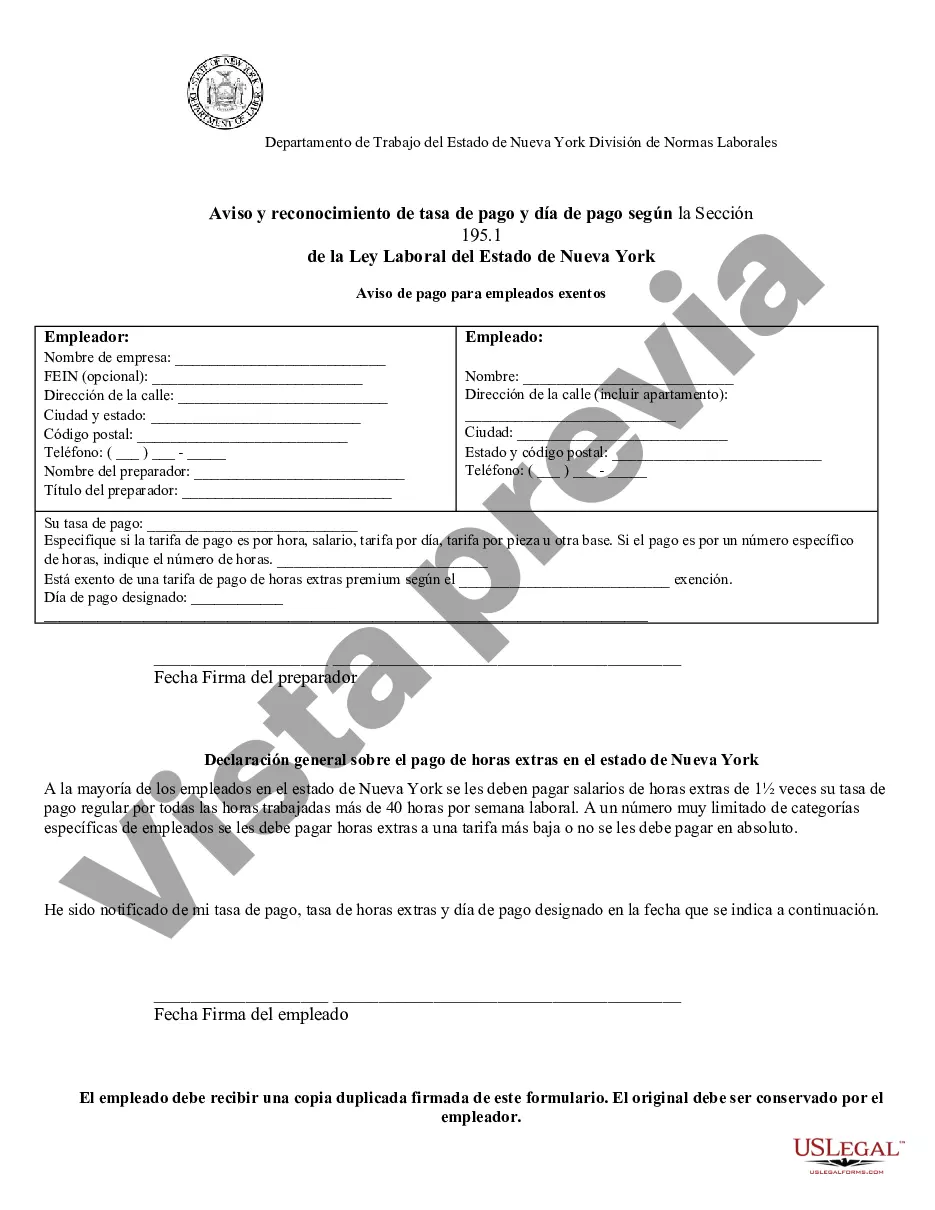

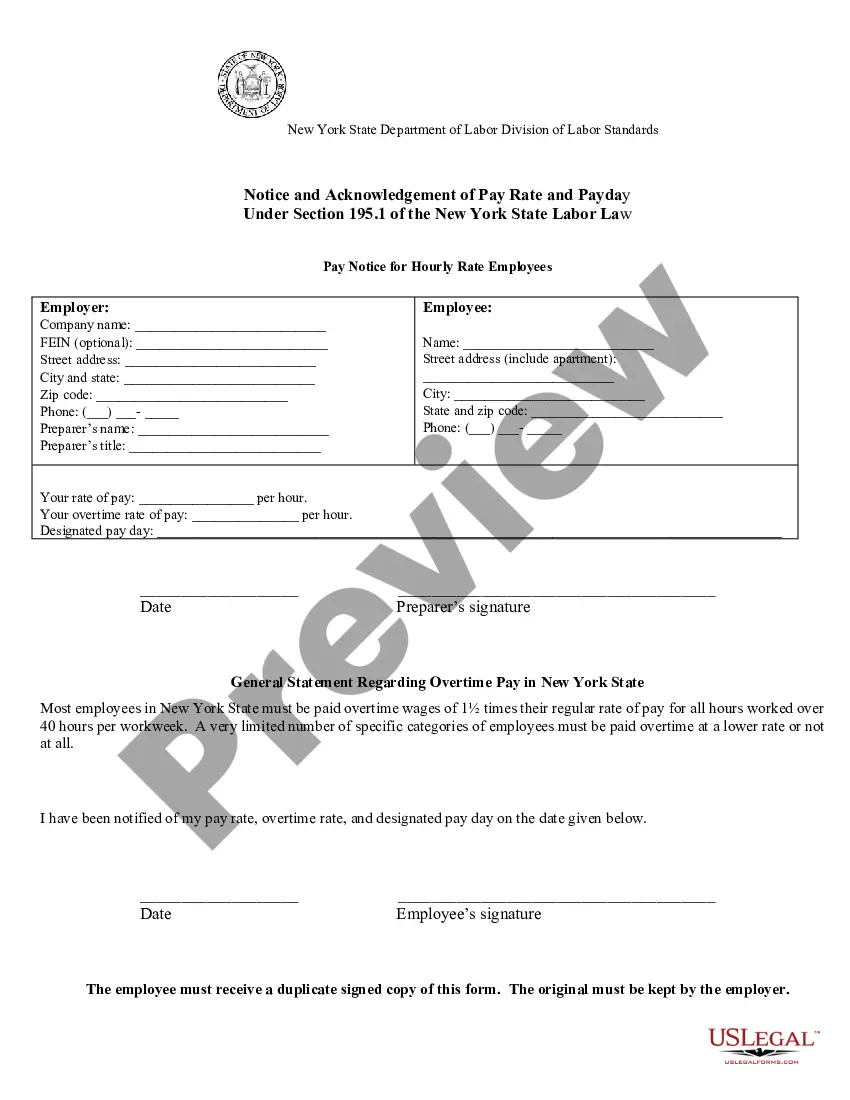

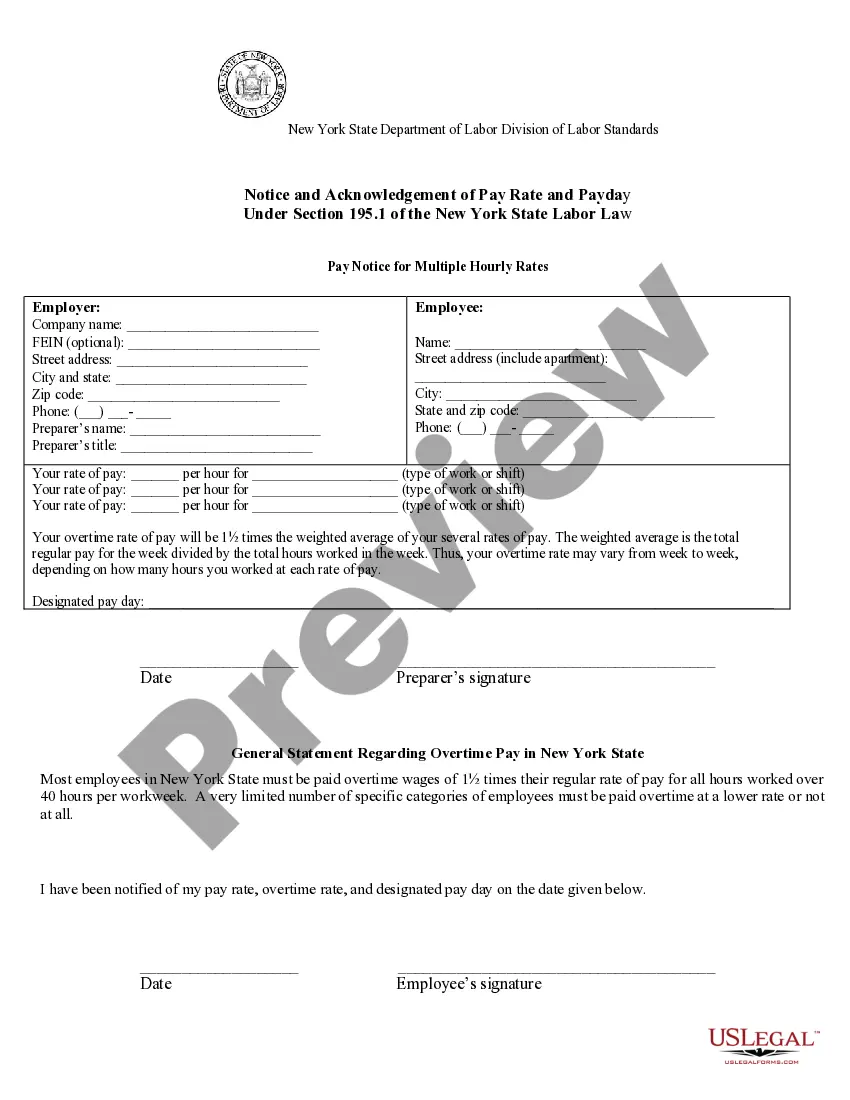

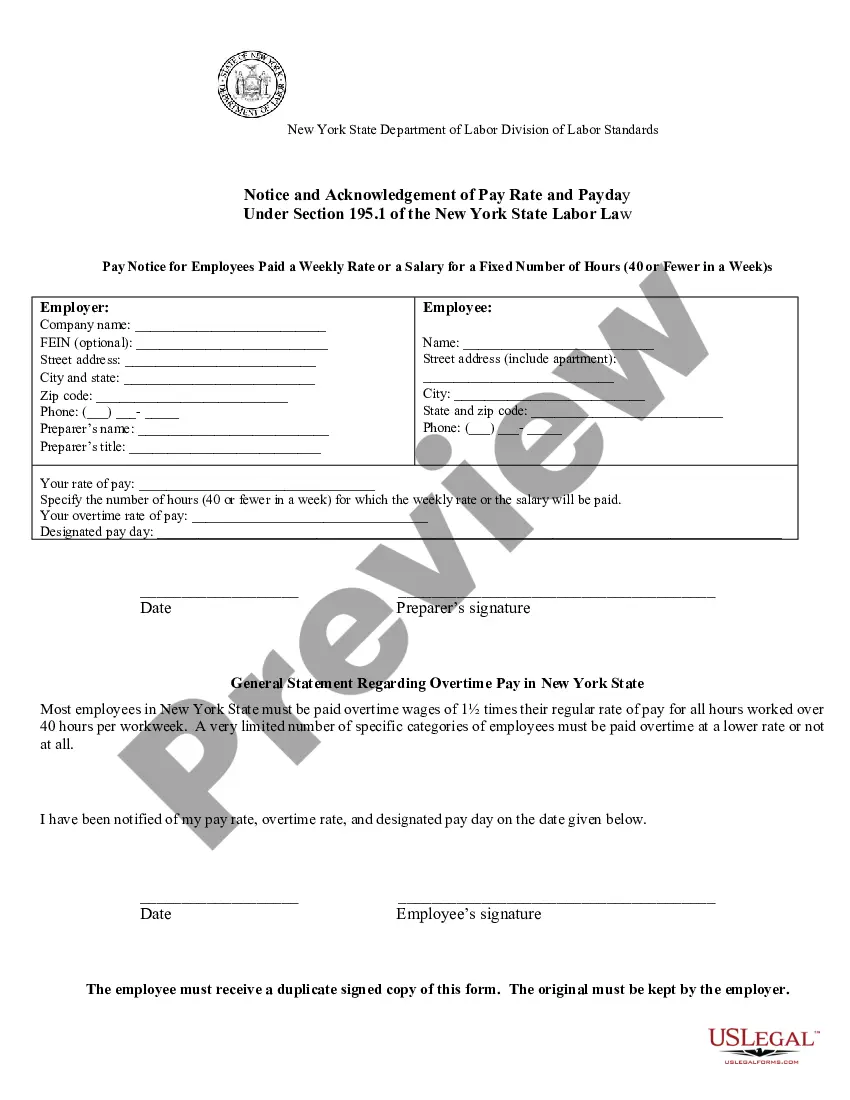

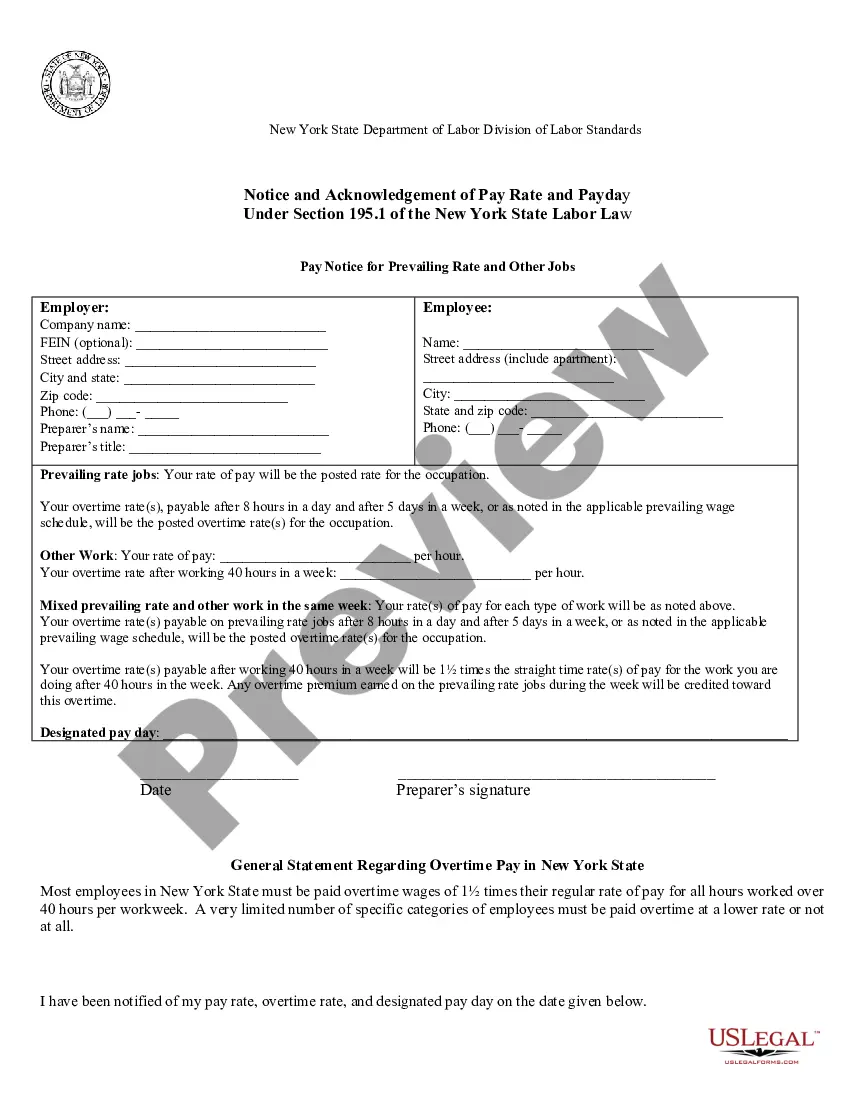

Queens New York Pay Notice for Exempt Employees — Notice and Acknowledgement of Pay Rate and Payday is a legally required document that informs exempt employees about their pay rate and payday. This notice serves to ensure transparency and compliance with the state's labor laws. Exempt employees, who are typically salaried employees, are exempt from certain wage and hour laws, such as overtime pay. The Queens New York Pay Notice is designed to make sure that exempt employees are aware of their pay rate, which is the amount they earn for their work, and their payday, which is the day on which they will receive their wages. The Pay Notice for Exempt Employees also includes additional information such as the employer's name, address, and contact details, as well as the exempt employee's job title or position. It may