment methods, such as cash, check, or bank transfer. 4. Assets and liabilities: The bill of sale lists the assets and liabilities included in the sale. This may encompass tangible assets such as equipment, inventory, and property, as well as intangible assets such as trademarks, patents, and permits. Any outstanding debts or obligations related to the business are documented as liabilities. 5. Representations and warranties: The document may include specific representations and warranties made by the seller regarding the condition, ownership, and legality of the business. These assurances protect the buyer from any undisclosed risks or liabilities associated with the business. 6. Closing and possession: The bill of sale states the date and location of the closing (when the ownership is transferred), as well as when the buyer will take possession of the business and its assets. It may also outline any post-closing obligations, such as assistance from the seller during the transition period. In addition to the standard Sparks Nevada Bill of Sale, there may be variations depending on the specific circumstances of the business sale. These variations may include: 1. Sparks Nevada Bill of Sale for a Sole Proprietorship: This type of bill of sale would be used when an individual is selling their sole proprietorship business. 2. Sparks Nevada Bill of Sale for a Partnership: If a partnership is selling their business, a bill of sale tailored to the unique aspects of a partnership structure may be required. 3. Sparks Nevada Bill of Sale for a Corporation: In the case of the sale of a corporate entity, a specialized bill of sale for corporations should be used, considering corporate governance and shareholder concerns. It is important to consult with legal professionals experienced in business transactions to ensure that the Sparks Nevada Bill of Sale accurately reflects the details of the sale and complies with all applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sparks Nevada Factura de venta en relación con la venta del negocio por parte del vendedor individual o corporativo - Nevada Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Sparks Nevada Factura De Venta En Relación Con La Venta Del Negocio Por Parte Del Vendedor Individual O Corporativo?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for legal services that, usually, are very costly. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to an attorney. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

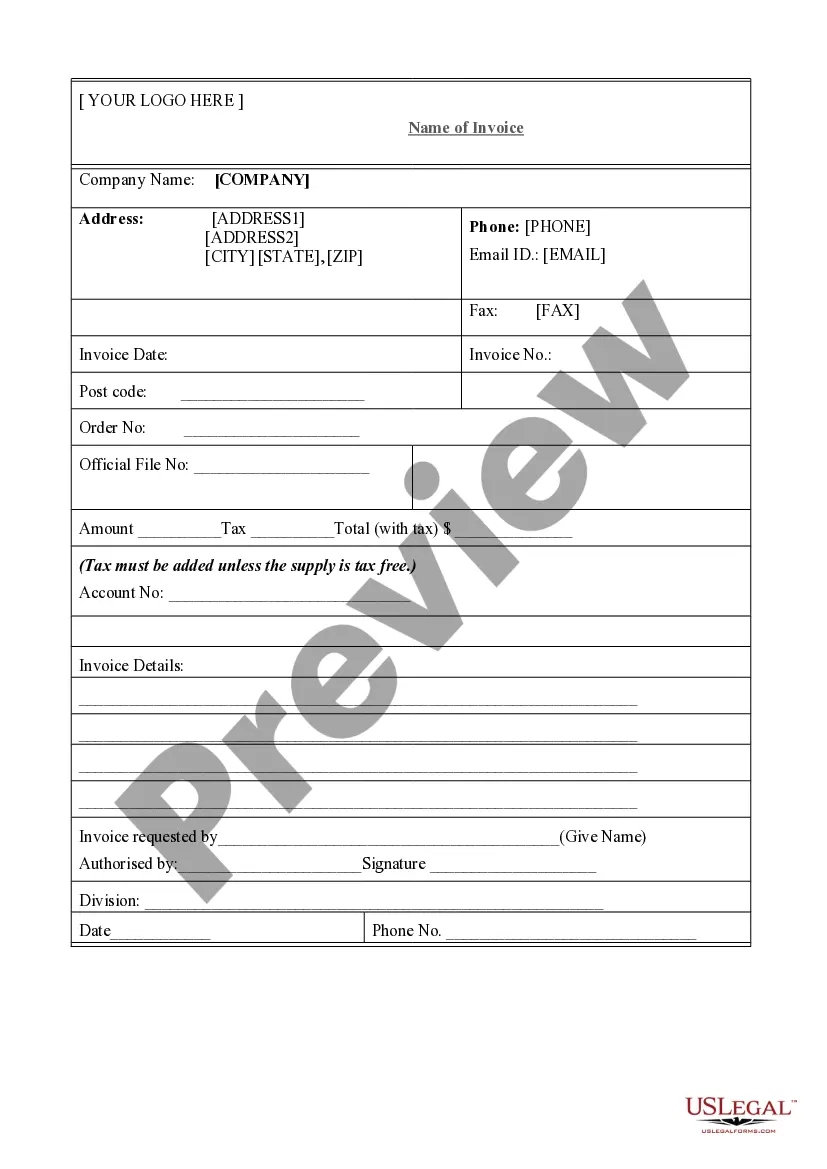

Take advantage of US Legal Forms whenever you need to get and download the Sparks Nevada Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is just as easy if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Sparks Nevada Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Sparks Nevada Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is suitable for you, you can pick the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!