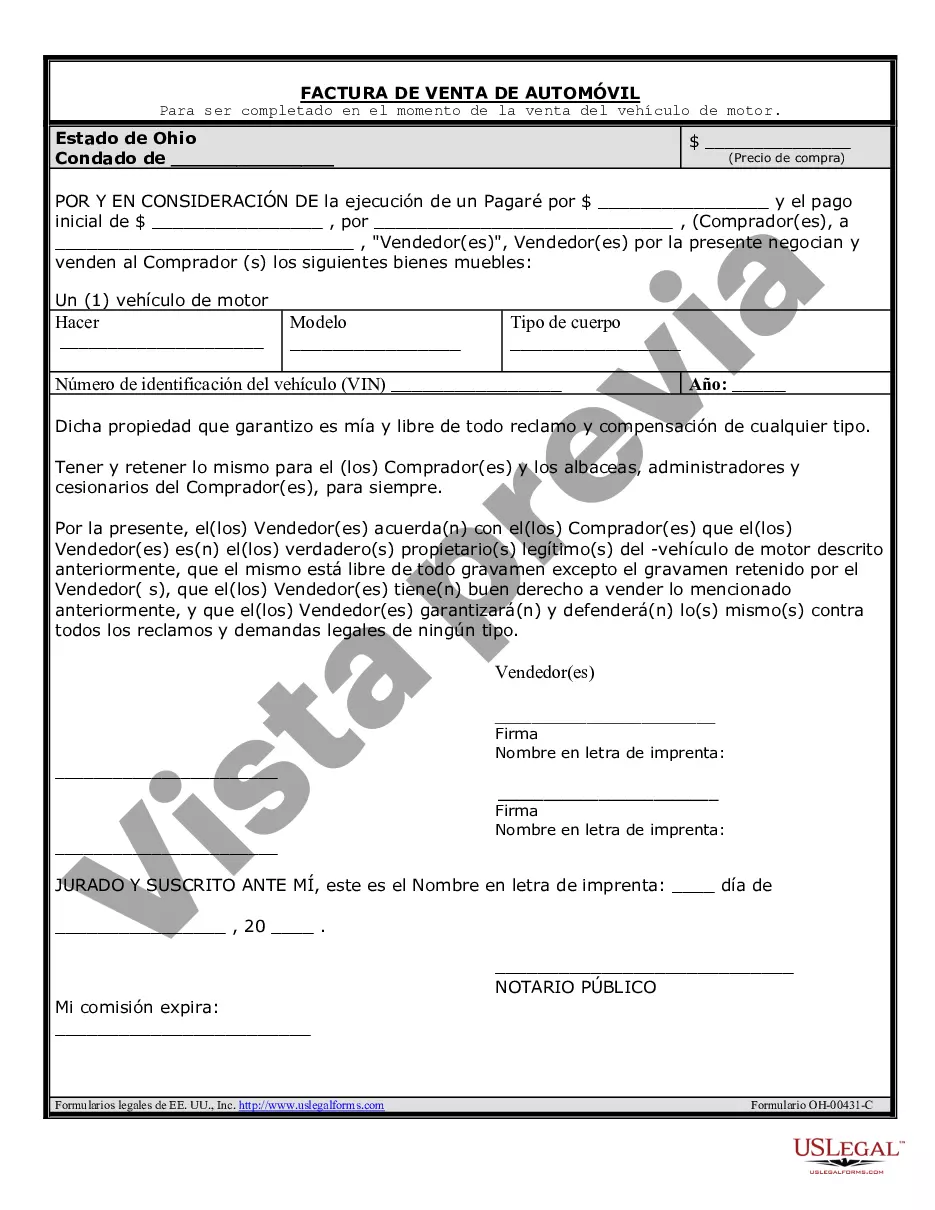

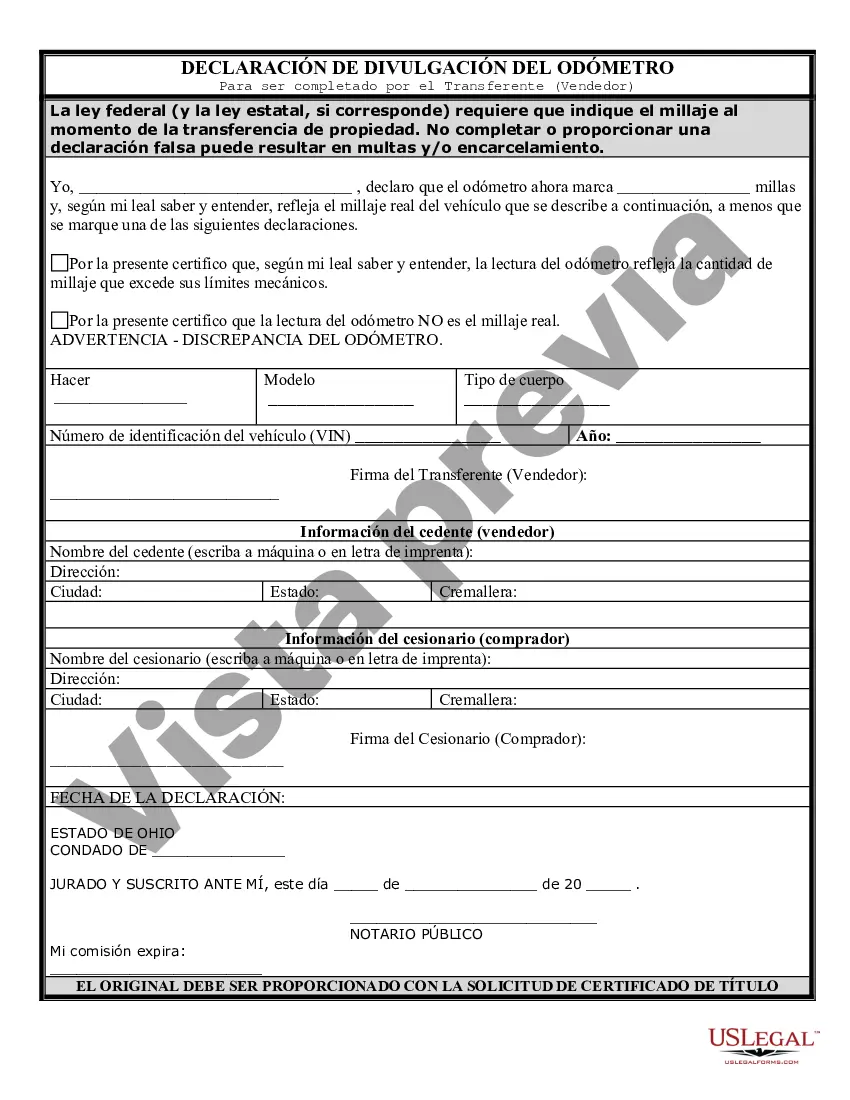

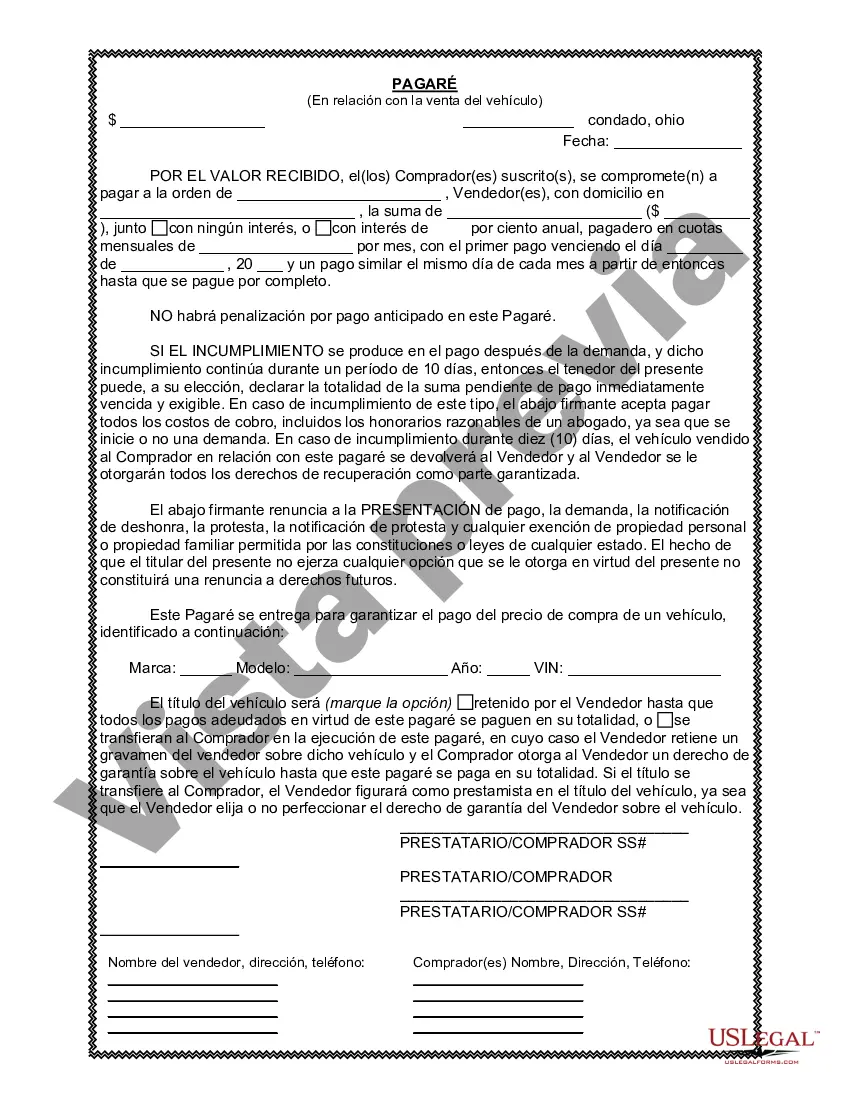

This forms package contains a Bill of Sale, Odometer Statement and Promissory Note. It is for the situation where the Buyer may be making a downpayment and paying the balance over time.

The Cuyahoga Ohio Bill of Sale for Automobile or Vehicle, including Odometer Statement and Promissory Note, is a legal document used to transfer ownership of a motor vehicle in Cuyahoga County, Ohio. This comprehensive bill of sale encompasses all the necessary details required for a smooth and lawful transaction. The Cuyahoga Ohio Bill of Sale for Automobile or Vehicle contains several key components. Firstly, it includes information about the seller and buyer, such as their full names, addresses, and contact details. This ensures that both parties can be easily identified throughout the process. Secondly, it includes a detailed