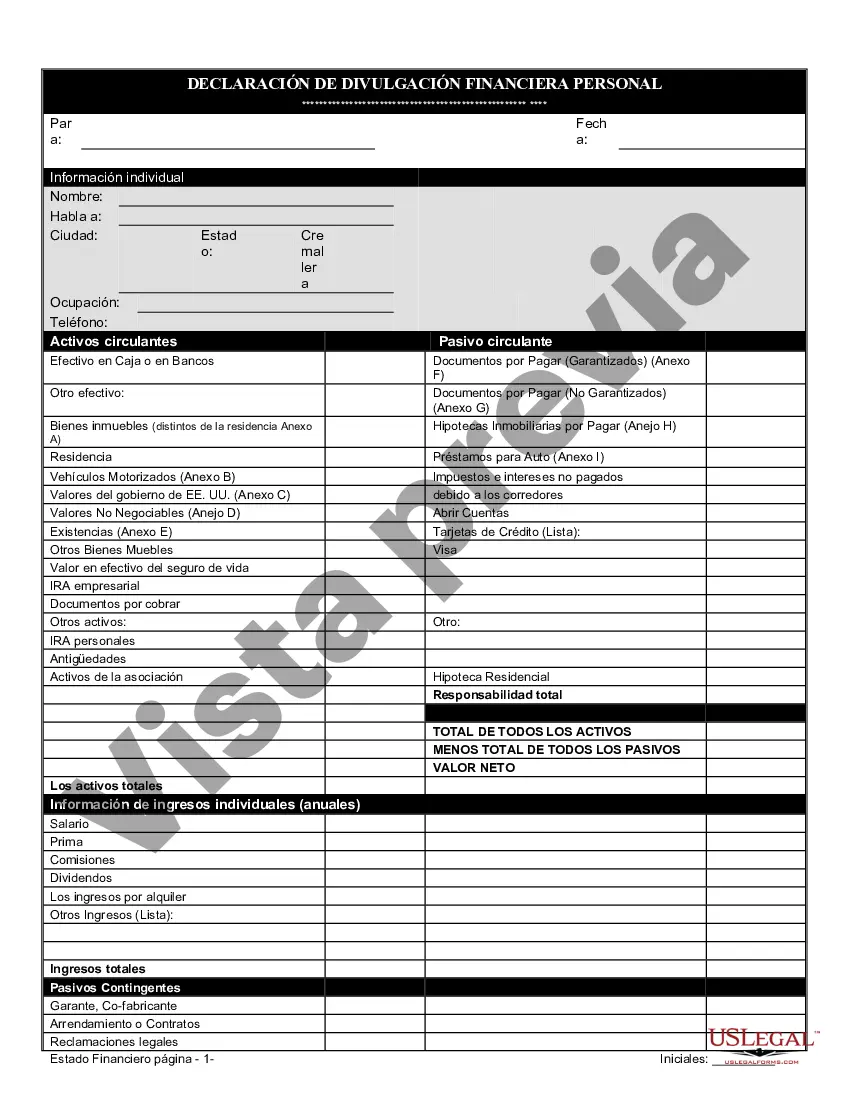

