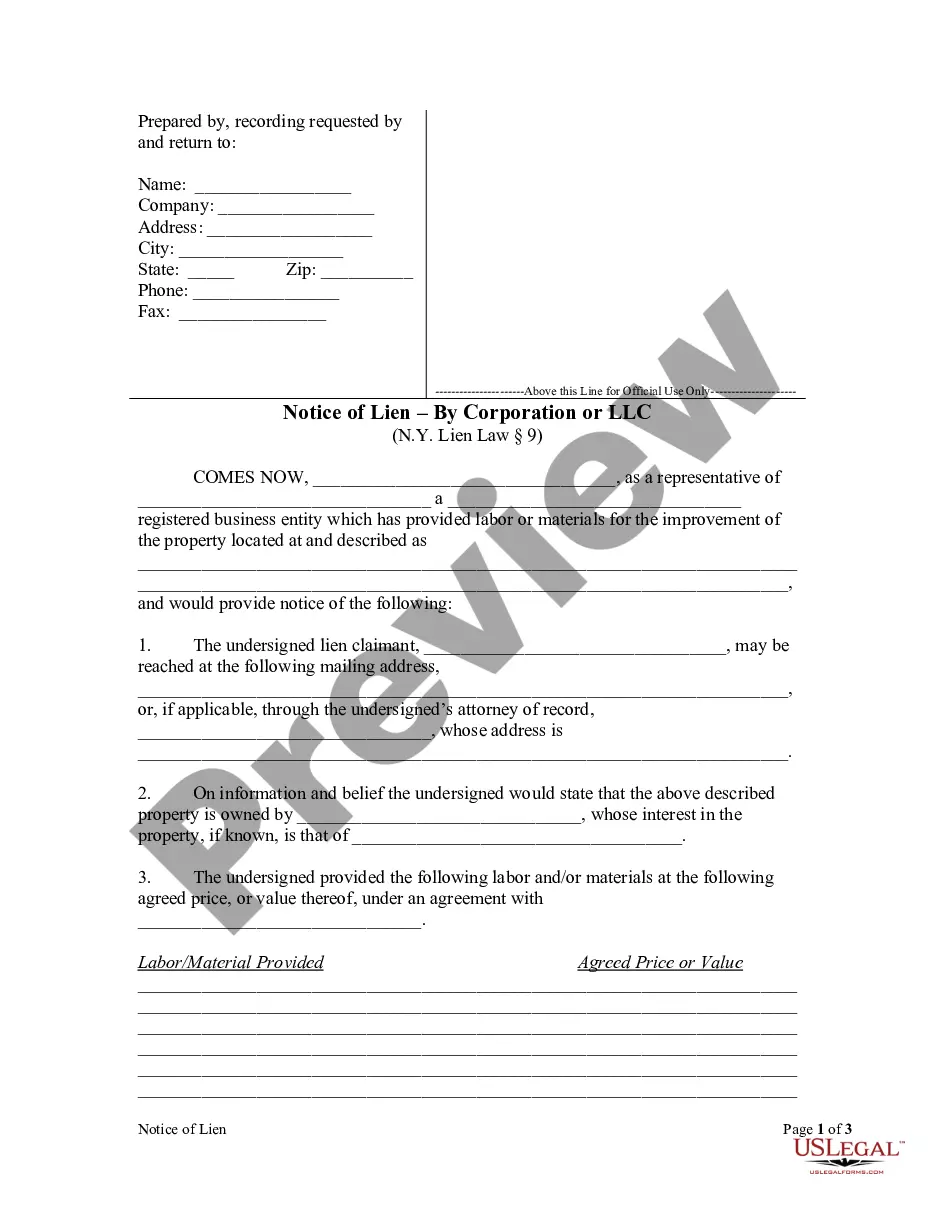

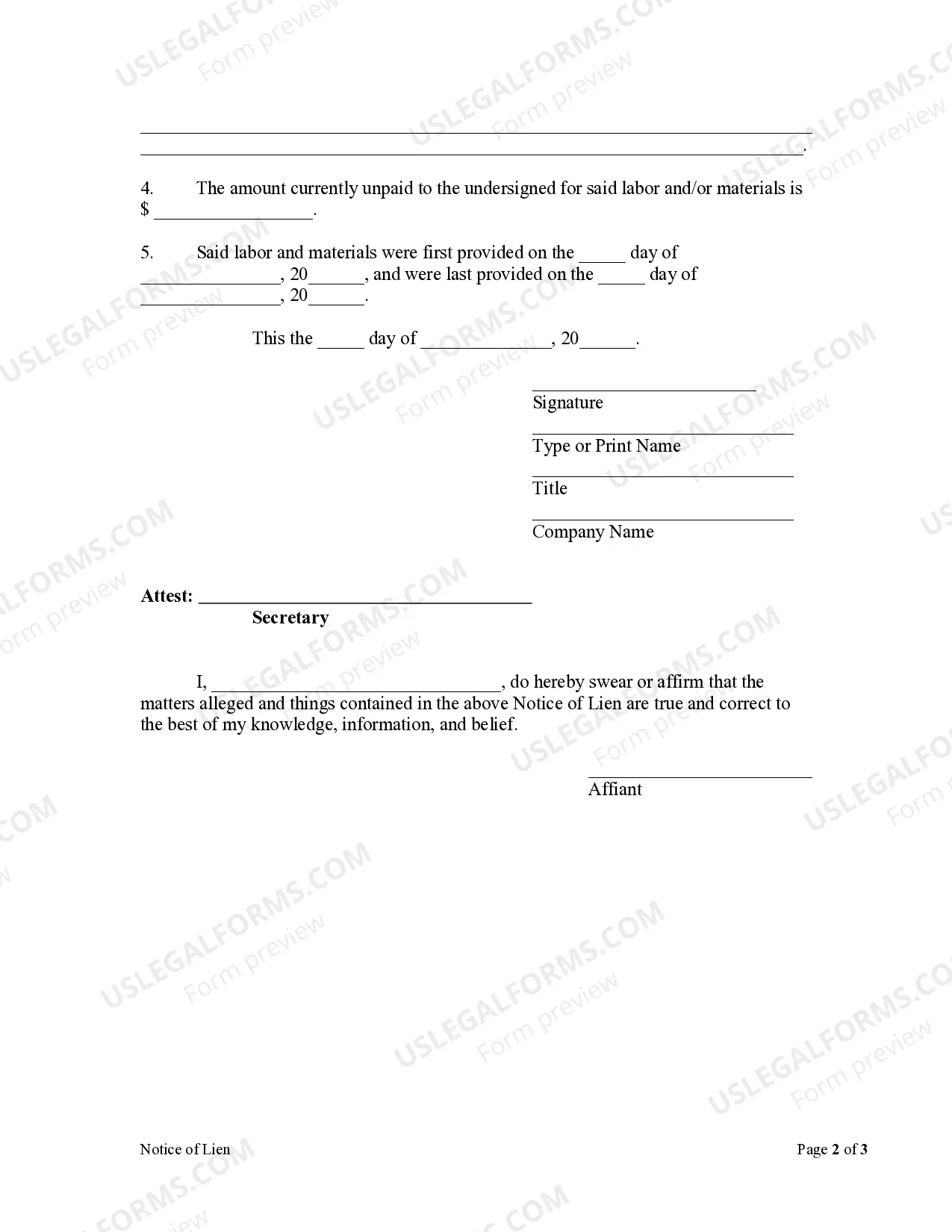

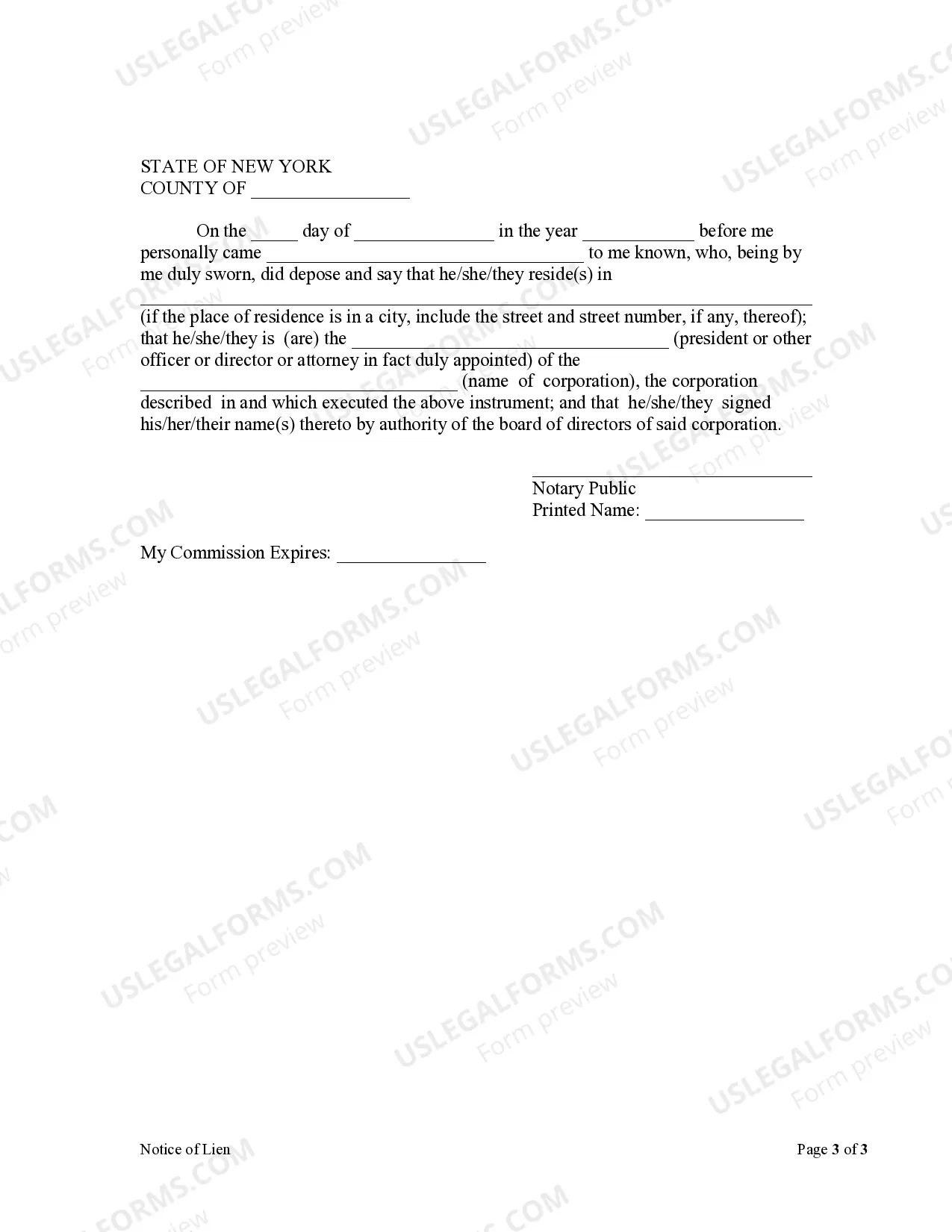

New York law requires a party desiring to claim a lien to file a Notice of Lien form in the office of the clerk of the county where the property is situated. The notice may be filed at any time during the progress of the work and the furnishing of the materials, or, within eight months after the completion of the contract, or the final performance of the work, or the final furnishing of the materials.

