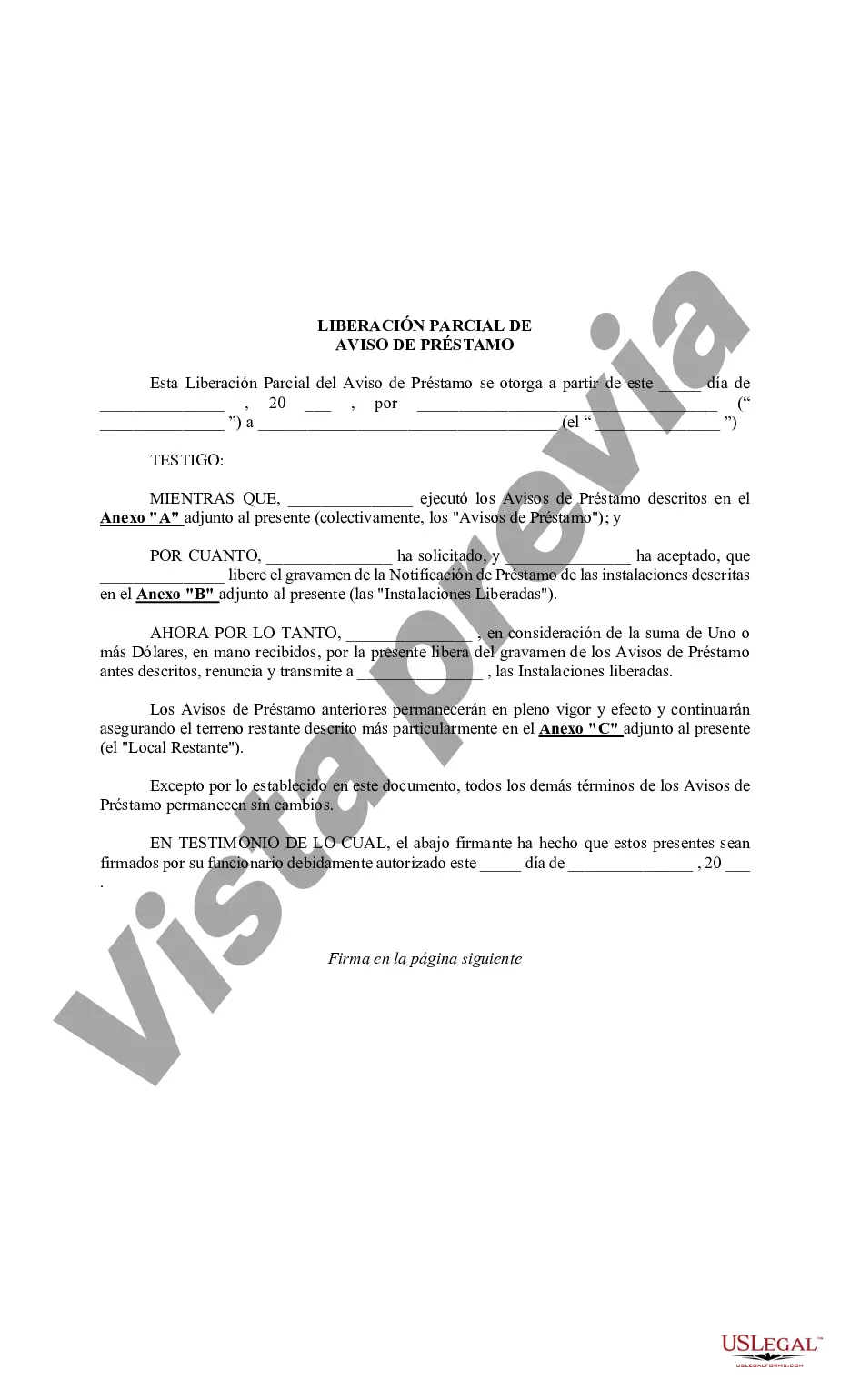

Title: Understanding the Suffolk New York Partial Release of Notice of Lending: Types and Guidelines Meta Description: Explore the different types of Suffolk New York Partial Release of Notice of Lending and gain valuable insights into its significance. Learn about the guidelines and requirements involved in this process. Keywords: Suffolk New York Partial Release of Notice of Lending, types, significance, guidelines, requirements Introduction: The Suffolk New York Partial Release of Notice of Lending is a legal document that plays a crucial role in the lending industry. This article will provide a detailed description of what this document entails, its various types, and the guidelines to ensure a smooth process. Understanding how it works and its importance will help borrowers, lenders, and other stakeholders navigate the lending landscape effectively. Types of Suffolk New York Partial Release of Notice of Lending: 1. Traditional Partial Release: In this type, the borrower seeks to release a particular portion of their collateral, typically real estate, from the original loan agreement. This freedom allows borrowers to sell or transfer a specific portion of the property while keeping the remaining collateral intact. 2. Debt Reduction Partial Release: This type focuses on reducing the amount of outstanding debt by releasing a portion of the collateral. Borrowers who are unable to repay the full loan amount may negotiate with lenders for a partial release, resulting in a reduced debt burden. 3. Development Phase Partial Release: Applicable mainly to construction loans, this type of partial release allows borrowers to access loan funds in phases. As the project progresses, lenders release portions of the loan, contingent upon completed stages or pre-agreed milestones. Significance of Suffolk New York Partial Release of Notice of Lending: 1. Flexibility for Borrowers: The partial release offers borrowers the flexibility to manage their assets effectively and make optimal use of their collateral, resulting in increased liquidity or reduced debt obligations. 2. Lender Protection: Lenders benefit from partial releases as they mitigate their risks associated with defaulting borrowers by ensuring they retain value against the loan. This enables them to recover potential losses efficiently. Guidelines and Requirements for the Suffolk New York Partial Release of Notice of Lending: 1. Accurate and Complete Documentation: Borrowers must provide accurate information about the collateral, such as a legal description of the released property and its boundaries, to ensure the partial release process proceeds smoothly. 2. Compliance with Legal Procedures: The Suffolk New York Partial Release of Notice of Lending must comply with local, state, and federal laws governing lending practices. Both parties involved in the process should consult legal counsel to ensure compliance. 3. Communication and Agreement: Effective communication and agreement between both parties play a vital role in the successful completion of a partial release. The terms and conditions, including the desired portion of collateral to be released or reduced, should be negotiated and documented appropriately. Conclusion: The Suffolk New York Partial Release of Notice of Lending offers borrowers and lenders the opportunity to navigate the lending landscape with flexibility and protection. By understanding the different types, significance, and adhering to the necessary guidelines and requirements, stakeholders can ensure a smooth and legally compliant partial release process. Seeking professional advice from legal experts is highly recommended ensuring all aspects are appropriately handled.

