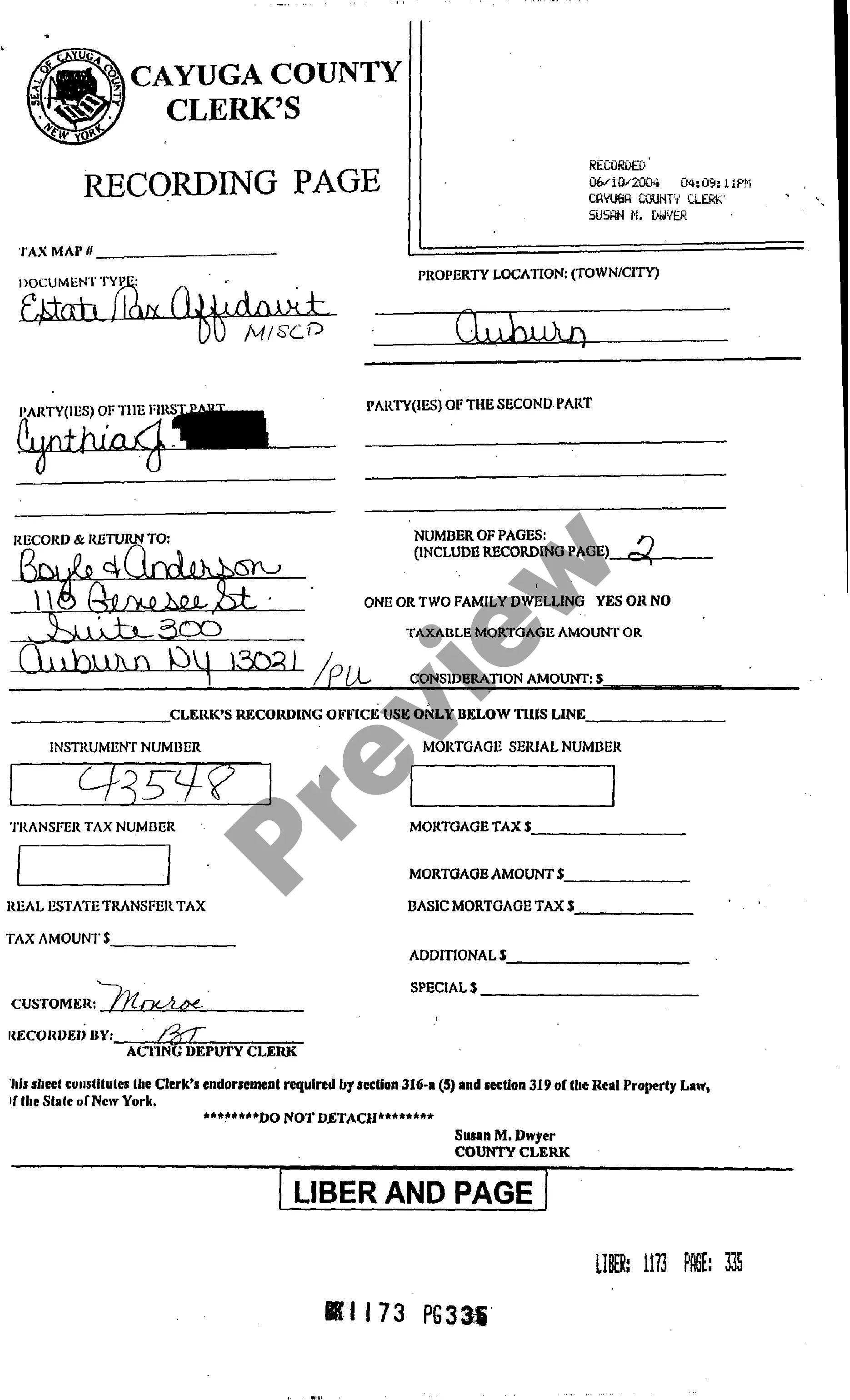

Syracuse New York Federal Estate Tax Affidavit

Description

How to fill out New York Federal Estate Tax Affidavit?

