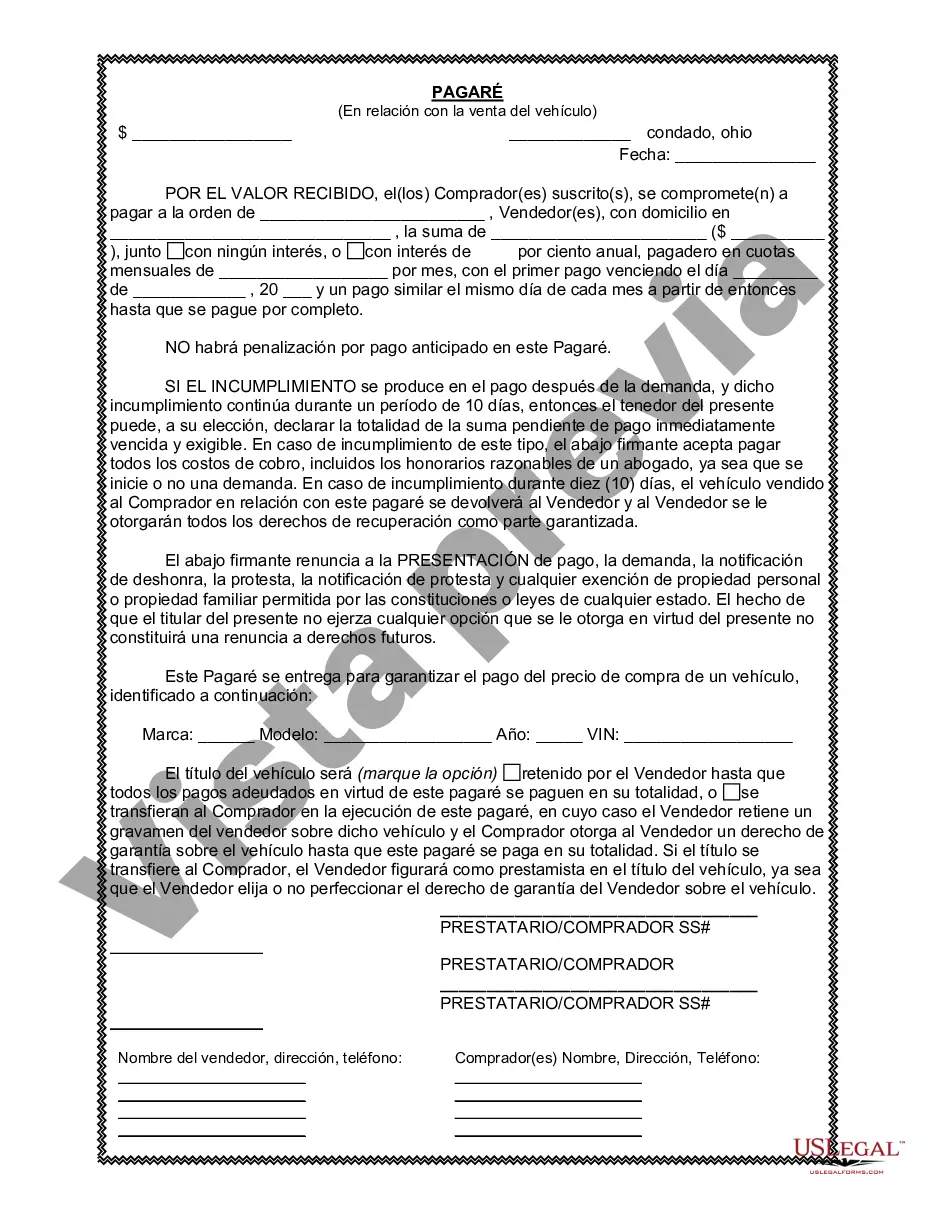

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

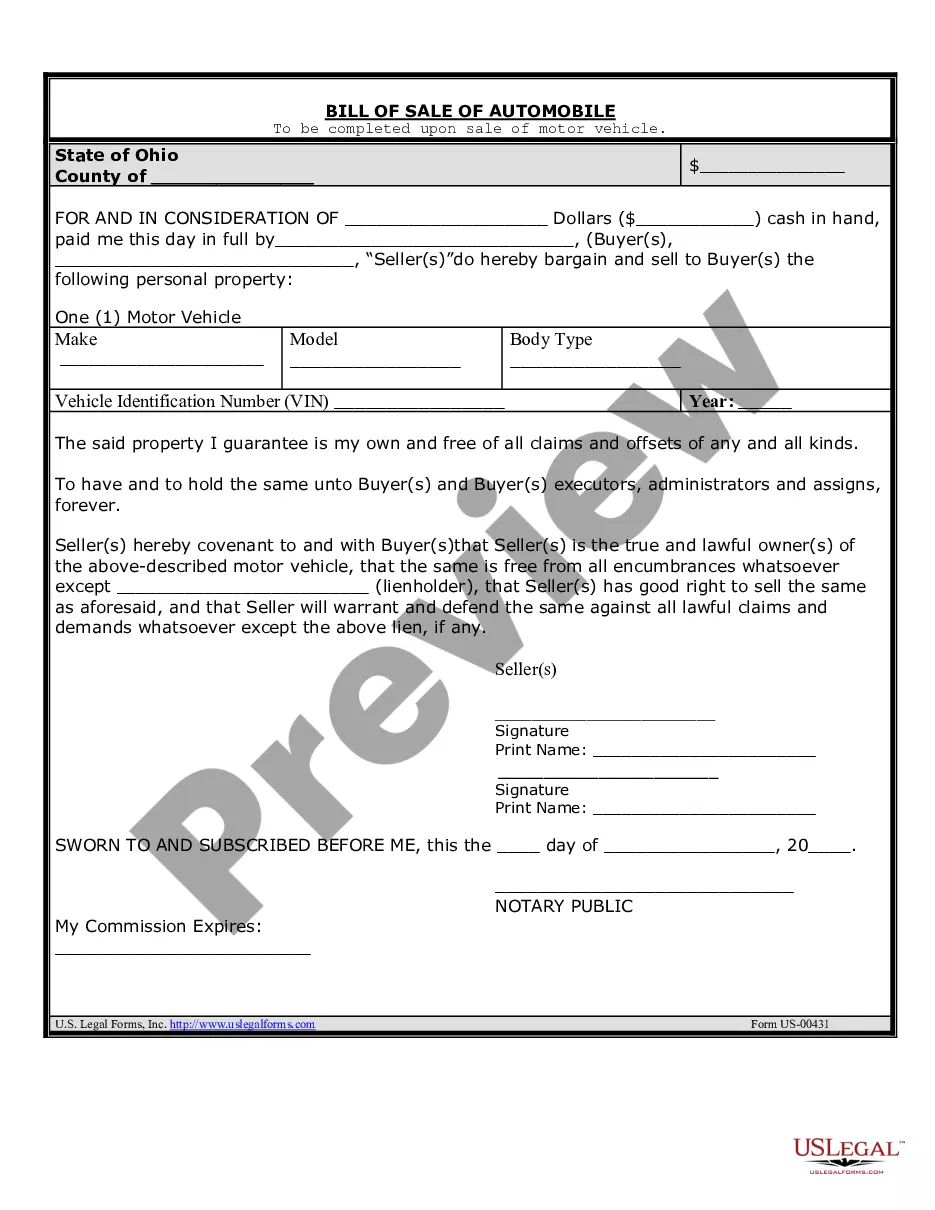

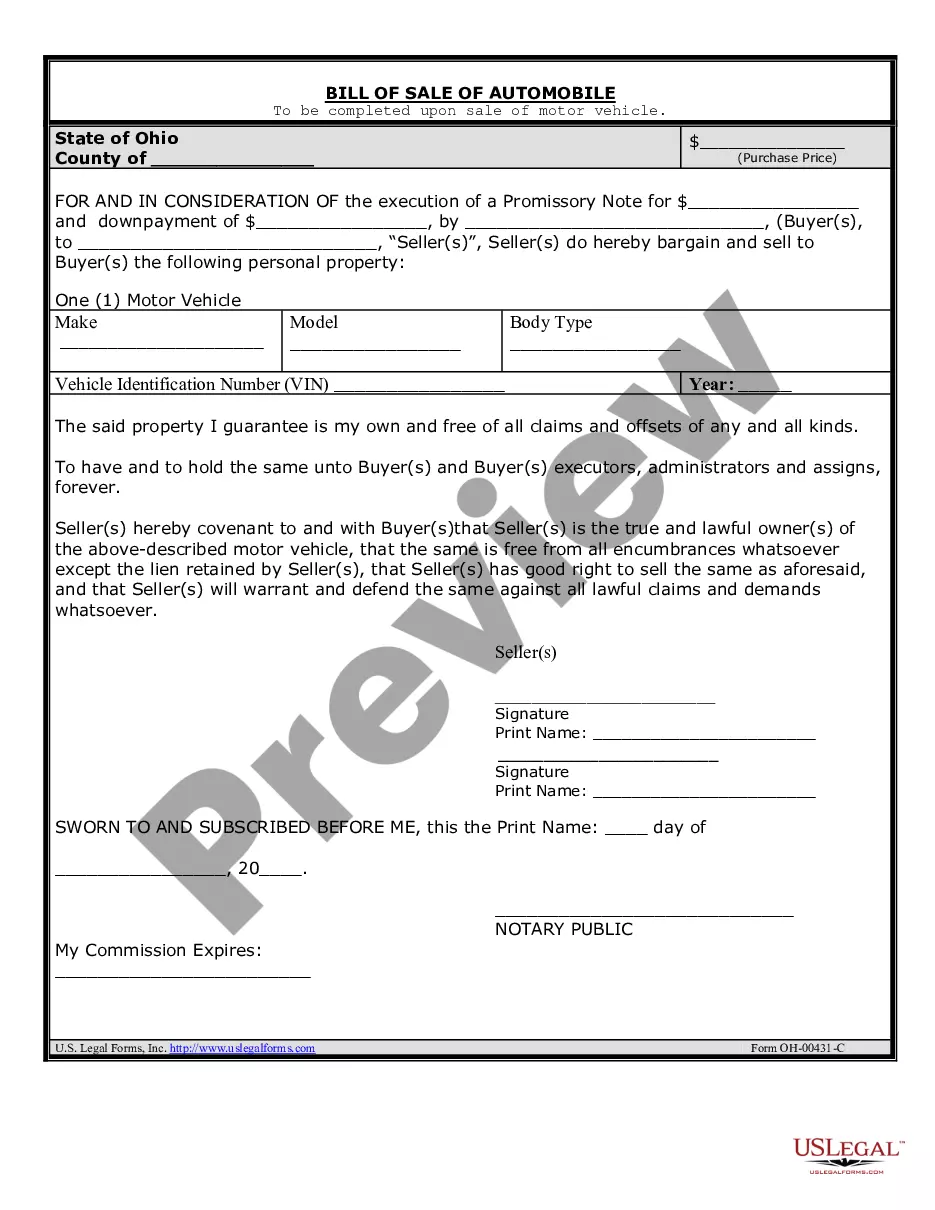

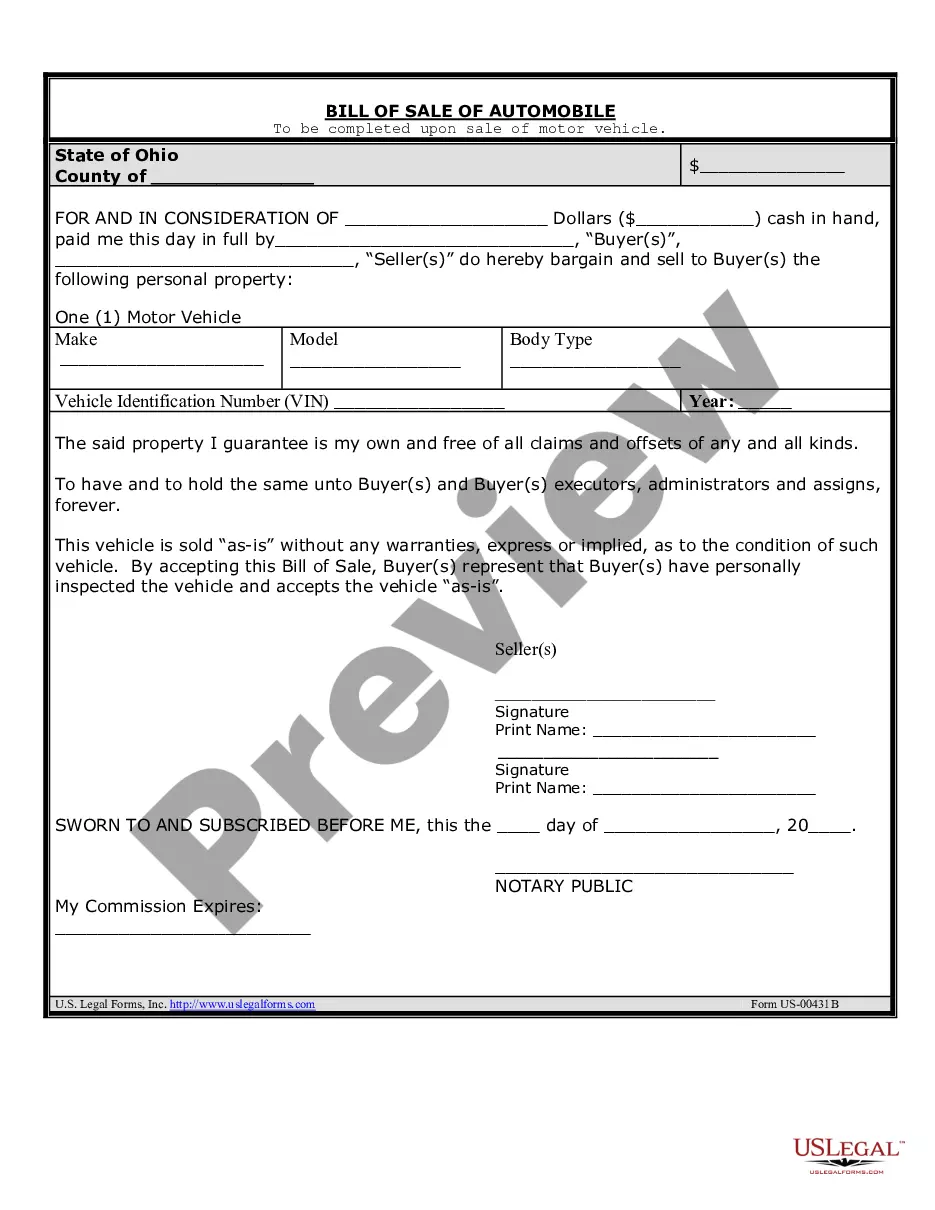

In Cuyahoga County, Ohio, a promissory note is often used in connection with the sale of a vehicle or automobile to ensure a legally binding agreement between the buyer and seller. This document outlines the specific terms and conditions of the sale, including the purchase price, payment schedule, and any applicable interest rates. It serves as evidence of the debt owed by the buyer to the seller. The Cuyahoga Ohio Promissory Note in Connection with Sale of Vehicle or Automobile is designed to protect the interests of both parties involved in the transaction. By detailing the agreement in writing, it helps prevent misunderstandings and provides legal recourse in case of non-payment or breach of contract. Some key components typically included in the Cuyahoga Ohio Promissory Note in Connection with Sale of Vehicle or Automobile are: 1. Identification of the Parties: The promissory note should clearly identify both the buyer and the seller, including their legal names, addresses, and contact details. 