A Nassau New York Legal Last Will and Testament Form for Single Person with Adult Children is a document that outlines a person's final wishes regarding the distribution of their assets and the care of their dependent children after their death. This legally binding document ensures that the individual's assets are transferred to their chosen beneficiaries according to their preferences and helps avoid potential conflicts or disputes among family members. The key elements included in this will form are as follows: 1. Identification and Personal Details: The form will require the person's full name, address, and contact information to establish their identity. 2. Executor Designation: The individual must name an executor who will handle the distribution of assets and fulfill the directions outlined in the will. This person should be trusted and willing to fulfill the responsibilities associated with this role. 3. Appointment of Guardians: If the single person has minor children, they will use the form to identify a guardian who will have the legal responsibility to care for and make decisions on behalf of their children after their demise. 4. Assets and Beneficiaries: The person will list their assets such as property, bank accounts, investments, and personal belongings. They will also designate specific individuals, their adult children in this case, as beneficiaries to receive these assets upon their passing. 5. Division of Assets: They will form can provide detailed instructions on how the assets should be divided among the adult children. This may include specific percentages or the allocation of specific items or properties. 6. Alternate Beneficiaries: In case any of the adult children predecease the individual, alternate beneficiaries may be named to ensure that the assets are appropriately distributed. 7. Residual Clause: A residual clause is included in the will to address any remaining assets that were not specifically allocated to beneficiaries. This clause ensures that any leftover assets are distributed according to the individual's stated wishes. It is important to note that there may be variations or additional considerations within this type of will form specific to individual circumstances, such as special bequests, trusts, or tax planning strategies. Consulting with an attorney who specializes in estate planning is advisable to ensure that the will accurately reflects the individual's wishes and adheres to New York state laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Formulario Legal de Última Voluntad y Testamento para Persona Soltera con Hijos Adultos - New York Last Will and Testament for Single Person with Adult Children

Category:

State:

New York

County:

Nassau

Control #:

NY-WIL-0001E

Format:

