Title: Understanding Suffolk New York Financial Account Transfer to Living Trust Introduction: A financial account transfer to a living trust is a comprehensive estate planning strategy that individuals in Suffolk, New York, commonly utilize to protect their assets and ensure a smooth transition of wealth to their beneficiaries. In this article, we will delve into the details of a Suffolk New York financial account transfer to a living trust, its benefits, and the different types of transfers available. 1. What is a Living Trust? A living trust, also known as a revocable trust, is a legal entity that holds an individual's assets during their lifetime and manages the distribution of those assets after their passing. By creating a living trust, individuals maintain control over their finances and can avoid probate, reduce estate taxes, and protect their interests. 2. Financial Account Transfer to Living Trust: Transferring financial accounts into a living trust involves re-titling ownership from an individual to the trust itself. This process typically includes bank accounts, investment accounts, retirement accounts, and other assets with a monetary value. 3. Benefits of a Suffolk New York Financial Account Transfer to Living Trust: a) Probate Avoidance: Unlike assets that pass through a will, assets held in a living trust bypass the probate process, providing privacy, cost savings, and quicker distribution to beneficiaries. b) Asset Protection: A trust can provide protection for assets from potential creditors, lawsuits, and other claims. c) Incapacity Planning: Living trusts also establish provisions for managing the trust maker's assets if they become incapacitated, ensuring seamless financial management. d) Continuous Control: The individual maintains full control of their assets during their lifetime and can change the trust's provisions or revoke it if necessary. 4. Types of Suffolk New York Financial Account Transfers to Living Trust: a) Revocable Living Trust: The most common type, allowing the person creating the trust (granter) to modify, amend, or revoke the trust during their lifetime. b) Irrevocable Living Trust: Once established, this type of trust cannot be easily changed or revoked; it offers additional asset protection and potential tax benefits. c) Testamentary Trust: Established through a will, this trust only becomes active upon the individual's death, transferring financial accounts to the designated trust beneficiaries. Conclusion: A Suffolk New York financial account transfer to a living trust is a practical option for individuals looking to protect their assets, avoid probate, and ensure a seamless transfer of wealth to their loved ones. Consulting with an experienced estate planning attorney is crucial to understand the legalities and determine the best trust plan according to specific circumstances and goals.

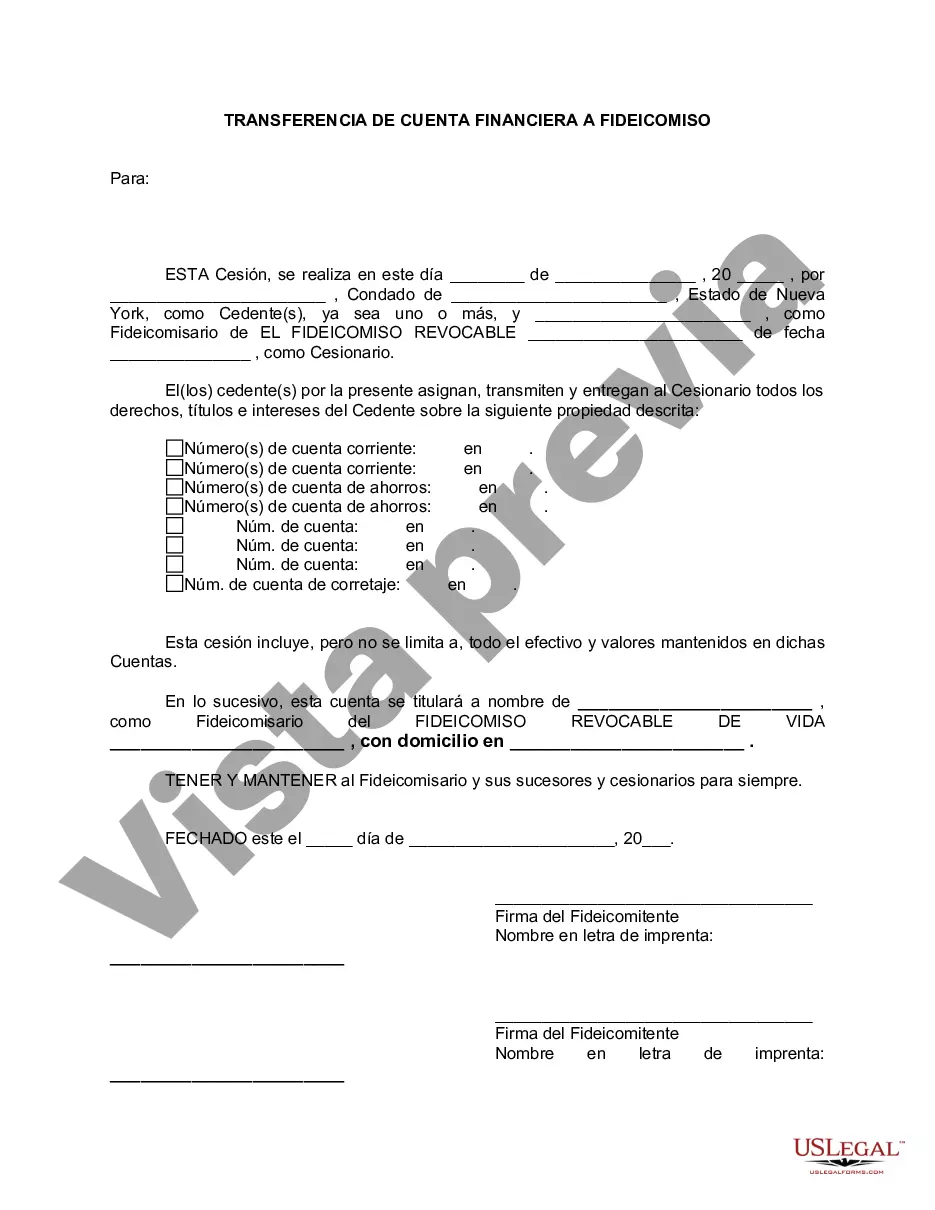

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Transferencia de cuenta financiera a fideicomiso en vida - New York Financial Account Transfer to Living Trust

Description

How to fill out Suffolk New York Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Make use of the US Legal Forms and get immediate access to any form sample you require. Our beneficial platform with a huge number of documents simplifies the way to find and get virtually any document sample you will need. It is possible to save, fill, and sign the Suffolk New York Financial Account Transfer to Living Trust in a few minutes instead of surfing the Net for several hours trying to find a proper template.

Utilizing our catalog is an excellent way to improve the safety of your form filing. Our professional legal professionals on a regular basis review all the documents to make certain that the forms are appropriate for a particular state and compliant with new laws and regulations.

How can you get the Suffolk New York Financial Account Transfer to Living Trust? If you already have a profile, just log in to the account. The Download option will appear on all the documents you view. Furthermore, you can find all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, stick to the tips listed below:

- Find the form you need. Make certain that it is the template you were looking for: verify its name and description, and take take advantage of the Preview function when it is available. Otherwise, use the Search field to find the needed one.

- Launch the saving procedure. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Download the document. Choose the format to get the Suffolk New York Financial Account Transfer to Living Trust and edit and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and reliable form libraries on the internet. We are always happy to assist you in any legal process, even if it is just downloading the Suffolk New York Financial Account Transfer to Living Trust.

Feel free to benefit from our service and make your document experience as convenient as possible!