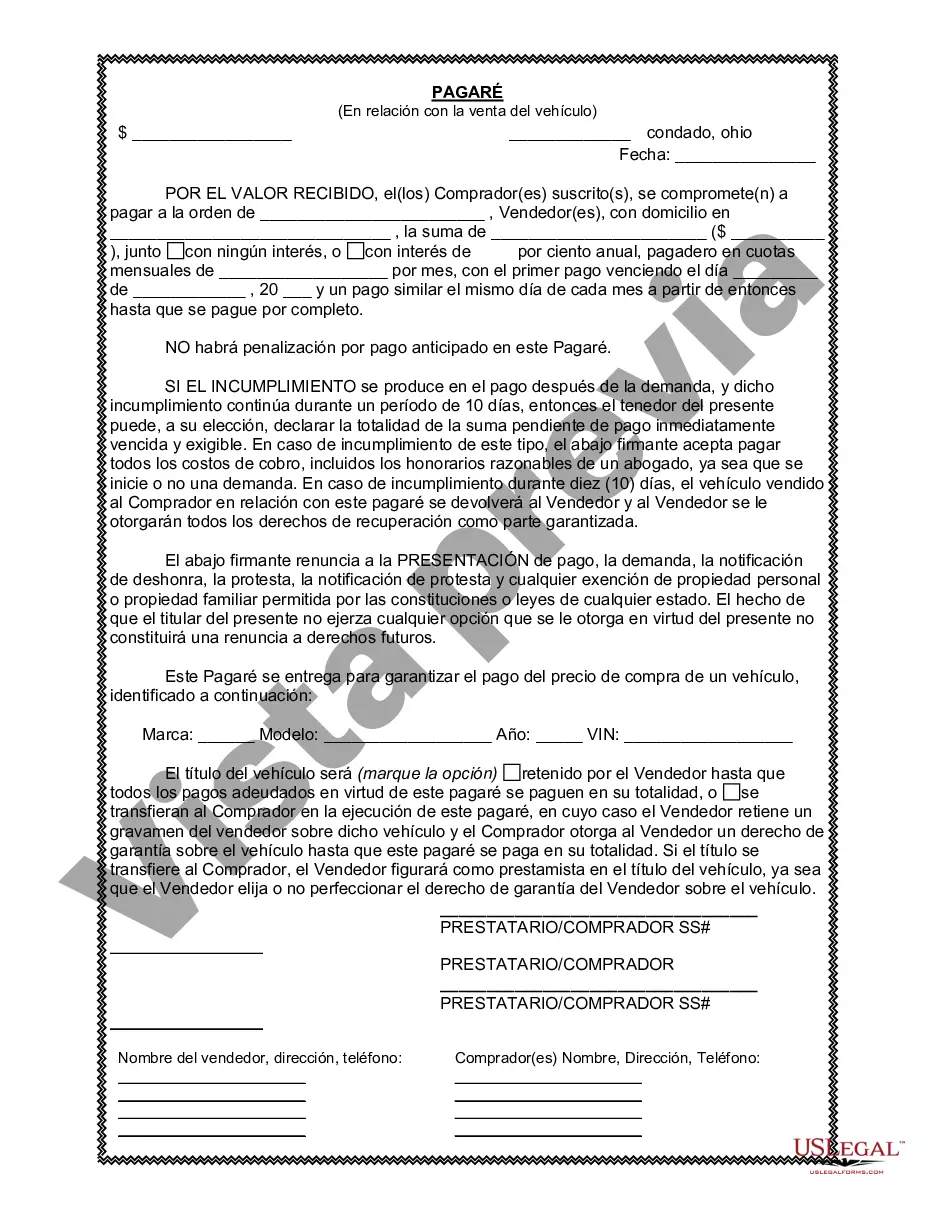

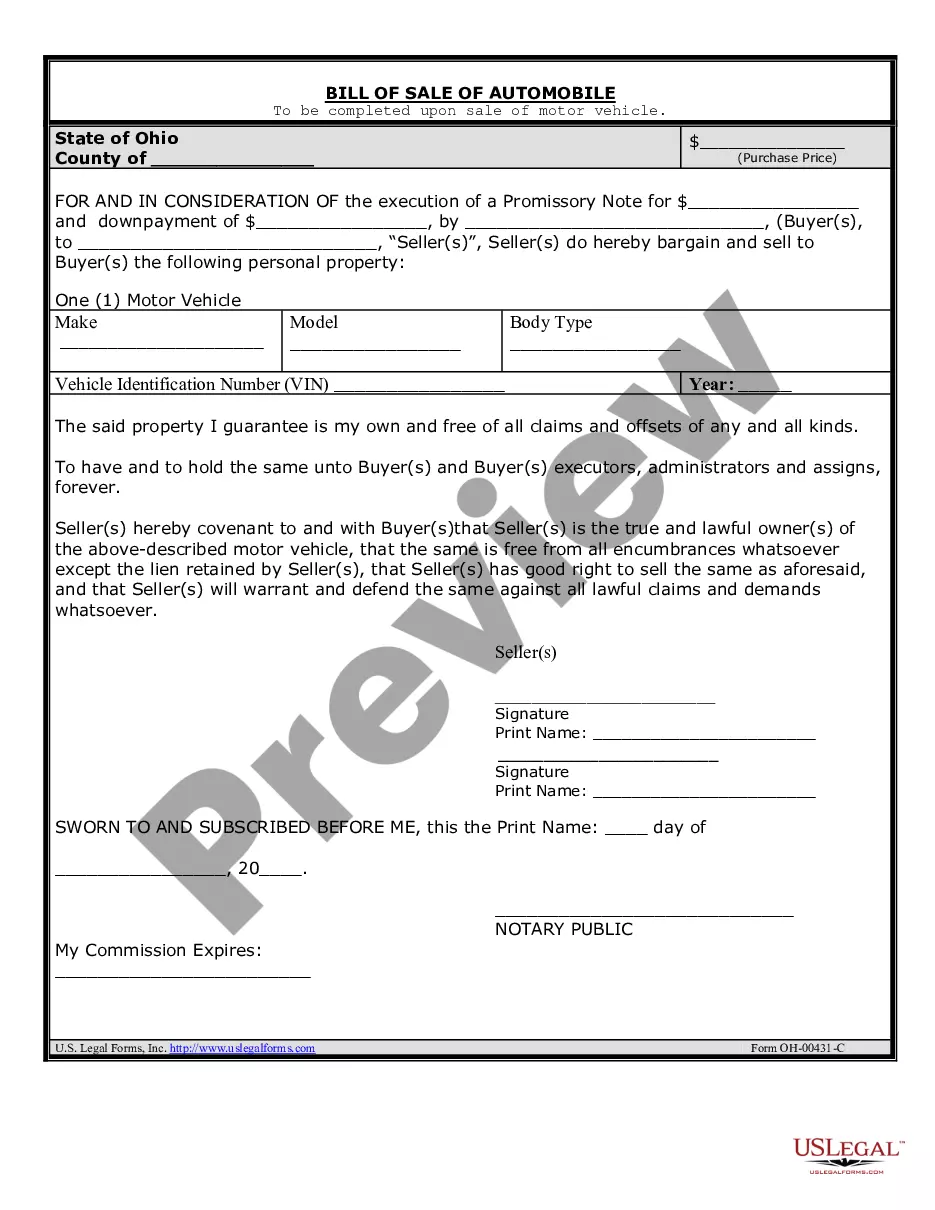

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

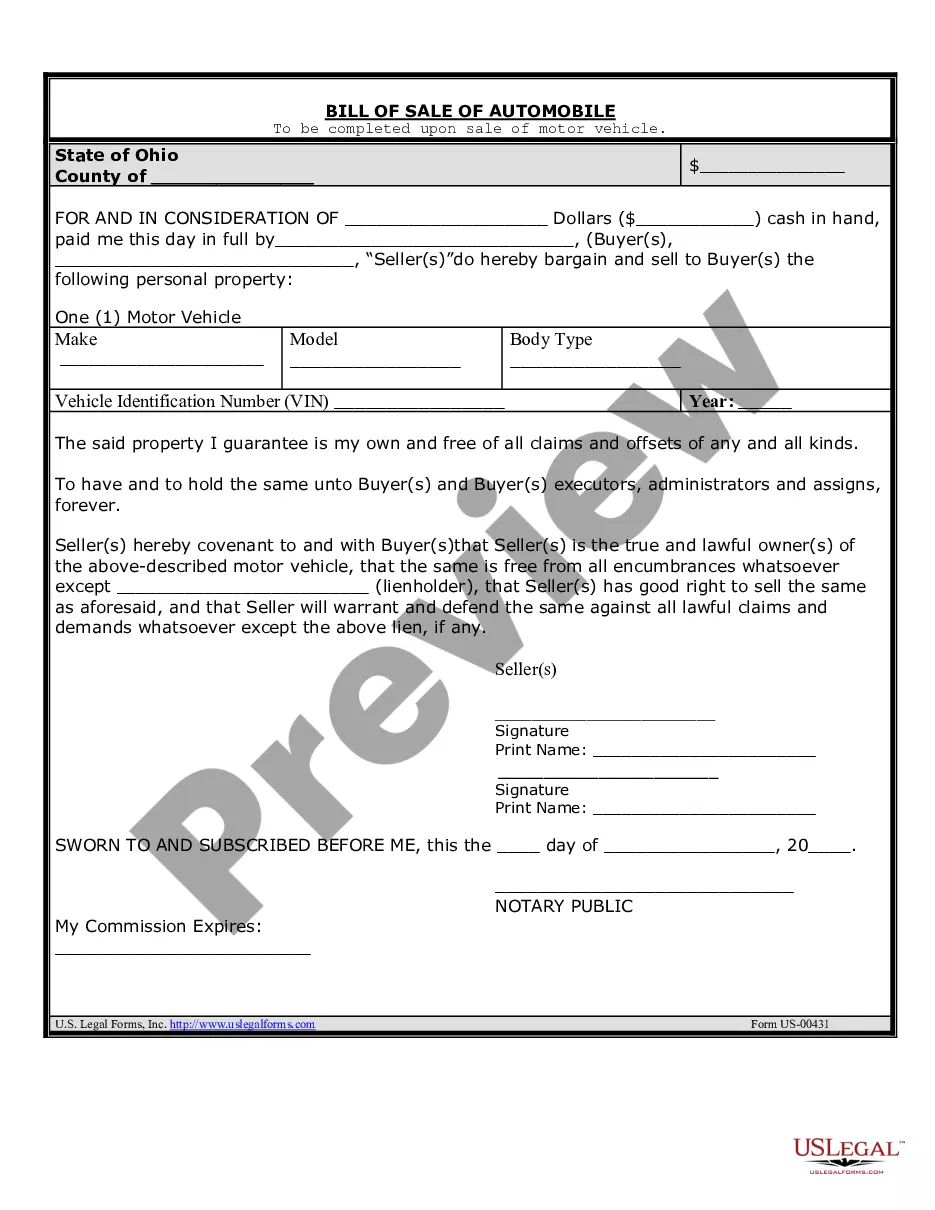

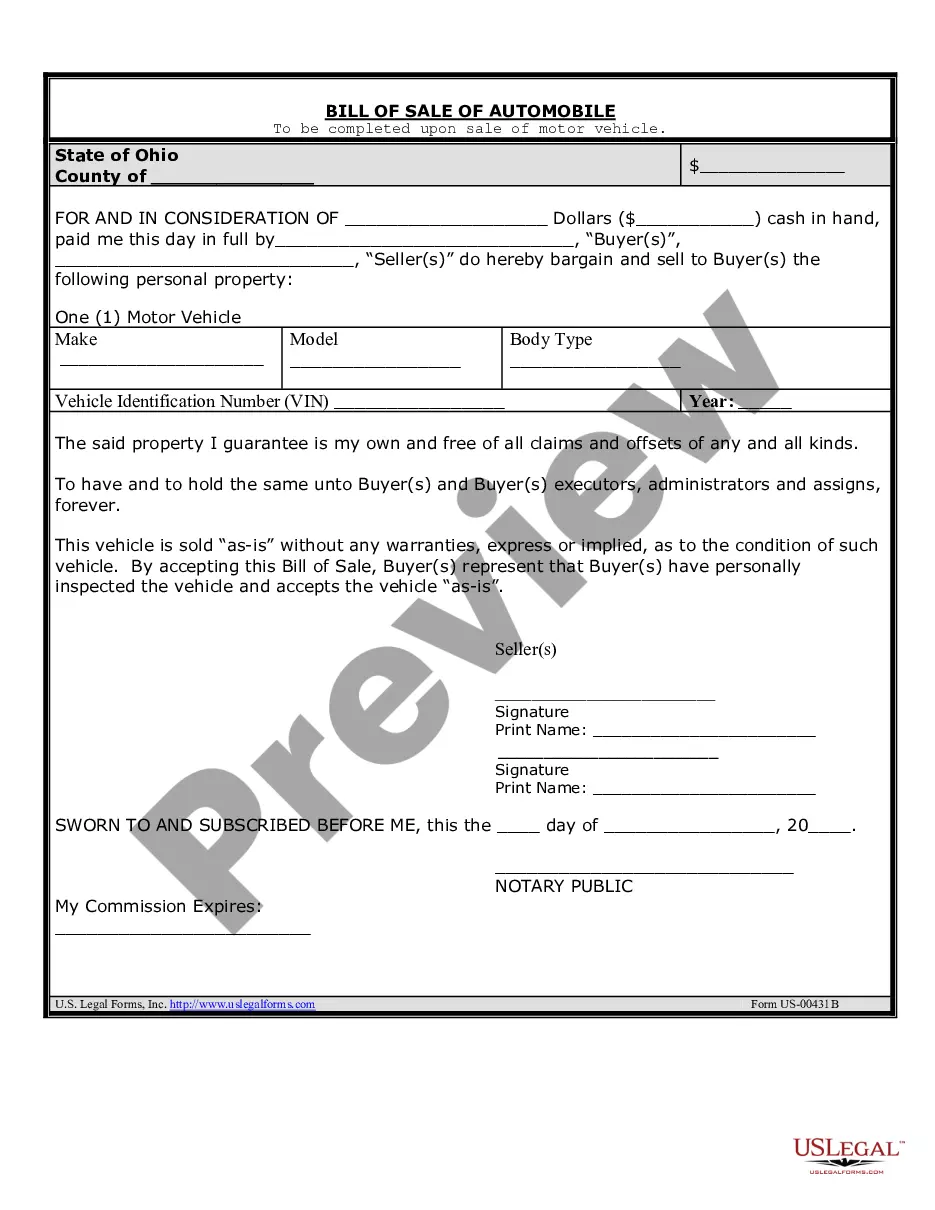

In Columbus, Ohio, a promissory note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and the seller. It essentially serves as an official acknowledgment of the debt owed by the buyer to the seller for the purchase of a vehicle, providing a sense of security for both parties involved. A Columbus Ohio promissory note typically contains relevant information such as the names and contact details of the buyer and seller, the date of the agreement, the description of the vehicle being sold, the agreed-upon purchase price, the terms of repayment, and any penalties or late fees that may be applicable. This legal document is significant in ensuring that all parties involved are aware of their responsibilities and obligations. It outlines the repayment plan that the buyer must adhere to, including the due dates and the frequency of payments. Furthermore, it may include important clauses regarding the consequences of default or non-payment. There may be different types of promissory notes in connection with the sale of a vehicle or automobile in Columbus, Ohio, depending on the specific circumstances and agreements made between the buyer and seller. Some of these variations may include: 1. Installment Promissory Note: This type of promissory note allows the buyer to make regular, scheduled payments over a specified period until the full purchase price and any applicable interest are repaid. 