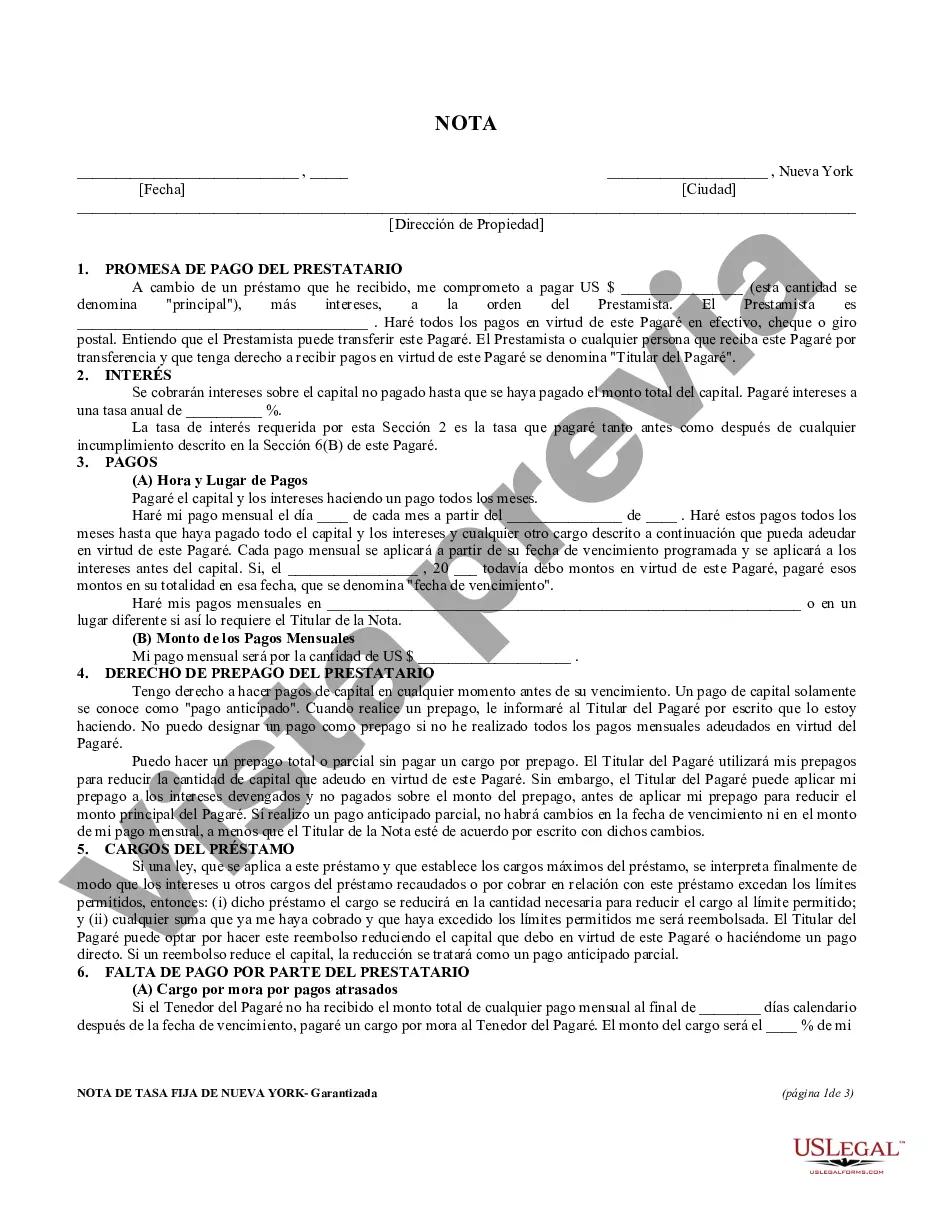

Queens, New York Secured Promissory Note is a legally binding agreement that outlines the terms and conditions of a loan transaction between a borrower and a lender in Queens, New York. This document serves as a written promise from the borrower to repay a specified amount of money to the lender within a predetermined timeframe, with interest. The purpose of a secured promissory note is to provide protection to the lender by securing the loan with collateral, such as real estate or personal property, to ensure repayment in case of default. By including this security element, lenders can have greater confidence in extending credit to borrowers in Queens, New York. Several types of Secured Promissory Notes exist in Queens, New York, each designed to cater to different financial scenarios and requirements: 1. Mortgage Note: A Mortgage Note is a common type of Secured Promissory Note used in real estate transactions. It specifically refers to a loan secured by a mortgage on a property situated in Queens, New York. In the event of default, the lender can initiate foreclosure proceedings to recover the outstanding debt. 2. Vehicle Loan Note: This type of Secured Promissory Note is used when lending funds to finance the purchase of a vehicle in Queens, New York. The loan is secured by the vehicle itself, allowing the lender to repossess and sell it to recover the outstanding debt if the borrower fails to make timely payments. 3. Collateralized Business Loan Note: A Collateralized Business Loan Note is intended for borrowers in Queens, New York seeking funding for their businesses. It involves providing collateral, such as equipment, inventory, or accounts receivable, to secure the loan. The lender has the right to seize and sell the collateral to recoup losses if the borrower defaults. 4. Personal Property Note: When individuals borrow money in Queens, New York, using personal property as collateral (such as jewelry, artwork, or valuable assets), a Personal Property Note can be utilized. In case of non-payment, the lender can claim and sell the pledged items to recover the loan amount. In summary, Queens, New York Secured Promissory Notes are essential legal documents that outline the terms and conditions of a loan. By providing lenders with collateral, these notes offer added security against default, ensuring the repayment of the loan. Various types of Secured Promissory Notes exist, including Mortgage Notes, Vehicle Loan Notes, Collateralized Business Loan Notes, and Personal Property Notes, each tailored to fit different borrowing scenarios in Queens, New York.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.00812345678 - New York Secured Promissory Note

Description

How to fill out Queens New York Pagaré Garantizado De Nueva York?

Make use of the US Legal Forms and obtain instant access to any form template you need. Our helpful website with a large number of documents makes it easy to find and obtain virtually any document sample you will need. It is possible to save, fill, and sign the Queens New York Secured Promissory Note in a few minutes instead of browsing the web for hours searching for a proper template.

Using our collection is a superb way to raise the safety of your record submissions. Our professional lawyers on a regular basis review all the records to make certain that the templates are relevant for a particular region and compliant with new laws and polices.

How do you obtain the Queens New York Secured Promissory Note? If you have a profile, just log in to the account. The Download button will appear on all the samples you look at. Additionally, you can find all the previously saved documents in the My Forms menu.

If you haven’t registered an account yet, stick to the instructions below:

- Open the page with the template you require. Make certain that it is the template you were looking for: verify its name and description, and make use of the Preview function when it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Launch the saving process. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order using a credit card or PayPal.

- Export the document. Select the format to get the Queens New York Secured Promissory Note and revise and fill, or sign it for your needs.

US Legal Forms is one of the most significant and reliable template libraries on the internet. We are always happy to help you in virtually any legal process, even if it is just downloading the Queens New York Secured Promissory Note.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!