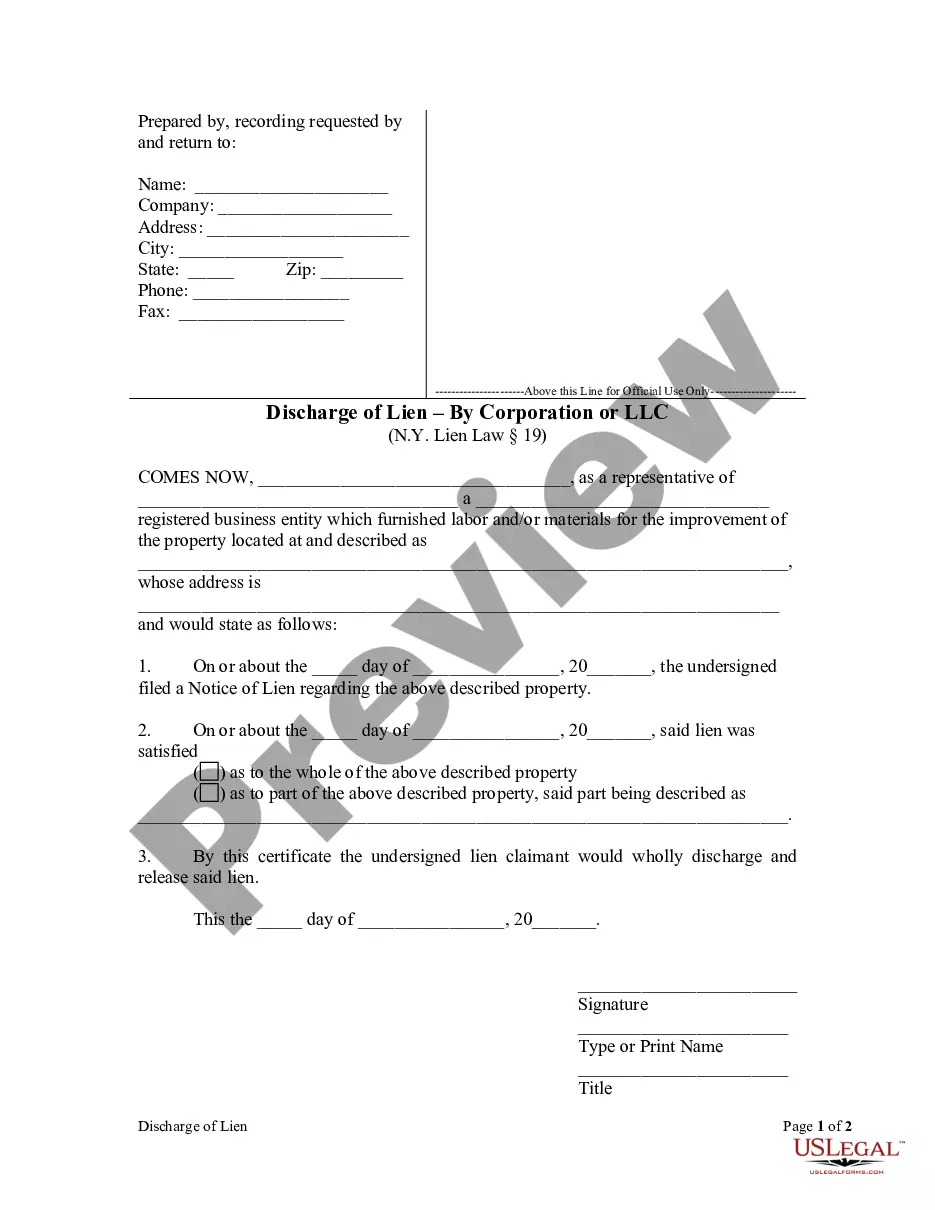

New York law permits a lien, other than a lien for public improvements, to be discharged by the issuing of a certificate, duly acknowledged by the lien holder and filed in the office where the notice of lien was filed.

