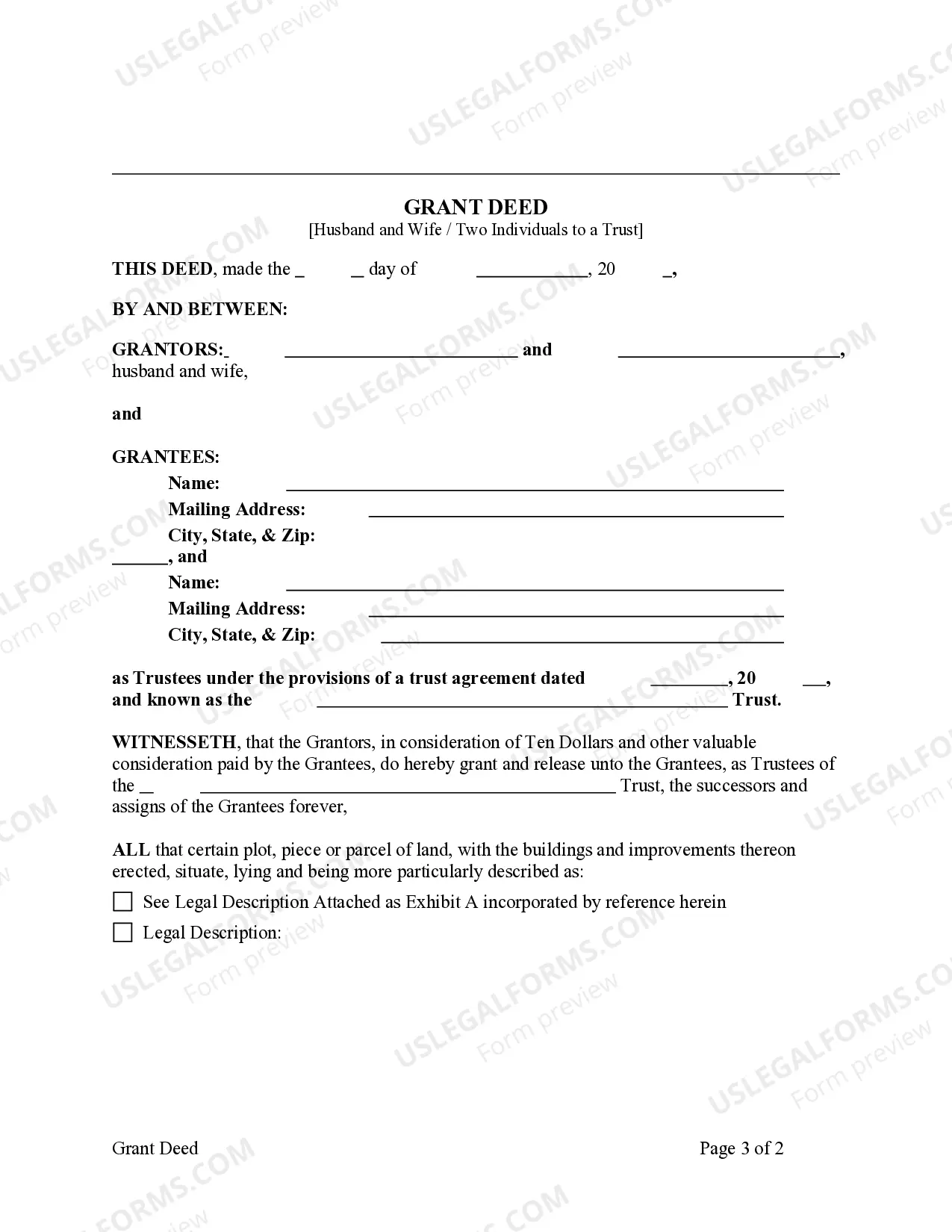

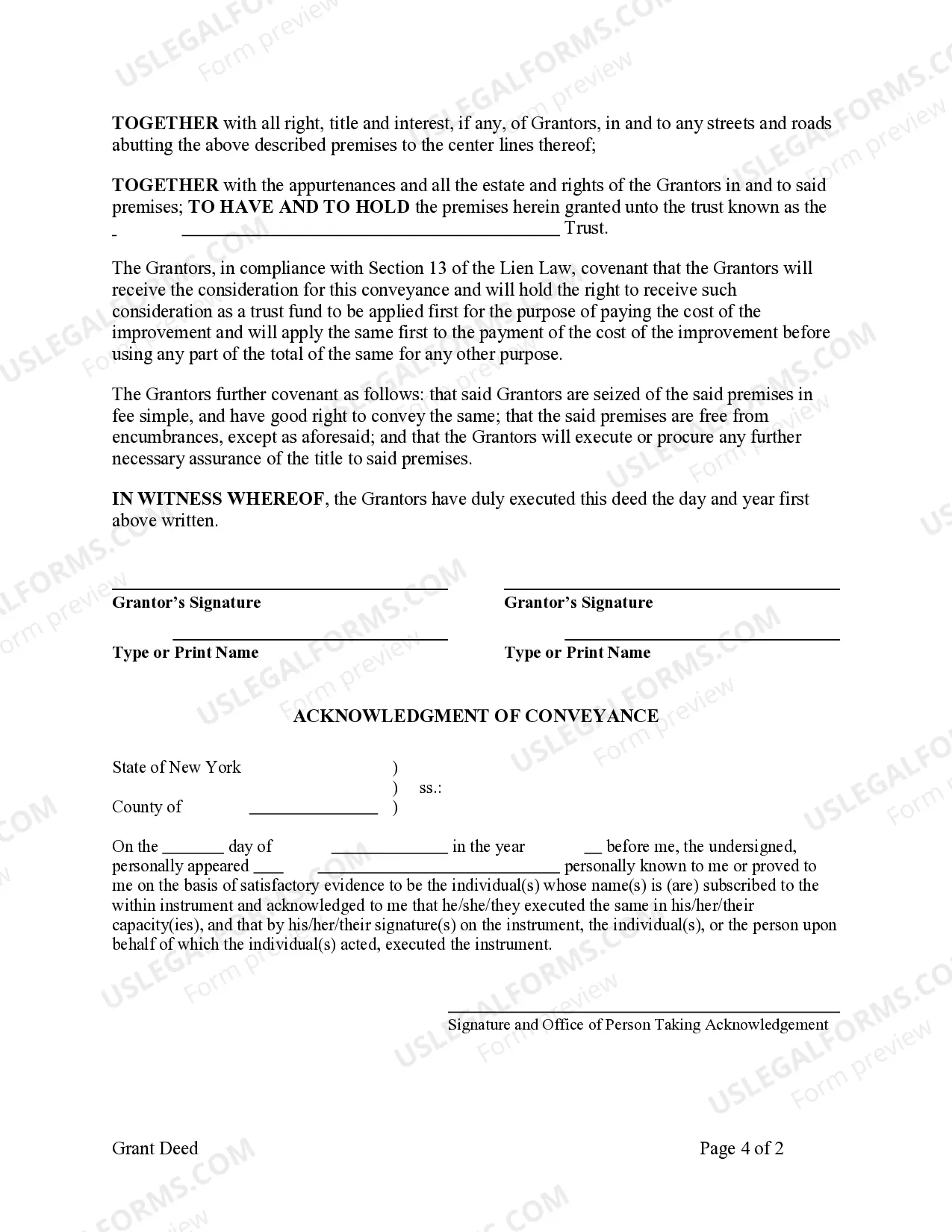

