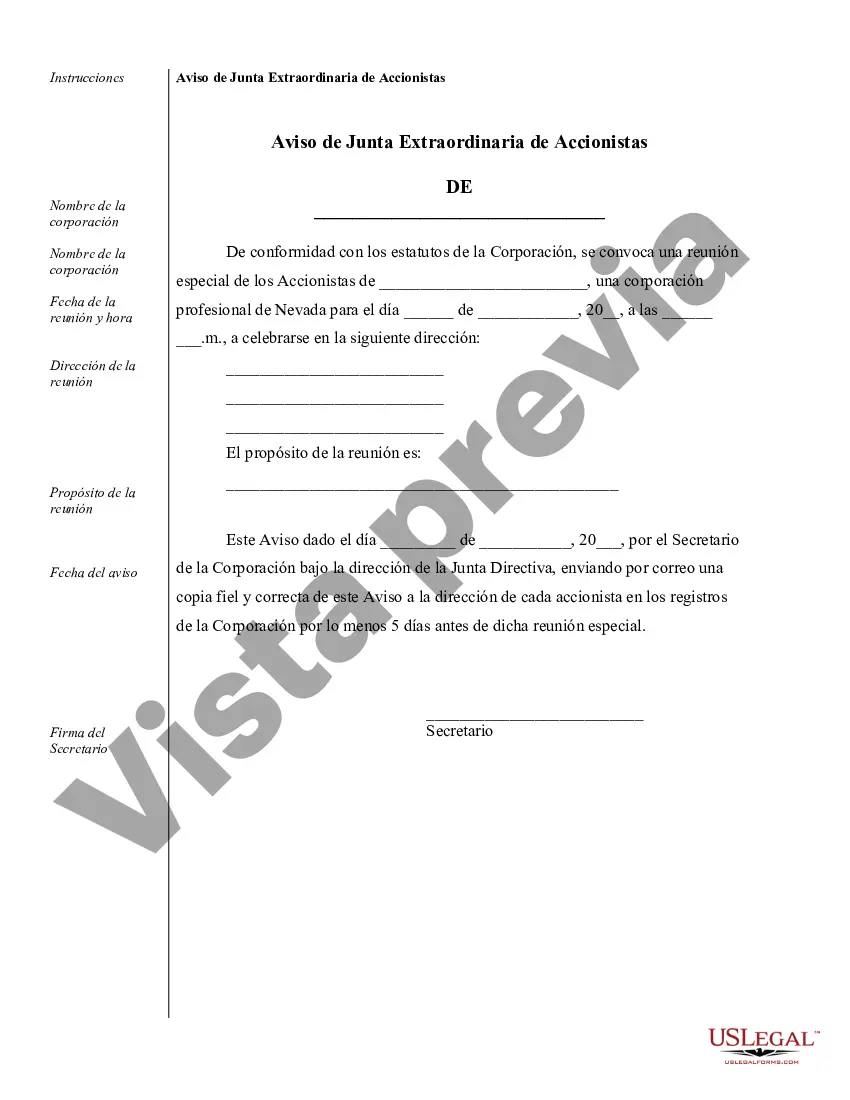

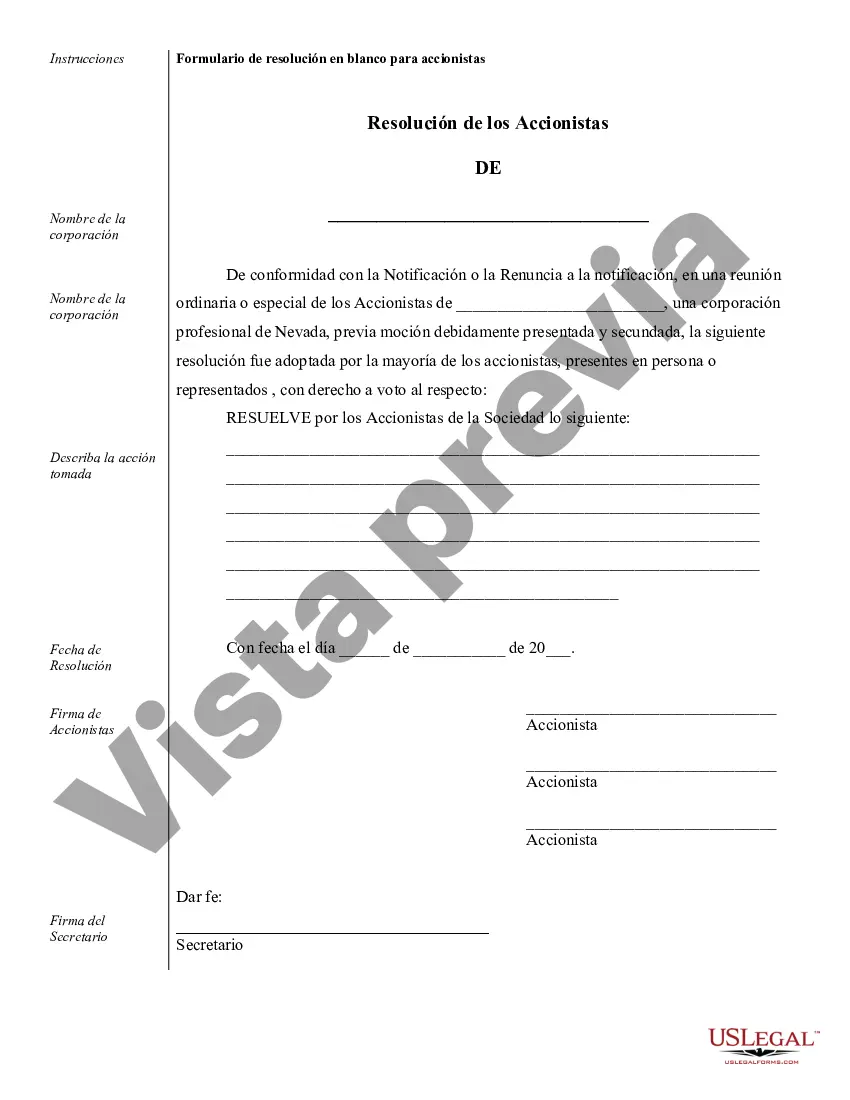

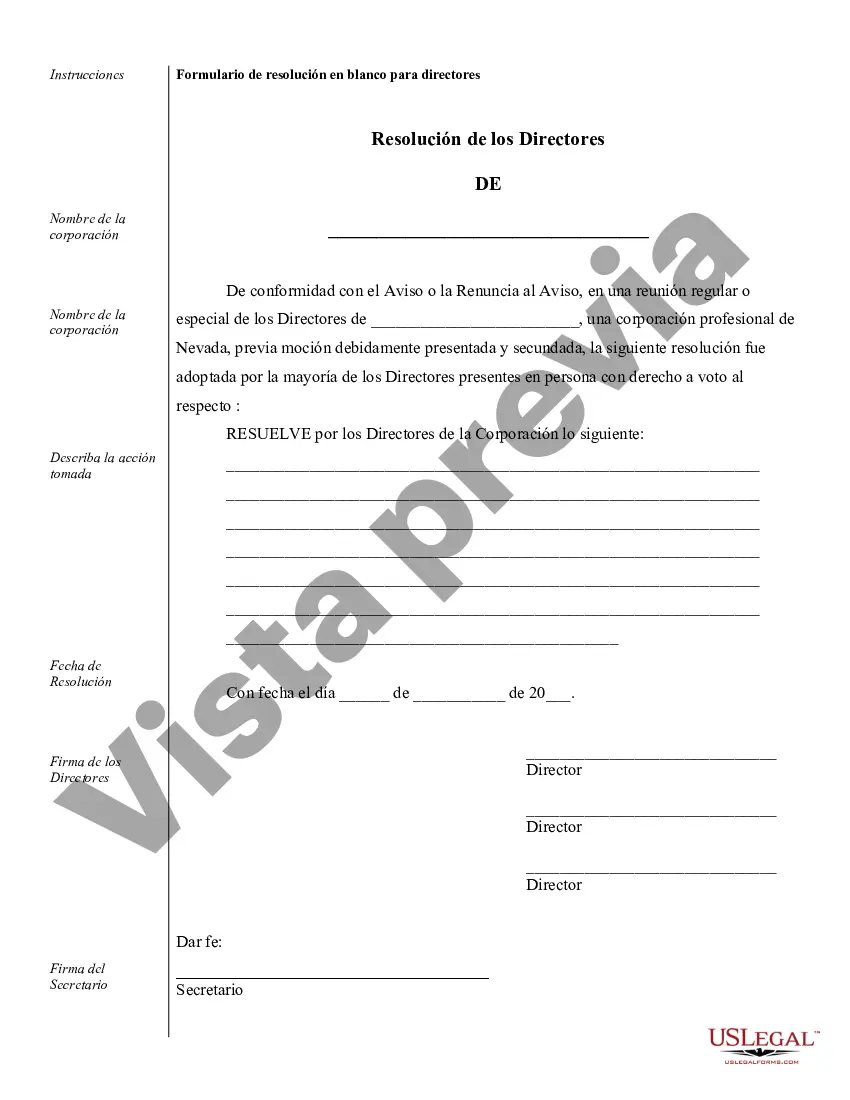

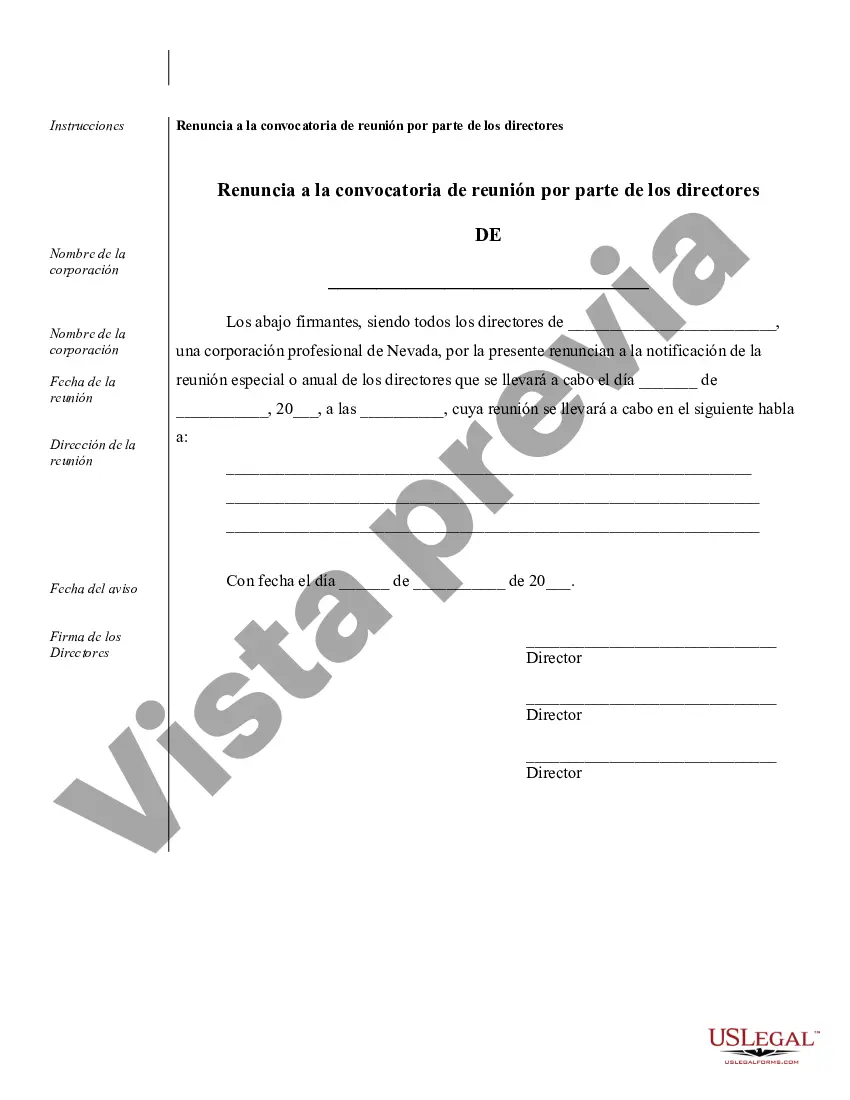

Clark Sample Corporate Records for a Nevada Professional Corporation serve as essential documents that outline the operations and legal aspects of a professional corporation based in the state of Nevada. Maintaining accurate and up-to-date corporate records is crucial for compliance, transparency, and ensuring that the corporation operates within the legal framework of Nevada. These records provide a comprehensive overview of the corporation's structure, ownership, financial activities, and important decisions. The following are some key types of Clark Sample Corporate Records for a Nevada Professional Corporation: 1. Articles of Incorporation: The Articles of Incorporation are the initial formation documents filed with the Secretary of State to establish the corporation's existence. They include details such as the corporation's name, purpose, registered agent, and the number and types of shares authorized. 2. Bylaws: Bylaws outline the internal rules and regulations that govern the corporation's operations and management. They typically cover matters like shareholder meetings, director responsibilities, voting procedures, and the roles of officers. 3. Shareholder Agreements: Shareholder agreements are contracts between the corporation and its shareholders, specifying their rights and obligations. They include provisions related to share transfers, dividend distribution, shareholder voting rights, and buy-sell agreements. 