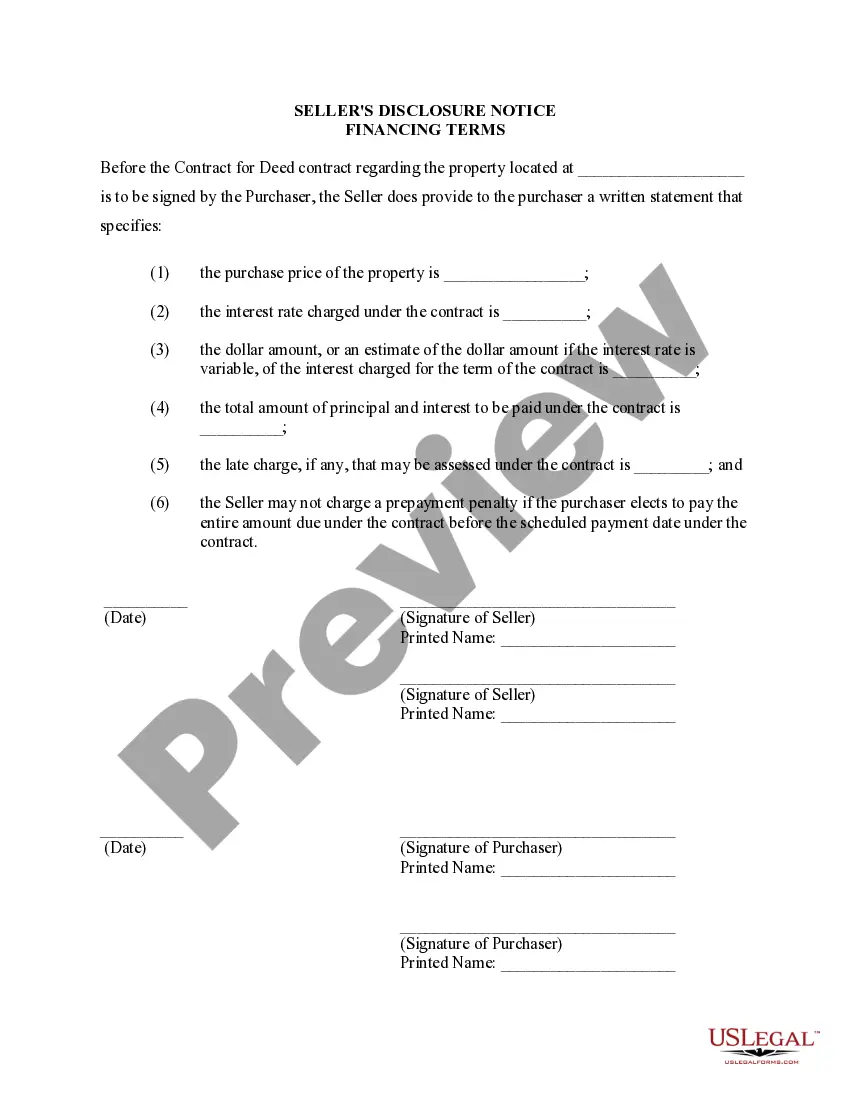

Nassau New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an important document that outlines the relevant financing terms for the purchase of a residential property. This disclosure is essential for potential buyers and sellers to have a clear understanding of the financial obligations and terms associated with the transaction. Here is a detailed description of what this disclosure typically includes: 1. Purchase Price: The disclosure will outline the agreed purchase price for the property. This is the amount that the buyer will pay over the course of the financing period. 2. Down Payment: It will specify the amount of money the buyer is required to pay as a down payment at the time of signing the contract. This down payment is typically a percentage of the purchase price. 3. Interest Rate: The disclosure will detail the interest rate that applies to the financing arrangement. This is the rate at which interest will accrue on the remaining balance of the purchase price. 4. Payment Schedule: It will outline the payment schedule agreed upon by the buyer and seller. This includes the frequency of payments (monthly, quarterly, etc.) and the specific due dates. 5. Term length: This refers to the agreed-upon duration of the financing arrangement. It specifies the length of time over which the buyer will make payments to the seller. 6. Late Payment Penalties: The disclosure may include information about any penalties or fees the buyer may incur for late payments. This could include late payment charges or interest rate adjustments. 7. Principal Reduction: It will state whether any portion of the buyer's payments will be applied to reducing the principal balance of the purchase price and how this reduction will be calculated. 8. Default and Remedies: The disclosure will mention the consequences of defaulting on the contract, such as possible foreclosure or loss of rights to the property. It may also explain the remedies available to the buyer or seller in case of default. 9. Property Taxes and Insurance: The disclosure may specify whether the buyer or seller is responsible for property taxes and insurance during the financing period. This can vary depending on the agreement between the parties. Different types of Nassau New York Seller's Disclosure of Financing Terms for Residential Property may include variations in the specific terms mentioned above. Each contract or agreement for deed may have unique terms and conditions tailored to the specific property and the circumstances of the buyer and seller. It's essential for both parties to carefully review and understand these financing terms before entering into the agreement. As transactions involving land contracts can be complex, it is advisable for buyers and sellers to seek legal counsel to ensure they are fully informed and protected throughout the process.

Nassau New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Nassau New York Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you are looking for a relevant form template, it’s extremely hard to find a better platform than the US Legal Forms site – probably the most comprehensive libraries on the internet. Here you can find a large number of document samples for business and individual purposes by types and states, or keywords. Using our advanced search function, getting the most up-to-date Nassau New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is as easy as 1-2-3. Moreover, the relevance of every record is verified by a group of expert lawyers that on a regular basis check the templates on our website and revise them in accordance with the newest state and county laws.

If you already know about our system and have an account, all you should do to receive the Nassau New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is to log in to your user profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have opened the sample you need. Read its information and utilize the Preview function (if available) to check its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to discover the appropriate record.

- Confirm your decision. Choose the Buy now option. Next, pick the preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the template. Choose the format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the received Nassau New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract.

Each template you save in your user profile has no expiry date and is yours permanently. It is possible to access them via the My Forms menu, so if you want to have an additional version for enhancing or creating a hard copy, you may return and download it once again at any moment.

Take advantage of the US Legal Forms professional catalogue to gain access to the Nassau New York Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract you were looking for and a large number of other professional and state-specific samples on one platform!