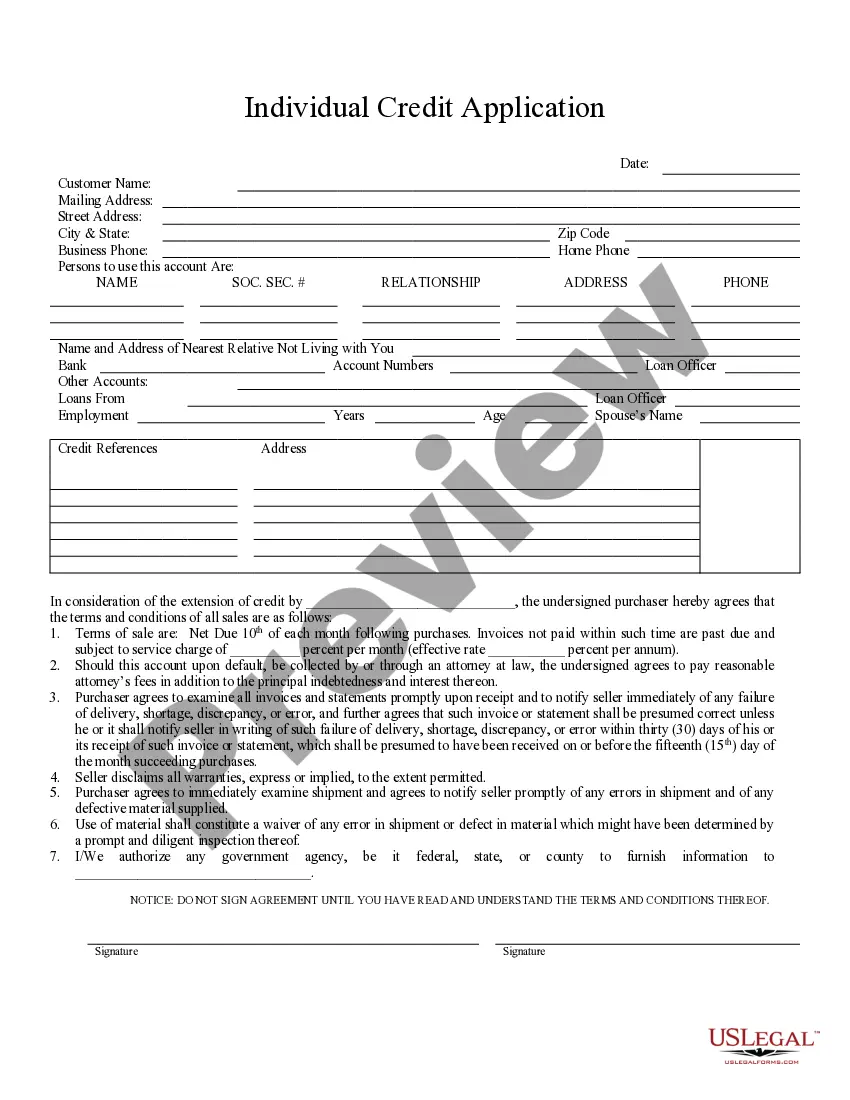

Nassau New York Individual Credit Application is a crucial step in the process of obtaining credit for individuals residing in Nassau County, New York. It is a formal document that individuals need to complete and submit to financial institutions or lenders when seeking credit, loans, or any other form of financial assistance. This credit application serves as a comprehensive record of an individual's personal and financial information, which lenders carefully evaluate before making a decision. It includes key information such as the applicant's full name, contact details, social security number, employment history, income details, monthly expenses, and existing assets and liabilities. Moreover, the application requires applicants to disclose their credit history, which entails information about any previous loans, debts, or bankruptcies. The Nassau New York Individual Credit Application forms are designed to accommodate various types of credit for individuals based on their specific needs and purposes. Some common types include: 1. Personal Loans Credit Application: This application is for individuals seeking funds for personal financial requirements such as medical expenses, education fees, home renovations, or debt consolidation. 2. Auto Loans Credit Application: This specific application is for individuals interested in purchasing a vehicle. It provides lenders with information about the desired vehicle and other necessary details to assess the creditworthiness of the applicant. 3. Home Mortgage Credit Application: This application is needed for individuals looking to finance a new home purchase or refinance their existing mortgage. It includes additional details like property value, desired loan amount, and information about any co-borrowers. 4. Credit Cards Application: Individuals who want to apply for a credit card can complete a separate application form that solely focuses on obtaining a revolving credit facility. By diligently filling out the Nassau New York Individual Credit Application, applicants provide banks and financial institutions with the relevant information needed to make informed credit decisions. Each type of credit application may have some specific requirements in terms of additional documentation or details, but the core information required remains consistent. It is important to note that the accuracy and completeness of the information provided in the credit application significantly impact the likelihood of approval and the terms, including interest rates and credit limits, offered by the lender. Therefore, it is crucial for applicants to take their time, review all the information, and ensure its accuracy before submitting the Nassau New York Individual Credit Application.

Nassau New York Individual Credit Application

Description

How to fill out Nassau New York Individual Credit Application?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for someone with no law education to draft such papers from scratch, mostly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms can save the day. Our service provides a massive catalog with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you want the Nassau New York Individual Credit Application or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Nassau New York Individual Credit Application quickly using our reliable service. In case you are presently a subscriber, you can go on and log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Nassau New York Individual Credit Application:

- Ensure the form you have found is good for your area because the regulations of one state or area do not work for another state or area.

- Review the form and go through a quick description (if provided) of scenarios the document can be used for.

- In case the form you chosen doesn’t suit your needs, you can start again and search for the needed document.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your credentials or register for one from scratch.

- Choose the payment gateway and proceed to download the Nassau New York Individual Credit Application as soon as the payment is completed.

You’re good to go! Now you can go on and print out the form or complete it online. Should you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.