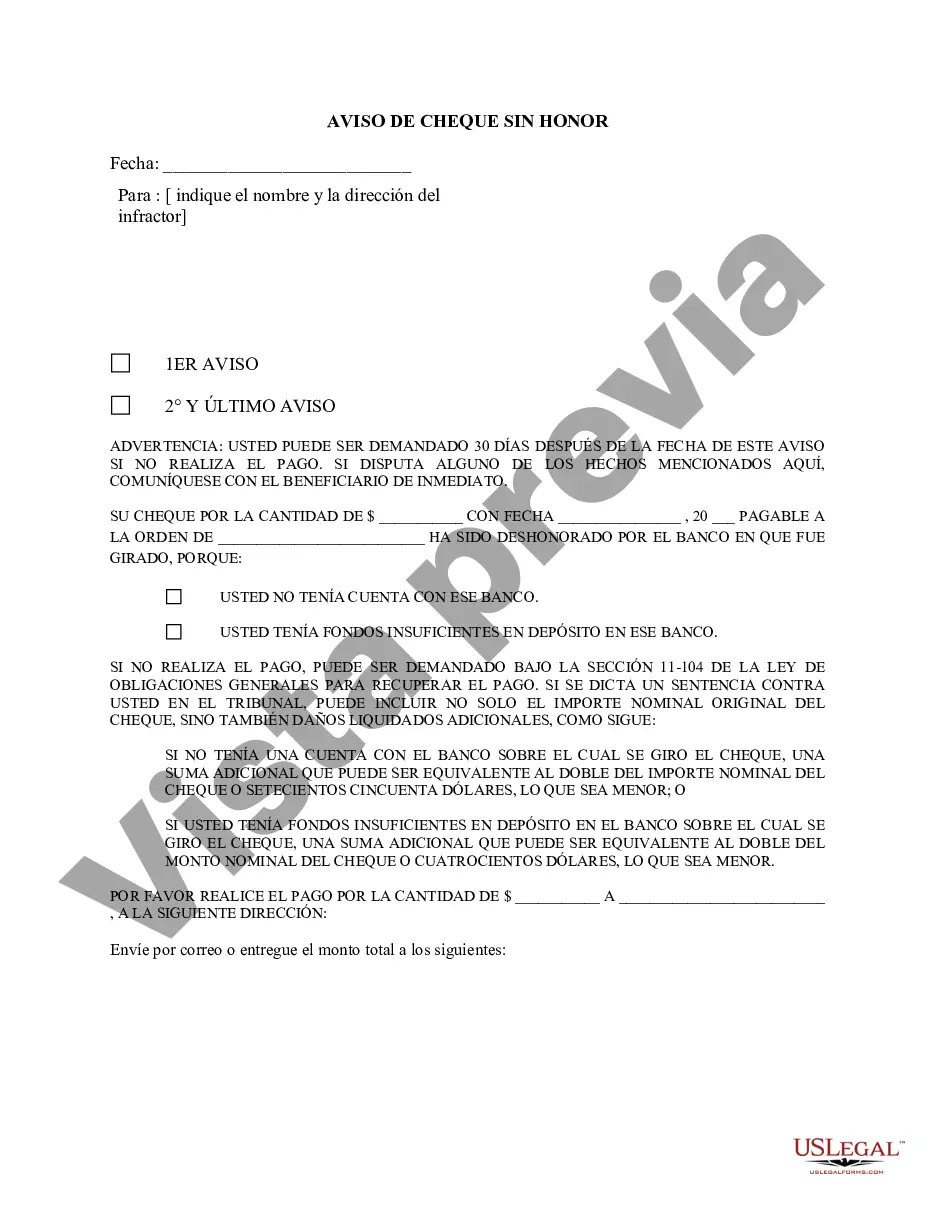

Nassau New York English Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check A bad check, also known as a bounced check, refers to a check that has been returned unpaid by the bank due to insufficient funds, a closed account, or other issues. In Nassau, New York, when such an incident occurs, a Notice of Dishonored Check is issued to inform the check issuer about the situation and request immediate resolution. 1. Nassau New York English Notice of Dishonored Check — Insufficient Funds: If a check is returned due to insufficient funds, it means that the account did not have enough money to cover the amount specified on the check. This type of bad check serves as a warning to the issuer to rectify the situation promptly. 2. Nassau New York English Notice of Dishonored Check — Closed Account: When a check is dishonored because the check writer's account has been closed, it implies that the issuer has closed their account after issuing the check, rendering it invalid. The Notice of Dishonored Check — Closed Account takes this into account and urges the account holder to address the matter immediately. 3. Nassau New York English Notice of Dishonored Check — Irregular Signature: An irregular signature can also lead to a dishonored check in Nassau, New York. If the signature on the check does not match the signature on file with the bank or appears suspicious, it may result in the check being returned. In this case, a Notice of Dishonored Check — Irregular Signature is issued, informing the check issuer of the discrepancy. 4. Nassau New York English Notice of Dishonored Check — Missing Signature: When a check lacks a required signature or has an incomplete signature, it can be considered a bad check. A Notice of Dishonored Check — Missing Signature is sent to the check writer in such cases, emphasizing the importance of completing all necessary information on the check to prevent further dishonor. 5. Nassau New York English Notice of Dishonored Check — Alteration/Forgery: If it is discovered that a check has been altered or forged, it becomes a bad check. Alterations typically involve changing the payee name or altering the amount, while forgery refers to the unauthorized creation or endorsement of a check. The Notice of Dishonored Check — Alteration/Forgery addresses these fraudulent activities and demands a resolution. Regardless of the specific type of dishonored check in Nassau, New York, it is essential for the check writer to resolve the issue promptly. Failure to do so may result in legal consequences and damage to their financial reputation. It is crucial to contact the bank or concerned party mentioned in the Notice of Dishonored Check and rectify the situation by providing the necessary funds or resolving any discrepancies to clear the issuer's name from any liability associated with a bad or bounced check.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Inglés Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - New York English Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Nassau New York Inglés Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Do you need a trustworthy and inexpensive legal forms supplier to get the Nassau New York English Notice of Dishonored Check - Civil - Keywords: bad check, bounced check? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of specific state and county.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Nassau New York English Notice of Dishonored Check - Civil - Keywords: bad check, bounced check conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the form is intended for.

- Restart the search in case the template isn’t suitable for your specific scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is completed, download the Nassau New York English Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in any provided format. You can get back to the website at any time and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours learning about legal papers online once and for all.