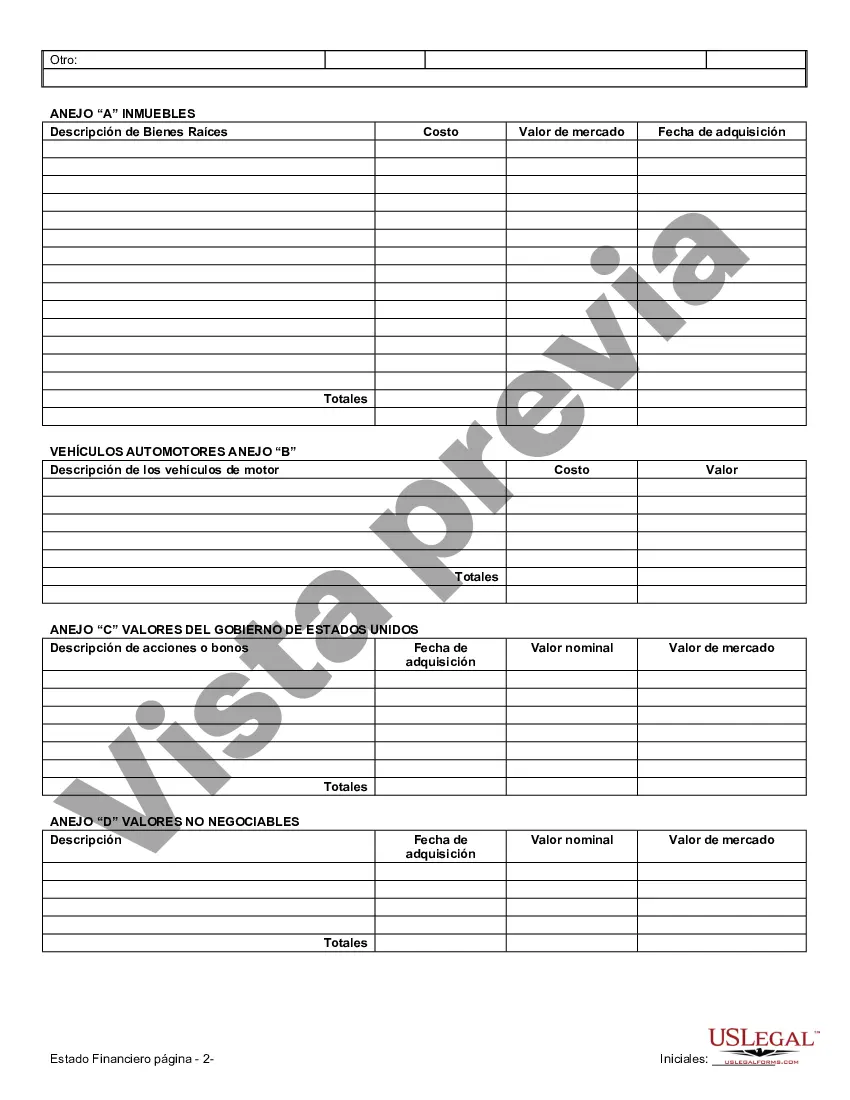

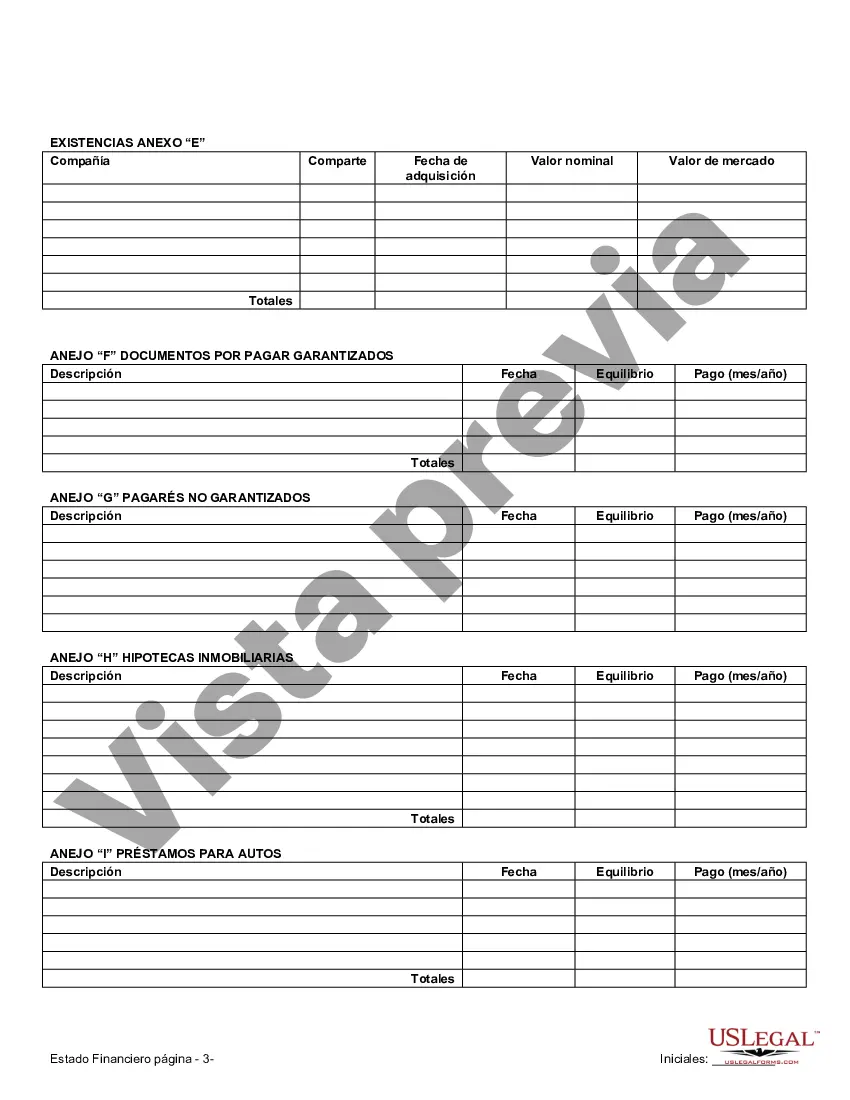