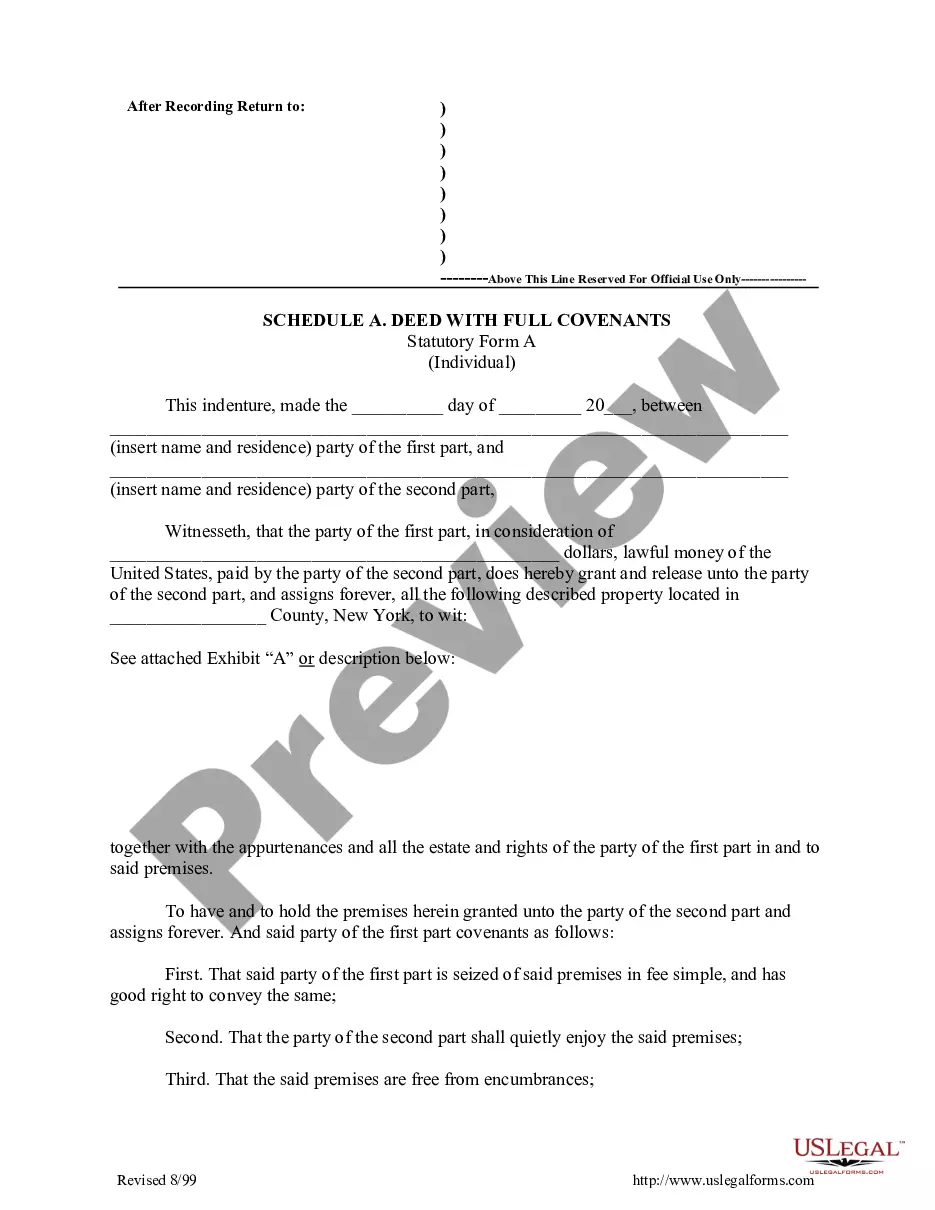

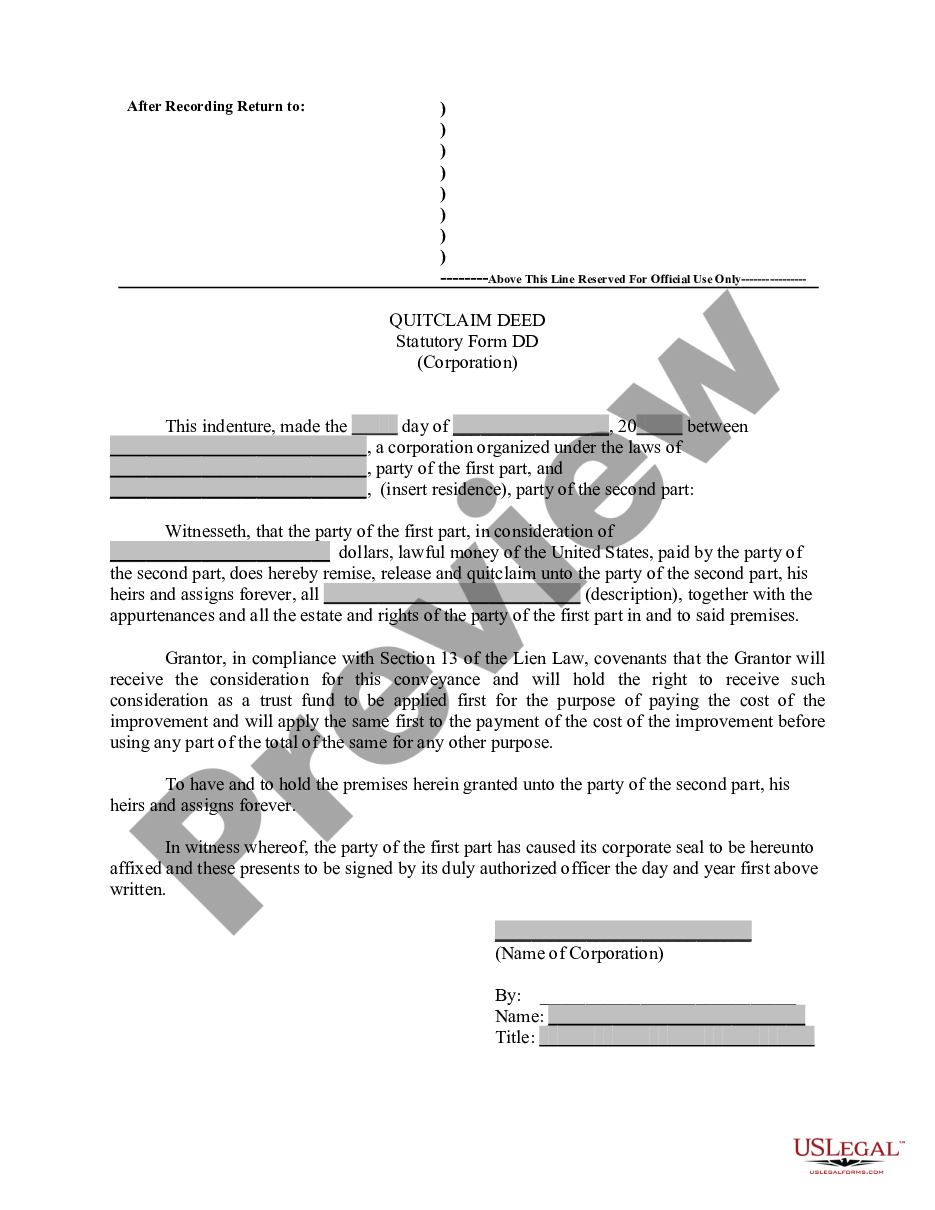

This form is a Grant Deed where the Grantors are two individuals, or husband and wife, and the Grantee is a Trust with two Trustees. This deed complies with all state statutory laws.

