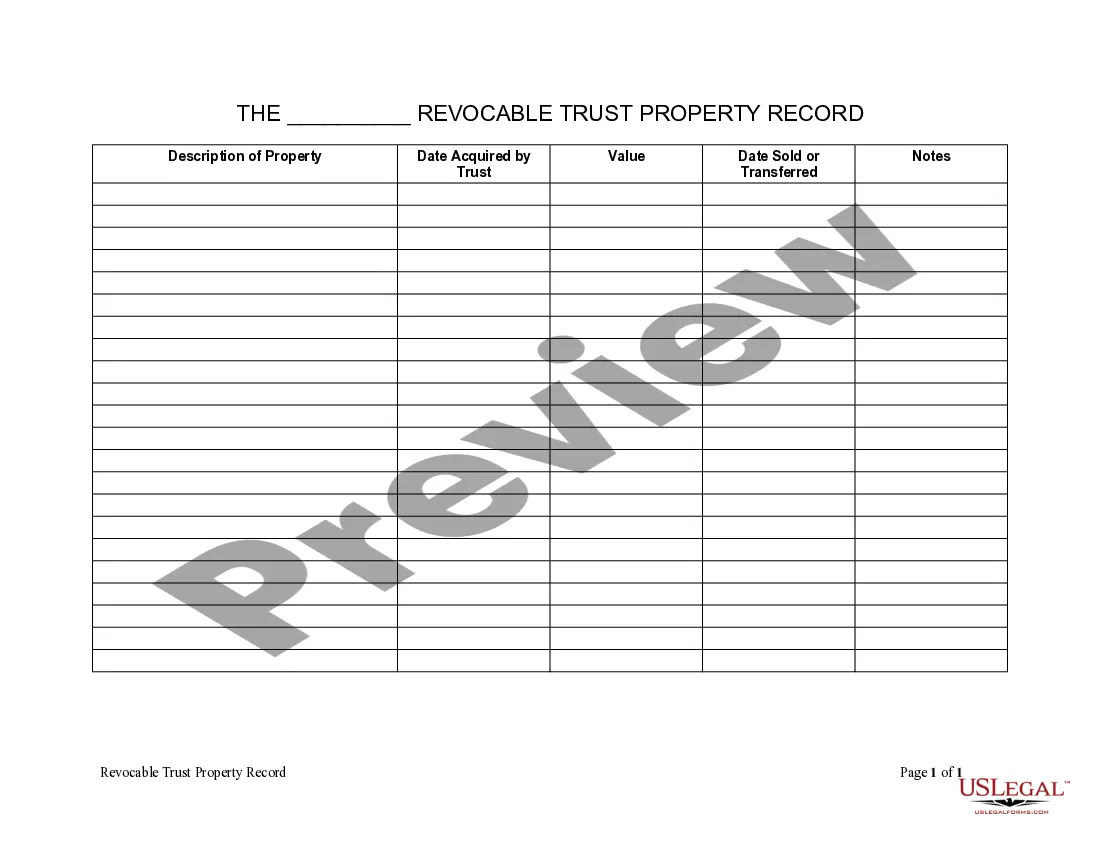

Rochester New York Living Trust Property Record

Description

How to fill out New York Living Trust Property Record?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our advantageous platform featuring thousands of documents simplifies the process of locating and obtaining nearly any document sample you require.

You can export, complete, and sign the Rochester New York Living Trust Property Record within minutes instead of spending countless hours online looking for a suitable template.

Using our library is a fantastic method to enhance the security of your form filing.

Access the page with the template you need. Ensure that it is the form you intended to discover: verify its title and description, and utilize the Preview feature if it is accessible.

Commence the downloading process. Click Buy Now and select the pricing plan that suits you. Then, establish an account and complete your order using a credit card or PayPal.

- Our skilled attorneys routinely review all documents to ensure the forms are pertinent to a specific area and adhere to new laws and regulations.

- How do you obtain the Rochester New York Living Trust Property Record? If you have a subscription, simply Log In to your account.

- The Download button will be activated on all the samples you view.

- Additionally, you can locate all the previously saved documents in the My documents section.

- If you don't have an account yet, adhere to the instructions below.

Form popularity

FAQ

To get a copy of your deed in Monroe County, NY, you'll need to contact the Monroe County Clerk's office directly. They will guide you through the process to access your Rochester New York Living Trust Property Record. Make sure to have relevant information about your property ready to expedite the request.

Yes, it is necessary to record a deed in New York. Recording your deed ensures that your ownership is protected and is essential for the validity of your Rochester New York Living Trust Property Record. This process helps prevent disputes over property ownership and provides public notice of ownership change.

To obtain a copy of your deed in Rochester, NY, you can visit the Monroe County Clerk’s office or their website for guidance. You'll find the necessary forms and information on how to request your Rochester New York Living Trust Property Record. Providing the specifics of your property, such as the address and transaction date, can streamline this process.

The Monroe County Clerk is responsible for maintaining official documents and records for the county. This office handles property records, including Rochester New York Living Trust Property Record, marriage licenses, and more. If you need to access public documents, this is where you would start your search.

Rochester is located in Monroe County, New York. This county plays a crucial role in managing property records, including the Rochester New York Living Trust Property Record. Understanding the county's structure can help you navigate local resources more effectively.

In New York, trusts are generally not recorded in a public registry like real estate transactions. However, specific documents related to the trust, like property deeds, may need to be filed. Maintaining a well-organized Rochester New York Living Trust Property Record is crucial for managing the trust and ensuring your wishes are followed. Consider utilizing US Legal Forms for handling necessary paperwork.

Yes, a living trust typically avoids probate in New York. Because the assets in the trust are not considered part of your estate, they pass directly to beneficiaries without going through the court probate process. This feature can save time and reduce costs, making a living trust a smart choice for many. Ensure your Rochester New York Living Trust Property Record is properly maintained to enjoy these benefits.

The minimum amount to establish a living trust can vary, but often there is no set minimum required by law. However, it's generally recommended to have a significant asset pool in a trust to make it worthwhile. Factors like the complexity of your estate and your goals for the Rochester New York Living Trust Property Record will also influence the amount needed. Seeking advice from a legal expert can clarify your specific situation.

To put a house in trust in New York, start by creating a living trust document that identifies the property and the beneficiaries. Next, you need to transfer the title of your house into the trust, which involves signing a deed that reflects this change. Ensure all paperwork is filed correctly to maintain your Rochester New York Living Trust Property Record. For a seamless process, consider consulting with professionals or using US Legal Forms.

One major mistake parents make when setting up a trust fund is failing to clearly outline the terms in the trust document. This can lead to misunderstandings and disputes among beneficiaries. Additionally, parents often overlook the importance of updating the trust as their situation changes. To ensure clarity and peace, consider using resources like US Legal Forms when preparing a Rochester New York Living Trust Property Record.