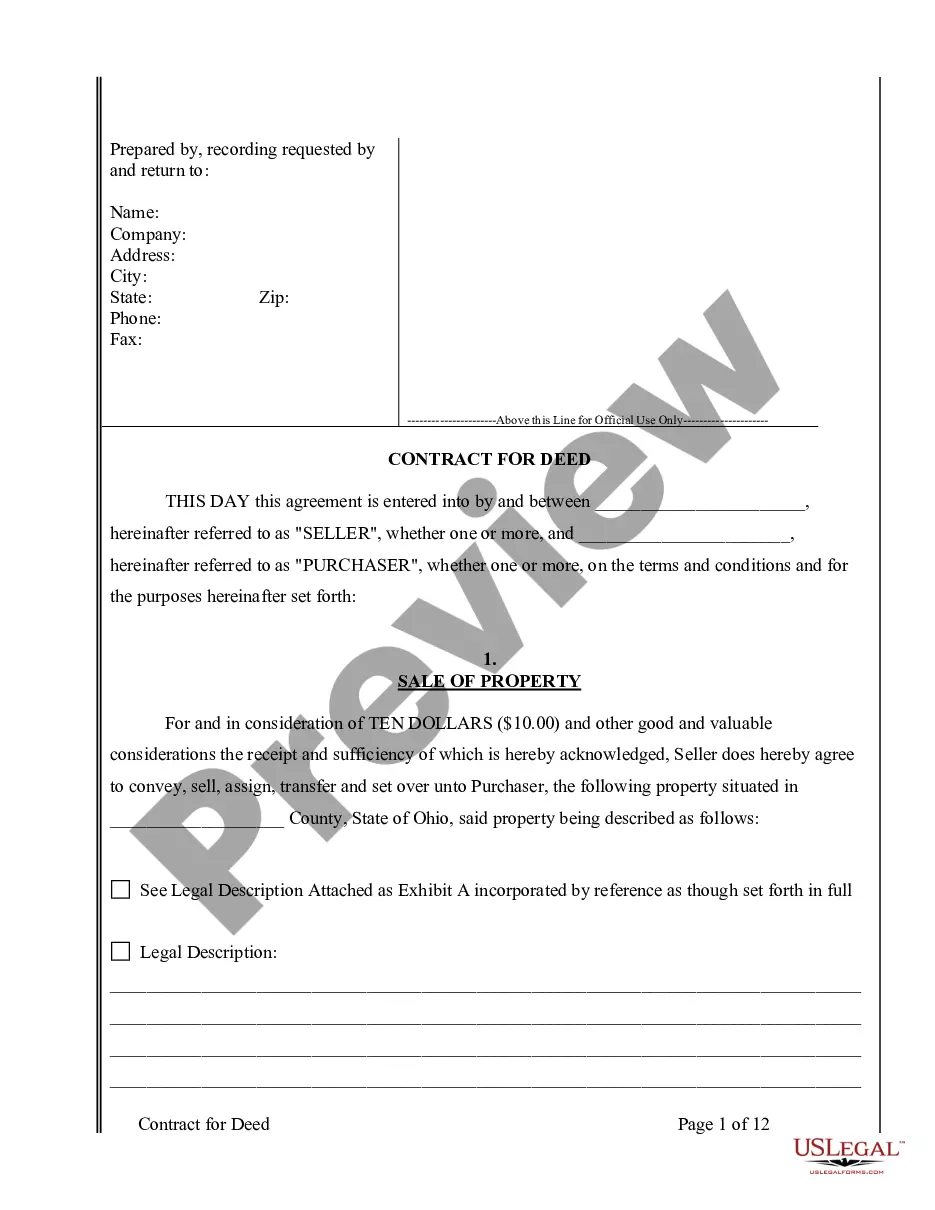

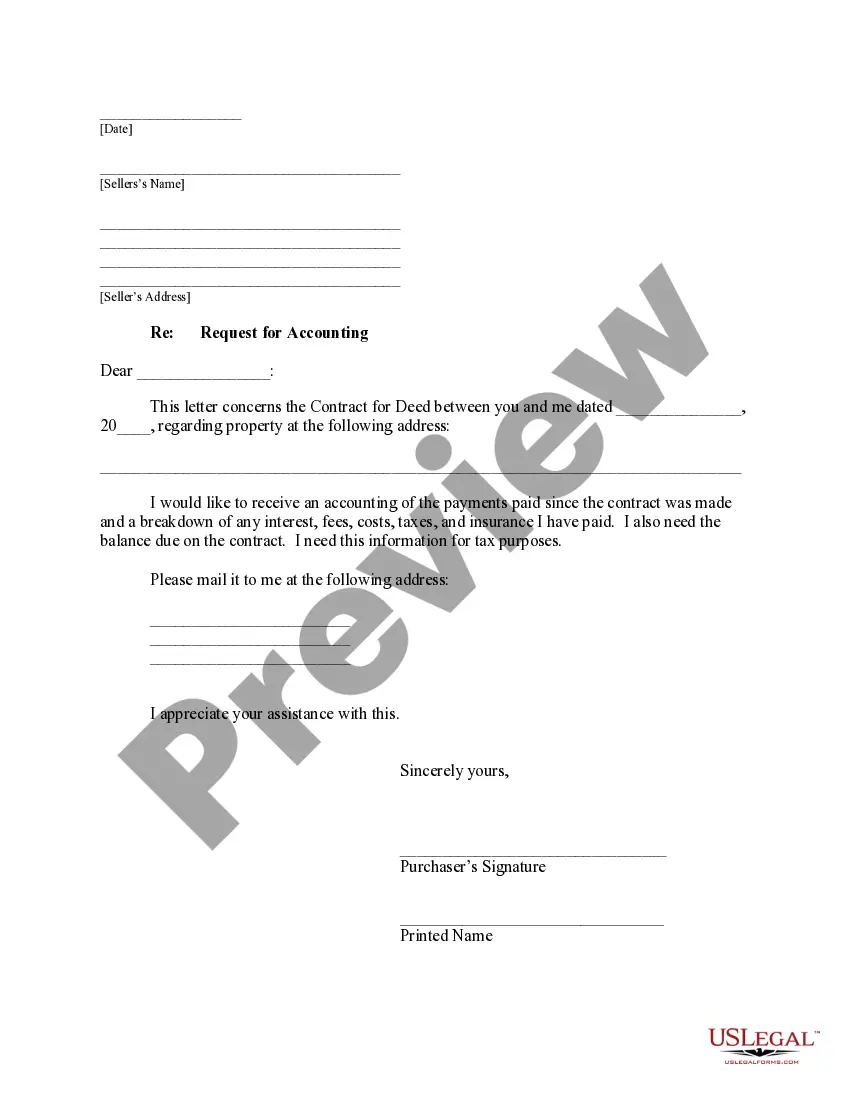

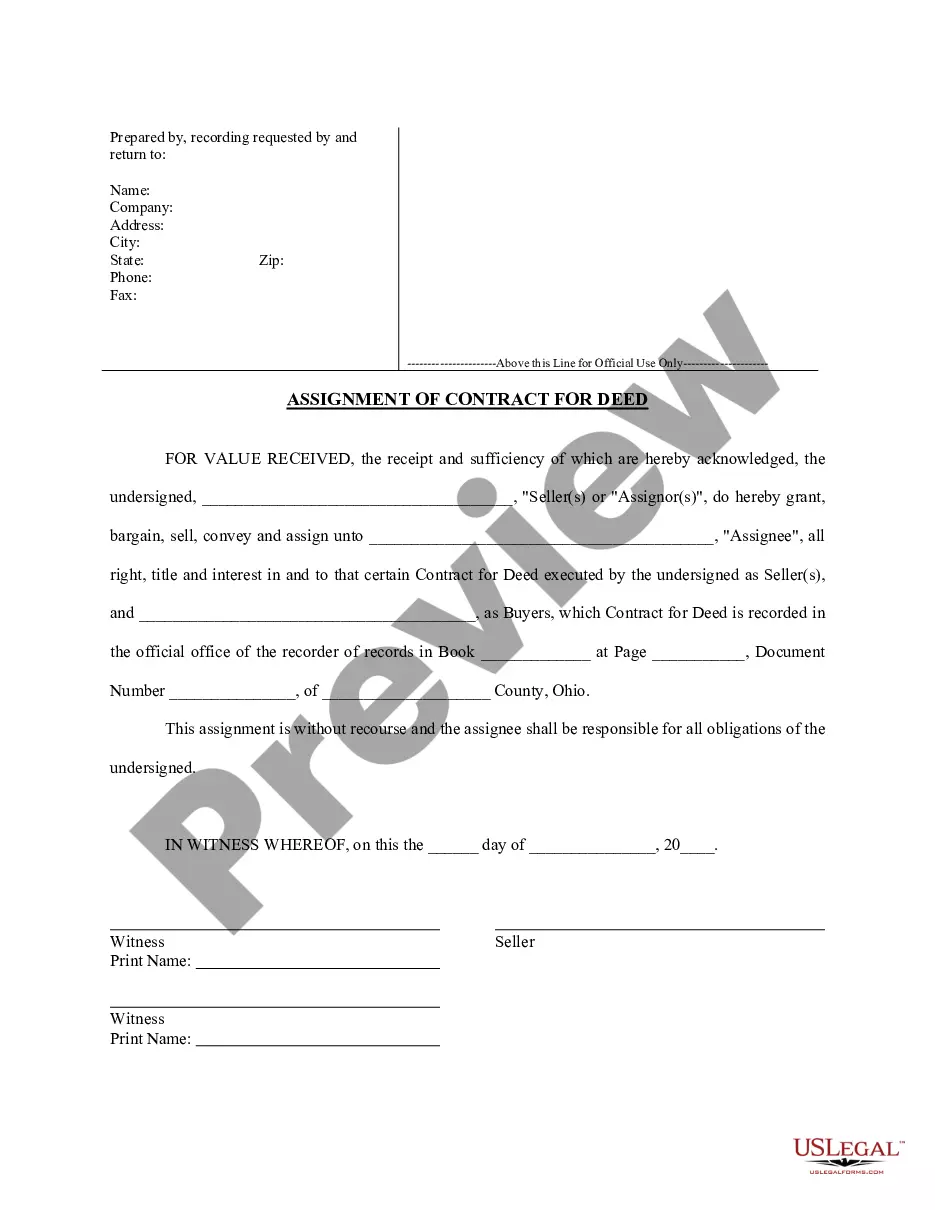

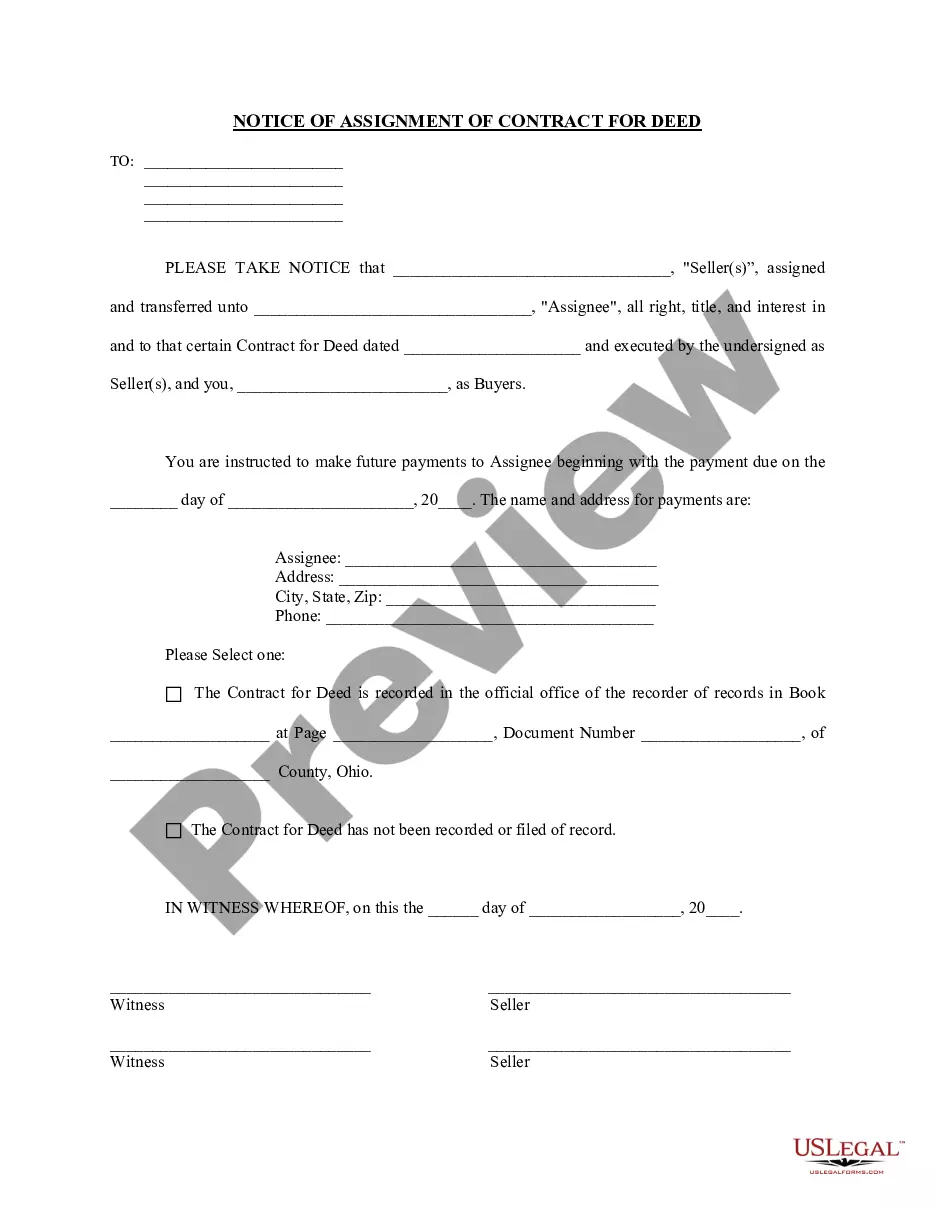

The Cincinnati Ohio Contract for Deed Seller's Annual Accounting Statement is a legally binding document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed agreement in Cincinnati, Ohio. This statement provides a detailed and thorough summary of the financial activities and the status of the contract throughout the year. In Cincinnati, Ohio, there are two common types of Contract for Deed Seller's Annual Accounting Statements: 1. Basic Annual Accounting Statement: This type of statement includes a comprehensive summary of all monetary transactions related to the contract for deed agreement. It contains details of the buyer's payments, any interest accrued, expenses incurred by the seller, and any outstanding balance. The statement also includes information about the property taxes, insurance premiums, repairs, and maintenance expenses. 