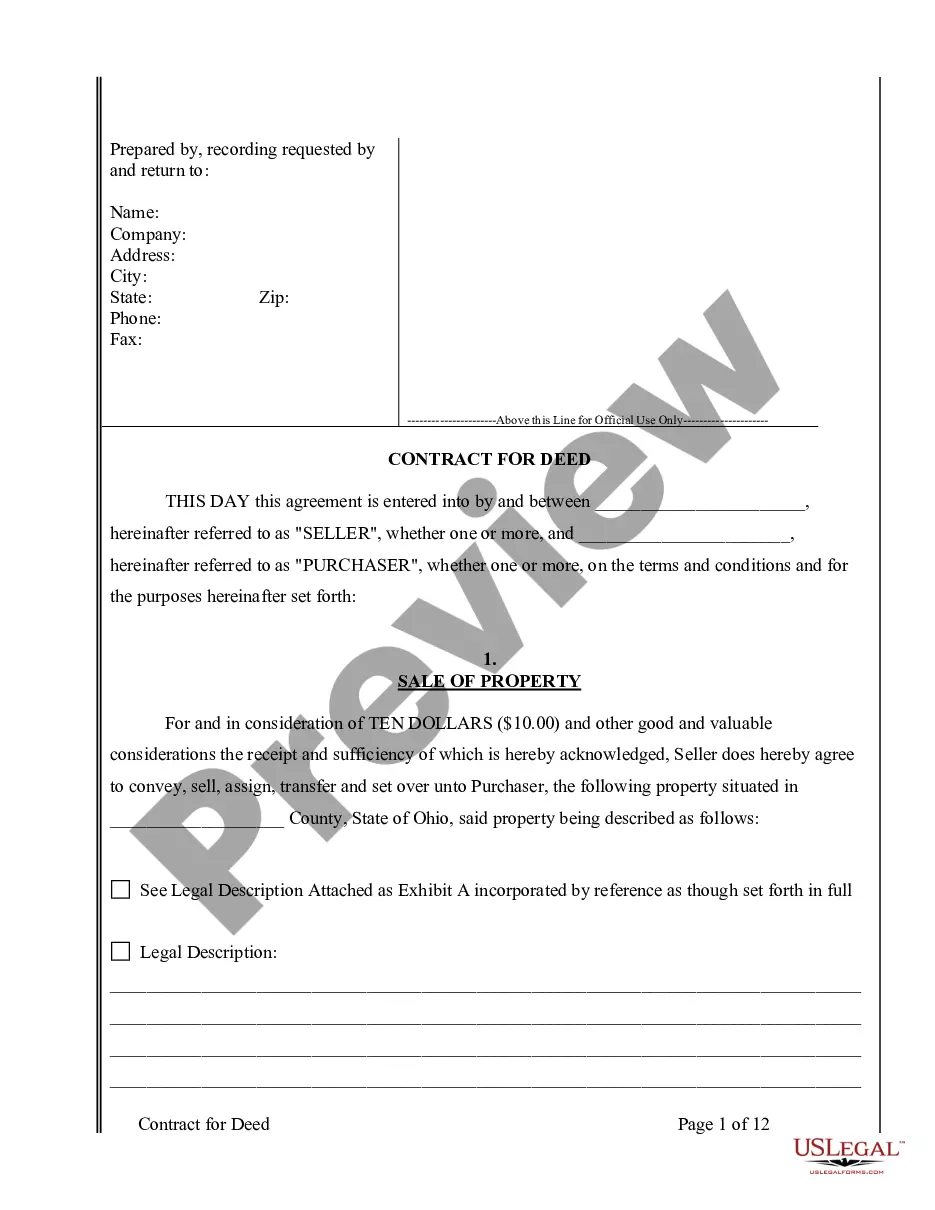

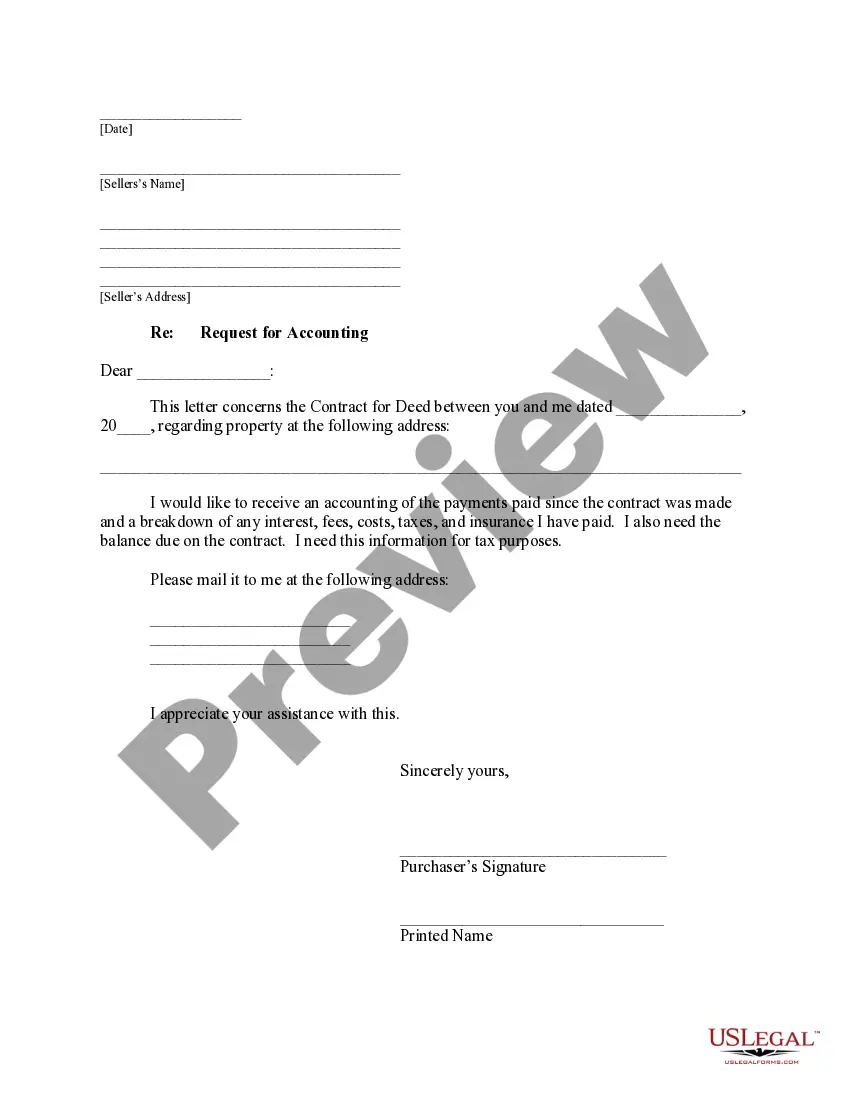

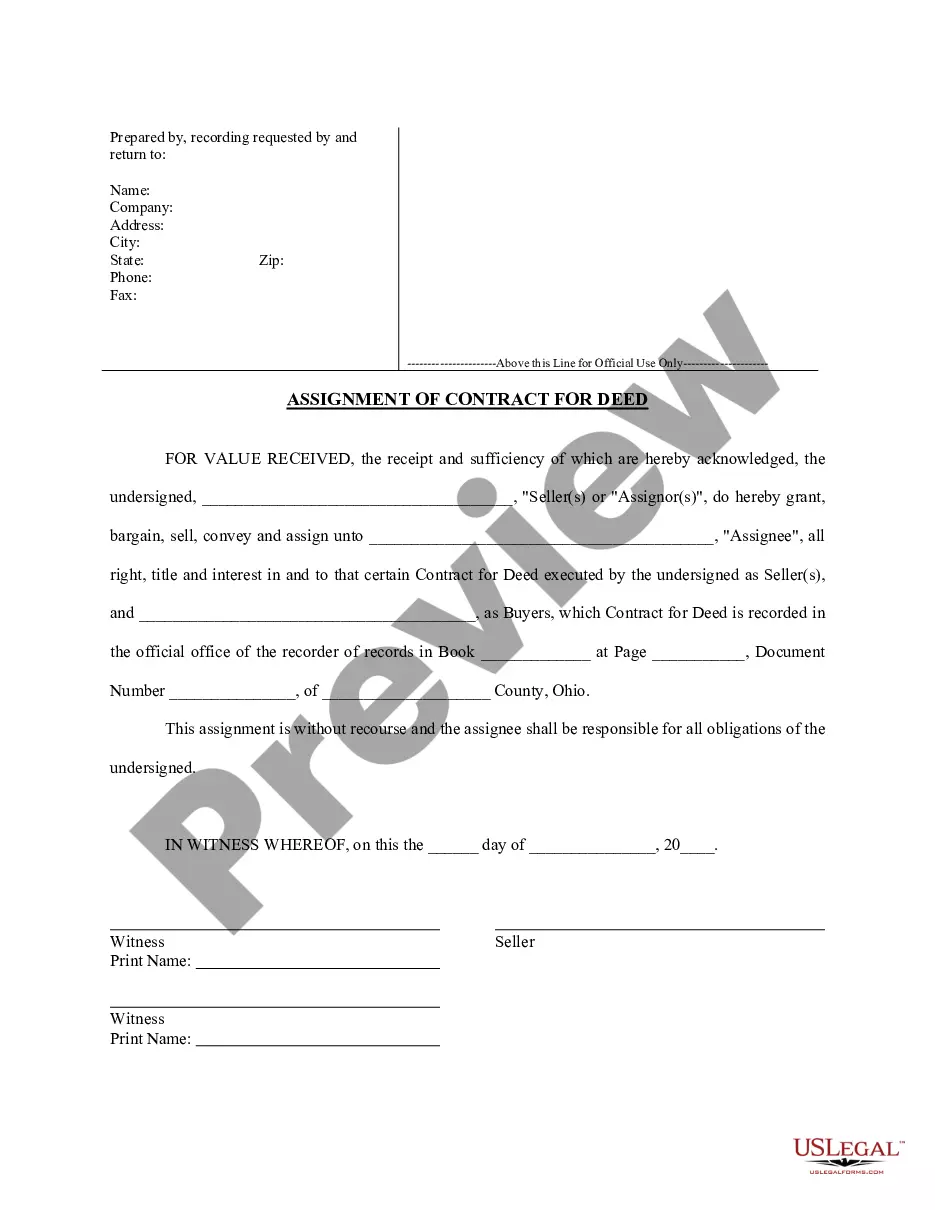

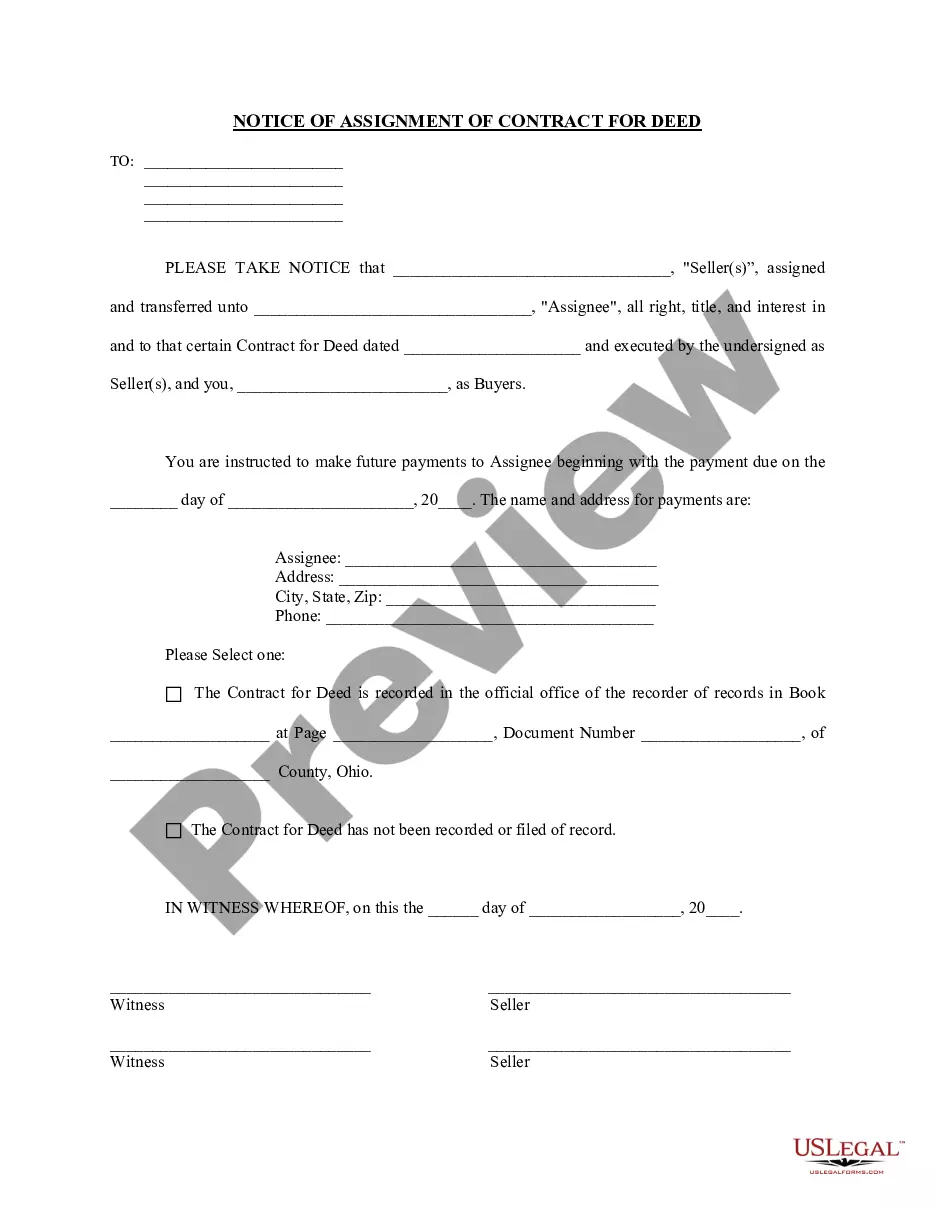

The Cuyahoga Ohio Contract for Deed Seller's Annual Accounting Statement is a crucial legal document that outlines the financial transactions and obligations between the seller and the buyer in a real estate contract for deed agreement. This statement acts as an official record of all income, expenses, and expenses related to the property in question throughout the year. In Cuyahoga County, Ohio, there are several types of Contract for Deed Seller's Annual Accounting Statements, each serving a specific purpose and tailored to different situations. These include: 1. Residential Property Accounting Statement: This type of statement is used when the contract for deed pertains to residential properties, such as single-family homes, townhouses, or condominiums. It details the income generated from the property, including rental payments, and itemizes the expenses incurred towards maintenance, repairs, property taxes, insurance, and other related costs. 