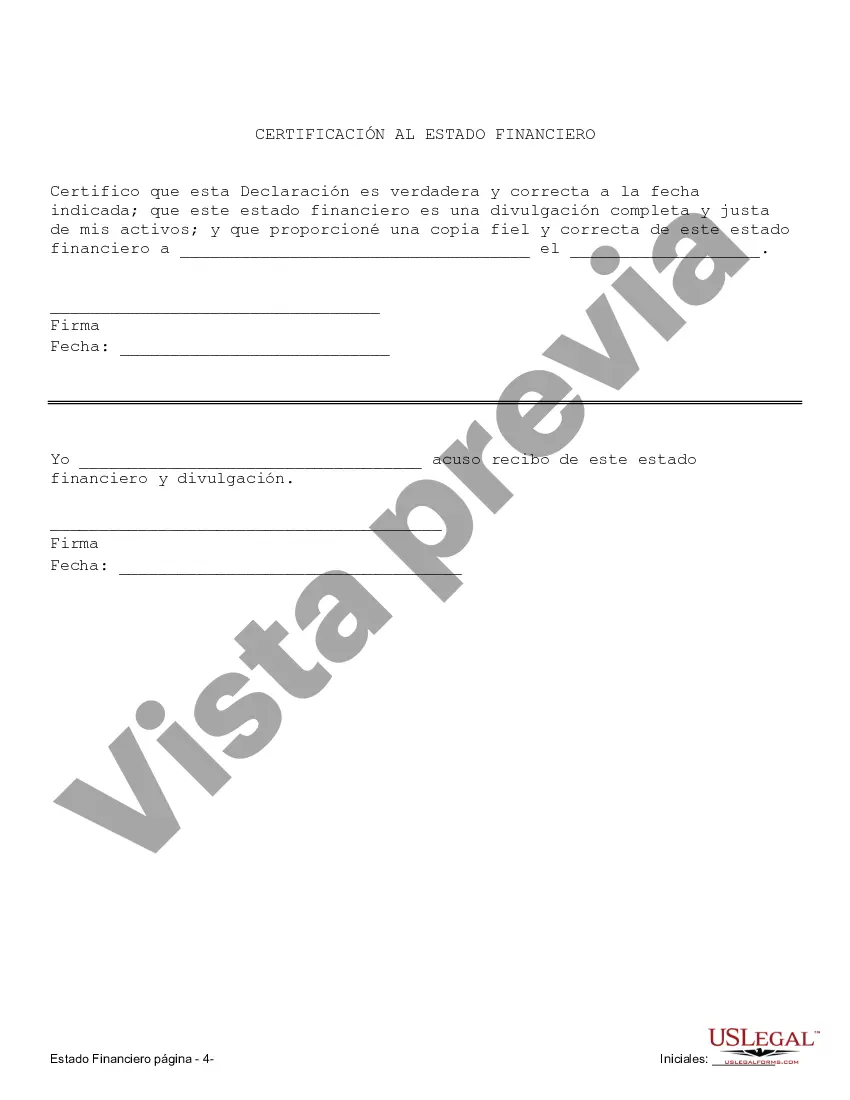

