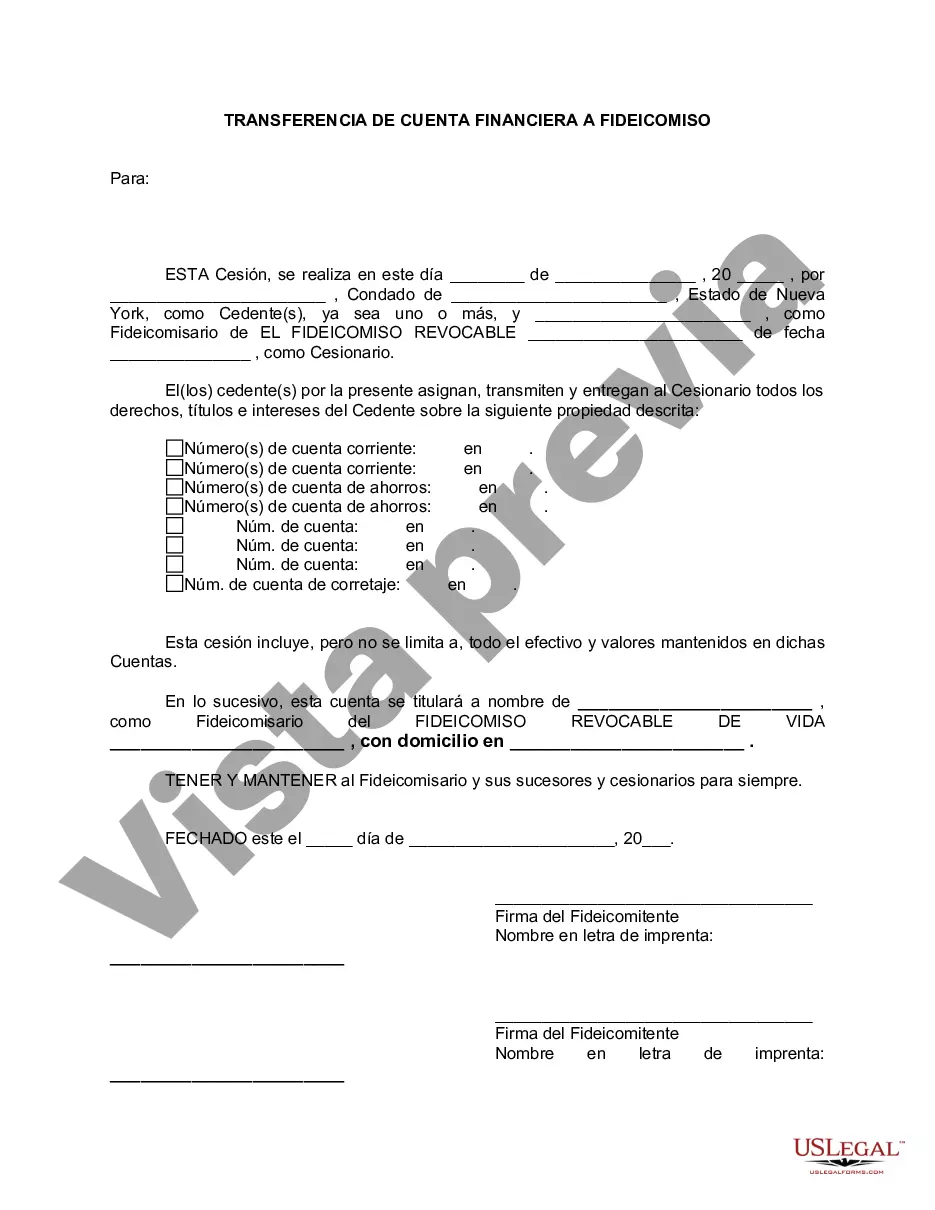

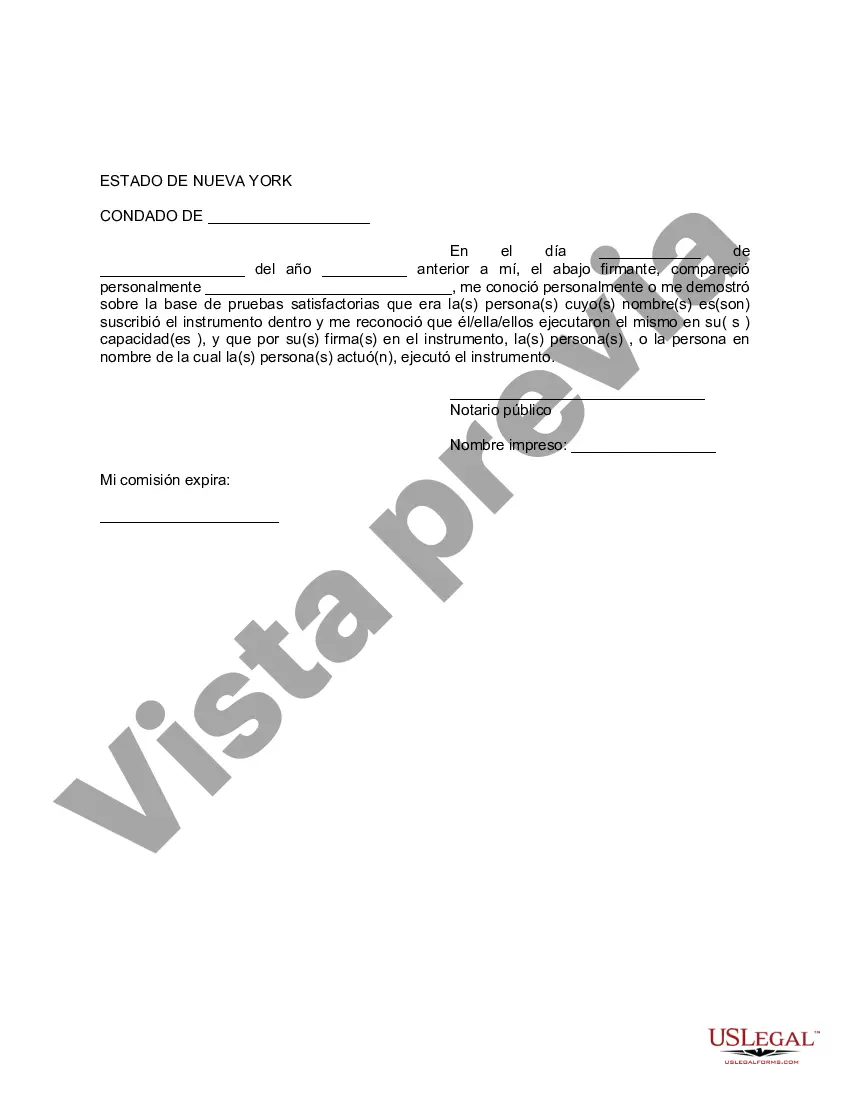

Queens New York Financial Account Transfer to Living Trust: A Comprehensive Guide In Queens, New York, transferring financial accounts to a living trust is a common estate planning strategy that provides numerous benefits to individuals and families. By establishing a living trust, residents of Queens can ensure their assets are protected, avoid probate, maintain privacy, and efficiently transfer wealth to their loved ones. This detailed description explores the various types of Queens New York financial account transfers to a living trust and highlights the advantages of each approach. 1. Traditional Financial Account Transfer: By choosing a traditional financial account transfer to a living trust, Queens residents can transfer their bank accounts, including savings, checking, and money market accounts, into the trust's ownership. This method allows the granter (the person creating the living trust) to retain complete control over the accounts during their lifetime while facilitating a seamless transfer of ownership upon their death. 2. Investment Account Transfer: For individuals with investment portfolios, transferring brokerage accounts, stocks, bonds, mutual funds, and other securities to a living trust can simplify the management and distribution process. By re-titling these accounts in the name of the trust, beneficiaries can avoid the delays and costs associated with probate and gain quick access to their inherited holdings. 3. Retirement Account Transfer: Residents of Queens who hold Individual Retirement Accounts (IRAs), 401(k)s, or other qualified retirement plans can also transfer these assets to a living trust. By designating the trust as the beneficiary, individuals can ensure that their retirement accounts will pass seamlessly to their chosen beneficiaries while also enjoying the potential tax advantages that a living trust can offer. 4. Real Estate Account Transfer: In Queens, New York, where real estate values are significant, transferring properties into a living trust can be a wise decision. Whether it's residential or commercial property, vacant land, or rental properties, re-titling the real estate into the trust's name ensures efficient management and distribution of these assets upon the granter's death, bypassing potentially expensive and time-consuming probate proceedings. 