also state the basis for the exempt employee's exemption, which could be professional, executive, or administrative roles, among others. Different types of Queens New York Pay Notice for Exempt Employees — Notice and Acknowledgement of Pay Rate and Payday may include variations in formatting, layout, or additional information based on specific employer requirements. However, the essential details, such as the pay rate, payday, employer information, and employee position, remain constant across all versions. It is crucial for employers in Queens, New York, to provide this notice to their exempt employees at the time of hiring and whenever changes occur in the employee's pay rate or payday. This notice must be given in writing and acknowledged by the employee to indicate that they have received, understood, and agreed to the terms outlined in the notice. Compliance with the Queens New York Pay Notice for Exempt Employees — Notice and Acknowledgement of Pay Rate and Payday is paramount for employers to avoid potential legal issues or penalties related to wage and hour laws. Employers must ensure that they accurately provide the required information and retain records of these notices and acknowledgements for their records. In conclusion, the Queens New York Pay Notice for Exempt Employees — Notice and Acknowledgement of Pay Rate and Payday is a crucial document that informs exempt employees about their pay rate, payday, and other relevant details. It helps establish transparency and compliance with labor laws while protecting the rights of both employers and employees.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Aviso de Pago para Empleados Exentos - Aviso y Reconocimiento de Tasa de Pago y Día de Pago - New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Aviso De Pago Para Empleados Exentos - Aviso Y Reconocimiento De Tasa De Pago Y Día De Pago?

Are you seeking a reliable and affordable provider of legal forms to purchase the Queens New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday? US Legal Forms is your ideal selection.

