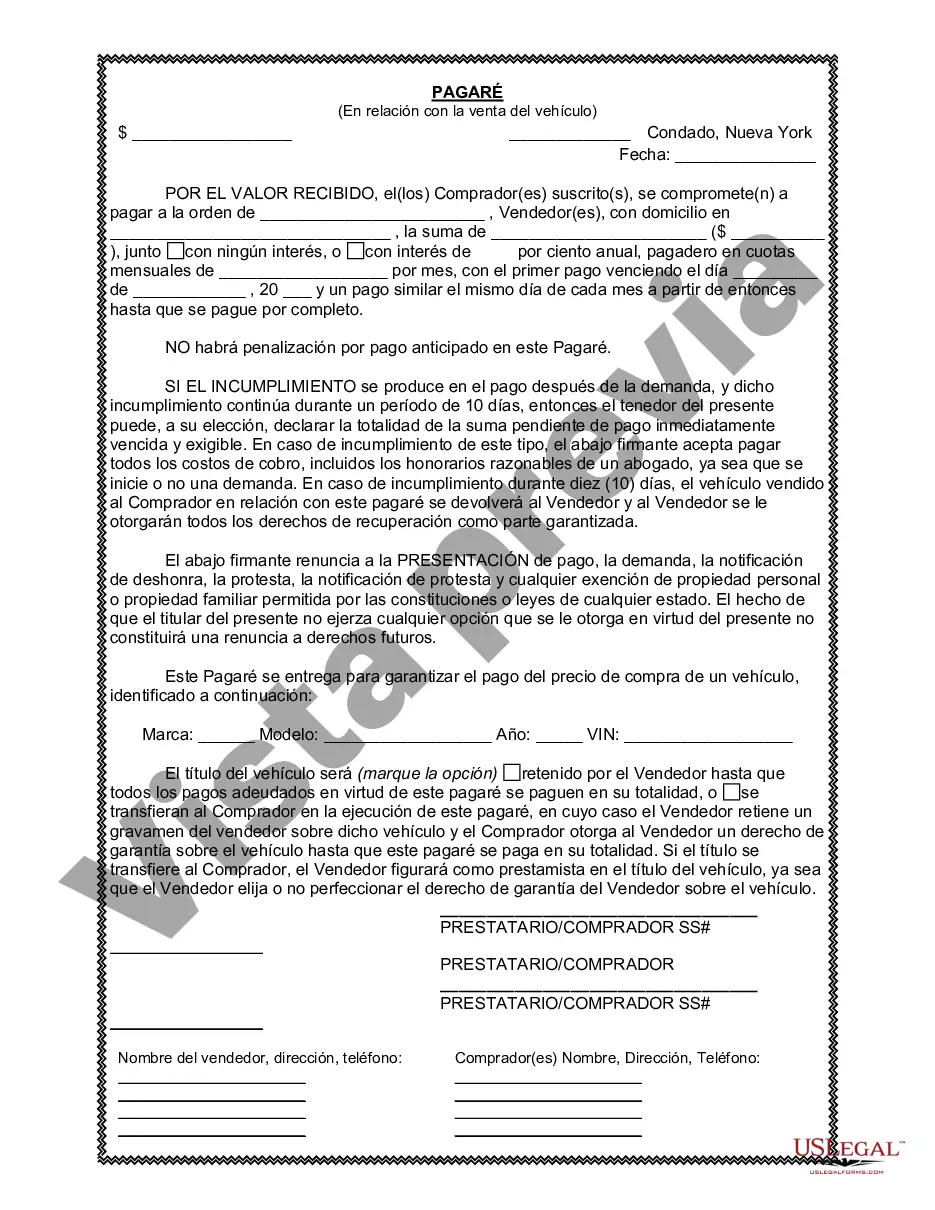

Nassau New York Pagaré en relación con la venta de vehículos o automóviles - New York Promissory Note in Connection with Sale of Vehicle or Automobile

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out New York Pagaré En Relación Con La Venta De Vehículos O Automóviles?

