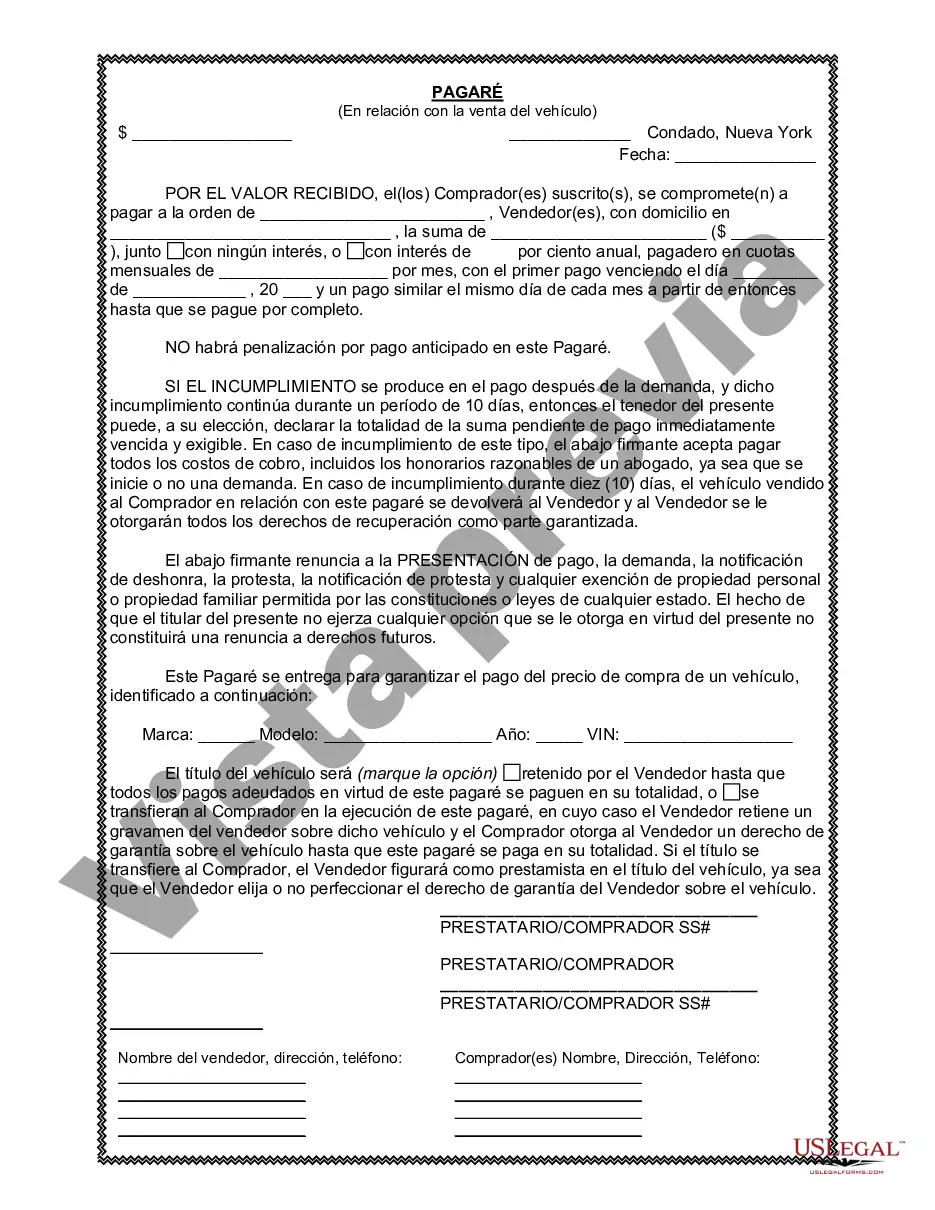

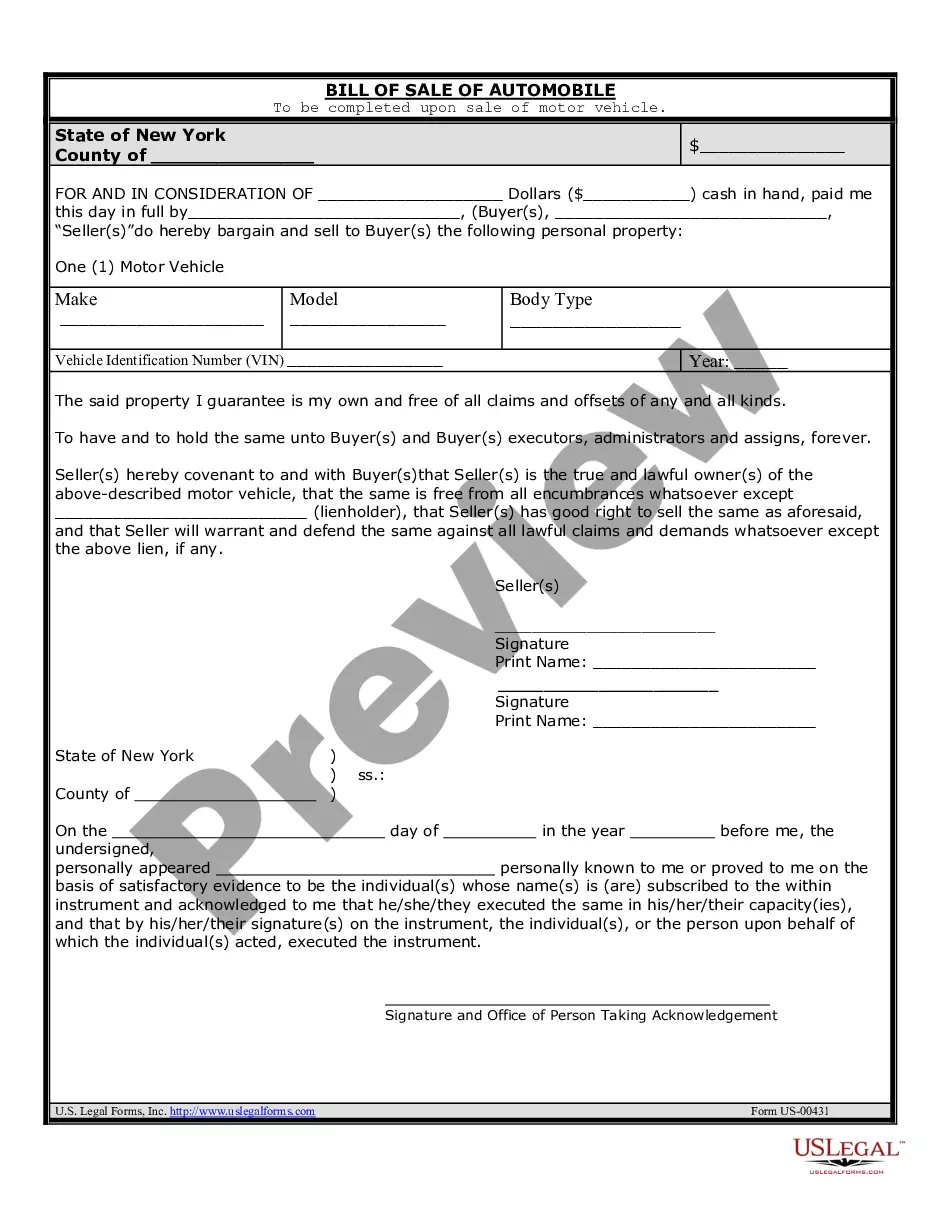

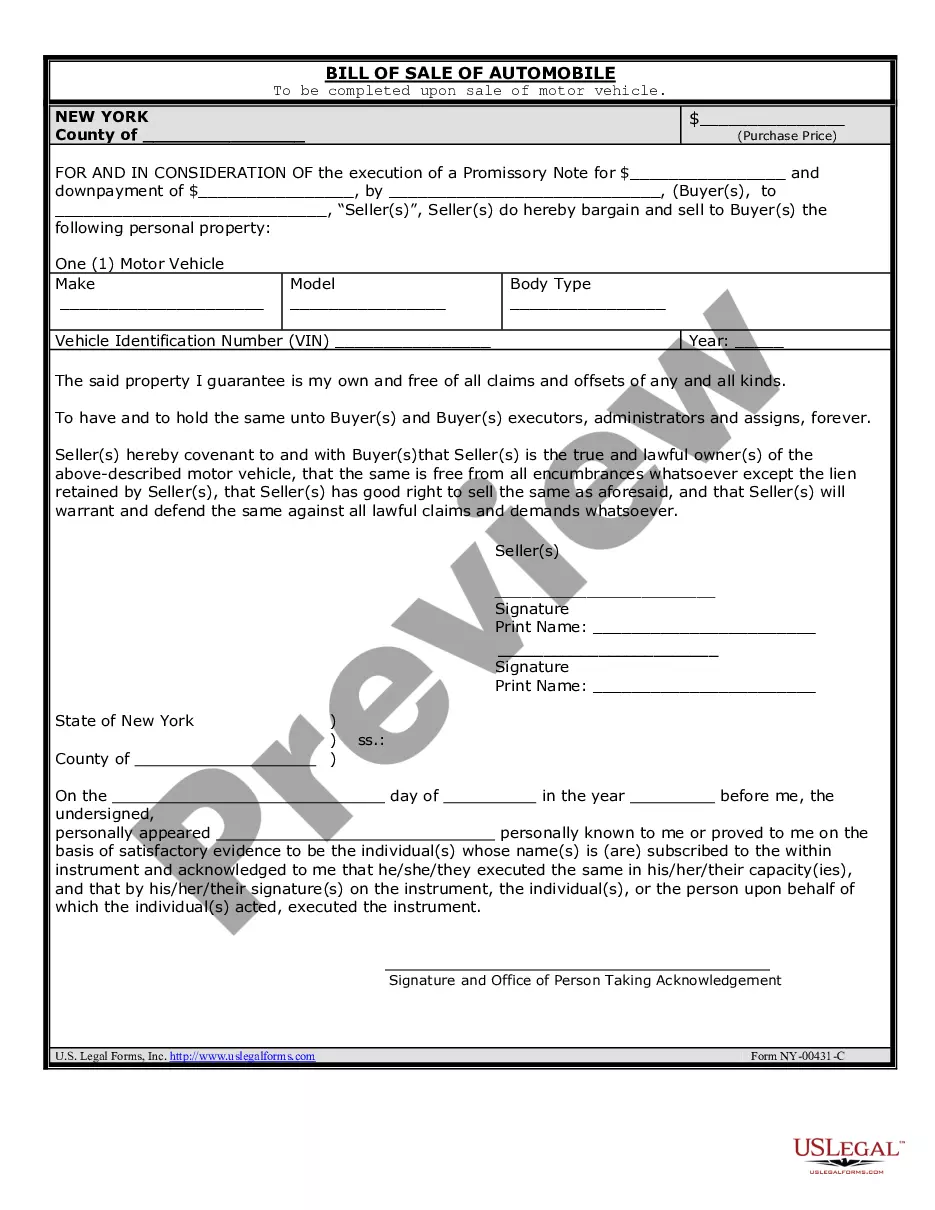

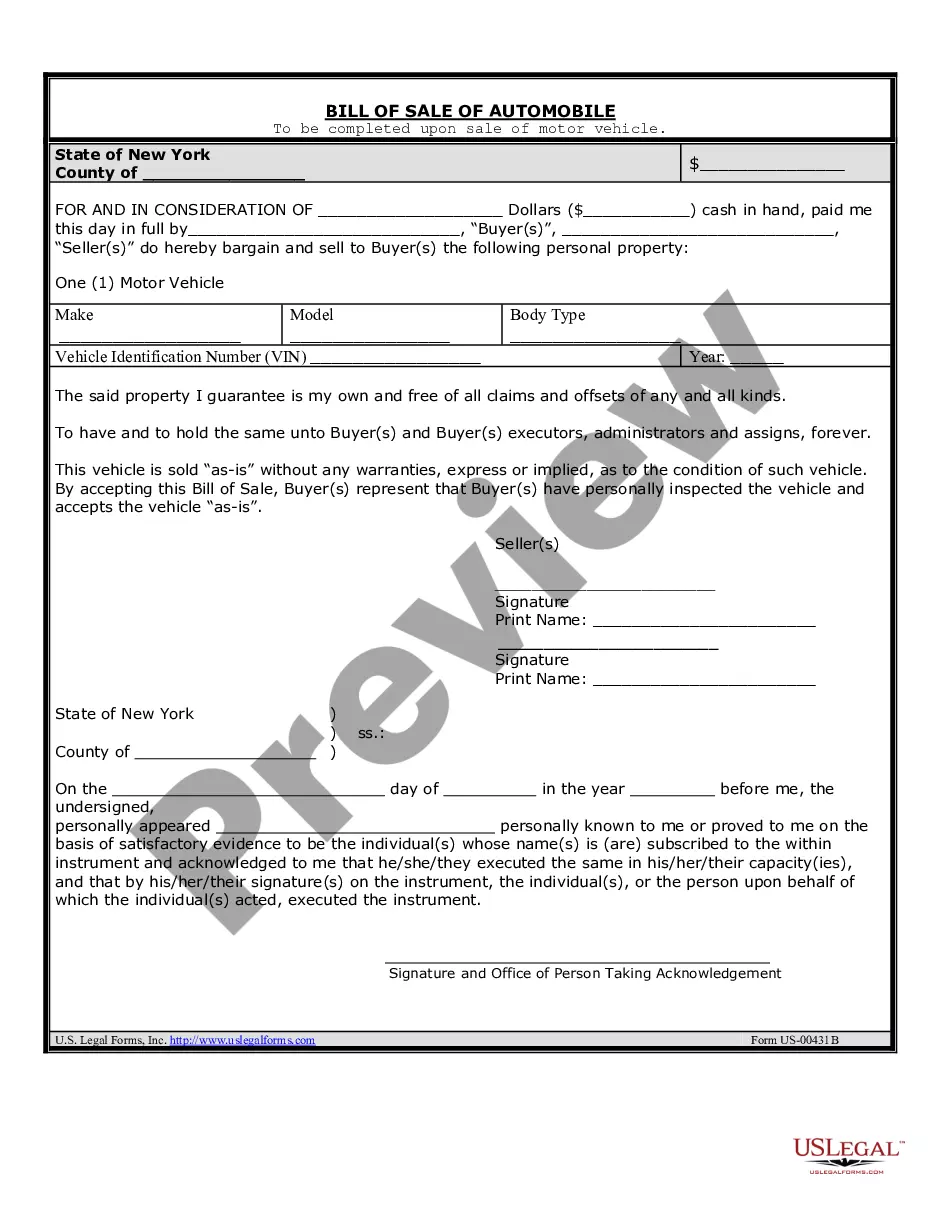

A Syracuse New York Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and a seller in the context of a vehicle sale. This promissory note serves as a written evidence of the loan agreement, securing the seller's right to receive payment and the buyer's obligation to repay the specified amount. The content of a Syracuse New York Promissory Note in Connection with Sale of Vehicle or Automobile typically includes: 1. Parties involved: The names, addresses, and contact information of both the buyer (borrower) and the seller (lender) are listed at the beginning of the promissory note. This ensures both parties are clearly identified and can be contacted if necessary. 2. Vehicle details: The make, model, year, VIN (Vehicle Identification Number), and any other relevant details about the vehicle being sold are stated. This provides a clear description of the asset that the buyer will finance through the promissory note. 3. Loan amount and payment terms: The total amount being financed is specified, along with