2. Balloon Promissory Note: Here, the buyer makes smaller periodic payments throughout the loan term, with a large final payment, often referred to as a "balloon payment," at the end of the term. 3. Secured Promissory Note: This type of promissory note includes provisions that allow the seller to retain a security interest in the vehicle being sold until the entire debt has been satisfied. If the buyer defaults on payments, the seller has the right to reclaim the vehicle. 4. Unsecured Promissory Note: Unlike the secured note, the unsecured promissory note doesn't involve any collateral or security interest. It relies entirely on the buyer's creditworthiness and trust when lending the funds. 5. Acceleration Promissory Note: This note allows the seller to demand immediate payment of the full remaining balance if the buyer fails to meet the agreed payment terms or defaults on the contract. It is essential for both the buyer and seller to carefully review and understand the terms and conditions outlined in the Columbus Ohio promissory note in connection with the sale of a vehicle or automobile. It is advisable to consult with a legal professional to ensure compliance with local laws and regulations, as well as to protect the rights and interests of both parties involved in the transaction.In Columbus, Ohio, a promissory note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and the seller. It essentially serves as an official acknowledgment of the debt owed by the buyer to the seller for the purchase of a vehicle, providing a sense of security for both parties involved. A Columbus Ohio promissory note typically contains relevant information such as the names and contact details of the buyer and seller, the date of the agreement, the description of the vehicle being sold, the agreed-upon purchase price, the terms of repayment, and any penalties or late fees that may be applicable. This legal document is significant in ensuring that all parties involved are aware of their responsibilities and obligations. It outlines the repayment plan that the buyer must adhere to, including the due dates and the frequency of payments. Furthermore, it may include important clauses regarding the consequences of default or non-payment. There may be different types of promissory notes in connection with the sale of a vehicle or automobile in Columbus, Ohio, depending on the specific circumstances and agreements made between the buyer and seller. Some of these variations may include: 1. Installment Promissory Note: This type of promissory note allows the buyer to make regular, scheduled payments over a specified period until the full purchase price and any applicable interest are repaid. 2. Balloon Promissory Note: Here, the buyer makes smaller periodic payments throughout the loan term, with a large final payment, often referred to as a "balloon payment," at the end of the term. 3. Secured Promissory Note: This type of promissory note includes provisions that allow the seller to retain a security interest in the vehicle being sold until the entire debt has been satisfied. If the buyer defaults on payments, the seller has the right to reclaim the vehicle. 4. Unsecured Promissory Note: Unlike the secured note, the unsecured promissory note doesn't involve any collateral or security interest. It relies entirely on the buyer's creditworthiness and trust when lending the funds. 5. Acceleration Promissory Note: This note allows the seller to demand immediate payment of the full remaining balance if the buyer fails to meet the agreed payment terms or defaults on the contract. It is essential for both the buyer and seller to carefully review and understand the terms and conditions outlined in the Columbus Ohio promissory note in connection with the sale of a vehicle or automobile. It is advisable to consult with a legal professional to ensure compliance with local laws and regulations, as well as to protect the rights and interests of both parties involved in the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.