Title: Understanding the Suffolk New York Partial Release of Notice of Lending: Types and Guidelines Meta Description: Explore the different types of Suffolk New York Partial Release of Notice of Lending and gain valuable insights into its significance. Learn about the guidelines and requirements involved in this process. Keywords: Suffolk New York Partial Release of Notice of Lending, types, significance, guidelines, requirements Introduction: The Suffolk New York Partial Release of Notice of Lending is a legal document that plays a crucial role in the lending industry. This article will provide a detailed description of what this document entails, its various types, and the guidelines to ensure a smooth process. Understanding how it works and its importance will help borrowers, lenders, and other stakeholders navigate the lending landscape effectively. Types of Suffolk New York Partial Release of Notice of Lending: 1. Traditional Partial Release: In this type, the borrower seeks to release a particular portion of their collateral, typically real estate, from the original loan agreement. This freedom allows borrowers to sell or transfer a specific portion of the property while keeping the remaining collateral intact. 2. Debt Reduction Partial Release: This type focuses on reducing the amount of outstanding debt by releasing a portion of the collateral. Borrowers who are unable to repay the full loan amount may negotiate with lenders for a partial release, resulting in a reduced debt burden. 3. Development Phase Partial Release: Applicable mainly to construction loans, this type of partial release allows borrowers to access loan funds in phases. As the project progresses, lenders release portions of the loan, contingent upon completed stages or pre-agreed milestones. Significance of Suffolk New York Partial Release of Notice of Lending: 1. Flexibility for Borrowers: The partial release offers borrowers the flexibility to manage their assets effectively and make optimal use of their collateral, resulting in increased liquidity or reduced debt obligations. 2. Lender Protection: Lenders benefit from partial releases as they mitigate their risks associated with defaulting borrowers by ensuring they retain value against the loan. This enables them to recover potential losses efficiently. Guidelines and Requirements for the Suffolk New York Partial Release of Notice of Lending: 1. Accurate and Complete Documentation: Borrowers must provide accurate information about the collateral, such as a legal description of the released property and its boundaries, to ensure the partial release process proceeds smoothly. 2. Compliance with Legal Procedures: The Suffolk New York Partial Release of Notice of Lending must comply with local, state, and federal laws governing lending practices. Both parties involved in the process should consult legal counsel to ensure compliance. 3. Communication and Agreement: Effective communication and agreement between both parties play a vital role in the successful completion of a partial release. The terms and conditions, including the desired portion of collateral to be released or reduced, should be negotiated and documented appropriately. Conclusion: The Suffolk New York Partial Release of Notice of Lending offers borrowers and lenders the opportunity to navigate the lending landscape with flexibility and protection. By understanding the different types, significance, and adhering to the necessary guidelines and requirements, stakeholders can ensure a smooth and legally compliant partial release process. Seeking professional advice from legal experts is highly recommended ensuring all aspects are appropriately handled.

