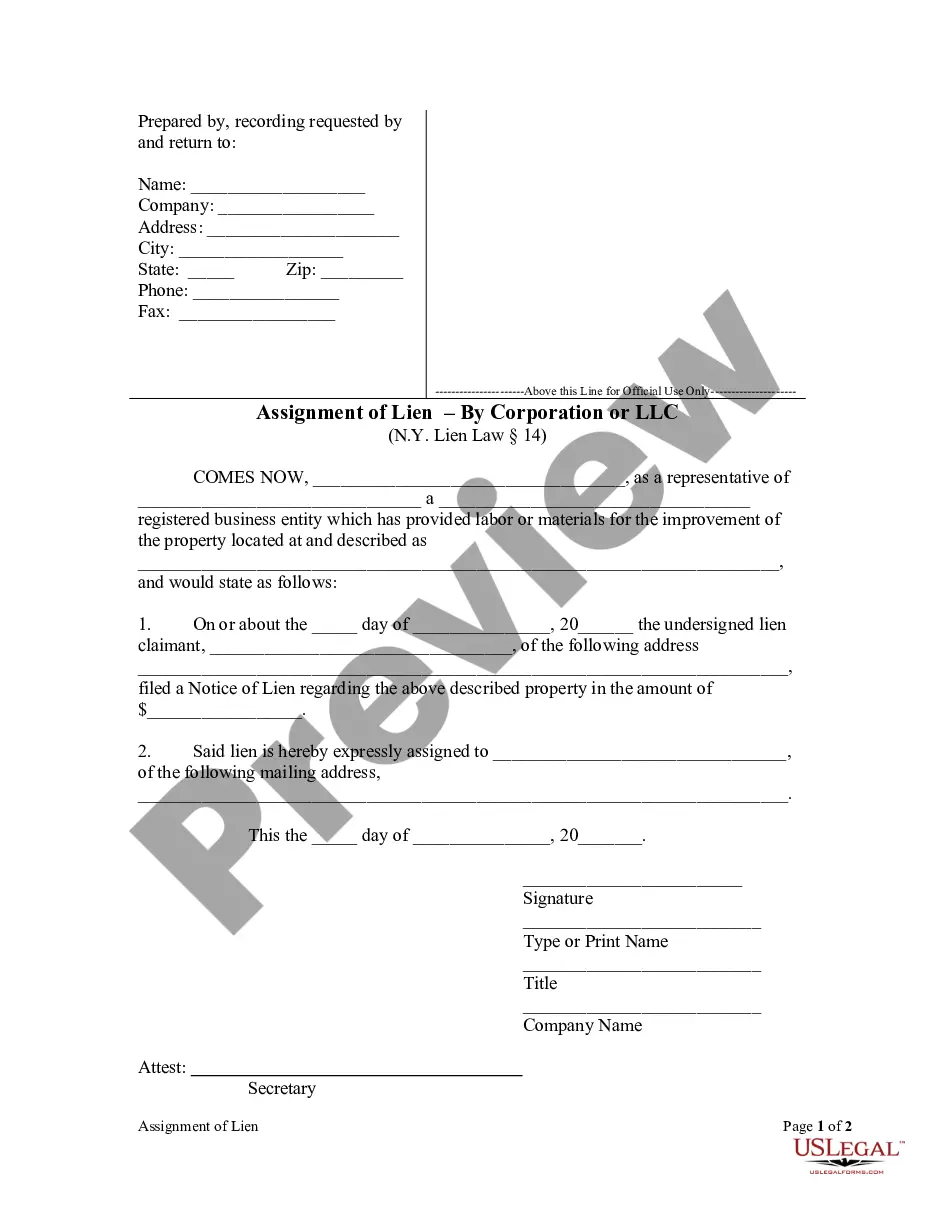

New York law permits a party to assign a lien using a written form signed and acknowledged by the lien holder.