2. Vehicle Description: Detailed information about the vehicle being sold should be included, such as make, model, year, vehicle identification number (VIN), and odometer reading. 3. Purchase Price: The agreed-upon purchase price of the vehicle should be clearly stated in the promissory note. It is essential to include the currency in which the payment will be made (e.g., US dollars) and whether any sales tax or additional fees are included or excluded. 4. Payment Terms: The payment terms describe how the purchase price will be paid, including the amount of the down payment (if any) and the remaining balance. It should specify the due dates of the installments, frequency of payments (monthly, bi-monthly, etc.), and the preferred method of payment (e.g., cash, check, electronic transfer). 5. Interest and Late Fees: If applicable, the promissory note may stipulate the interest rate charged on any outstanding balances and outline any penalties or late fees for delayed or missed payments. It is important to comply with state usury laws that govern the maximum allowable interest rate. 6. Security Interest: In some cases, the seller may retain a security interest in the vehicle until the debt is fully paid. This section of the promissory note should outline any specific conditions or consequences associated with this arrangement. 7. Acceleration Clause: The promissory note may include an acceleration clause, which gives the seller the right to demand full payment of the remaining balance if the buyer defaults on the agreed-upon payment terms. It is essential to consult with an attorney or legal professional familiar with Ohio state laws to ensure the Cuyahoga Ohio Promissory Note in Connection with Sale of Vehicle or Automobile complies with all relevant regulations. This will help protect both the buyer and seller throughout the vehicle purchase process, encompassing various types of promissory notes commonly used in these transactions. Individual names for these note types may vary, but they often include variations like Installment Sale Agreement, Vehicle Financing Agreement, or Auto Loan Agreement.In Cuyahoga County, Ohio, a promissory note is often used in connection with the sale of a vehicle or automobile to ensure a legally binding agreement between the buyer and seller. This document outlines the specific terms and conditions of the sale, including the purchase price, payment schedule, and any applicable interest rates. It serves as evidence of the debt owed by the buyer to the seller. The Cuyahoga Ohio Promissory Note in Connection with Sale of Vehicle or Automobile is designed to protect the interests of both parties involved in the transaction. By