Rochester New York Seller's Information for Appraiser provided to Buyer is a comprehensive set of documents and details pertaining to a property in Rochester, New York, which are shared by the seller with the appraiser to help the buyer assess the value and condition of the property. This information is crucial for determining an accurate appraisal and provides valuable insights into the property's history, features, and maintenance records. Key Components of Rochester New York Seller's Information for Appraiser: 1. Property Details: This section includes essential information about the property, such as its address, lot size, architectural style, number of bedrooms and bathrooms, overall square footage, and any additional features like a garage, basement, or pool. 2. Property History: This section provides a comprehensive overview of the property's history. It includes details about previous owners, purchase and sale dates, and any significant changes made to the property over the years. This information gives the appraiser a thorough understanding of the property's past. 3. Property Improvements: Here, the seller outlines all major improvements made to the property, including renovations, additions, or upgrades. This section helps the appraiser assess the overall value of the property by considering its condition and any enhancements that have been made. 4. Maintenance Records: The seller provides documentation regarding routine maintenance and repairs performed on the property. This includes receipts, invoices, and records for services like plumbing, electrical work, HVAC systems, and roof maintenance. Such records demonstrate the owner's commitment to the property's upkeep, which can impact the appraisal results. 5. Homeowners Association (HOA) Information: If the property is part of an HOA, the seller provides all relevant details, such as monthly fees, rules and regulations, and any pending special assessments. Appraisers take these factors into account when evaluating the property's value. 6. Property Taxes: Sellers provide information on the property's current tax assessment, including the assessment value, tax rates, and any exemptions or abatement applied. Understanding the tax implications is important for both buyers and appraisers in estimating the property's value accurately. Other types of Rochester New York Seller's Information for Appraiser can include additional specifics tailored to the property type. For instance: — Condo or Townhouse Specifics: If the property is a condominium or townhouse, additional documentation might include HOA bylaws, association financial statements, and any pending or completed special assessments. — Commercial Property Information: In the case of commercial properties, sellers might provide information on tenant lease agreements, rental income, and expenses associated with the property. In conclusion, Rochester New York Seller's Information for Appraiser is a crucial collection of documents and details that enable the appraiser to assess the value of a property accurately. By providing comprehensive information about the property's history, improvements, maintenance records, and other pertinent details, sellers aid the appraiser in performing a detailed appraisal and helping buyers make informed decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Rochester New York Información del vendedor para el tasador proporcionada al comprador - New York Seller's Information for Appraiser provided to Buyer

Description

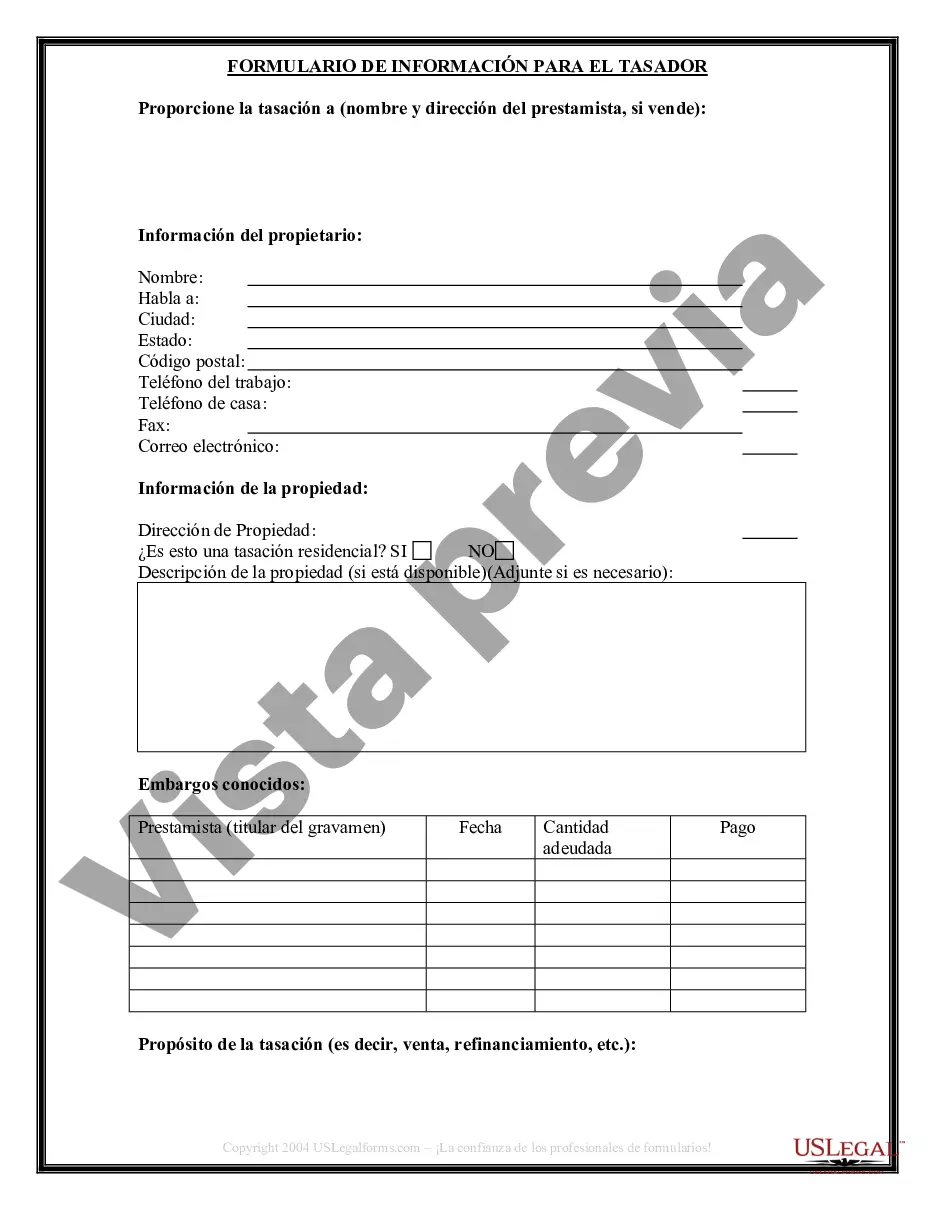

How to fill out Rochester New York Información Del Vendedor Para El Tasador Proporcionada Al Comprador?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Rochester New York Seller's Information for Appraiser provided to Buyer gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Rochester New York Seller's Information for Appraiser provided to Buyer takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Rochester New York Seller's Information for Appraiser provided to Buyer. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!