Obtaining validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It's an online repository of over 85,000 legal documents for both personal and business purposes, including various real-world situations.

All the forms are systematically organized by type of use and jurisdiction, making the search for the Syracuse New York Federal Estate Tax Affidavit as quick and simple as possible.

Maintaining documents organized and compliant with legal standards is crucial. Take advantage of the US Legal Forms library to always have necessary document templates readily available for any requirements!

- Verify the Preview mode and document description.

- Ensure you've selected the appropriate one that satisfies your needs and fully aligns with your local jurisdiction standards.

- Search for an alternate template if necessary.

- If you detect any discrepancies, use the Search tab above to locate the correct one. If it fits your needs, proceed to the next step.

- Complete the purchase of the document.

Form popularity

FAQ

To navigate around New York State estate taxes, conducting thorough estate planning is essential. Consider utilizing tools like trusts or gifting strategies to reduce the taxable value of your estate. Utilizing platforms like uslegalforms can assist you in properly preparing a Syracuse New York Federal Estate Tax Affidavit, ensuring you follow all necessary steps to minimize your tax burden.

New York does not impose an inheritance tax, so beneficiaries do not owe taxes on what they inherit. However, understanding how the estate is taxed via the Syracuse New York Federal Estate Tax Affidavit can help ensure that no unexpected fees arise. Proper estate planning, such as setting up trusts, may be beneficial to minimalize any potential tax impact.

In New York State, you must file an estate tax return if the deceased person's estate exceeds a certain threshold. Currently, this threshold is set at $6.58 million. If you're dealing with a Syracuse New York Federal Estate Tax Affidavit, it's crucial to ensure that you understand these limits to avoid unexpected tax liabilities.

Avoiding estate tax in New York can be achieved through strategic estate planning, like using life insurance policies outside the estate or establishing charitable trusts. Additionally, gifting assets and setting up family limited partnerships can be effective methods. To fully understand your options, consider reaching out for assistance regarding the Syracuse New York Federal Estate Tax Affidavit, which can provide the necessary framework for your estate strategy.

Filing a federal tax return for an estate typically involves completing IRS Form 706 if the estate exceeds the federal exemption amount. This form helps report the value of the decedent’s assets, debts, and all relevant deductions. It is crucial to ensure accuracy in this process to avoid complications. Utilizing resources related to the Syracuse New York Federal Estate Tax Affidavit can help clarify requirements and streamline your filing.

To avoid New York estate tax, consider strategies such as establishing an irrevocable trust or making lifetime gifts below the annual exclusion limit. You can also utilize deductions for debts and expenses from the estate before calculating tax. Engaging with a professional who specializes in the Syracuse New York Federal Estate Tax Affidavit can provide valuable guidance to ensure your estate plan is tax-efficient.

The 3 year clawback rule in New York refers to a provision that allows the state to reclaim certain gifts made within three years of a person’s death. This means that if you transfer assets to reduce your estate tax burden, the state may include those in your taxable estate if you pass away within three years. Understanding this rule is crucial for effective estate planning. It’s advisable to seek insight into the Syracuse New York Federal Estate Tax Affidavit to navigate this situation properly.

Legally avoiding estate tax often involves careful financial planning and the use of certain strategies. One common method is to make use of trusts, which can help in reducing the taxable estate. Additionally, gifting assets while you are alive can minimize your estate value. For more tailored strategies, consider consulting legal professionals experienced with the Syracuse New York Federal Estate Tax Affidavit.

To file your federal estate tax return, you must complete IRS Form 706 and submit it to the IRS service center designated for your state. Typically, this form can be mailed to the address specified in the IRS instructions. Utilizing services like USLegalForms can facilitate your understanding of the Syracuse New York Federal Estate Tax Affidavit and streamline your filing process.

Yes, if the estate exceeds the New York State estate tax threshold, you are required to file an estate tax return in New York. This is pertinent especially for estates valued above $6.58 million. Working with resources like USLegalForms can simplify the process of handling the Syracuse New York Federal Estate Tax Affidavit, ensuring compliance with state laws.