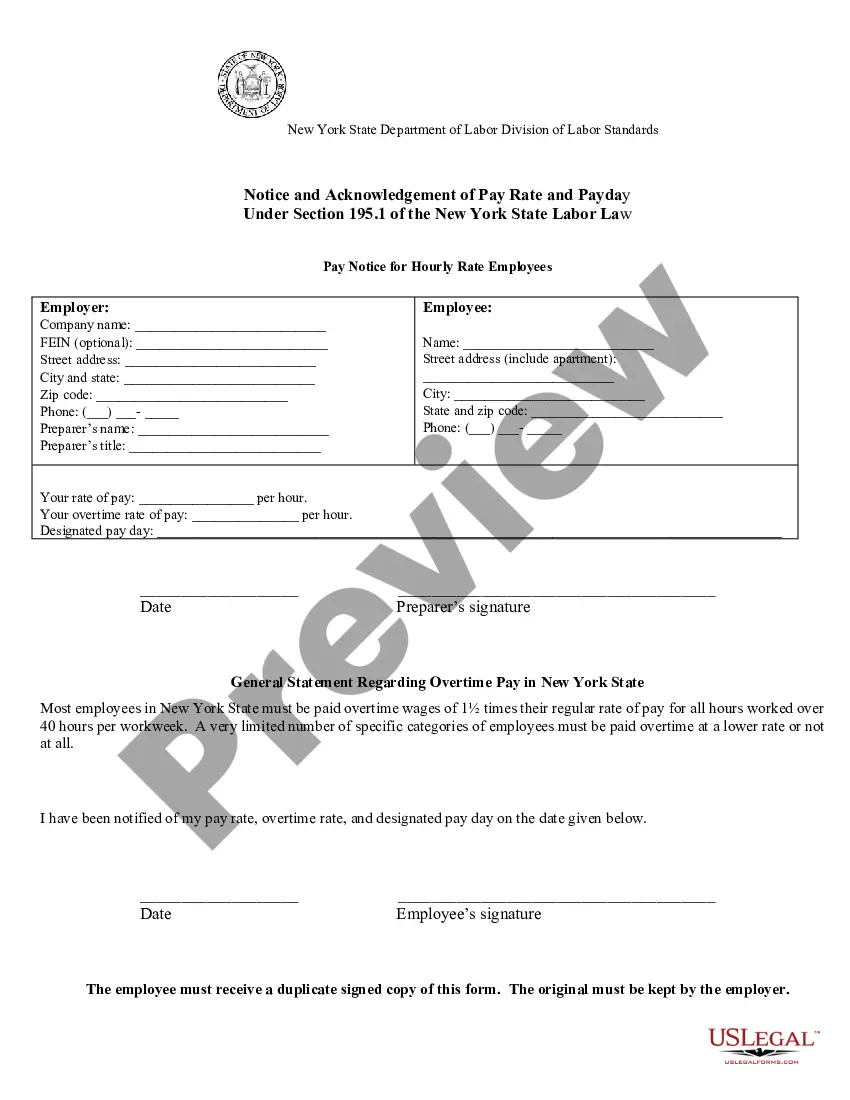

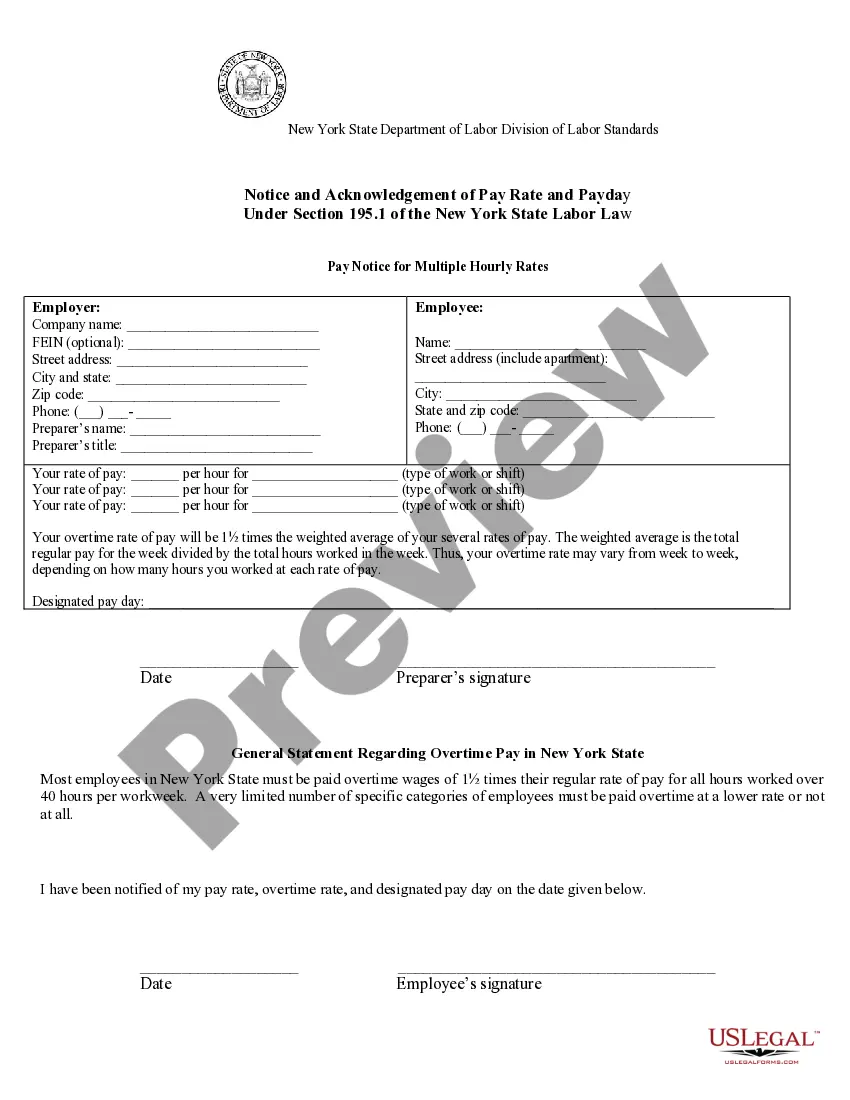

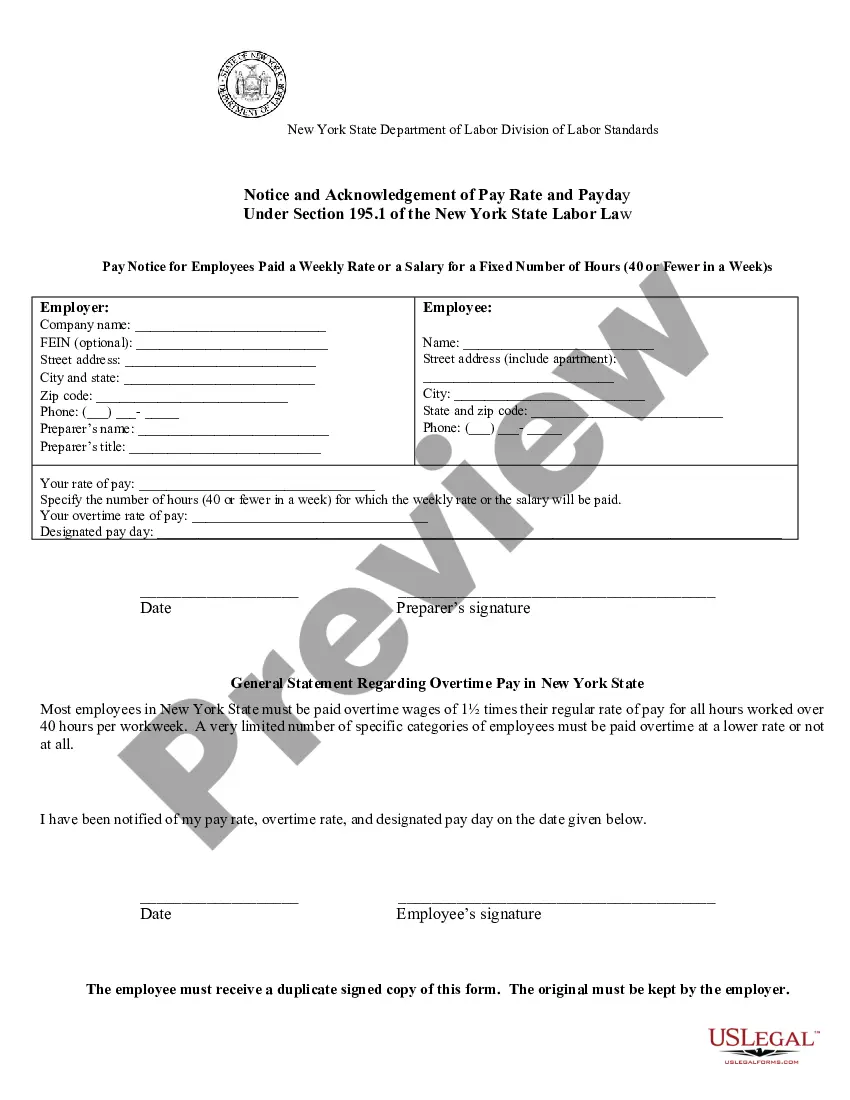

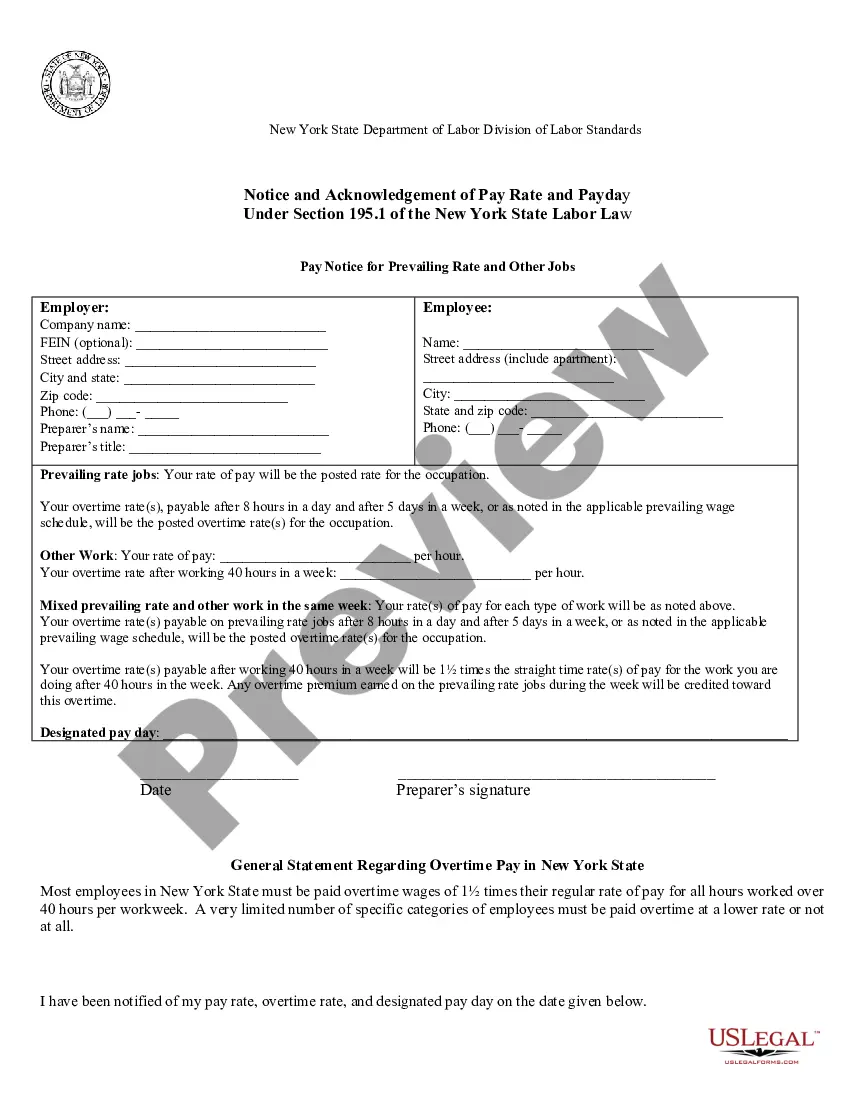

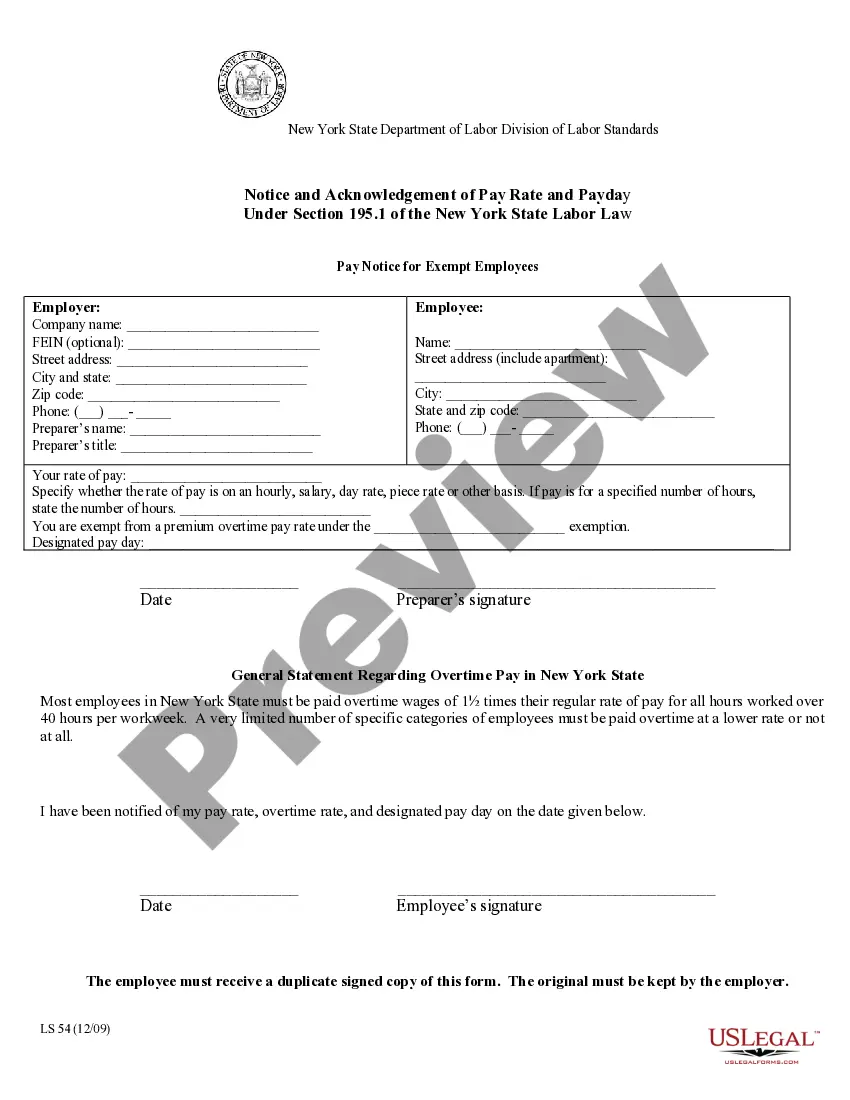

The Syracuse New York Pay Notice for Exempt Employees — Notice and Acknowledgement of Pay Rate and Payday is a legal document that employers in Syracuse, New York are required to provide to their exempt employees. This notice serves as a means of informing employees about their pay rate and payday, ensuring transparency and compliance with state employment laws. Here are the key details that should be included in the notice: 1. Purpose: The Syracuse New York Pay Notice for Exempt Employees serves to inform exempt employees about their pay rate and payday as required by the laws of the state. 2. Employee Information: The notice should include the employee's name, job title, and employee identification number if applicable. This ensures that the notice is personalized and specific to each employee. 3. Pay Rate: The notice must clearly state the employee's pay rate. This includes the hourly rate for employees paid on an hourly basis or the salary amount for those on a fixed salary. The pay rate should be expressed in dollars per hour or per annum. 