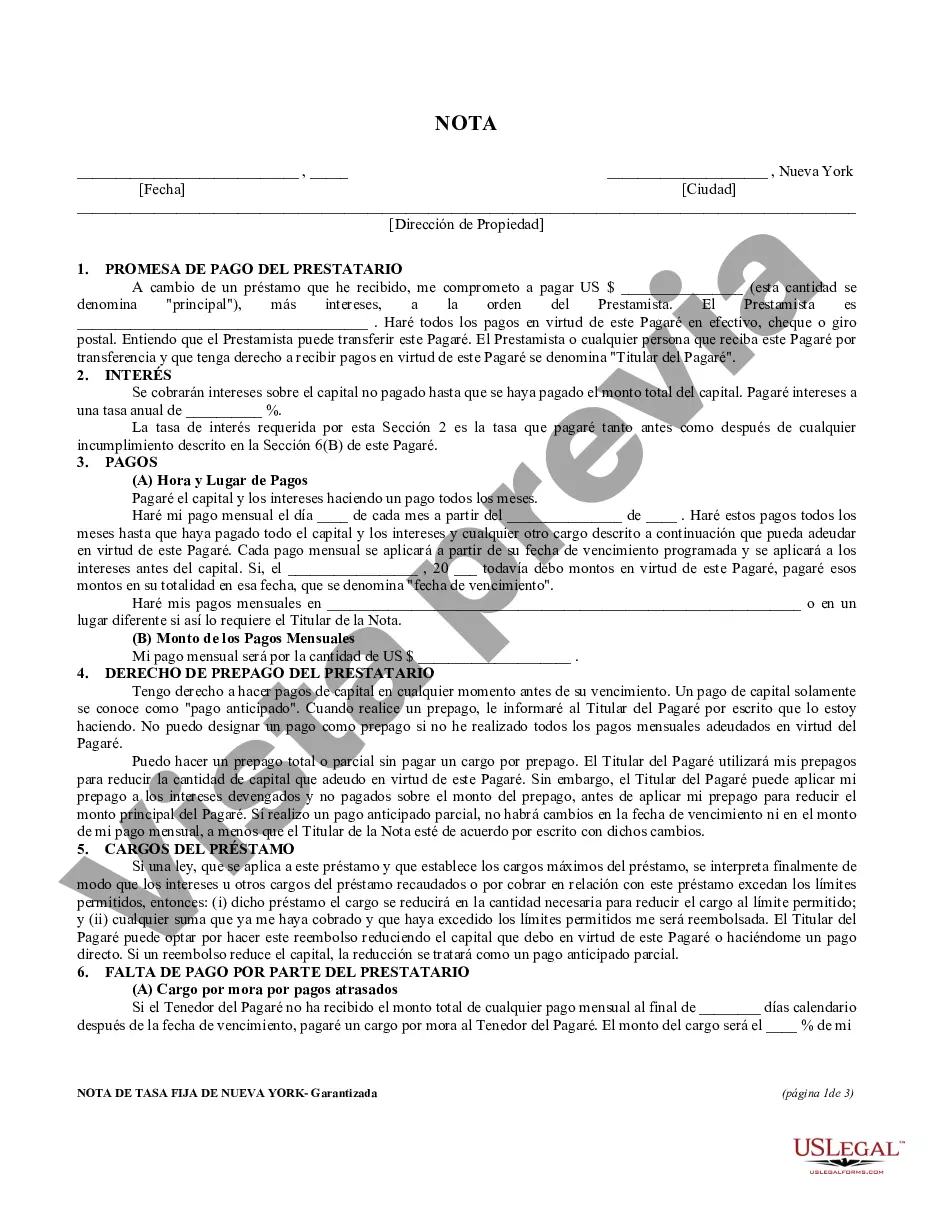

A Syracuse New York Secured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Syracuse, New York. It serves as a written evidence of the debt and specifies the borrower's promise to repay the loaned amount to the lender. The main purpose of a secured promissory note is to provide security for the lender in case the borrower defaults on the loan. This is achieved by including a collateral provision in the note. The collateral can be any valuable asset owned by the borrower, such as real estate, vehicles, or other personal property. By pledging collateral, the borrower agrees that the lender has the right to claim and sell the collateral to recover the loaned amount if the borrower fails to repay. In Syracuse, New York, there are different types of secured promissory notes that one might come across, each tailored to specific circumstances and purposes. Some of these variations include: 1. Real Estate Secured Promissory Note: This type of note is commonly used when the loan is specifically secured by real estate property. It clearly identifies the property being pledged as collateral and specifies the rights and responsibilities of both the lender and borrower in relation to the real estate asset. 2. Vehicle Secured Promissory Note: When a loan is secured by a vehicle, such as a car or a motorcycle, this type of note is utilized. It outlines the details of the vehicle being used as collateral and the steps required to transfer ownership to the lender in case of default. 3. Blanket Secured Promissory Note: This note covers multiple assets as collateral. It allows the borrower to pledge various types of personal property, such as furniture, appliances, or equipment, as security for the loan. Regardless of the specific type, a Syracuse New York Secured Promissory Note should include key provisions such as the loan amount, interest rate, repayment schedule, penalties for late or missed payments, events of default, and a description of the collateral involved. It is crucial for both parties involved in the loan agreement to carefully review and understand the terms before signing the note to ensure their rights and obligations are adequately protected. Seeking legal advice is also advised to ensure compliance with applicable laws and regulations in Syracuse, New York.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Syracuse New York Pagaré garantizado de Nueva York - New York Secured Promissory Note

Description

How to fill out Syracuse New York Pagaré Garantizado De Nueva York?

If you are searching for a valid form, it’s difficult to choose a more convenient place than the US Legal Forms website – one of the most comprehensive libraries on the web. With this library, you can get a large number of document samples for organization and personal purposes by categories and states, or keywords. With the high-quality search option, discovering the latest Syracuse New York Secured Promissory Note is as elementary as 1-2-3. Moreover, the relevance of each and every file is proved by a team of skilled lawyers that on a regular basis check the templates on our website and update them based on the newest state and county requirements.

If you already know about our platform and have an account, all you should do to get the Syracuse New York Secured Promissory Note is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have opened the form you require. Check its explanation and utilize the Preview feature (if available) to check its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to get the needed document.

- Affirm your choice. Choose the Buy now button. After that, pick the preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Use your bank card or PayPal account to complete the registration procedure.

- Get the template. Select the file format and download it to your system.

- Make adjustments. Fill out, edit, print, and sign the received Syracuse New York Secured Promissory Note.

Every single template you add to your user profile has no expiry date and is yours forever. You can easily access them using the My Forms menu, so if you want to have an extra copy for enhancing or creating a hard copy, feel free to come back and save it again at any moment.

Make use of the US Legal Forms professional catalogue to gain access to the Syracuse New York Secured Promissory Note you were seeking and a large number of other professional and state-specific samples on a single website!