2. Detailed Annual Accounting Statement: This type of statement provides a more extensive breakdown of the financial activities associated with the contract for deed agreement. It includes an itemized list of all payments made by the buyer, including principal, interest, and any additional charges. The detailed statement also highlights any deductions for property taxes, insurance, and maintenance. Moreover, it may include a section on escrow account transactions, if applicable. Keywords: Cincinnati Ohio, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, obligations, buyer, seller, agreement, summary, year, contract, Basic Annual Accounting Statement, monetary transactions, interest, expenses, outstanding balance, property taxes, insurance premiums, repairs, maintenance, Detailed Annual Accounting Statement, itemized list, payments, principal, charges, deductions, escrow account transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cincinnati Ohio Contrato de Escrituración Estado Contable Anual del Vendedor - Ohio Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Cincinnati Ohio Contrato De Escrituración Estado Contable Anual Del Vendedor?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for a person with no legal education to create such paperwork from scratch, mostly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform provides a huge catalog with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you want the Cincinnati Ohio Contract for Deed Seller's Annual Accounting Statement or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Cincinnati Ohio Contract for Deed Seller's Annual Accounting Statement quickly using our trusted platform. If you are presently a subscriber, you can proceed to log in to your account to download the needed form.

Nevertheless, if you are new to our platform, make sure to follow these steps prior to downloading the Cincinnati Ohio Contract for Deed Seller's Annual Accounting Statement:

- Be sure the template you have chosen is suitable for your location because the regulations of one state or county do not work for another state or county.

- Preview the form and go through a quick outline (if provided) of scenarios the document can be used for.

- If the form you selected doesn’t meet your requirements, you can start over and search for the suitable form.

- Click Buy now and pick the subscription option you prefer the best.

- with your credentials or register for one from scratch.

- Choose the payment gateway and proceed to download the Cincinnati Ohio Contract for Deed Seller's Annual Accounting Statement as soon as the payment is through.

You’re all set! Now you can proceed to print out the form or complete it online. In case you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.