In Queens, New York, if you have received a bad check or a bounced check, it is important to understand the procedures involved in issuing a Notice of Dishonored Check. This notice plays a vital role in recovering funds owed to you and seeking legal recourse if necessary. In this detailed description, we will explore the various aspects of Queens New York English Notice of Dishonored Check — Civil, covering topics such as the definition of a bad check, the reasons behind a check being bounced, and the steps involved in issuing this notice. A bad check, also known as a bounced check, refers to a check that is not honored by the payer's bank due to insufficient funds or a closed account. It is considered a breach of contract and can have serious consequences. When you receive a bad check, it disrupts your financial plans and may cause financial strain. There are different types of Queen New York English Notice of Dishonored Check — Civil that can be used when dealing with a bad check. Let's explore a few of these types: 1. Personal Check: A bad check issued by an individual's personal bank account, usually intended for personal transactions or payments. 2. Business Check: A bad check issued by a business entity, commonly used for commercial transactions or payments. 3. Post-Dated Check: A check that is dated for a future date. If such a check is deposited or cashed before the date specified, and it bounces, it can be considered a bad check. Now, let's delve into the procedure of issuing a Notice of Dishonored Check — Civil in Queens, New York: 1. Verification: First, ensure that the check has indeed bounced by contacting your bank. Provide them with the necessary details, such as the check number, payer's account information, and the amount in question. 2. Notification: Once confirmed, promptly notify the payer about the dishonored check. Detail the specifics such as the check amount, date it was presented, and the reason it was returned unpaid. In this notice, it is crucial to use the appropriate tone, adhering to legal guidelines to make it formal and informative. 3. Demand for Payment: Clearly state your expectation for the payment to be made within a specified period. Inform the payer about the potential consequences if the payment is not resolved promptly, which may include legal actions. 4. Certified Mail: Send the Notice of Dishonored Check to the payer using certified mail with a return receipt requested. This helps in establishing a paper trail and ensures that the payer receives the notice. 5. Legal Action: If the payment is not made within the given timeframe, you may pursue legal actions such as filing a lawsuit or seeking mediation, depending on the amount involved. Consult with a legal professional to understand the best course of action. In conclusion, dealing with a bad check or a bounced check can be stressful, but understanding the process of issuing a Queens New York English Notice of Dishonored Check — Civil can help you navigate through the situation. By following the correct procedure and using proper legal language, you increase your chances of recovering the funds owed to you and potentially receiving compensation for any damages incurred. Remember, seeking legal advice is always recommended ensuring that you handle the situation appropriately and within the bounds of the law.

