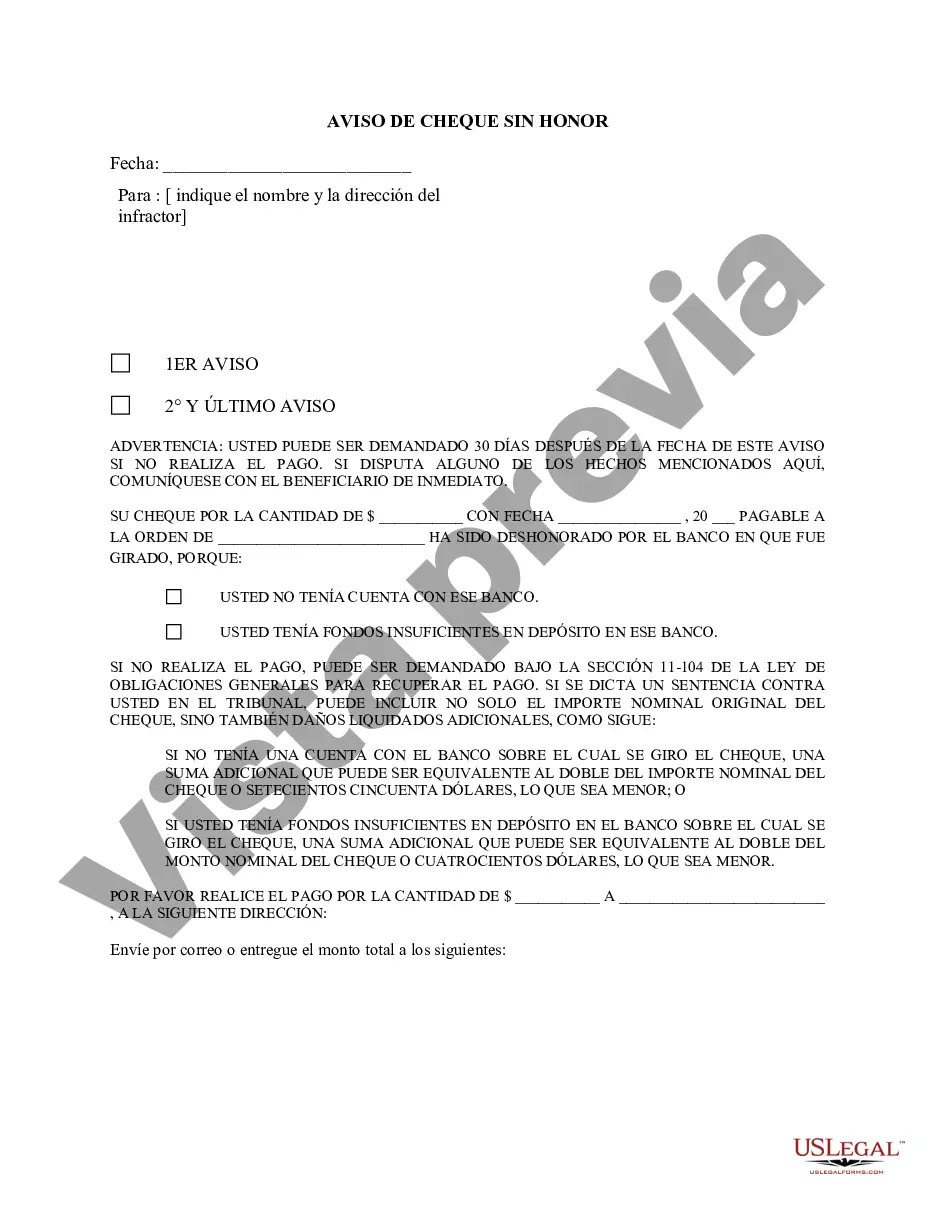

Title: Understanding Kings New York English Notice of Dishonored Check — Civil Introduction: In Kings New York, just like in any other jurisdiction, the issuance of a bad or bounced check is a serious offense. When someone writes a check that cannot be honored by their bank due to insufficient funds or any other reason, it is considered a dishonored or bounced check. This article aims to provide a detailed description of the Kings New York English Notice of Dishonored Check — Civil, focusing on its significance, possible consequences, and potential penalties. Types of Kings New York English Notice of Dishonored Check — Civil: 1. Simple Bad Check: This type encompasses checks written without sufficient funds in the account, resulting in dishonor by the bank. It may be unintentional or inadvertent, but it still falls under the umbrella of a bad check. 2. Fraudulent Check: These checks are deliberately issued by individuals with the intent to deceive, defraud, or mislead the recipient. Fraudulent checks can include stolen or forged signatures, altered amounts, or checks drawn on closed accounts. Detailed Description: The Kings New York English Notice of Dishonored Check — Civil serves as an official document indicating that a check has been dishonored by the bank. This notice is usually sent by the payee or the financial institution to the check issuer, informing them of the dishonored transaction. It acts as a formal notification to the issuer to rectify the situation promptly. 1. Consequences of a Dishonored Check: When someone receives a Kings New York English Notice of Dishonored Check — Civil, it is crucial to address the situation promptly, as failure to do so can lead to severe consequences. Some potential consequences include: — Legal Action: The payee or the financial institution may file a civil lawsuit against the issuer to recover the amount owed, along with added compensation, attorney fees, and court costs. — Negative Impact on Credit History: If the dishonored check remains unresolved, it may negatively impact the issuer's credit score and history. This can hinder future borrowing opportunities and financial transactions. — Potential Criminal Charges: In certain cases, particularly if the check was intentionally fraudulent, the issuer may face criminal charges under New York laws. These charges can range from misdemeanors to felonies, depending on the nature and intent of the offense. 2. Resolving a Dishonored Check: It is essential for the issuer to contact the payee or the financial institution promptly upon receiving the Kings New York English Notice of Dishonored Check — Civil. Resolving the dishonored check can be done through several paths, including but not limited to: — Payment of the Check: The issuer can immediately make the payment to the payee or the financial institution for the full amount of the dishonored check, along with any associated fees or penalties. — Negotiation and Communication: Open communication with the payee or financial institution can sometimes lead to an arrangement or negotiation, such as setting up a payment plan or discussing alternative methods of settling the debt. — Legal Support: In situations where legal advice or representation is needed, the issuer may choose to consult an attorney specializing in check dishonor cases. Legal professionals can guide the issuer through the necessary legal procedures and represent them during any potential litigation processes. Conclusion: Receiving a Kings New York English Notice of Dishonored Check — Civil is a serious matter that should not be taken lightly. Issuing a bad or bounced check can have significant consequences, both in terms of legal action and damage to one's financial reputation. It is crucial for individuals to understand their responsibilities and promptly address any dishonored check situations to mitigate potential penalties and resolve the issue in a timely manner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Inglés Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - New York English Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Kings New York Inglés Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

We always want to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for legal services that, usually, are very expensive. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Kings New York English Notice of Dishonored Check - Civil - Keywords: bad check, bounced check or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Kings New York English Notice of Dishonored Check - Civil - Keywords: bad check, bounced check complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Kings New York English Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is proper for you, you can select the subscription option and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!