description of the vehicle being sold, including its make, model, year, Vehicle Identification Number (VIN), and any other relevant details. One critical aspect of this bill of sale is the inclusion of an Odometer Statement. This statement records the vehicle's mileage at the time of sale and guarantees that the mileage reading is accurate to the best of the seller's knowledge. This is important for buyers to verify the condition of the vehicle and to prevent any potential fraud related to mileage tampering. Another noteworthy feature of the Cuyahoga Ohio Bill of Sale for Automobile or Vehicle is the inclusion of a Promissory Note. This document outlines any agreed-upon payment terms, such as the total purchase price, down payment, and installment plan if applicable. The Promissory Note protects both the buyer and seller by clearly defining the financial obligations and terms of the sale. It's important to note that different types of Cuyahoga Ohio Bills of Sale for Automobile or Vehicle may exist, depending on the specific circumstances or additional requirements. For example, a bill of sale may be specifically used for selling a used car, while another type may be used for selling a motorcycle or recreational vehicle (RV). However, regardless of the specific type, all Cuyahoga Ohio Bills of Sale for Automobile or Vehicle should include the necessary information mentioned above. Completing a proper and detailed bill of sale is crucial to ensure a secure vehicle transaction. It protects both the buyer and seller, assuring the legality of the sale and providing a clear record of ownership transfer. If you're selling or buying a vehicle in Cuyahoga County, Ohio, it is highly recommended consulting with a legal professional or utilize a reputable template to ensure you're utilizing the appropriate bill of sale for your specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.