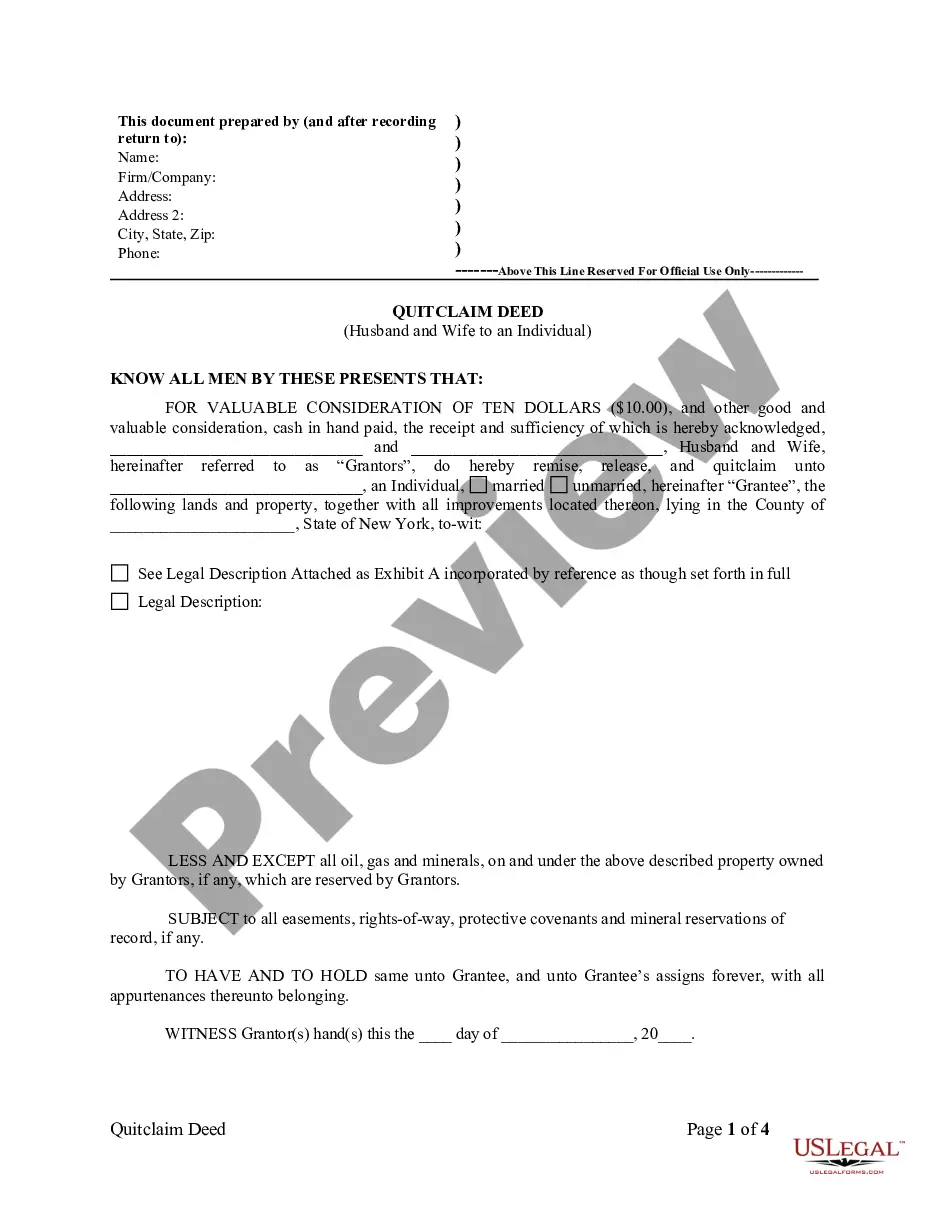

A Queens New York Quitclaim Deed from Husband and Wife to an Individual is a legal document that transfers the ownership interest of a property from a married couple to a third party, known as the grantee or individual. This type of deed can be used when the couple wants to relinquish their rights and interests in a property to a specific individual, often a family member, friend, or buyer. A Quitclaim Deed is a popular choice when transferring a property without any warranties or guarantees regarding the property's title. The deed essentially conveys whatever interest the couple has in the property, without making any promises or assurances about the existence of liens, encumbrances, or other claims on the property. In Queens, New York, there may be different variations of the Quitclaim Deed from Husband and Wife to an Individual, depending on the specific circumstances. Some possible variations may include: 1. Joint Tenancy with Right of Survivorship Quitclaim Deed: This type of deed is commonly used by married couples who own the property together as joint tenants with rights of survivorship. It ensures that if one spouse passes away, the surviving spouse automatically receives the deceased spouse's ownership interest in the property. 2. Community Property Quitclaim Deed: In some cases, the property may be considered community property if the couple resides in a state that recognizes community property laws. This type of deed is used to transfer the community property interest from both spouses to an individual, giving the grantee the new, individual ownership. 3. Partial Interest Quitclaim Deed: The partial interest quitclaim deed is used when the couple wants to transfer only a portion of their ownership interest in the property to an individual. This allows them to retain partial ownership while granting the recipient ownership over a specific percentage or portion. When executing a Queens New York Quitclaim Deed from Husband and Wife to an Individual, it is essential to ensure compliance with all local and state laws, including filing requirements and recording fees. It is also recommended consulting with an experienced real estate attorney who can provide guidance, draft the deed, and ensure all legal obligations are met. Keywords: Queens New York Quitclaim Deed, Husband and Wife, Individual, Transfer of Ownership, Property, Granter, Grantee, Legal Document, Titles, Liens, Encumbrances, Joint Tenancy with Right of Survivorship, Community Property, Partial Interest Quitclaim Deed, Filing Requirements, Recording Fees, Real Estate Attorney.

Queens New York Quitclaim Deed from Husband and Wife to an Individual

Description

How to fill out Queens New York Quitclaim Deed From Husband And Wife To An Individual?

If you are searching for a valid form, it’s extremely hard to choose a more convenient service than the US Legal Forms website – probably the most comprehensive online libraries. With this library, you can get a large number of templates for company and personal purposes by types and regions, or key phrases. With the high-quality search feature, finding the newest Queens New York Quitclaim Deed from Husband and Wife to an Individual is as elementary as 1-2-3. Additionally, the relevance of each record is proved by a team of skilled attorneys that regularly check the templates on our platform and update them based on the newest state and county requirements.

If you already know about our platform and have an account, all you should do to get the Queens New York Quitclaim Deed from Husband and Wife to an Individual is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have opened the form you want. Check its explanation and make use of the Preview option to explore its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to discover the needed document.

- Confirm your decision. Select the Buy now option. Following that, select your preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the form. Indicate the file format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the acquired Queens New York Quitclaim Deed from Husband and Wife to an Individual.

Every form you add to your profile does not have an expiration date and is yours forever. You always have the ability to access them using the My Forms menu, so if you want to receive an extra duplicate for enhancing or printing, you can return and save it once more at any time.

Take advantage of the US Legal Forms professional catalogue to get access to the Queens New York Quitclaim Deed from Husband and Wife to an Individual you were seeking and a large number of other professional and state-specific samples on one website!