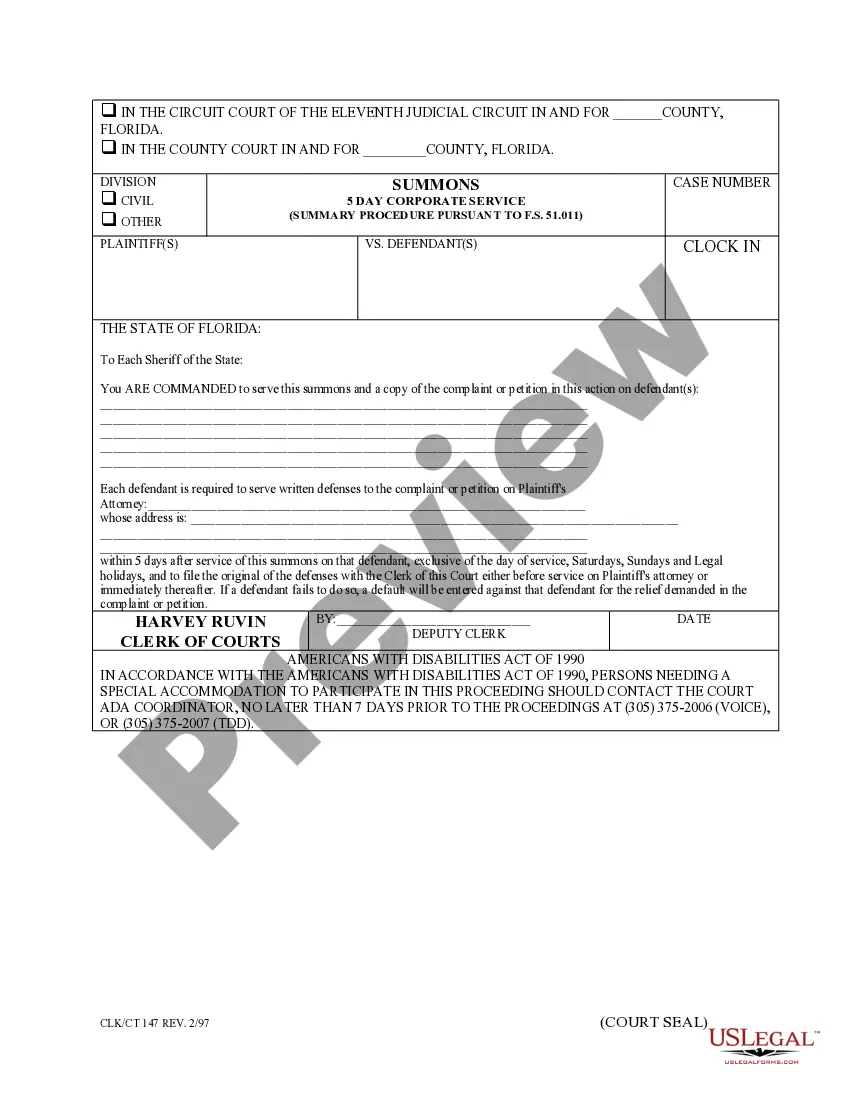

The Syracuse New York UCC1 Financing Statement is a legal document that provides public notice of a secured party's interest in personal property provided as collateral for a loan. It is filed under the Uniform Commercial Code (UCC) for the State of New York. UCC1 Financing Statements play a crucial role in securing loans and protecting lenders' rights in cases of default or bankruptcy. By filing this statement, lenders establish their priority in claiming assets, ensuring that they have a legal hold over the collateral provided by the debtor. In Syracuse, New York, like in other states, there are different types of UCC1 Financing Statements that serve specific purposes. Some notable variations include: 1. Initial Financing Statement: This is the primary UCC1 filing made by a lender to establish their interest in the debtor's personal property. It includes essential information like the names of the debtor and secured party, a description of the collateral, and any additional terms or agreements. 2. Amendment: An amendment to a UCC1 Financing Statement is filed in case of any changes to the original document, such as updates to the collateral description, debtor or secured party information, or any other modifications agreed upon by the parties involved. Amendments ensure accuracy and maintain the continuity of the financing statement. 3. Assignment: If a lender wishes to transfer its interest to another party, an assignment UCC1 Financing Statement is filed. This document effectively allows the security interest to be transferred to a new secured party. 4. Continuation: A continuation UCC1 Financing Statement is filed when the initial UCC1 statement expires, typically after five years, and the secured party wishes to extend its claim over the collateral. Filing a continuation statement ensures that the creditor's priority is maintained, preventing potential competition with other creditors. It is essential to file the UCC1 Financing Statement accurately and in a timely manner to protect the lender's interest. Any mistakes or omissions may jeopardize the lender's claim to the collateral, potentially leading to financial loss. In conclusion, the Syracuse New York UCC1 Financing Statement is a vital legal document utilized by creditors to establish and protect their security interest in personal property of a debtor. By filing various types of UCC1 Financing Statements, lenders can secure their position, modify existing agreements, and transfer their interest, ultimately safeguarding their investment.

Syracuse New York UCC1 Financing Statement

Description

How to fill out Syracuse New York UCC1 Financing Statement?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person with no legal background to create such paperwork cfrom the ground up, mostly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform provides a massive library with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you require the Syracuse New York UCC1 Financing Statement or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Syracuse New York UCC1 Financing Statement in minutes employing our reliable platform. If you are already an existing customer, you can go on and log in to your account to get the needed form.

Nevertheless, in case you are unfamiliar with our library, make sure to follow these steps before downloading the Syracuse New York UCC1 Financing Statement:

- Be sure the form you have found is good for your location since the regulations of one state or county do not work for another state or county.

- Review the form and read a quick outline (if provided) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your needs, you can start again and look for the necessary form.

- Click Buy now and choose the subscription plan you prefer the best.

- utilizing your credentials or register for one from scratch.

- Select the payment method and proceed to download the Syracuse New York UCC1 Financing Statement once the payment is done.

You’re good to go! Now you can go on and print the form or complete it online. Should you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.