2. Commercial Property Accounting Statement: This statement is specifically designed for contract for deed agreements involving commercial properties, such as office buildings, retail spaces, or warehouses. It accounts for the diverse income sources, such as rent, leases, or other business activities, and provides a comprehensive overview of the property's financial performance. Expenses such as utilities, property management fees, advertising costs, and repairs are also included. 3. Agricultural Property Accounting Statement: This statement applies to contract for deed agreements involving agricultural properties, including farms, ranches, or vineyards. It outlines the income generated from cash crops, livestock sales, or any other agricultural activities. Additionally, it includes expenses related to farm management, equipment maintenance, fertilizers, seeds, livestock feed, and other agricultural inputs. Regardless of the specific type, the Cuyahoga Ohio Contract for Deed Seller's Annual Accounting Statement is important for both the seller and the buyer to maintain transparency and ensure compliance with the contract terms. It enables the seller to account for the financial aspects of the property and provides the buyer with an accurate record of their financial commitments and rights. By regularly reviewing and preparing this statement, the parties involved can track the financial progress of the contract for deed agreement, address any discrepancies, and ensure a fair and transparent relationship throughout the contract term.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Contrato de Escrituración Estado Contable Anual del Vendedor - Ohio Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Cuyahoga Ohio Contrato De Escrituración Estado Contable Anual Del Vendedor?

If you are looking for a relevant form, it’s difficult to choose a more convenient platform than the US Legal Forms site – probably the most extensive online libraries. Here you can find a huge number of form samples for company and personal purposes by categories and states, or keywords. Using our advanced search feature, getting the latest Cuyahoga Ohio Contract for Deed Seller's Annual Accounting Statement is as elementary as 1-2-3. In addition, the relevance of each and every record is verified by a team of expert lawyers that on a regular basis review the templates on our platform and revise them according to the newest state and county laws.

If you already know about our system and have a registered account, all you should do to get the Cuyahoga Ohio Contract for Deed Seller's Annual Accounting Statement is to log in to your user profile and click the Download button.

If you utilize US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have chosen the form you want. Check its information and make use of the Preview feature (if available) to check its content. If it doesn’t meet your needs, use the Search field at the top of the screen to find the appropriate document.

- Confirm your selection. Choose the Buy now button. Following that, pick your preferred subscription plan and provide credentials to sign up for an account.

- Process the purchase. Make use of your credit card or PayPal account to finish the registration procedure.

- Get the template. Pick the format and download it to your system.

- Make changes. Fill out, revise, print, and sign the obtained Cuyahoga Ohio Contract for Deed Seller's Annual Accounting Statement.

Every single template you add to your user profile does not have an expiry date and is yours permanently. You always have the ability to gain access to them via the My Forms menu, so if you want to have an extra duplicate for editing or printing, feel free to come back and save it once more anytime.

Take advantage of the US Legal Forms professional catalogue to gain access to the Cuyahoga Ohio Contract for Deed Seller's Annual Accounting Statement you were looking for and a huge number of other professional and state-specific samples in a single place!