Syracuse New York Assignment to Living Trust

Description

How to fill out New York Assignment To Living Trust?

Take advantage of the US Legal Forms and gain immediate access to any document template you need.

Our user-friendly platform, featuring a vast array of templates, enables you to locate and acquire nearly any document sample you need.

You can save, complete, and validate the Syracuse New York Assignment to Living Trust in just a few minutes instead of spending hours online searching for a suitable template.

Using our collection is an outstanding approach to enhance the security of your document filings. Our skilled legal experts routinely examine all the forms to ensure that they are suitable for a specific state and adhere to recent laws and regulations.

US Legal Forms is among the most comprehensive and dependable document libraries available online.

Our team is always prepared to support you in any legal endeavor, even if it's just downloading the Syracuse New York Assignment to Living Trust.

- How can you obtain the Syracuse New York Assignment to Living Trust.

- If you possess a subscription, simply Log In to your account. The Download button will be activated on all the documents you view.

- Furthermore, you can find all previously saved documents in the My documents section.

- If you haven't yet created an account, follow the steps outlined below.

- Locate the form you need. Confirm that it is the correct form: verify its title and description, and utilize the Preview option if available. If not, use the Search bar to find the right one.

- Initiate the saving process. Click Buy Now and select the pricing plan that works best for you. Then, create your account and complete your order using a credit card or PayPal.

- Download the document. Select the format to receive the Syracuse New York Assignment to Living Trust and review and complete or sign it based on your needs.

Form popularity

FAQ

It is often beneficial for parents to place their assets in a trust to help manage and protect those assets for their heirs. A trust can simplify the transfer of their assets and minimize potential estate taxes, making it a practical choice for many families. However, it’s vital for them to understand how to set it up and manage it properly. For those considering a Syracuse New York Assignment to Living Trust, seeking advice from estate planning professionals can clarify this decision.