5. Business Account Transfer: Entrepreneurs and business owners in Queens who wish to transfer ownership of their businesses to their chosen beneficiaries can opt for a business account transfer to a living trust. This approach helps preserve business continuity and secure the future of the enterprise while allowing for a seamless transition of management and assets to the trust beneficiaries. By utilizing any of these Queens New York financial account transfers to a living trust, individuals can provide their families with peace of mind, avoid the probate process, minimize estate taxes, and ensure that their assets are protected and efficiently managed according to their wishes. Consulting with an experienced estate planning attorney in Queens is crucial to tailor these transfers to one's unique financial circumstances and specific goals, guaranteeing a smooth and successful transition of wealth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Transferencia de cuenta financiera a fideicomiso en vida - New York Financial Account Transfer to Living Trust

Description

How to fill out Queens New York Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you are searching for a relevant form template, it’s difficult to choose a better service than the US Legal Forms website – one of the most comprehensive online libraries. Here you can find a large number of form samples for business and personal purposes by categories and regions, or key phrases. With the high-quality search option, discovering the most recent Queens New York Financial Account Transfer to Living Trust is as elementary as 1-2-3. Furthermore, the relevance of each and every record is proved by a team of skilled lawyers that regularly review the templates on our website and update them in accordance with the newest state and county laws.

If you already know about our platform and have a registered account, all you need to receive the Queens New York Financial Account Transfer to Living Trust is to log in to your user profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have chosen the form you need. Look at its description and make use of the Preview option (if available) to explore its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to get the needed record.

- Confirm your decision. Select the Buy now option. Next, choose the preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Select the file format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the obtained Queens New York Financial Account Transfer to Living Trust.

Each template you add to your user profile has no expiration date and is yours permanently. You always have the ability to gain access to them via the My Forms menu, so if you need to receive an additional duplicate for editing or printing, feel free to come back and download it once again at any moment.

Make use of the US Legal Forms professional library to gain access to the Queens New York Financial Account Transfer to Living Trust you were seeking and a large number of other professional and state-specific samples in a single place!