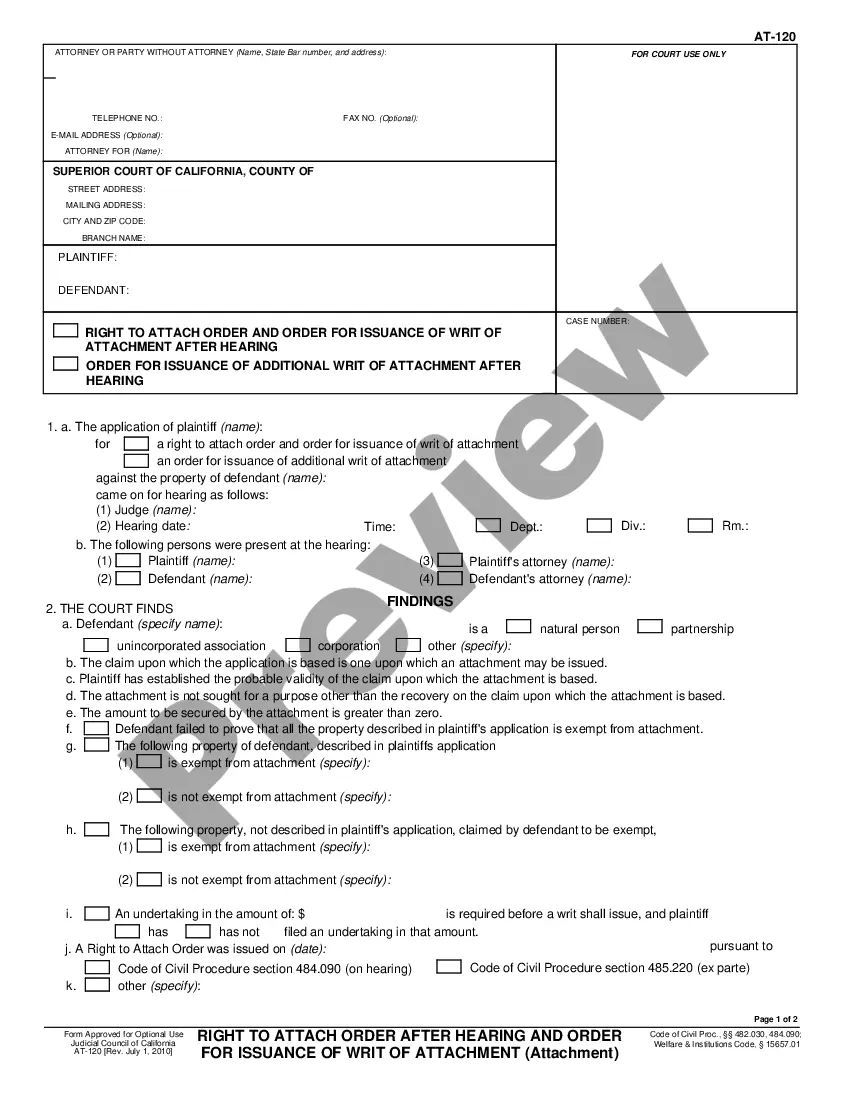

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.