If you are seeking an authentic document, it’s incredibly difficult to discover a more user-friendly site than the US Legal Forms platform – one of the largest repositories on the web.

With this repository, you can obtain numerous sample documents for business and personal use by categories and regions, or keywords.

Thanks to the highly efficient search feature, locating the most recent Nassau New York Promissory Note related to the Sale of Vehicle or Automobile is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration procedure.

Obtain the document. Select the file format and download it onto your device. Make alterations. Complete, modify, print, and sign the acquired Nassau New York Promissory Note related to the Sale of Vehicle or Automobile.

- Additionally, the accuracy of each individual document is confirmed by a team of expert attorneys who consistently review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to acquire the Nassau New York Promissory Note related to the Sale of Vehicle or Automobile is to Log In to your user profile and click on the Download option.

- If you are using US Legal Forms for the first time, just adhere to the instructions provided below.

- Ensure you have located the sample you require. Review its description and utilize the Preview option to examine its contents. If it does not meet your requirements, use the Search option at the top of the screen to find the necessary document.

- Confirm your selection. Click on the Buy now option. After that, choose your preferred pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

Los expertos recomiendan que las personas no deben destinar mas del 10 a 15% de sus ingresos mensuales para pagar su auto. Asimismo, el gasto total de un auto por mes no debe superar el 20% del sueldo neto. Los gastos de un vehiculo incluyen el mantenimiento, el seguro y la gasolina.

5 consejos para pagar tu credito automotriz antes de tiempo Divide tu pago mensual en pagos bisemanales. Es importante revisar que tu contrato de tu credito automotriz te permita hacer pagos parciales.Redondea tus pagos.Aprovecha ese dinero extra.No te brinques mensualidades.Busca un refinanciamiento de tu credito.

Tiene dos opciones de financiacion: un prestamo directo o la financiacion del concesionario. Prestamo directo: significa que esta tomando un prestamo en un banco, compania financiera o en una cooperativa de credito.

El financiamiento es el proceso por el que se proporciona capital a una empresa o persona para utilizar en un proyecto o negocio, es decir, recursos como dinero y credito para que pueda ejecutar sus planes. En el caso de las companias, suelen ser prestamos bancarios o recursos aportados por sus inversionistas.

¿Cual es una buena tasa de interes para un prestamo de coche? Puntaje de credito promedio para coches nuevosTasa porcentual anualTasa porcentual anual781-8503.17%3.8%661-7804.03%5.48%601-6606.79%10.1%501-60010.98%16.27%1 more row

Autos nuevos y usados La tasa de interes promedio de un prestamo de auto usado fue del 9.65% en el primer trimestre de 2020, en comparacion con el 5.61% de un prestamo de auto nuevo, segun el informe de Experian sobre el estado del mercado financiero automotriz.

El que usted pueda pagar por adelantado y por completo su prestamo vehicular sin que lo penalicen depende de su contrato y de la ley en su estado. Si el prestamista quiere cobrarle una multa o cargo por adelantar el pago completo de su prestamo, el contrato debe contener una clausula de penalizacion por prepago.

El pago mensual de su auto se basa en el monto del prestamo, el plazo del prestamo y la tasa de interes para el prestamo. El monto del prestamo se basa en el precio de compra neto del vehiculo (mas impuesto sobre las ventas) o el precio del vehiculo menos cualquier reembolso en efectivo, canje o pago inicial.

¿Cual es una buena tasa de interes para un prestamo de coche? Puntaje de credito promedio para coches nuevosTasa porcentual anualPuntaje de credito promedio para coches usados661-7804.03%661-780601-6606.79%601-660501-60010.98%501-600300-50013.76%300-5001 more row

Lo tipico. El punto de partida para determinar si eres elegible seran tus ingresos y facturas, y la relacion entre estos dos factores. Generalmente, los prestamistas de alto riesgo requieren que ganes al menos $1,500 a $2,500 al mes antes de impuestos de una sola fuente de ingresos.