Queens New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay — Notice and Acknowledgement of Pay Rate and Payday. In Queens, New York, it is important for employers to provide a comprehensive Pay Notice to their employees who are paid a salary for varying hours, day rate, piece rate, flat rate, or other non-hourly pay. This Pay Notice ensures transparency and compliance with the state's labor laws, protecting the rights of both employers and employees. There are several types of Pay Notices that may be applicable based on the method of payment: 1. Pay Notice for Employees Paid a Salary for Varying Hours: This Pay Notice is designed for employees who receive a consistent salary but work varying hours. It clearly states the employee's salary, the regular workweek duration, and the method used to calculate overtime pay. Employers must observe the Fair Labor Standards Act (FLEA) regulations when determining the overtime rate for such employees. 2. Pay Notice for Employees Paid a Day Rate: For employees receiving a day rate, this Pay Notice outlines the daily rate of pay, the specific duties or tasks associated with the day rate, and the employer's policies on breaks, overtime, and any other entitlements related to their pay. 3. Pay Notice for Employees Paid a Piece Rate: Employees paid a piece rate are compensated per item produced or service rendered. The Pay Notice for this category of employees includes information on the approved piece rate, the method used to track productivity or output, and the criteria necessary to qualify for piece rate compensation. Employers must carefully define and document the unit of production and ensure minimum wage compliance. 4. Pay Notice for Employees Paid a Flat Rate: This Pay Notice is intended for employees who receive a fixed amount for performing a specified task or completing a project regardless of hours worked. It clarifies the terms of the flat rate payment, including the expected completion timeframe, any additional compensation for overtime, and any deductions or withholding that might be applicable. 5. Pay Notice for Employees Paid Other Non-Hourly Pay: Some employees may fall under other non-hourly pay arrangements, such as commissioned salespersons or employees paid on a percentage basis. This Pay Notice should specify the agreed-upon pay structure, the applicable commission rates or percentages, and any other relevant terms and conditions that govern the employee's compensation. Regardless of the specific type of Pay Notice required, it is crucial for both employers and employees to acknowledge the receipt and understanding of the pay rate and payday information. This acknowledgement serves as legal documentation, ensuring that both parties are informed about their rights and obligations. Employers must keep records of these acknowledgements to demonstrate compliance with New York State labor laws. By providing these detailed Pay Notices tailored to specific pay arrangements, employers in Queens, New York comply with the law and contribute to a fair and transparent working environment for their employees.

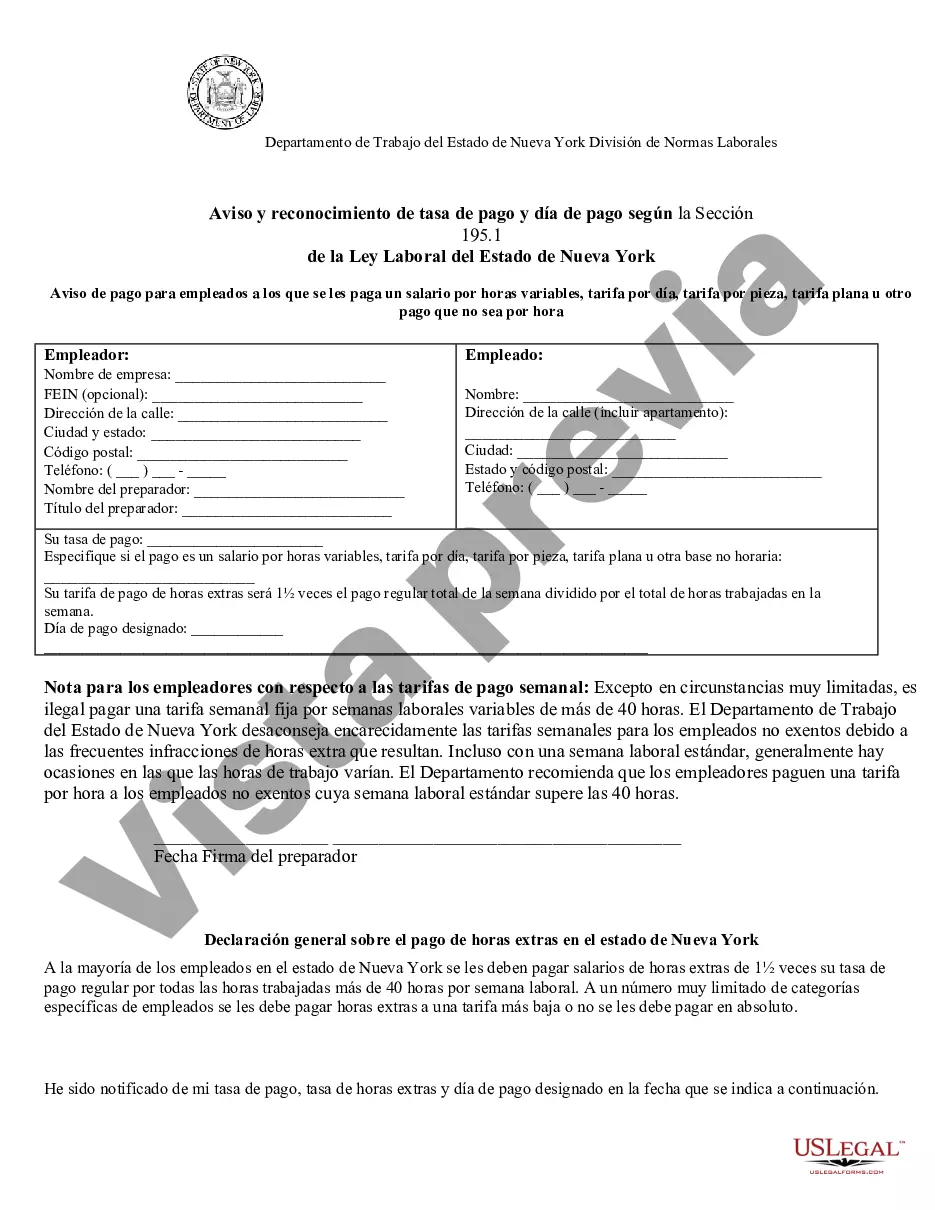

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Aviso de pago para empleados a los que se les paga un salario por horas variables, tarifa por día, tarifa por pieza, tarifa plana u otro pago que no sea por hora: aviso y reconocimiento de la tarifa de pago y el día de pago - New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out Queens New York Aviso De Pago Para Empleados A Los Que Se Les Paga Un Salario Por Horas Variables, Tarifa Por Día, Tarifa Por Pieza, Tarifa Plana U Otro Pago Que No Sea Por Hora: Aviso Y Reconocimiento De La Tarifa De Pago Y El Día De Pago?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal solutions that, as a rule, are extremely costly. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Queens New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is just as effortless if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Queens New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Queens New York Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non-Hourly Pay - Notice and Acknowledgement of Pay Rate and Payday is proper for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!