A Nassau New York Grant Deed from two Individuals, or Husband and Wife, to Trust is a legal document that transfers ownership of real property from two individuals who may either be Husband and Wife, or two individuals, to a trust entity. This type of deed is commonly used when individuals wish to transfer property to a trust for various purposes such as estate planning or asset protection. The specific keywords relevant to this topic could include "Nassau New York Grant Deed", "Husband and Wife transfer to Trust", "property ownership transfer", "real estate transfer to trust", "trustee", "beneficiary", "asset protection", "estate planning", and "real property transfer". There are different types of Nassau New York Grant Deeds from two Individuals, or Husband and Wife, to Trust such as: 1. Revocable Trust Grant Deed: This type of grant deed allows the individuals, who are often the granters and trustees, to retain control and ownership over the property during their lifetimes. They have the flexibility to transfer, sell, or mortgage the property as per their discretion. However, upon their passing or incapacitation, the property seamlessly transfers to the named beneficiaries of the trust without the need for probate. 2. Irrevocable Trust Grant Deed: In this form of grant deed, the individuals transfer ownership of the property to an irrevocable trust, where they no longer have control or ownership rights. Once the transfer is complete, the individuals cannot change or revoke the trust. This type of trust offers stronger asset protection benefits and may have tax advantages, but it restricts the granters' ability to modify or access the property. 3. Special Needs Trust Grant Deed: Designed specifically for individuals with disabilities, this type of grant deed transfers the property to a trust that provides for the care, support, and expenses of the individual with special needs. This allows the granters to ensure their loved one is cared for without compromising their eligibility for government benefits. 4. Living Trust Grant Deed: With a living trust grant deed, individuals transfer their property to a trust while maintaining control and ownership during their lifetimes. This type of deed helps avoid probate, streamline the transfer of assets upon death, and maintain privacy as trust documents are typically not publicly recorded. Overall, Nassau New York Grant Deeds from two Individuals, or Husband and Wife, to Trust, provide a legally binding mechanism to transfer property ownership, protect assets, and facilitate estate planning goals. Seeking advice from a qualified attorney or real estate professional is important when executing such deeds to ensure compliance with local laws and regulations.A Nassau New York Grant Deed from two Individuals, or Husband and Wife, to Trust is a legal document that transfers ownership of real property from two individuals who may either be Husband and Wife, or two individuals, to a trust entity. This type of deed is commonly used when individuals wish to transfer property to a trust for various purposes such as estate planning or asset protection. The specific keywords relevant to this topic could include "Nassau New York Grant Deed", "Husband and Wife transfer to Trust", "property ownership transfer", "real estate transfer to trust", "trustee", "beneficiary", "asset protection", "estate planning", and "real property transfer". There are different types of Nassau New York Grant Deeds from two Individuals, or Husband and Wife, to Trust such as: 1. Revocable Trust Grant Deed: This type of grant deed allows the individuals, who are often the granters and trustees, to retain control and ownership over the property during their lifetimes. They have the flexibility to transfer, sell, or mortgage the property as per their discretion. However, upon their passing or incapacitation, the property seamlessly transfers to the named beneficiaries of the trust without the need for probate. 2. Irrevocable Trust Grant Deed: In this form of grant deed, the individuals transfer ownership of the property to an irrevocable trust, where they no longer have control or ownership rights. Once the transfer is complete, the individuals cannot change or revoke the trust. This type of trust offers stronger asset protection benefits and may have tax advantages, but it restricts the granters' ability to modify or access the property. 3. Special Needs Trust Grant Deed: Designed specifically for individuals with disabilities, this type of grant deed transfers the property to a trust that provides for the care, support, and expenses of the individual with special needs. This allows the granters to ensure their loved one is cared for without compromising their eligibility for government benefits. 4. Living Trust Grant Deed: With a living trust grant deed, individuals transfer their property to a trust while maintaining control and ownership during their lifetimes. This type of deed helps avoid probate, streamline the transfer of assets upon death, and maintain privacy as trust documents are typically not publicly recorded. Overall, Nassau New York Grant Deeds from two Individuals, or Husband and Wife, to Trust, provide a legally binding mechanism to transfer property ownership, protect assets, and facilitate estate planning goals. Seeking advice from a qualified attorney or real estate professional is important when executing such deeds to ensure compliance with local laws and regulations.