Word

Instant download

Description

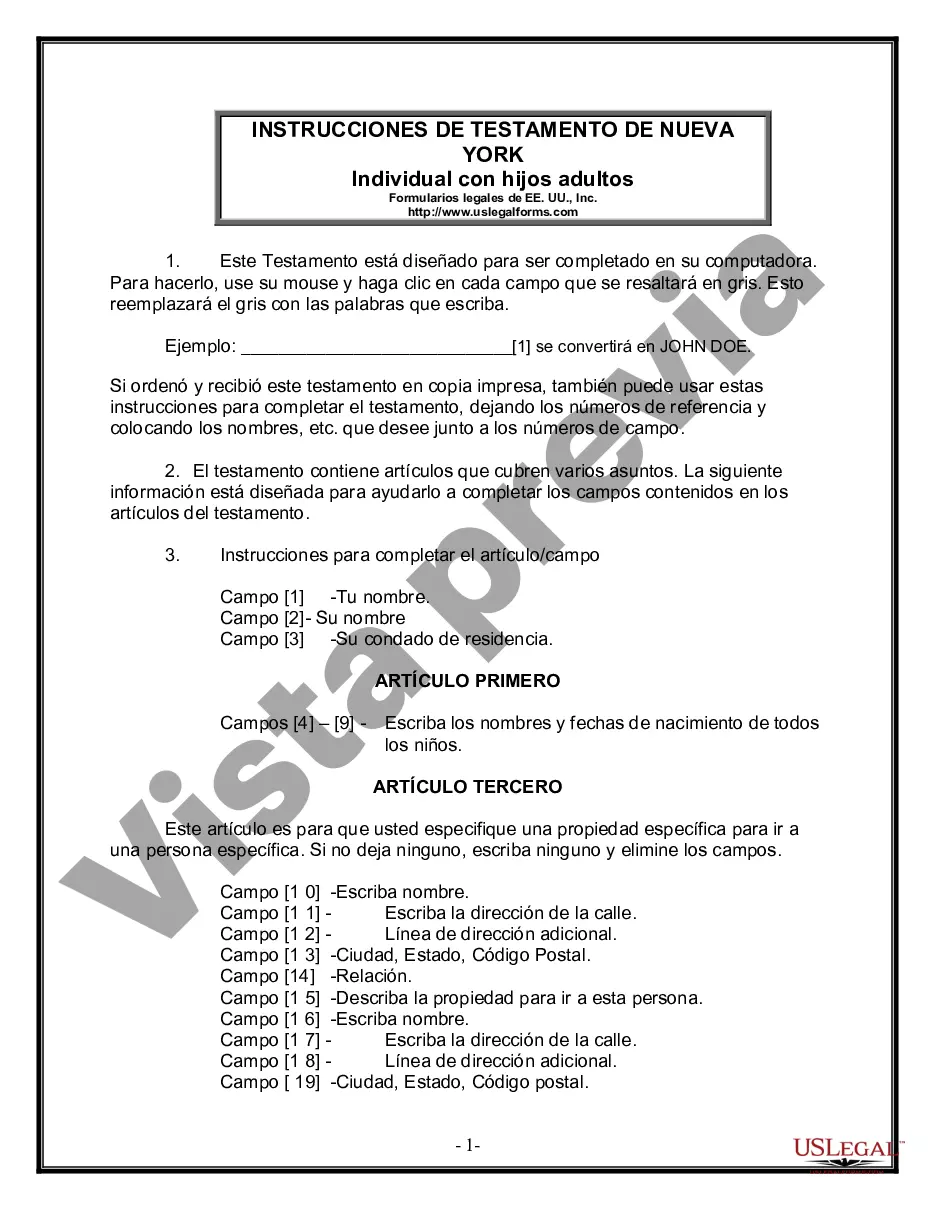

Descarga en línea en formato Word. Formulario de testamento redactado profesionalmente con instrucciones.

A Nassau New York Legal Last Will and Testament Form for Single Person with Adult Children is a document that outlines a person's final wishes regarding the distribution of their assets and the care of their dependent children after their death. This legally binding document ensures that the individual's assets are transferred to their chosen beneficiaries according to their preferences and helps avoid potential conflicts or disputes among family members. The key elements included in this will form are as follows: 1. Identification and Personal Details: The form will require the person's full name, address, and contact information to establish their identity. 2. Executor Designation: The individual must name an executor who will handle the distribution of assets and fulfill the directions outlined in the will. This person should be trusted and willing to fulfill the responsibilities associated with this role. 3. Appointment of Guardians: If the single person has minor children, they will use the form to identify a guardian who will have the legal responsibility to care for and make decisions on behalf of their children after their demise. 4. Assets and Beneficiaries: The person will list their assets such as property, bank accounts, investments, and personal belongings. They will also designate specific individuals, their adult children in this case, as beneficiaries to receive these assets upon their passing. 5. Division of Assets: They will form can provide detailed instructions on how the assets should be divided among the adult children. This may include specific percentages or the allocation of specific items or properties. 6. Alternate Beneficiaries: In case any of the adult children predecease the individual, alternate beneficiaries may be named to ensure that the assets are appropriately distributed. 7. Residual Clause: A residual clause is included in the will to address any remaining assets that were not specifically allocated to beneficiaries. This clause ensures that any leftover assets are distributed according to the individual's stated wishes. It is important to note that there may be variations or additional considerations within this type of will form specific to individual circumstances, such as special bequests, trusts, or tax planning strategies. Consulting with an attorney who specializes in estate planning is advisable to ensure that the will accurately reflects the individual's wishes and adheres to New York state laws.

Free preview

How to fill out Nassau New York Formulario Legal De Última Voluntad Y Testamento Para Persona Soltera Con Hijos Adultos?

If you’ve already utilized our service before, log in to your account and save the Nassau New York Legal Last Will and Testament Form for Single Person with Adult Children on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Nassau New York Legal Last Will and Testament Form for Single Person with Adult Children. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!