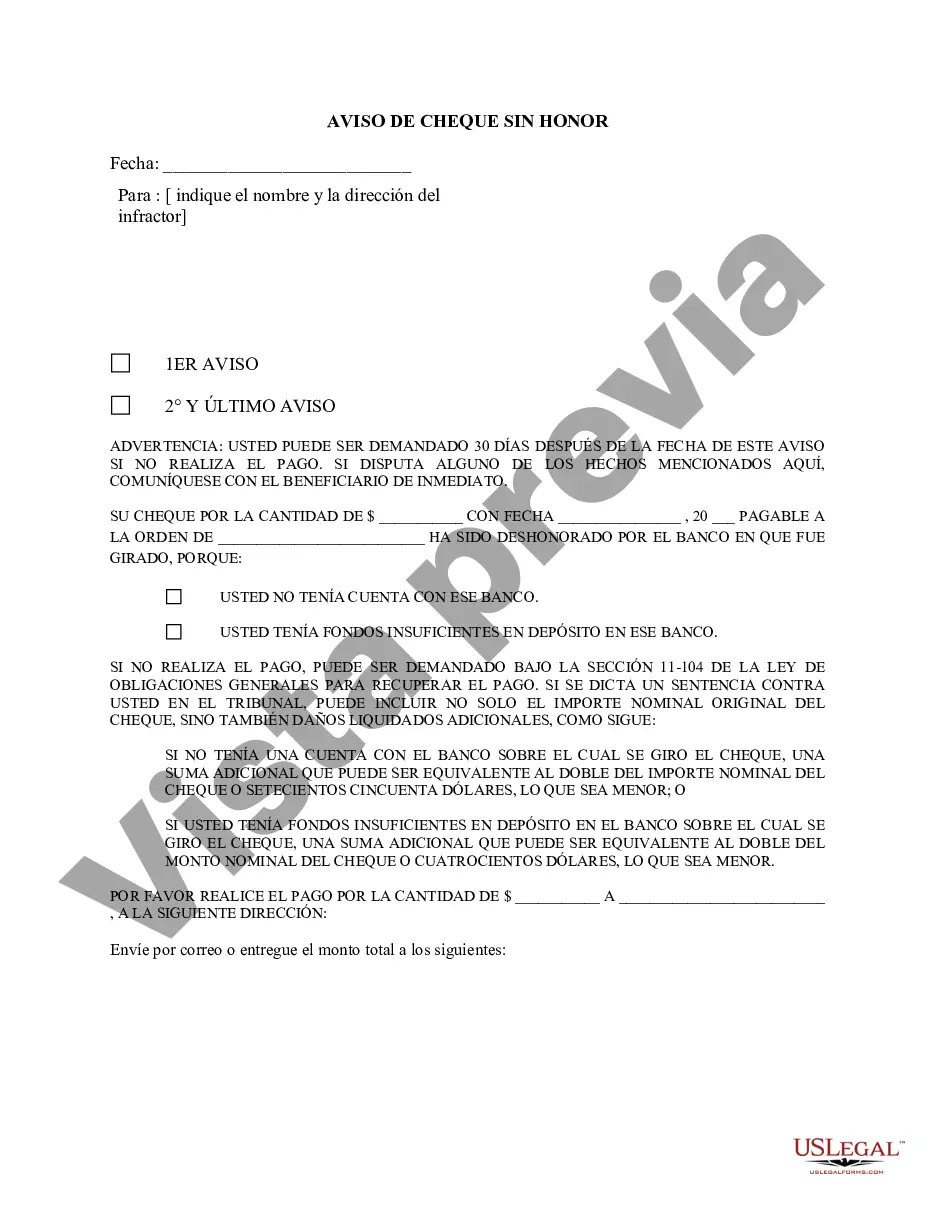

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Inglés Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - New York English Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

State:

New York

County:

Queens

Control #:

NY-401N

Format:

Word

Instant download

Description

Formulario de aviso de cheque sin fondos.

In Queens, New York, if you have received a bad check or a bounced check, it is important to understand the procedures involved in issuing a Notice of Dishonored Check. This notice plays a vital role in recovering funds owed to you and seeking legal recourse if necessary. In this detailed description, we will explore the various aspects of Queens New York English Notice of Dishonored Check — Civil, covering topics such as the definition of a bad check, the reasons behind a check being bounced, and the steps involved in issuing this notice. A bad check, also known as a bounced check, refers to a check that is not honored by the payer's bank due to insufficient funds or a closed account. It is considered a breach of contract and can have serious consequences. When you receive a bad check, it disrupts your financial plans and may cause financial strain. There are different types of Queen New York English Notice of Dishonored Check — Civil that can be used when dealing with a bad check. Let's explore a few of these types: 1. Personal Check: A bad check issued by an individual's personal bank account, usually intended for personal transactions or payments. 2. Business Check: A bad check issued by a business entity, commonly used for commercial transactions or payments. 3. Post-Dated Check: A check that is dated for a future date. If such a check is deposited or cashed before the date specified, and it bounces, it can be considered a bad check. Now, let's delve into the procedure of issuing a Notice of Dishonored Check — Civil in Queens, New York: 1. Verification: First, ensure that the check has indeed bounced by contacting your bank. Provide them with the necessary details, such as the check number, payer's account information, and the amount in question. 2. Notification: Once confirmed, promptly notify the payer about the dishonored check. Detail the specifics such as the check amount, date it was presented, and the reason it was returned unpaid. In this notice, it is crucial to use the appropriate tone, adhering to legal guidelines to make it formal and informative. 3. Demand for Payment: Clearly state your expectation for the payment to be made within a specified period. Inform the payer about the potential consequences if the payment is not resolved promptly, which may include legal actions. 4. Certified Mail: Send the Notice of Dishonored Check to the payer using certified mail with a return receipt requested. This helps in establishing a paper trail and ensures that the payer receives the notice. 5. Legal Action: If the payment is not made within the given timeframe, you may pursue legal actions such as filing a lawsuit or seeking mediation, depending on the amount involved. Consult with a legal professional to understand the best course of action. In conclusion, dealing with a bad check or a bounced check can be stressful, but understanding the process of issuing a Queens New York English Notice of Dishonored Check — Civil can help you navigate through the situation. By following the correct procedure and using proper legal language, you increase your chances of recovering the funds owed to you and potentially receiving compensation for any damages incurred. Remember, seeking legal advice is always recommended ensuring that you handle the situation appropriately and within the bounds of the law.

Free preview

How to fill out Queens New York Inglés Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

If you’ve already utilized our service before, log in to your account and download the Queens New York English Notice of Dishonored Check - Civil - Keywords: bad check, bounced check on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make sure you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Queens New York English Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!