4. Pay Period: Employers must specify the pay period covered by the notice (e.g., weekly, bi-weekly, semi-monthly, monthly). This ensures that employees are aware of the frequency at which they will be paid. 5. Payday: The notice should clearly indicate the exact day or days on which employees will be paid. This includes specifying if the payday falls on a specific day of the week or a fixed date of the month. 6. Additional Compensation: If there are other forms of compensation that employees are entitled to, such as bonuses, commissions, or allowances, this should be clearly mentioned in the notice. 7. Deductions: Employers should disclose any deductions that may be made from the employee's wages, such as taxes, healthcare contributions, or retirement plan contributions. This ensures transparency regarding the employee's net pay. Some additional types of Syracuse New York Pay Notice for Exempt Employees — Notice and Acknowledgement of Pay Rate and Payday may include: 1. Temporal Variation Notice: In certain situations, an exempt employee's pay rate and payday may vary due to temporary factors, such as seasonal work or project-based employment. A Temporal Variation Notice would inform employees about these temporary variations in pay rate and payday. 2. Change in Pay Rate Notice: If an exempt employee's pay rate changes permanently, a Change in Pay Rate Notice should be provided. This notice would outline the new pay rate and effective date of the change. 3. Change in Payday Notice: If there is a permanent change in the employee's payday, such as due to a company policy change or restructuring, employers should issue a Change in Payday Notice. This notice would inform employees about the new payday and any adjustments in the pay period if applicable. Employers must ensure that these notices are provided to exempt employees in a timely manner and that employees acknowledge their receipt and understanding of the information presented. Proper compliance with Syracuse New York Pay Notice requirements helps maintain a transparent and harmonious work environment.

Syracuse New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Exempt Employees - Notice And Acknowledgement Of Pay Rate And Payday?

We consistently strive to reduce or evade legal complications when addressing delicate legal or financial issues. To achieve this, we engage attorney services that are typically quite costly. Nonetheless, not every legal matter is equally intricate. Many can be handled independently.

US Legal Forms is an online collection of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library empowers you to manage your affairs without relying on a lawyer. We provide access to legal document templates that are not always publicly accessible.

Utilize US Legal Forms whenever you need to obtain and download the Syracuse New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday or any other document promptly and securely. Simply Log In to your account and click the Get button adjacent to it. If you misplace the document, you can always re-download it in the My documents section.