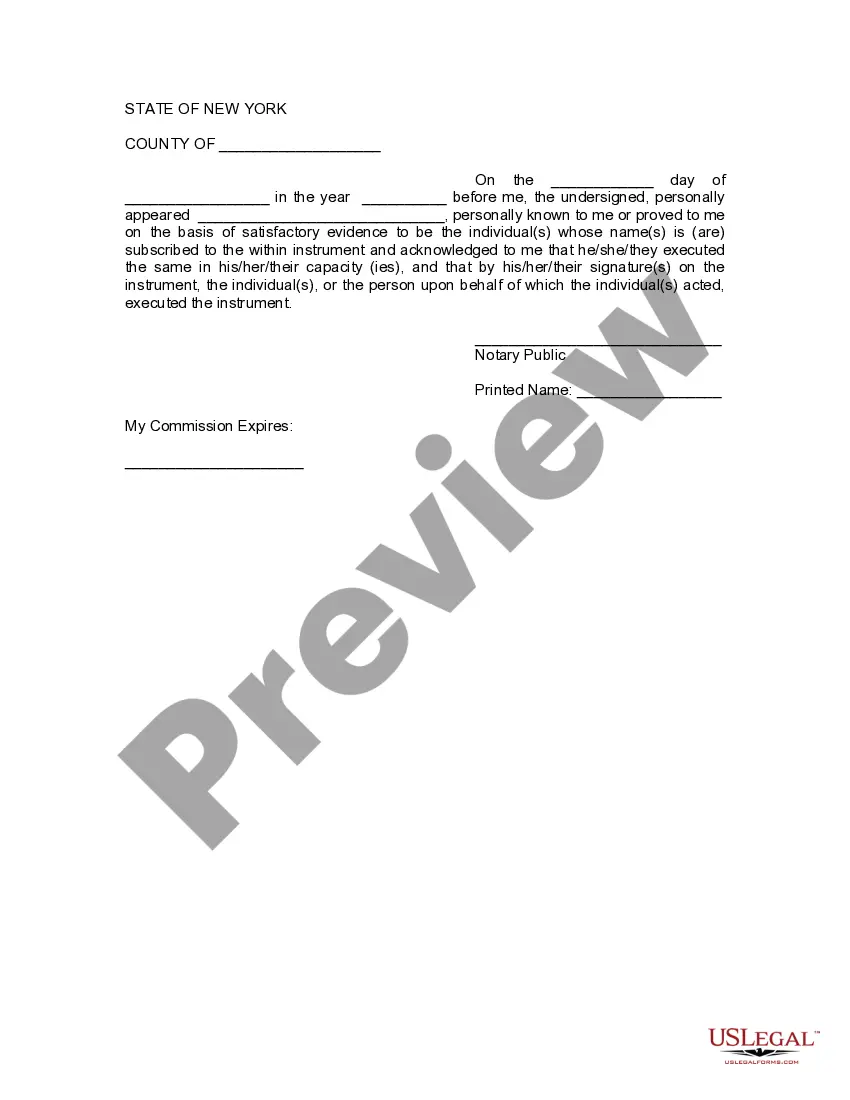

To transfer property to a trust in New York, you generally need to execute a deed that transfers ownership from yourself to the trust. This deed must be properly notarized and filed with the county clerk to ensure public record. Depending on the property type, additional forms may be necessary. For a seamless transfer process in your Syracuse New York Assignment to Living Trust, consider using platforms like USLegalForms that provide labeled forms and expert guidance.

Filing a living trust in New York typically involves creating a trust document that outlines all necessary details about the trust and its beneficiaries. Once created, the trust should be properly funded by transferring your assets into it. It is advisable to consult with an attorney experienced in Syracuse New York Assignment to Living Trust, as they can guide you through the specific legal requirements and ensure that your trust is valid and enforceable.

One risk associated with a trust fund is the possibility of legal challenges from beneficiaries or heirs, especially if there are ambiguities in the trust terms. Additionally, if the trust is not managed well, it may not provide the financial benefits originally intended for the beneficiaries. Another risk involves the costs associated with creating and maintaining the trust, which could drain the assets intended for family use. To mitigate these risks in your Syracuse New York Assignment to Living Trust, consider seeking professional guidance.

A significant mistake parents often make is failing to fund the trust adequately. Without funding, the trust cannot fulfill its intended purpose of holding assets. Additionally, some parents may overlook communicating their wishes to their children, leading to misunderstandings about how the trust should be managed. When creating a trust in Syracuse, New York, it is essential to ensure all assets are correctly assigned to the trust.

One potential downfall of having a trust is the ongoing management and maintenance it requires. If you do not properly fund your trust, your assets may not pass through it as intended, leading to complications. Additionally, some people might overlook their responsibilities to update the trust as their circumstances change, resulting in confusion or disputes down the line. For those considering a Syracuse New York Assignment to Living Trust, it’s crucial to understand these aspects for effective estate planning.

Filling out a living trust can seem daunting, but it is manageable with the right steps. Begin by gathering necessary information about your assets, beneficiaries, and any specific provisions you wish to include. Next, you can use a reliable service like US Legal Forms, which offers templates tailored for a Syracuse New York Assignment to Living Trust. This service simplifies the process by providing clear guidance and comprehensive options, ensuring your trust meets local legal requirements.

To transfer your property into a trust in New York, you must first ensure that the trust is properly established and legally recognized. Next, you will need to prepare a new deed that names the trust as the owner of the property. It's crucial to file this deed with the county clerk's office. If you seek additional guidance on this process, USLegalForms offers resources to assist with your Syracuse New York Assignment to Living Trust, simplifying the transition of your assets.

While a living trust offers many benefits, it also has downsides that you should consider. One downside includes the initial setup costs and time required to create a living trust correctly. Additionally, if you do not fund the trust by transferring assets into it, it may not serve its purpose effectively. For those looking to manage their estate efficiently in Syracuse, New York Assignment to Living Trust can be a valuable tool, but proper setup and funding is essential.

In a Syracuse New York Assignment to Living Trust, not all assets are suitable for inclusion. For instance, retirement accounts and life insurance policies often do not belong in a trust, as they have designated beneficiaries. Furthermore, personal items like vehicles or furniture might not be worth placing in a trust unless they hold significant value. Understanding which assets fit into your trust is crucial for effective estate planning.