Nassau New York Notice of Lien by Corporation or LLC is a legal document filed to publicly announce a financial claim against a property or real estate. This notice is typically issued by a corporation or limited liability company (LLC) when there is an unpaid debt owed to them by the property owner. The Nassau New York Notice of Lien by Corporation or LLC is an important step in protecting the creditor's rights and ensuring that they can recover the outstanding amount. This lien notice puts others on notice that there is a valid claim against the property, making it difficult for the property owner to sell or transfer the property without resolving the debt. There are different types of Nassau New York Notice of Lien by Corporation or LLC, including: 1. Mechanic's Lien: This type of lien is commonly filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services to improve a property. It ensures that these parties are compensated for their work or supplies, as the lien encumbers the property until the debt is paid. 2. Judgment Lien: When a creditor obtains a court judgment against a debtor, they can file a judgment lien on the debtor's property. This lien effectively becomes a security interest in the property and can be foreclosed upon if the debtor fails to fulfill their obligation. 3. Tax Lien: If a property owner fails to pay their taxes, the government agency responsible for collecting taxes can file a tax lien on the property. This lien ensures that the government can recoup the unpaid taxes by selling the property or by other means. 4. HOA (Homeowners Association) Lien: Homeowners associations can file a lien against a property for unpaid dues or assessments. This lien protects the association's right to collect the outstanding amounts and may result in foreclosure if the debt remains unpaid. It is crucial for creditors to file the Nassau New York Notice of Lien by Corporation or LLC accurately and within the specified time frame to establish their claim. Failing to do so may result in the loss of their rights to the property or their ability to recover the unpaid debt. If you find yourself facing a Nassau New York Notice of Lien by Corporation or LLC, it is important to seek legal advice to understand your rights and potential options for resolving the debt. Consulting an attorney experienced in property law can help navigate the complexities of these liens and protect your interests.Nassau New York Notice of Lien by Corporation or LLC is a legal document filed to publicly announce a financial claim against a property or real estate. This notice is typically issued by a corporation or limited liability company (LLC) when there is an unpaid debt owed to them by the property owner. The Nassau New York Notice of Lien by Corporation or LLC is an important step in protecting the creditor's rights and ensuring that they can recover the outstanding amount. This lien notice puts others on notice that there is a valid claim against the property, making it difficult for the property owner to sell or transfer the property without resolving the debt. There are different types of Nassau New York Notice of Lien by Corporation or LLC, including: 1. Mechanic's Lien: This type of lien is commonly filed by contractors, subcontractors, or suppliers who have provided labor, materials, or services to improve a property. It ensures that these parties are compensated for their work or supplies, as the lien encumbers the property until the debt is paid. 2. Judgment Lien: When a creditor obtains a court judgment against a debtor, they can file a judgment lien on the debtor's property. This lien effectively becomes a security interest in the property and can be foreclosed upon if the debtor fails to fulfill their obligation. 3. Tax Lien: If a property owner fails to pay their taxes, the government agency responsible for collecting taxes can file a tax lien on the property. This lien ensures that the government can recoup the unpaid taxes by selling the property or by other means. 4. HOA (Homeowners Association) Lien: Homeowners associations can file a lien against a property for unpaid dues or assessments. This lien protects the association's right to collect the outstanding amounts and may result in foreclosure if the debt remains unpaid. It is crucial for creditors to file the Nassau New York Notice of Lien by Corporation or LLC accurately and within the specified time frame to establish their claim. Failing to do so may result in the loss of their rights to the property or their ability to recover the unpaid debt. If you find yourself facing a Nassau New York Notice of Lien by Corporation or LLC, it is important to seek legal advice to understand your rights and potential options for resolving the debt. Consulting an attorney experienced in property law can help navigate the complexities of these liens and protect your interests.