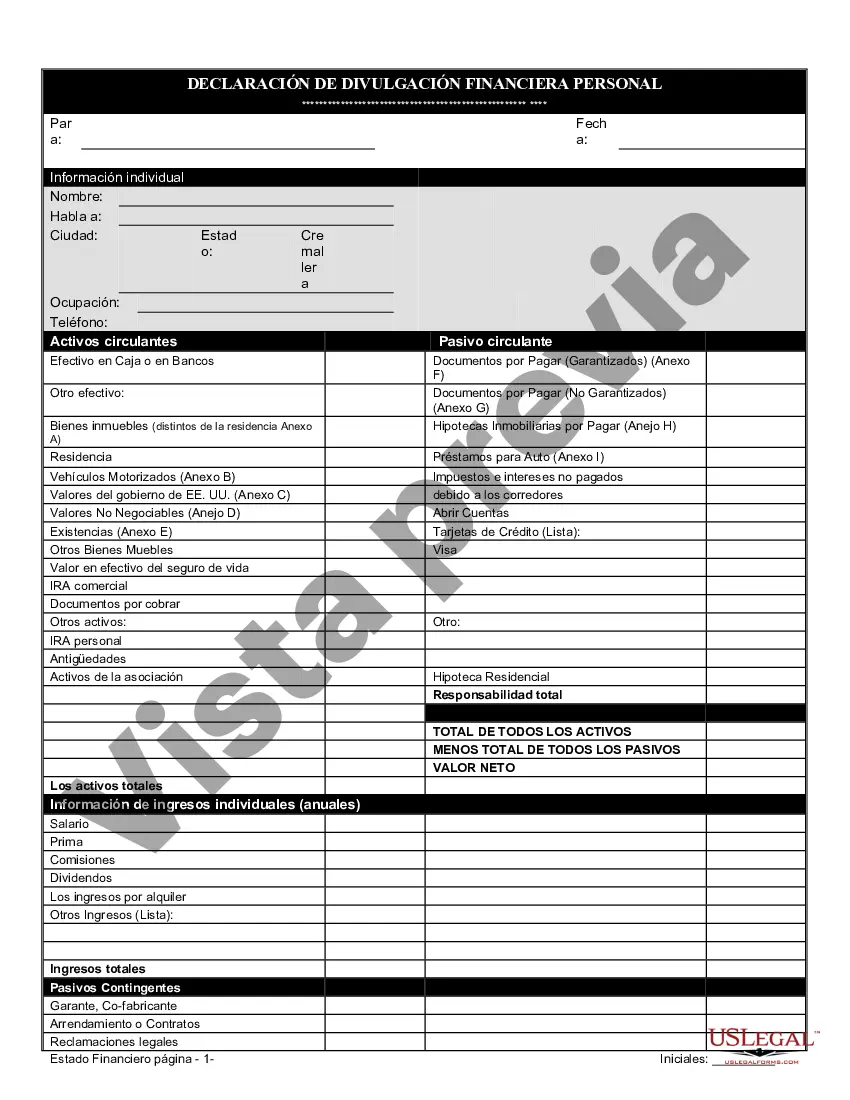

