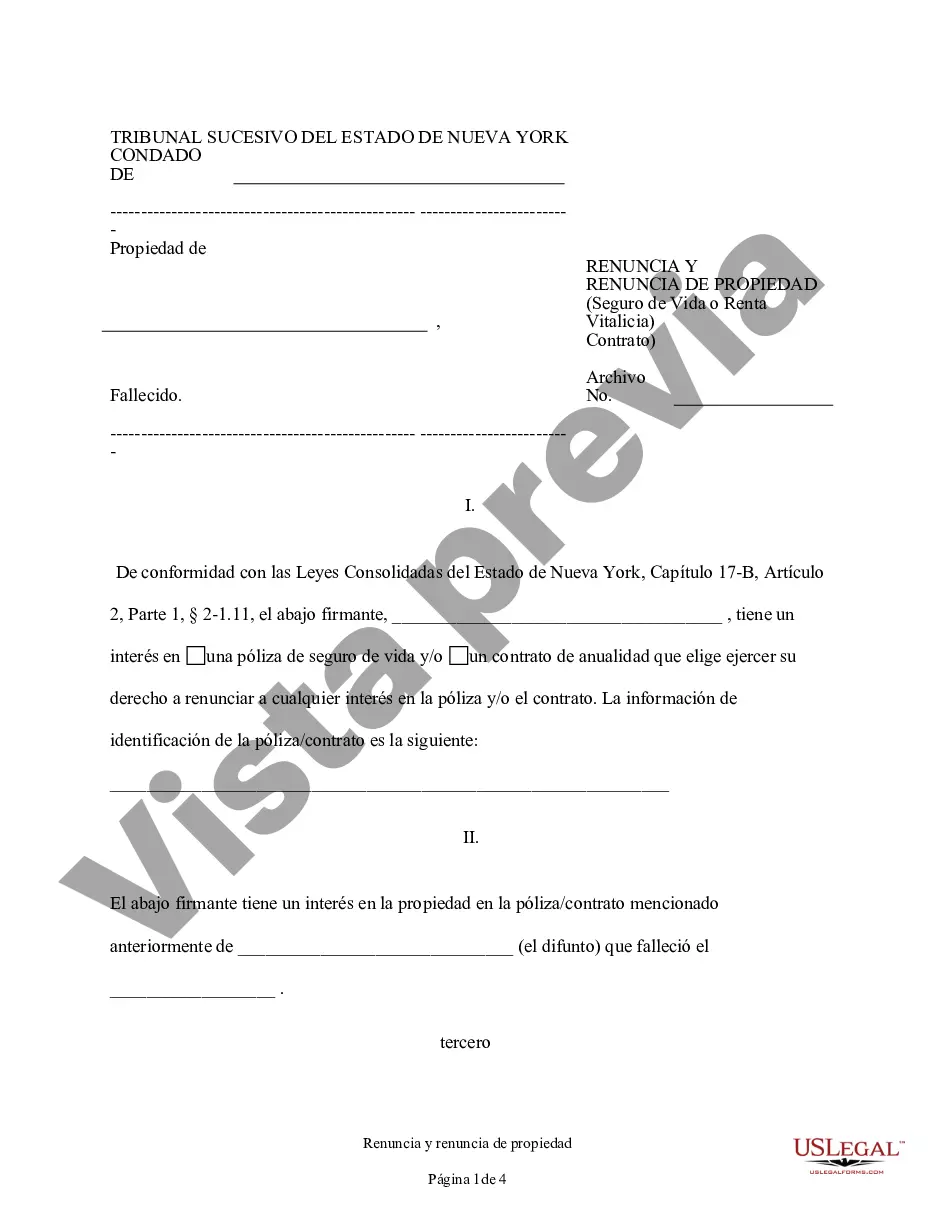

A Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract refers to a legal process where an individual voluntarily gives up their right to receive the proceeds or benefits from a life insurance or annuity contract. This renouncement and disclaimer can occur within the context of various scenarios, including estate planning, asset protection, or disinheritance. In Suffolk County, New York, there are different types of renunciations and disclaimers that individuals can pursue, depending on their specific circumstances. One type of renunciation and disclaimer is related to estate planning. In this case, an individual may choose to renounce their rights to the proceeds or benefits from a life insurance or annuity contract in order to minimize their estate's overall tax liability or to facilitate the distribution of assets according to their desired estate plan. By renouncing the property or benefits, they effectively relinquish any control or claim over the policy, allowing it to be distributed or used as directed by the policyholder's estate plan. Another type of renunciation and disclaimer involves asset protection. Individuals facing potential creditors or legal actions may choose to renounce ownership rights to their life insurance or annuity contracts, thereby shielding the proceeds or benefits from being accessed by those seeking to satisfy outstanding debts or legal judgments. This type of renunciation can be a strategic move to safeguard valuable assets and protect the financial well-being of loved ones. Moreover, renunciation and disclaimer of property from life insurance or annuity contracts can also be utilized in cases of disinheritance. When an individual wishes to exclude a specific beneficiary from receiving benefits from their life insurance or annuity contracts, they can renounce and disclaim their rights to the policy. This action ensures that the excluded party will not be able to claim or access the proceeds or benefits, aligning with the policyholder's intentions for the distribution of their estate. In Suffolk County, New York, individuals pursuing renunciation and disclaimer of property from life insurance or annuity contracts must adhere to state-specific laws and regulations. Legal formalities, such as filing a written renunciation or disclaimer with the appropriate authorities, may be required to ensure the renunciation is valid and legally binding. It is essential to consult an experienced attorney or estate planner when considering Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. They can provide guidance tailored to the individual's unique circumstances, helping them make informed decisions and navigate the legal process effectively. By understanding the various types and implications of renunciation and disclaimer, individuals can protect their assets, structure their estates, and ensure their wishes are realized.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Renuncia y Renuncia de Bienes del Seguro de Vida o Contrato de Renta Vitalicia - New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Suffolk New York Renuncia Y Renuncia De Bienes Del Seguro De Vida O Contrato De Renta Vitalicia?

If you are looking for a valid form, it’s extremely hard to choose a more convenient service than the US Legal Forms website – probably the most extensive libraries on the internet. With this library, you can find thousands of document samples for company and individual purposes by categories and states, or keywords. With our advanced search option, getting the latest Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is as elementary as 1-2-3. Moreover, the relevance of each and every record is proved by a team of skilled lawyers that on a regular basis check the templates on our platform and update them according to the newest state and county laws.

If you already know about our platform and have a registered account, all you should do to receive the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is to log in to your profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have found the sample you need. Read its explanation and make use of the Preview option (if available) to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to discover the needed document.

- Affirm your choice. Click the Buy now option. Following that, pick the preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Use your bank card or PayPal account to complete the registration procedure.

- Get the form. Indicate the format and download it to your system.

- Make adjustments. Fill out, modify, print, and sign the obtained Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

Every single form you add to your profile has no expiry date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you need to get an extra copy for editing or creating a hard copy, feel free to return and download it once more anytime.

Make use of the US Legal Forms extensive collection to get access to the Suffolk New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract you were seeking and thousands of other professional and state-specific samples on one website!