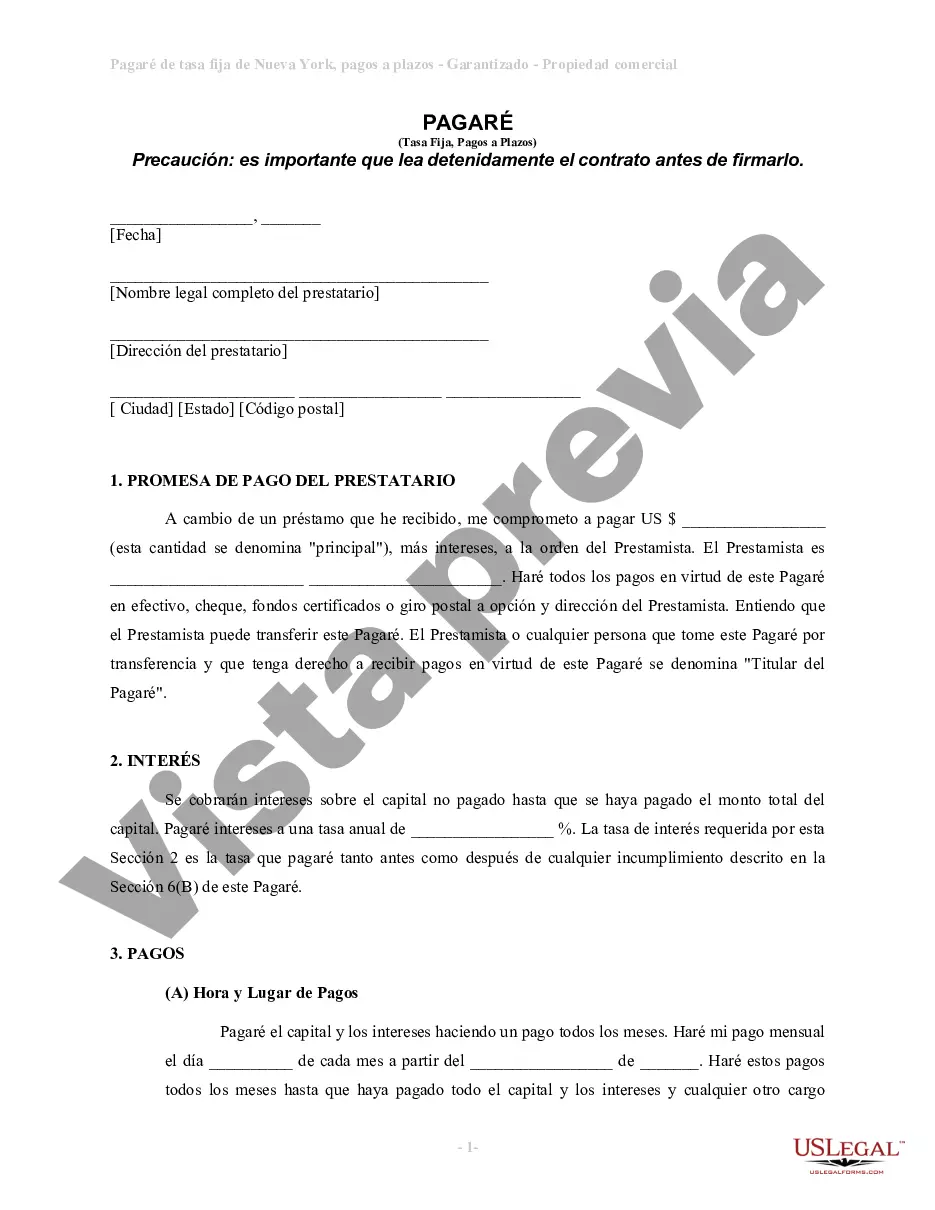

This is a Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Kings New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a financial instrument that provides borrowers with the opportunity to obtain financing for commercial real estate projects in New York. This type of promissory note offers stability and predictability through fixed interest rates and structured repayment terms. Secured by commercial real estate, these promissory notes give lenders a level of confidence in the repayment process. By using real estate as collateral, lenders gain a form of security that can be repossessed in case of default. This collateral acts as a safeguard, ensuring that lenders have an avenue to recoup their investment in the event of non-payment. Kings New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate comes in various types, each tailored to specific financing needs. These types may include: 1. Construction Loan: This promissory note is designed for borrowers who plan to construct a new commercial property or undertake substantial renovations on an existing one. The loan covers the expenses related to the construction process, such as labor, materials, and permits. 2. Acquisition Loan: Buyers looking to purchase commercial real estate can benefit from this type of promissory note. It provides the necessary funds to acquire the property, whether it's a retail space, office building, or industrial facility. 3. Refinance Loan: Borrowers who wish to replace an existing loan on a commercial property can opt for a refinancing promissory note. This type of loan assists in paying off the current debt, often with improved terms such as lower interest rates or extended repayment periods. 4. Bridge Loan: Kings New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate can also be in the form of a bridge loan. These short-term loans act as a temporary financing solution while the borrower arranges for more permanent financing or sells the property. 5. Rehabilitation Loan: Designed for property owners who aim to restore, repair, or update commercial real estate, this promissory note provides the necessary funds to carry out the rehabilitation project. It may cover expenses such as architectural design, construction, and building permits. It's essential to note that the terms and conditions of Kings New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate may vary depending on the lender, borrower's creditworthiness, loan amount, and property value. Prospective borrowers should carefully review all the terms and consult a financial advisor before entering into any financing agreements.Kings New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a financial instrument that provides borrowers with the opportunity to obtain financing for commercial real estate projects in New York. This type of promissory note offers stability and predictability through fixed interest rates and structured repayment terms. Secured by commercial real estate, these promissory notes give lenders a level of confidence in the repayment process. By using real estate as collateral, lenders gain a form of security that can be repossessed in case of default. This collateral acts as a safeguard, ensuring that lenders have an avenue to recoup their investment in the event of non-payment. Kings New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate comes in various types, each tailored to specific financing needs. These types may include: 1. Construction Loan: This promissory note is designed for borrowers who plan to construct a new commercial property or undertake substantial renovations on an existing one. The loan covers the expenses related to the construction process, such as labor, materials, and permits. 2. Acquisition Loan: Buyers looking to purchase commercial real estate can benefit from this type of promissory note. It provides the necessary funds to acquire the property, whether it's a retail space, office building, or industrial facility. 3. Refinance Loan: Borrowers who wish to replace an existing loan on a commercial property can opt for a refinancing promissory note. This type of loan assists in paying off the current debt, often with improved terms such as lower interest rates or extended repayment periods. 4. Bridge Loan: Kings New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate can also be in the form of a bridge loan. These short-term loans act as a temporary financing solution while the borrower arranges for more permanent financing or sells the property. 5. Rehabilitation Loan: Designed for property owners who aim to restore, repair, or update commercial real estate, this promissory note provides the necessary funds to carry out the rehabilitation project. It may cover expenses such as architectural design, construction, and building permits. It's essential to note that the terms and conditions of Kings New York Installments Fixed Rate Promissory Note Secured by Commercial Real Estate may vary depending on the lender, borrower's creditworthiness, loan amount, and property value. Prospective borrowers should carefully review all the terms and consult a financial advisor before entering into any financing agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.