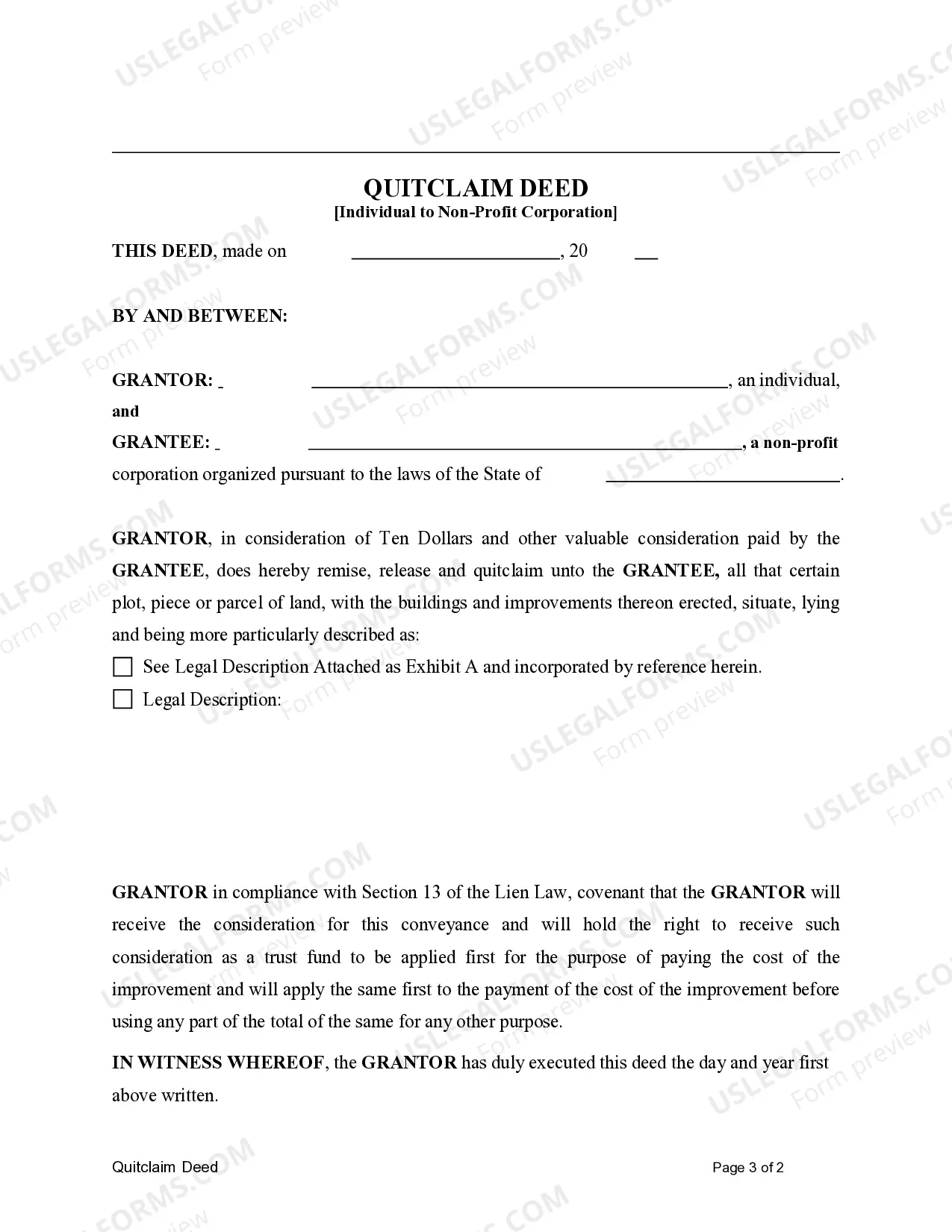

This form is a Quitclaim Deed where the Grantor is an individual, and the Grantee is a non-profit corporation. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Kings New York Quitclaim Deed from an Individual to a Non-Profit Corporation is a legal document that transfers property ownership from an individual to a non-profit organization located in Kings County, New York. This type of deed ensures that the individual is relinquishing any claim or interest they have in the specified property and transferring it solely to the non-profit corporation. This deed is often used when an individual wishes to donate real estate or any other property to a non-profit organization based in Kings County, New York. It allows the individual to transfer their ownership rights to the non-profit corporation without making any warranties about the property's condition or title. By executing this deed, the individual is essentially stating that they are giving up all rights, interests, and claims to the property being transferred. It is important to note that a quitclaim deed does not guarantee that the property is free from liens, encumbrances, or other claims. Therefore, it is recommended for the non-profit corporation to conduct a thorough title search before accepting the property. Different types of Kings New York Quitclaim Deed from an Individual to a Non-Profit Corporation could include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used to transfer ownership from an individual to a non-profit corporation. It simply transfers the individual's interest in the property without any warranties. 2. Special Quitclaim Deed: This deed specifies any additional terms or conditions agreed upon by the parties involved in the transfer. For example, it may include provisions regarding the use of the property or any financial obligations associated with it. 3. Bargain and Sale Quitclaim Deed: This type of quitclaim deed implies that the individual transferring the property has the legal right to do so but makes no specific warranties about the property's history or title. In conclusion, a Kings New York Quitclaim Deed from an Individual to a Non-Profit Corporation is a legal document that allows individual property owners to transfer their ownership rights to a non-profit organization in Kings County, New York. It is essential to consult with an attorney or real estate professional to ensure that the deed is executed correctly and all necessary precautions are taken before accepting the property.A Kings New York Quitclaim Deed from an Individual to a Non-Profit Corporation is a legal document that transfers property ownership from an individual to a non-profit organization located in Kings County, New York. This type of deed ensures that the individual is relinquishing any claim or interest they have in the specified property and transferring it solely to the non-profit corporation. This deed is often used when an individual wishes to donate real estate or any other property to a non-profit organization based in Kings County, New York. It allows the individual to transfer their ownership rights to the non-profit corporation without making any warranties about the property's condition or title. By executing this deed, the individual is essentially stating that they are giving up all rights, interests, and claims to the property being transferred. It is important to note that a quitclaim deed does not guarantee that the property is free from liens, encumbrances, or other claims. Therefore, it is recommended for the non-profit corporation to conduct a thorough title search before accepting the property. Different types of Kings New York Quitclaim Deed from an Individual to a Non-Profit Corporation could include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used to transfer ownership from an individual to a non-profit corporation. It simply transfers the individual's interest in the property without any warranties. 2. Special Quitclaim Deed: This deed specifies any additional terms or conditions agreed upon by the parties involved in the transfer. For example, it may include provisions regarding the use of the property or any financial obligations associated with it. 3. Bargain and Sale Quitclaim Deed: This type of quitclaim deed implies that the individual transferring the property has the legal right to do so but makes no specific warranties about the property's history or title. In conclusion, a Kings New York Quitclaim Deed from an Individual to a Non-Profit Corporation is a legal document that allows individual property owners to transfer their ownership rights to a non-profit organization in Kings County, New York. It is essential to consult with an attorney or real estate professional to ensure that the deed is executed correctly and all necessary precautions are taken before accepting the property.