the agreed-upon interest rate, if applicable. The promissory note should include a breakdown of how the loan will be repaid, including the number of installments, due dates, and payment amounts. This section may also describe any late payment penalties or fees. 4. Security interest: The promissory note should detail the security interest being taken in the vehicle. This means that in the event of default, the lender has the right to repossess the vehicle as legally permitted. The note may also mention the responsibilities of the buyer regarding insurance, maintenance, and registration of the vehicle. 5. Promissory note duration: The length of time within which the buyer is expected to repay the loan is stated here. This may be expressed as a specific number of months or years, or it may be open-ended. The note may also outline the rights and obligations of both parties should the buyer wish to pay off the loan early. 6. Signatures and notarization: The promissory note must be signed and dated by both the buyer and seller to indicate their agreement to the terms. Additionally, notarization may be required to validate the authenticity of the signatures. Different types of Syracuse New York Promissory Notes in Connection with Sale of Vehicle or Automobile may include variations in terms and conditions or additional clauses specific to the parties involved. Some common variants may include: 1. Installment Sales Contract: This type of promissory note allows the buyer to make payments in installments over a specified period, typically with interest included. 2. Balloon Payment Note: In this variant, the buyer agrees to make lower monthly payments during the term and then pay a large lump sum, the "balloon payment," at the end. This arrangement may be suitable for buyers who anticipate a future financial windfall. 3. Secured Promissory Note: When the buyer secures the loan with collateral, such as the vehicle being purchased, it is considered a secured promissory note. This provides the lender with added security in case of default. In conclusion, a Syracuse New York Promissory Note in Connection with Sale of Vehicle or Automobile is a crucial legal document that establishes the terms and conditions of a loan agreement between a buyer and seller. It ensures both parties are clear about their responsibilities and protects the seller's rights in case of default. Different variations of this promissory note may exist depending on specific terms, payment arrangements, and security measures implemented.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Syracuse New York Pagaré en relación con la venta de vehículos o automóviles - New York Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Syracuse New York Pagaré En Relación Con La Venta De Vehículos O Automóviles?

We always strive to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we apply for legal services that, as a rule, are extremely expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of an attorney. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Syracuse New York Promissory Note in Connection with Sale of Vehicle or Automobile or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Syracuse New York Promissory Note in Connection with Sale of Vehicle or Automobile adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Syracuse New York Promissory Note in Connection with Sale of Vehicle or Automobile would work for your case, you can select the subscription plan and proceed to payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!