4. Board of Directors Meeting Minutes: These records document the discussions, decisions, and resolutions made during board meetings. They provide a detailed account of the corporation's major actions, including approval of financial statements, appointment of officers, and the adoption of important corporate policies. 5. Stock Ledger: The stock ledger is a record book that contains information on the ownership of shares in the corporation. It includes details such as the names of shareholders, the number of shares held, and any transfers or changes in ownership. 6. Financial Statements: Financial statements give an overview of the corporation's financial health and performance. These records typically include balance sheets, income statements, and cash flow statements, providing a snapshot of the corporation's assets, liabilities, revenue, and expenses. 7. Tax Filings: These records consist of documents filed with the Internal Revenue Service (IRS) and the Nevada Department of Taxation, including corporate tax returns, payroll tax filings, and sales tax returns. 8. Contracts and Agreements: Corporate records also encompass various contracts and agreements entered into by the corporation, such as client agreements, vendor contracts, employment agreements, and lease agreements. These documents ensure proper documentation of legally binding commitments. Maintaining well-organized and up-to-date Clark Sample Corporate Records for a Nevada Professional Corporation is vital for legal compliance, financial transparency, and effective corporate governance. These records provide a comprehensive overview of the corporation's structure, ownership, and overall operations, making them essential for regulatory filings, audits, and potential legal disputes. Regularly reviewing and updating these records is imperative to ensure the corporation meets all legal requirements and maintains a strong foundation for its success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Muestra de registros corporativos para una corporación profesional de Nevada - Sample Corporate Records for a Nevada Professional Corporation

Description

How to fill out Clark Muestra De Registros Corporativos Para Una Corporación Profesional De Nevada?

Benefit from the US Legal Forms and get immediate access to any form template you require. Our beneficial platform with a large number of documents allows you to find and obtain virtually any document sample you want. It is possible to export, complete, and certify the Clark Sample Corporate Records for a Nevada Professional Corporation in just a couple of minutes instead of surfing the Net for hours searching for an appropriate template.

Utilizing our catalog is a superb strategy to improve the safety of your record filing. Our professional legal professionals regularly review all the records to make certain that the forms are relevant for a particular state and compliant with new acts and polices.

How can you get the Clark Sample Corporate Records for a Nevada Professional Corporation? If you have a profile, just log in to the account. The Download button will appear on all the samples you look at. Moreover, you can get all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the tips listed below:

- Find the form you need. Make certain that it is the template you were looking for: verify its headline and description, and use the Preview function if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving process. Click Buy Now and select the pricing plan you like. Then, create an account and process your order using a credit card or PayPal.

- Export the file. Choose the format to get the Clark Sample Corporate Records for a Nevada Professional Corporation and revise and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and reliable document libraries on the web. Our company is always ready to assist you in virtually any legal procedure, even if it is just downloading the Clark Sample Corporate Records for a Nevada Professional Corporation.

Feel free to take advantage of our service and make your document experience as straightforward as possible!

Form popularity

Interesting Questions

More info

6. License or privilege to drive, operate a motor vehicle (NRS) A person who holds a currently valid driver license in this state is entitled to drive and operate all motor vehicles within this state when accompanied by and subject to the control of: A parent of the person under 18 years of age; A person who has secured or maintained legal custody of the person under 18 years of age for at least 60 days; or A person with whom the person has a personal, lawful, and stable home at which the person is regularly present for a period of 60 days. It does not matter whether someone is licensed by another state or other country.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.