Whether you require a straightforward agreement to define rules for cohabitation with your partner or a collection of forms to facilitate your divorce proceedings in court, we have you covered. Our platform offers more than 85,000 current legal document templates for personal and business applications. All templates we provide are not generic but tailored to the specifications of specific states and counties.

To obtain the form, you need to Log In to your account, find the necessary template, and hit the Download button next to it. Please keep in mind that you can download your previously acquired form templates anytime via the My documents tab.

Are you a newcomer to our platform? No problem. You can set up an account in just a few minutes, but first, ensure to do the following.

Now you can create your account. Then, choose the subscription option and move on to payment. Once the payment is finalized, download the Queens New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday in any available file format. You can revisit the site at any time and redownload the form without additional cost.

Locating current legal forms has never been simpler. Try US Legal Forms today and stop wasting time on extensive online research for legal documents.

- Check if the Queens New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday aligns with the regulations of your state and locality.

- Review the form's specifications (if available) to determine its suitability.

- Restart your search if the template does not fit your legal needs.

Form popularity

Interesting Questions

More info

Please use each of the buttons below to begin the online application process. First Name : Last Name : Email Address (Must be valid) : Phone Number : Other Phone Number : E-Mail Address : Job Title (Optional) : Department / Area of Work (Select 1) (You may select more than 1 option, but there will only be 1 selection in the results' column.) (Select 1) (Employee Title: Please select one.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.