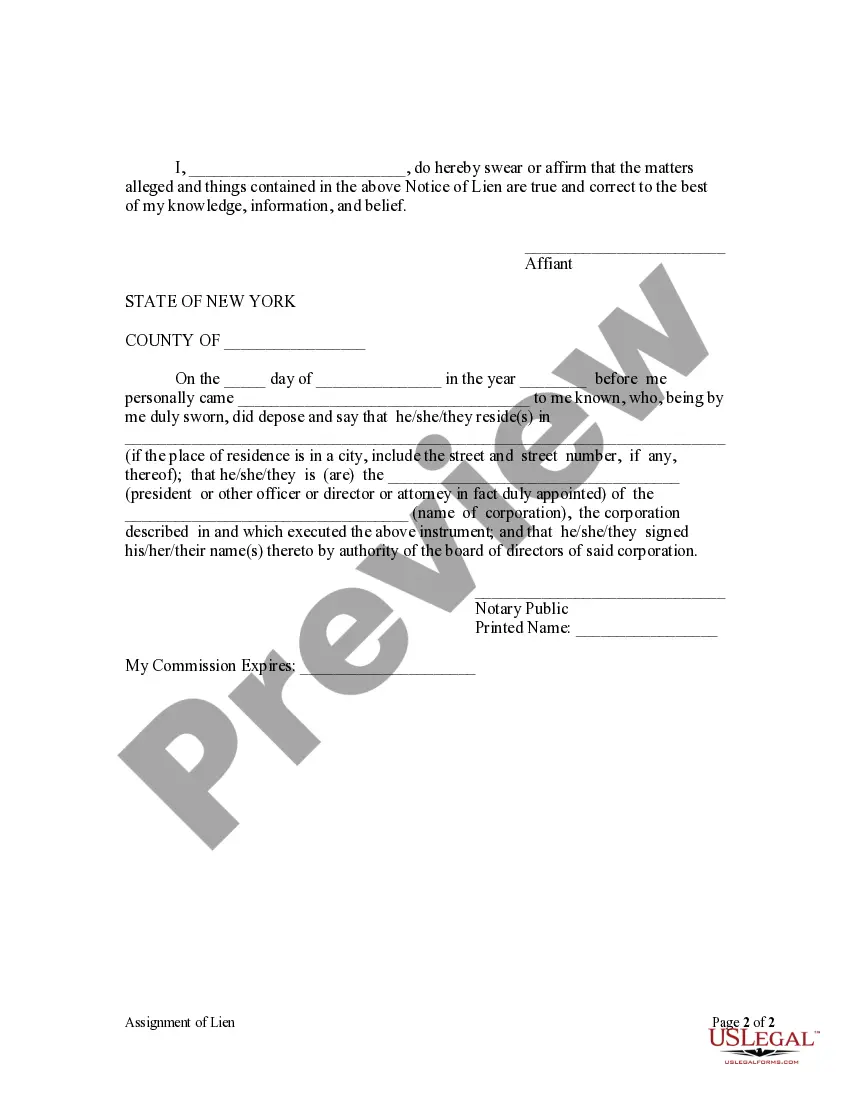

Kings New York Assignment of Lien by Corporation or LLC is a legal process that allows a corporation or limited liability company (LLC) to transfer their claim or interest in a property to another party. This assignment of lien is often used to recover debts, secure payments, or enforce property rights. When a corporation or LLC has a lien on a property, it means they have a legal claim against that property to secure a debt owed to them. However, sometimes these entities may want to transfer their interest in the lien to another party, either to collect the debt more efficiently or to assign the lien to a third party for other purposes. The Kings County in New York has specific requirements and procedures for completing an assignment of lien by a corporation or LLC. These guidelines must be followed to ensure the transfer of the lien is legally valid and enforceable. It's essential to consult an attorney or legal expert familiar with Kings County's specific regulations for precise guidance in such matters. There may be different types of Kings New York Assignment of Lien by Corporation or LLC, depending on the purpose or conditions of the transfer. These variations may include: 1. Voluntary Assignment of Lien: This type of assignment occurs when a corporation or LLC willingly transfers their lien to another party, usually due to a business arrangement, debt settlement, or a change in ownership. 2. Involuntary Assignment of Lien: In some cases, a corporation or LLC's lien may be involuntarily assigned by court order or through legal action taken by creditors or other interested parties. This typically happens when the original lien holder fails to meet their obligations or defaults on a debt. 3. Assignment of Lien as Collateral: In certain instances, a corporation or LLC may use their lien as collateral for a loan or financial agreement. This type of assignment is often seen in business transactions where the lien is pledged as security against a debt or obligation. 4. Assignment of Lien to a Third Party: Corporations or LCS may also assign their lien rights to a third-party individual or entity. This could be done when the original lien holder wants to transfer the entire lien or a portion of it to someone else in exchange for compensation, assistance, or other considerations. To successfully execute a Kings New York Assignment of Lien by Corporation or LLC, it is crucial to comply with the legal requirements and procedures in place. Failing to fulfill these obligations may result in an invalid transfer, rendering the lien unenforceable or causing potential legal complications. Therefore, engaging legal professionals specializing in real estate and corporate law is highly recommended navigating through the complexities involved in such transactions.Kings New York Assignment of Lien by Corporation or LLC is a legal process that allows a corporation or limited liability company (LLC) to transfer their claim or interest in a property to another party. This assignment of lien is often used to recover debts, secure payments, or enforce property rights. When a corporation or LLC has a lien on a property, it means they have a legal claim against that property to secure a debt owed to them. However, sometimes these entities may want to transfer their interest in the lien to another party, either to collect the debt more efficiently or to assign the lien to a third party for other purposes. The Kings County in New York has specific requirements and procedures for completing an assignment of lien by a corporation or LLC. These guidelines must be followed to ensure the transfer of the lien is legally valid and enforceable. It's essential to consult an attorney or legal expert familiar with Kings County's specific regulations for precise guidance in such matters. There may be different types of Kings New York Assignment of Lien by Corporation or LLC, depending on the purpose or conditions of the transfer. These variations may include: 1. Voluntary Assignment of Lien: This type of assignment occurs when a corporation or LLC willingly transfers their lien to another party, usually due to a business arrangement, debt settlement, or a change in ownership. 2. Involuntary Assignment of Lien: In some cases, a corporation or LLC's lien may be involuntarily assigned by court order or through legal action taken by creditors or other interested parties. This typically happens when the original lien holder fails to meet their obligations or defaults on a debt. 3. Assignment of Lien as Collateral: In certain instances, a corporation or LLC may use their lien as collateral for a loan or financial agreement. This type of assignment is often seen in business transactions where the lien is pledged as security against a debt or obligation. 4. Assignment of Lien to a Third Party: Corporations or LCS may also assign their lien rights to a third-party individual or entity. This could be done when the original lien holder wants to transfer the entire lien or a portion of it to someone else in exchange for compensation, assistance, or other considerations. To successfully execute a Kings New York Assignment of Lien by Corporation or LLC, it is crucial to comply with the legal requirements and procedures in place. Failing to fulfill these obligations may result in an invalid transfer, rendering the lien unenforceable or causing potential legal complications. Therefore, engaging legal professionals specializing in real estate and corporate law is highly recommended navigating through the complexities involved in such transactions.