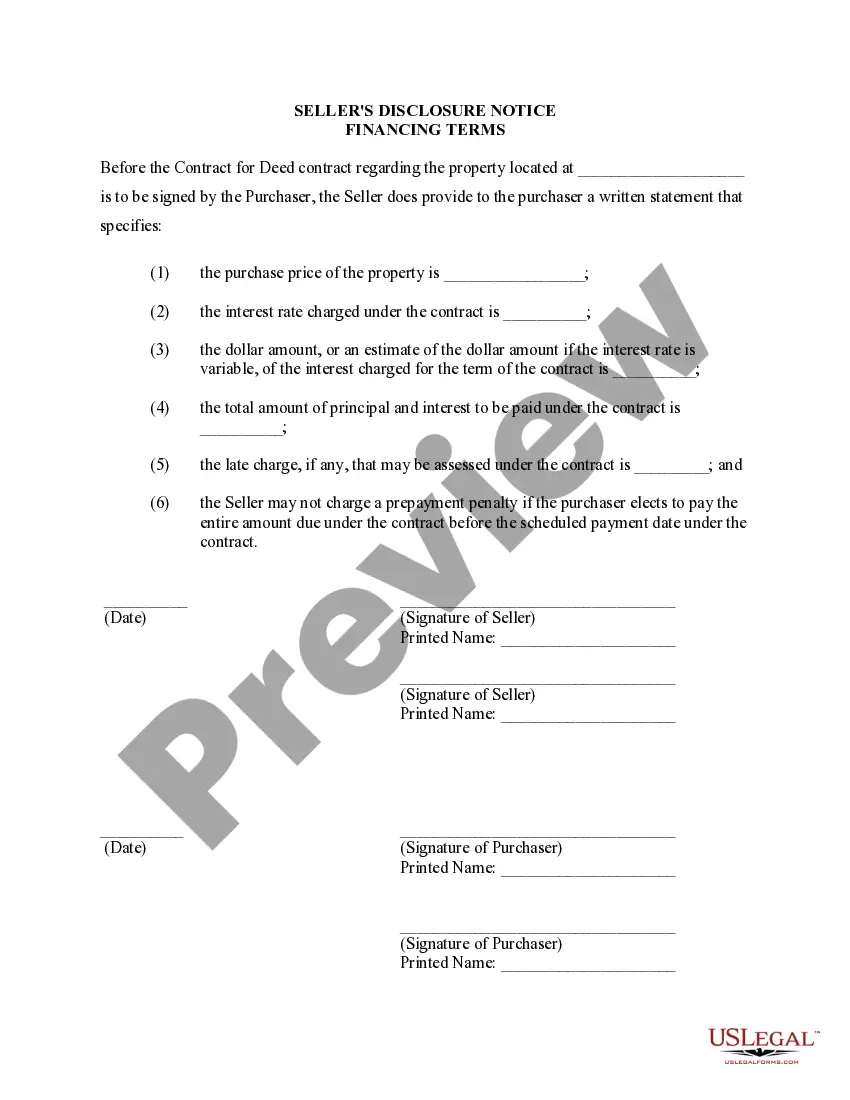

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Dayton Ohio Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is a crucial legal document that outlines the specific terms and conditions regarding the financing arrangements in the property transaction. This disclosure ensures transparency and protects both the buyer and seller involved in the land contract. Several types or variations of Seller's Disclosure of Financing Terms may exist in Dayton, Ohio, each tailored to address different aspects of the land contract. These include: 1. Basic Financing Terms: This Seller's Disclosure document provides a comprehensive overview of the primary financing terms associated with the residential property. It includes information such as the purchase price, down payment amount, interest rate, payment schedule, and any balloon payment details. 2. Tax and Insurance Obligations: This variant of the disclosure focuses on the buyer's responsibilities regarding property taxes and insurance. It outlines whether the buyer or the seller will be responsible for these payments during the financing period. 3. Maintenance and Repair Obligations: This specific type of Seller's Disclosure enumerates who is responsible for maintenance and repair costs during the land contract period. It clarifies whether the buyer or the seller assumes these obligations. 4. Default and Remedies: This disclosure variant delves into the consequences and remedies in the event of a default by either party. It outlines the penalties, fees, and potential remedies available to the non-defaulting party. 5. Disclosure of Liens and Encumbrances: This type of Seller's Disclosure provides information about any existing liens, encumbrances, or legal claims on the property. It ensures that the buyer is aware of any potential issues regarding the property's title. 6. Prepayment and Early Termination Terms: This variant of the disclosure outlines the conditions under which the land contract can be terminated early or prepaid. It includes information on any penalties or fees associated with such actions. The Dayton Ohio Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed a/k/a Land Contract is essential for both buyers and sellers to have a clear understanding of the financial obligations and terms involved in the transaction. It serves as a safeguard against any potential misunderstandings or disputes that may arise during the financing period.The Dayton Ohio Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is a crucial legal document that outlines the specific terms and conditions regarding the financing arrangements in the property transaction. This disclosure ensures transparency and protects both the buyer and seller involved in the land contract. Several types or variations of Seller's Disclosure of Financing Terms may exist in Dayton, Ohio, each tailored to address different aspects of the land contract. These include: 1. Basic Financing Terms: This Seller's Disclosure document provides a comprehensive overview of the primary financing terms associated with the residential property. It includes information such as the purchase price, down payment amount, interest rate, payment schedule, and any balloon payment details. 2. Tax and Insurance Obligations: This variant of the disclosure focuses on the buyer's responsibilities regarding property taxes and insurance. It outlines whether the buyer or the seller will be responsible for these payments during the financing period. 3. Maintenance and Repair Obligations: This specific type of Seller's Disclosure enumerates who is responsible for maintenance and repair costs during the land contract period. It clarifies whether the buyer or the seller assumes these obligations. 4. Default and Remedies: This disclosure variant delves into the consequences and remedies in the event of a default by either party. It outlines the penalties, fees, and potential remedies available to the non-defaulting party. 5. Disclosure of Liens and Encumbrances: This type of Seller's Disclosure provides information about any existing liens, encumbrances, or legal claims on the property. It ensures that the buyer is aware of any potential issues regarding the property's title. 6. Prepayment and Early Termination Terms: This variant of the disclosure outlines the conditions under which the land contract can be terminated early or prepaid. It includes information on any penalties or fees associated with such actions. The Dayton Ohio Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed a/k/a Land Contract is essential for both buyers and sellers to have a clear understanding of the financial obligations and terms involved in the transaction. It serves as a safeguard against any potential misunderstandings or disputes that may arise during the financing period.