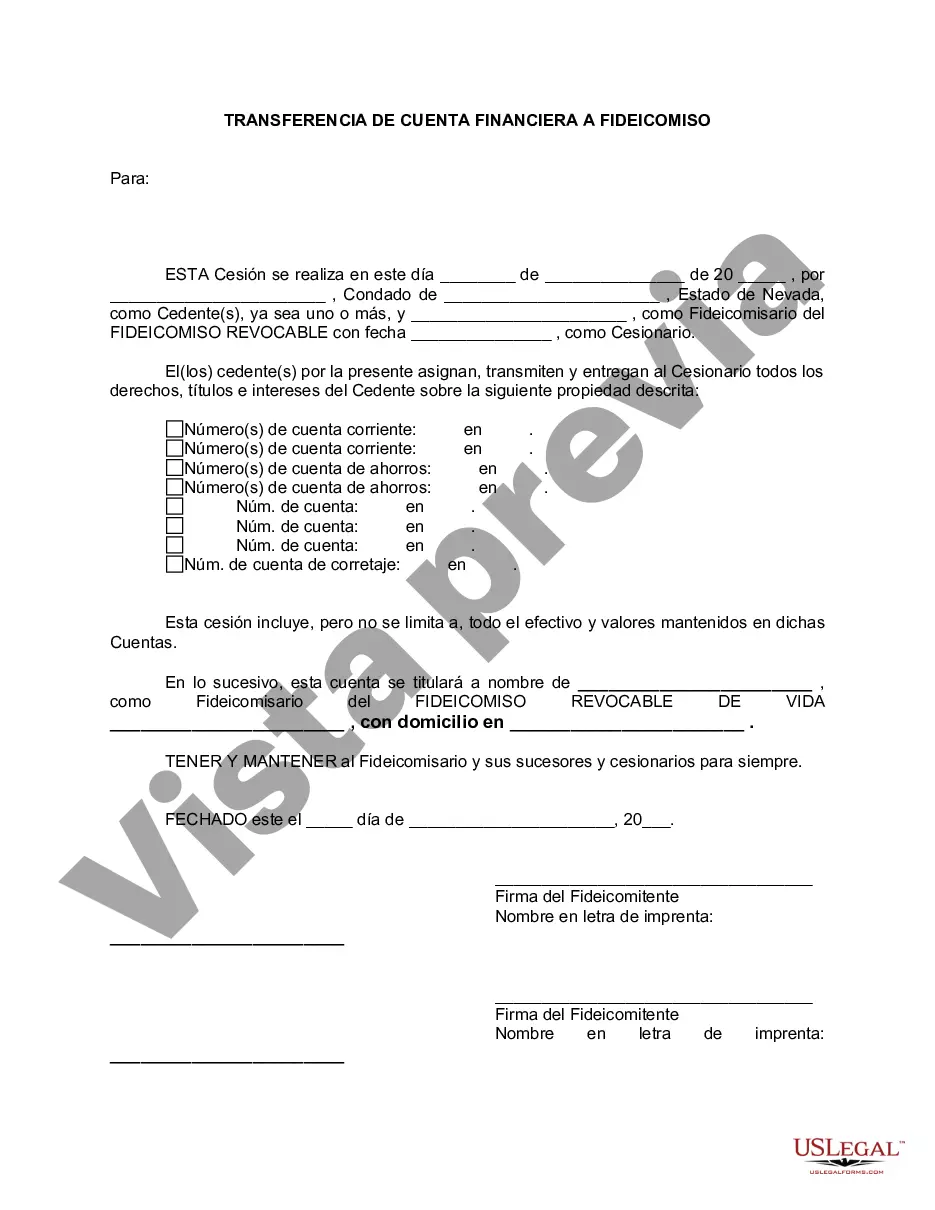

Las Vegas Nevada Financial Account Transfer to Living Trust is a legal process that allows individuals to transfer their financial accounts into a trust to ensure a smooth and efficient transfer of wealth to their chosen beneficiaries upon their passing. This process is undertaken by residents of Las Vegas, Nevada, who wish to protect their assets and streamline the distribution of their wealth. There are different types of Las Vegas Nevada Financial Account Transfer to Living Trust that individuals should be aware of: 1. Revocable Living Trust: In this type of transfer, individuals have the flexibility to change or revoke the terms of the trust during their lifetime. It enables them to retain control over their assets while providing a seamless transition upon their passing. 2. Irrevocable Living Trust: This type of account transfer is not amendable or revocable once executed. By transferring financial accounts to an irrevocable living trust, individuals can protect their assets from estate taxes, creditors, and potential lawsuits. 3. Testamentary Living Trust: Unlike the revocable and irrevocable living trusts, this type comes into effect only upon the individual's passing. It means that the financial accounts are transferred into the trust through a will. This type of transfer is suitable for those who prefer to retain control over their assets until their death. When undergoing a Las Vegas Nevada Financial Account Transfer to Living Trust, individuals must follow these steps: 1. Seek Legal Assistance: It is essential to consult with an experienced estate planning attorney who specializes in living trusts. They will guide you through the legal process and help draft the necessary documents. 2. Identify Financial Accounts: Compile a comprehensive list of all your financial accounts, including bank accounts, investment portfolios, retirement accounts, insurance policies, and any other assets that you wish to include in the living trust. 3. Create the Living Trust Agreement: With the assistance of your attorney, you will draft the living trust agreement. This document outlines the terms and conditions of the trust, including the designated beneficiaries and instructions for asset distribution. 4. Fund the Living Trust: The next step is to transfer the ownership of your financial accounts from your individual name to the living trust. This may involve contacting your financial institutions and providing them with the necessary documentation. 5. Review and Update: It is crucial to review and update your living trust regularly, especially if there are any significant life changes such as marriage, divorce, birth of children, or acquisition of new assets. By undergoing a Las Vegas Nevada Financial Account Transfer to Living Trust, individuals gain peace of mind knowing that their financial accounts will be efficiently transferred to their chosen beneficiaries while minimizing disputes, probate costs, and estate taxes. Seek advice from a qualified legal professional to ensure a seamless and successful living trust transfer in Las Vegas, Nevada.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Las Vegas Nevada Transferencia de cuenta financiera a fideicomiso en vida - Nevada Financial Account Transfer to Living Trust

Description

How to fill out Las Vegas Nevada Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Make use of the US Legal Forms and have instant access to any form you want. Our beneficial website with a huge number of document templates makes it easy to find and obtain almost any document sample you will need. You are able to save, complete, and certify the Las Vegas Nevada Financial Account Transfer to Living Trust in just a matter of minutes instead of browsing the web for hours trying to find an appropriate template.

Using our collection is a great way to improve the safety of your record filing. Our professional attorneys regularly review all the records to ensure that the templates are relevant for a particular state and compliant with new acts and polices.

How can you get the Las Vegas Nevada Financial Account Transfer to Living Trust? If you have a profile, just log in to the account. The Download option will appear on all the samples you look at. Furthermore, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction listed below:

- Open the page with the form you require. Ensure that it is the form you were hoping to find: verify its name and description, and use the Preview option when it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the downloading process. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Save the document. Choose the format to get the Las Vegas Nevada Financial Account Transfer to Living Trust and modify and complete, or sign it for your needs.

US Legal Forms is among the most extensive and reliable form libraries on the web. Our company is always happy to assist you in any legal case, even if it is just downloading the Las Vegas Nevada Financial Account Transfer to Living Trust.

Feel free to take advantage of our service and make your document experience as efficient as possible!