The procedure is equally simple if you’re new to the platform! You can establish your account in just a few minutes. Make sure to verify whether the Syracuse New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday adheres to the laws and regulations of your state and region.

- Additionally, it’s essential to review the form’s description (if present), and if you notice any inconsistencies with what you originally sought, look for an alternative form.

- Once you’ve confirmed that the Syracuse New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday suits your needs, you can select the subscription option and proceed with payment.

- Subsequently, you can download the document in any format offered.

- With over 24 years of our operation, we’ve assisted millions by providing ready-to-customize and up-to-date legal forms.

- Seize the opportunity with US Legal Forms now to conserve time and resources!

Form popularity

FAQ

Labor Law Section 191 outlines the frequency by which employees must be paid. Manual Workers: Wages must be paid weekly and not later than seven calendar days after the end of the week in which the wages are earned.

Work any number of hours in a day: New York employers are not restricted in the number of hours they require employees to work each day. This means that an employer may legally ask an individual to work shifts of 8, 10, 12 or more hours each day.

If an employee is exempt from FLSA and any state, local, or union overtime laws, then it is legal to work 60 hours a week on salary. Some employers do pay exempt employees for overtime work through time-and-a-half, bonuses, or extra time off.

To file a claim, you will need to complete a form to claim unpaid wages, wage supplements, minimum wage/overtime and various non-wage items, if your situation meets the criteria below. Unpaid Wages: Your employer did not pay you for all hours worked (including on-the-job training).

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.

Employers must pay their employees within seven days of their particular pay period, whether it is on a weekly or biweekly basis. While some exceptions exist, most employers cannot engage in untimely wage payments. Unfortunately, many New York employers do not pay their employees on time.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

There is no general legal limit on how long the employer can require adults to work, but you are entitled to overtime pay for all hours worked after 40 in a work week.

The State of New York requires that employers tell their employees what their compensation will be in plain terms. The compensation could be paid out hourly, daily, weekly, or monthly. If the salary is paid weekly, then the employer should clearly explain to the employee the number of hours covered by the weekly rate.