detailing the agreement in writing, it helps prevent misunderstandings and provides legal recourse in case of non-payment or breach of contract. Some key components typically included in the Cuyahoga Ohio Promissory Note in Connection with Sale of Vehicle or Automobile are: 1. Identification of the Parties: The promissory note should clearly identify both the buyer and the seller, including their legal names, addresses, and contact details. 2. Vehicle Description: Detailed information about the vehicle being sold should be included, such as make, model, year, vehicle identification number (VIN), and odometer reading. 3. Purchase Price: The agreed-upon purchase price of the vehicle should be clearly stated in the promissory note. It is essential to include the currency in which the payment will be made (e.g., US dollars) and whether any sales tax or additional fees are included or excluded. 4. Payment Terms: The payment terms describe how the purchase price will be paid, including the amount of the down payment (if any) and the remaining balance. It should specify the due dates of the installments, frequency of payments (monthly, bi-monthly, etc.), and the preferred method of payment (e.g., cash, check, electronic transfer). 5. Interest and Late Fees: If applicable, the promissory note may stipulate the interest rate charged on any outstanding balances and outline any penalties or late fees for delayed or missed payments. It is important to comply with state usury laws that govern the maximum allowable interest rate. 6. Security Interest: In some cases, the seller may retain a security interest in the vehicle until the debt is fully paid. This section of the promissory note should outline any specific conditions or consequences associated with this arrangement. 7. Acceleration Clause: The promissory note may include an acceleration clause, which gives the seller the right to demand full payment of the remaining balance if the buyer defaults on the agreed-upon payment terms. It is essential to consult with an attorney or legal professional familiar with Ohio state laws to ensure the Cuyahoga Ohio Promissory Note in Connection with Sale of Vehicle or Automobile complies with all relevant regulations. This will help protect both the buyer and seller throughout the vehicle purchase process, encompassing various types of promissory notes commonly used in these transactions. Individual names for these note types may vary, but they often include variations like Installment Sale Agreement, Vehicle Financing Agreement, or Auto Loan Agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.