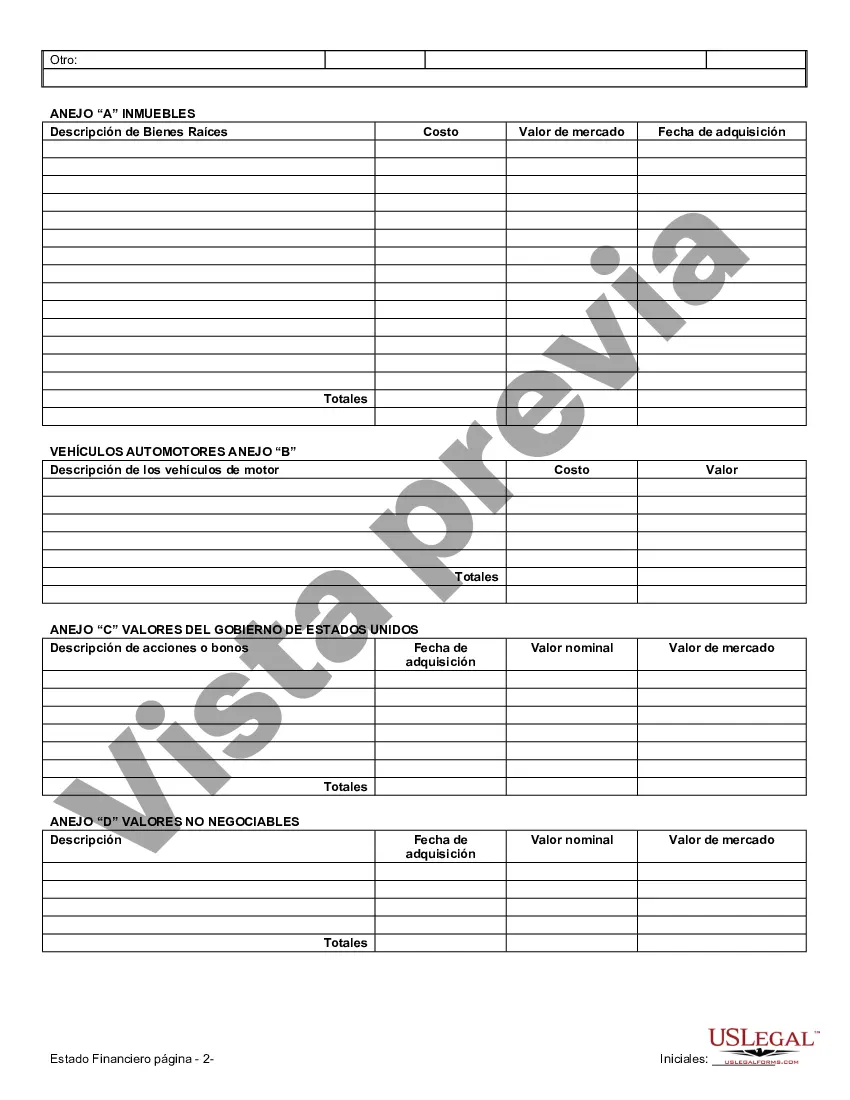

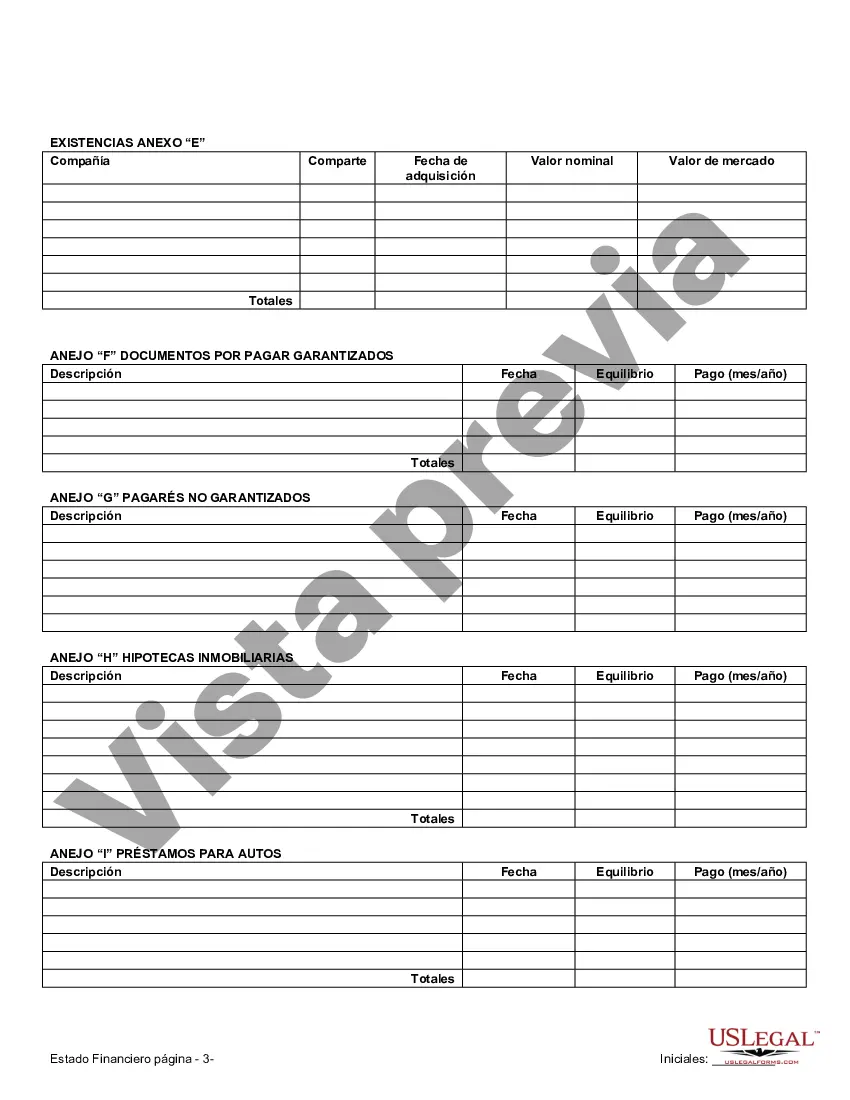

