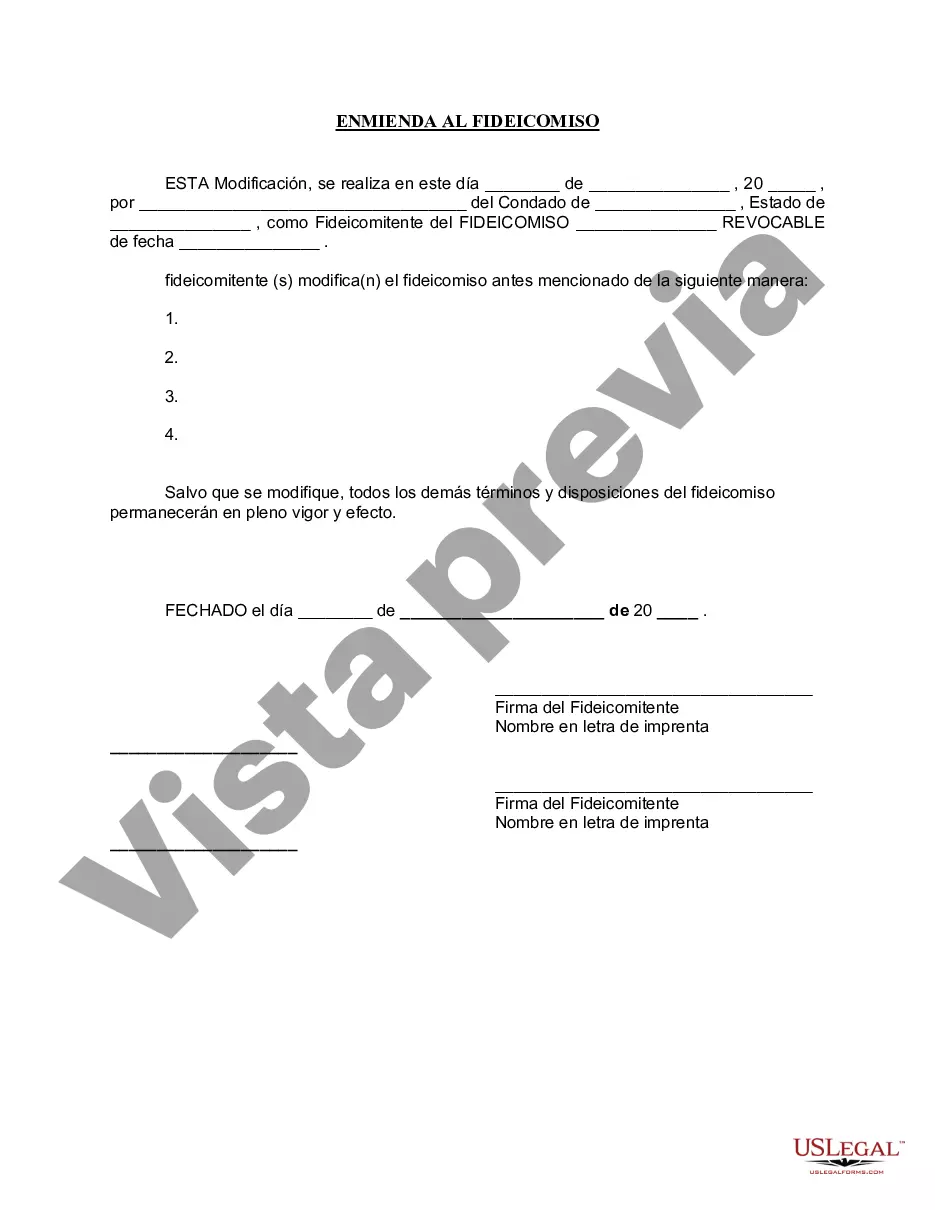

The Queens New York Amendment to Living Trust is a legal document that allows individuals in Queens, New York, to make changes or updates to their living trust. A living trust is a type of estate planning tool that enables individuals to transfer their assets to a trust during their lifetime, thereby avoiding probate and ensuring a smooth transfer of assets to their beneficiaries upon their passing. The Queens New York Amendment to Living Trust is necessary when there is a need to modify certain provisions within the original living trust. This may include changes in beneficiaries, assets, trustees, or any other relevant details. By executing an amendment, individuals can ensure their living trust accurately reflects their current wishes, circumstances, and legal requirements. There are various types of Queens New York Amendments to Living Trust, depending on the specific changes individuals want to make. Some common types include: 1. Beneficiary Amendment: This amendment allows individuals to add, remove, or change beneficiaries listed in the original living trust. It may be needed when there is a birth, death, marriage, divorce, or change in relationships with beneficiaries. 2. Asset Amendment: This amendment enables individuals to add, remove, or modify the assets included in the living trust. It is useful when individuals acquire or sell assets, or if they want to re-allocate their assets among different beneficiaries. 3. Trustee Amendment: This amendment allows individuals to appoint, replace, or remove trustees named in the living trust. It may be necessary if the original trustee becomes incapacitated, passes away, or if individuals prefer to change trustees for any other reason. 4. Administrative Amendment: This type of amendment deals with administrative details of the living trust, such as changing the address of the trust, updating contact information, or making modifications to the appointment of successor trustees. Executing a Queens New York Amendment to Living Trust requires complying with specific legal formalities outlined in the New York State laws. It is advisable to consult an experienced attorney who specializes in estate planning and trusts to ensure the amendment is executed properly and complies with all relevant regulations. By utilizing the Queens New York Amendment to Living Trust, individuals can ensure their estate plans remain current, meet their goals, and efficiently transfer their assets to their intended beneficiaries after their passing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Enmienda al fideicomiso en vida - New York Amendment to Living Trust

Description

How to fill out Queens New York Enmienda Al Fideicomiso En Vida?

Do you need a reliable and inexpensive legal forms provider to get the Queens New York Amendment to Living Trust? US Legal Forms is your go-to option.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of specific state and area.

To download the form, you need to log in account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Queens New York Amendment to Living Trust conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is good for.

- Restart the search if the template isn’t suitable for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Queens New York Amendment to Living Trust in any provided file format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting hours learning about legal papers online once and for all.