The Rochester New York Federal Estate Tax Affidavit is an essential legal document used in the process of estate planning and probate in the Rochester area. It is required to determine the federal estate tax liability of a deceased individual's estate. The purpose of the Rochester New York Federal Estate Tax Affidavit is to calculate and report any potential federal estate tax owed by the estate to the Internal Revenue Service (IRS). This document provides a comprehensive account of all the assets, debts, and liabilities of the deceased person at the time of their death. By accurately completing the Rochester New York Federal Estate Tax Affidavit, executors and administrators of an estate can ensure compliance with federal tax laws and avoid any penalties associated with inaccurate reporting or underpayment of estate taxes. Some important details that need to be included in the Rochester New York Federal Estate Tax Affidavit are: 1. Personal Information: The document must include the legal name, social security number, and date of death of the deceased person. It may also require information about the executor or administrator handling the estate. 2. Asset Details: The affidavit must include a detailed list of all the assets owned by the deceased individual. This may include real estate properties, bank accounts, investment accounts, businesses, vehicles, valuable personal possessions, and life insurance policies. 3. Debts and Liabilities: It is essential to include any outstanding debts, mortgages, loans, or other financial obligations of the deceased. These liabilities may be deducted from the gross estate value to determine the taxable estate. 4. Valuation: The affidavit may require the valuation of each asset at the time of the individual's death. This valuation helps determine the fair market value of the estate and calculate the potential federal estate tax owed. 5. Tax Exemptions and Deductions: The affidavit must consider any applicable federal estate tax exemptions or deductions that may apply. These may include the marital deduction, charitable deductions, and the unified credit. It is important to note that there are no specific types of Rochester New York Federal Estate Tax Affidavits, as the requirements and regulations for estate taxes are standardized at the federal level. However, variations in estate tax affidavits may arise based on the complexity of the estate, the size of the assets, and the specific instructions provided by the IRS. To ensure accuracy and compliance with federal tax laws, it is highly recommended seeking the assistance of a qualified estate attorney or tax professional when completing the Rochester New York Federal Estate Tax Affidavit. They can provide expert guidance, ensure all relevant information is included, and navigate any complexities that may arise during the process.

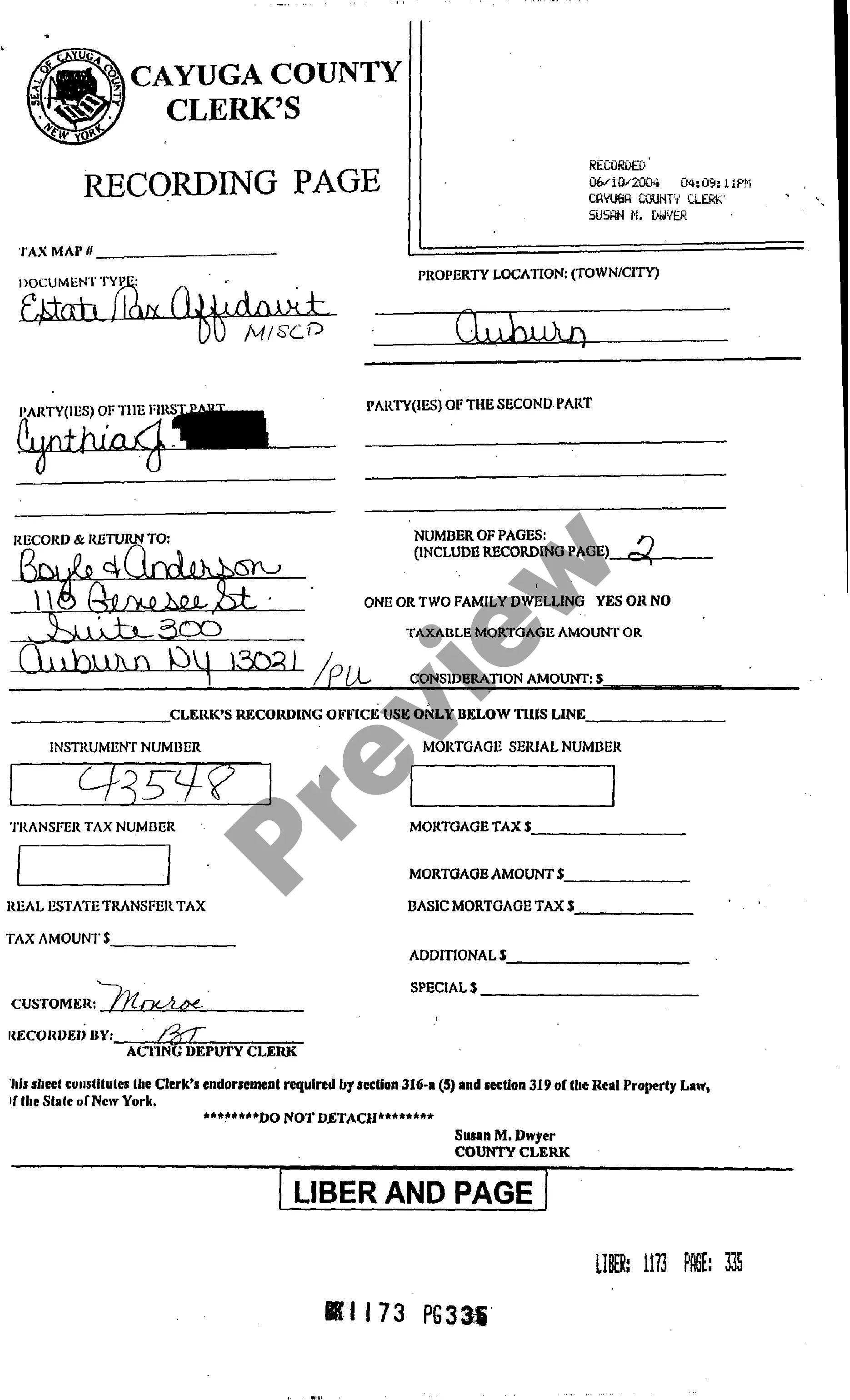

Rochester New York Federal Estate Tax Affidavit

Description

How to fill out Rochester New York Federal Estate Tax Affidavit?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone with no law education to draft this sort of papers from scratch, mainly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform provides a massive catalog with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI tpapers.

Whether you want the Rochester New York Federal Estate Tax Affidavit or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Rochester New York Federal Estate Tax Affidavit quickly employing our trusted platform. If you are presently an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are unfamiliar with our library, ensure that you follow these steps before obtaining the Rochester New York Federal Estate Tax Affidavit:

- Be sure the form you have chosen is good for your location since the regulations of one state or county do not work for another state or county.

- Review the form and go through a quick outline (if provided) of scenarios the document can be used for.

- If the one you selected doesn’t meet your requirements, you can start over and search for the necessary form.

- Click Buy now and choose the subscription option that suits you the best.

- with your credentials or create one from scratch.

- Select the payment method and proceed to download the Rochester New York Federal Estate Tax Affidavit once the payment is done.

You’re good to go! Now you can proceed to print the form or complete it online. If you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.