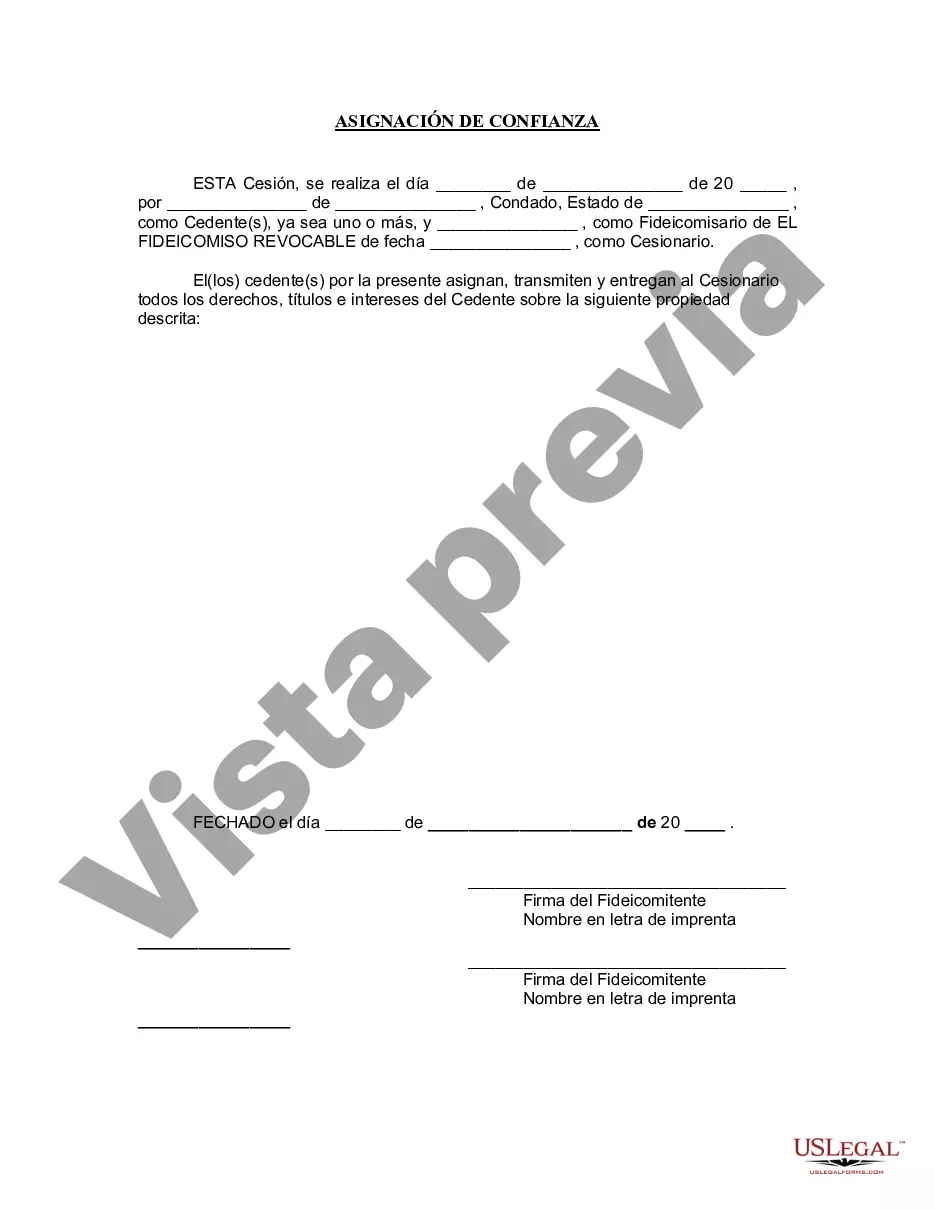

Clark Nevada Asignación a un fideicomiso en vida - Nevada Assignment to Living Trust

Description

How to fill out Nevada Asignación A Un Fideicomiso En Vida?

If you have previously used our service, Log In to your account and download the Clark Nevada Assignment to Living Trust onto your device by clicking the Download button. Ensure your subscription is current. If it isn't, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have uninterrupted access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to quickly locate and save any template for your personal or business needs!

- Confirm you’ve located the right document. Read the description and utilize the Preview option, if accessible, to verify if it satisfies your requirements. If it doesn’t suit you, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Clark Nevada Assignment to Living Trust. Select the file format for your document and store it on your device.

- Complete your example. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

La principal ventaja que ofrece un fideicomiso es la proteccion del ahorro a largo plazo para un fin especifico. Por tanto, se trata sin duda, de una de las mejores formas de pensar en el futuro.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Contrato mediante el cual una Persona Fisica o Moral transmite la titularidad de ciertos bienes y derechos a una institucion fiduciaria, expresamente autorizada para fungir como tal.

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

Se reconoce como un fideicomiso al contrato mediante el cual una persona a la que se le conoce como fideicomitente o fiduciante delega determinados bienes de su propiedad, a otra persona llamada fiduciario, para que esta administre de la mejor manera los bienes en beneficio de un tercero, llamado fideicomisario o

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

¿Cuales Son Las Desventajas De Un Fideicomiso En Vida? No hay supervision judicial. Una de las ventajas del proceso de sucesion es que se cuenta con la proteccion de un tribunal.Es posible no financiar adecuadamente un fideicomiso en vida.Puede no ser tan bueno para patrimonios pequenos.