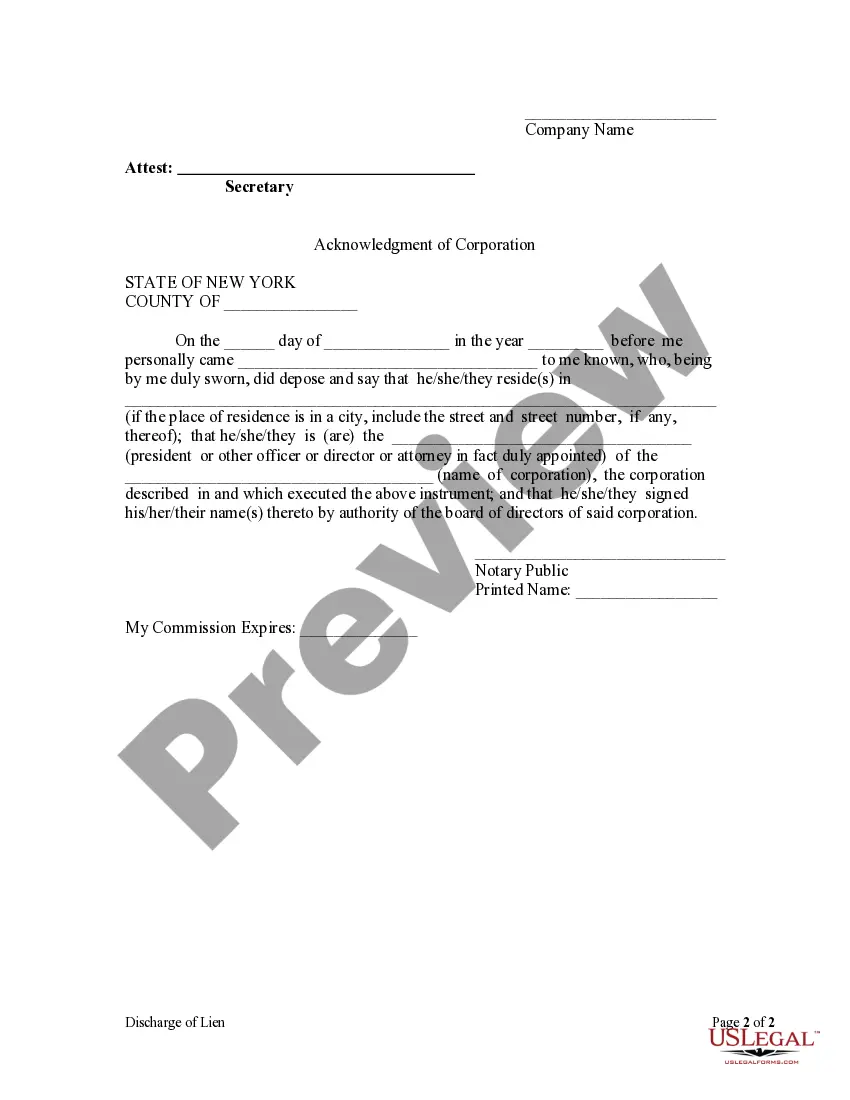

Nassau New York Discharge of Lien by Corporation or LLC refers to the legal process through which a corporation or limited liability company (LLC) can release or remove a lien that has been placed on a property. This discharge of lien is typically sought when the corporation or LLC has satisfied the debts or obligations owed to a creditor, contractor, or supplier who placed the lien. In Nassau County, New York, there are different types of discharge of lien processes that corporations or LCS can utilize based on specific circumstances. These include: 1. Voluntary Discharge of Lien: A corporation or LLC can initiate a voluntary discharge of lien when it has successfully fulfilled its financial obligations or settled the debt with the lien holder. By filing a voluntary discharge, the corporation or LLC requests the removal of the lien from the property records. 2. Court-Ordered Discharge of Lien: In certain cases, a corporation or LLC may need a court's intervention to discharge the lien. This typically occurs when there is a dispute or disagreement between the parties involved, and a judge needs to determine the appropriate resolution. The court may order the discharge of the lien if it deems the corporation or LLC has met its obligations. 3. Discharge of Lien by Partial Payment: If a corporation or LLC has partially paid off the debts secured by the lien, it can request a discharge of lien by providing evidence of the partial payments made. This process allows the corporation or LLC to release the lien on the property, demonstrating their commitment to fulfill the remaining obligations. 4. Conditional Discharge of Lien: A conditional discharge of lien occurs when a corporation or LLC agrees to specific conditions set forth by the lien holder for the release of the lien. This typically involves negotiated terms, such as an extended payment plan or additional collateral, which will allow the lien to be discharged once the agreed-upon conditions are met. To initiate any of these Nassau New York Discharge of Lien by Corporation or LLC processes, the corporation or LLC is required to file the appropriate legal paperwork with the Nassau County Clerk's Office. These documents typically include a discharge of lien form, proof of payment or fulfillment of obligations, and any supporting evidence or agreements related to the circumstances. It is essential to consult with a qualified attorney or legal professional to ensure compliance with all relevant statutes and regulations during the discharge of lien process. Likewise, thorough record-keeping and documentation of payments and communications are crucial for a smooth and successful discharge of lien by a corporation or LLC in Nassau County, New York.Nassau New York Discharge of Lien by Corporation or LLC refers to the legal process through which a corporation or limited liability company (LLC) can release or remove a lien that has been placed on a property. This discharge of lien is typically sought when the corporation or LLC has satisfied the debts or obligations owed to a creditor, contractor, or supplier who placed the lien. In Nassau County, New York, there are different types of discharge of lien processes that corporations or LCS can utilize based on specific circumstances. These include: 1. Voluntary Discharge of Lien: A corporation or LLC can initiate a voluntary discharge of lien when it has successfully fulfilled its financial obligations or settled the debt with the lien holder. By filing a voluntary discharge, the corporation or LLC requests the removal of the lien from the property records. 2. Court-Ordered Discharge of Lien: In certain cases, a corporation or LLC may need a court's intervention to discharge the lien. This typically occurs when there is a dispute or disagreement between the parties involved, and a judge needs to determine the appropriate resolution. The court may order the discharge of the lien if it deems the corporation or LLC has met its obligations. 3. Discharge of Lien by Partial Payment: If a corporation or LLC has partially paid off the debts secured by the lien, it can request a discharge of lien by providing evidence of the partial payments made. This process allows the corporation or LLC to release the lien on the property, demonstrating their commitment to fulfill the remaining obligations. 4. Conditional Discharge of Lien: A conditional discharge of lien occurs when a corporation or LLC agrees to specific conditions set forth by the lien holder for the release of the lien. This typically involves negotiated terms, such as an extended payment plan or additional collateral, which will allow the lien to be discharged once the agreed-upon conditions are met. To initiate any of these Nassau New York Discharge of Lien by Corporation or LLC processes, the corporation or LLC is required to file the appropriate legal paperwork with the Nassau County Clerk's Office. These documents typically include a discharge of lien form, proof of payment or fulfillment of obligations, and any supporting evidence or agreements related to the circumstances. It is essential to consult with a qualified attorney or legal professional to ensure compliance with all relevant statutes and regulations during the discharge of lien process. Likewise, thorough record-keeping and documentation of payments and communications are crucial for a smooth and successful discharge of lien by a corporation or LLC in Nassau County, New York.