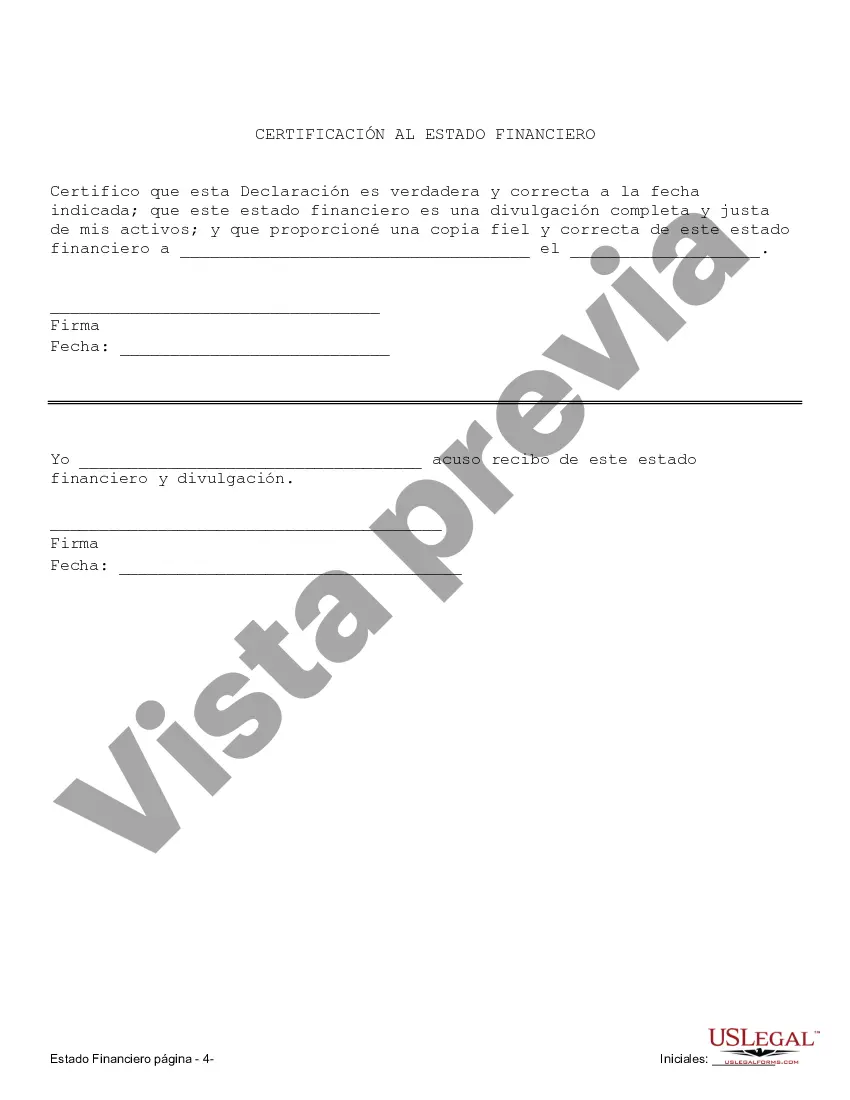

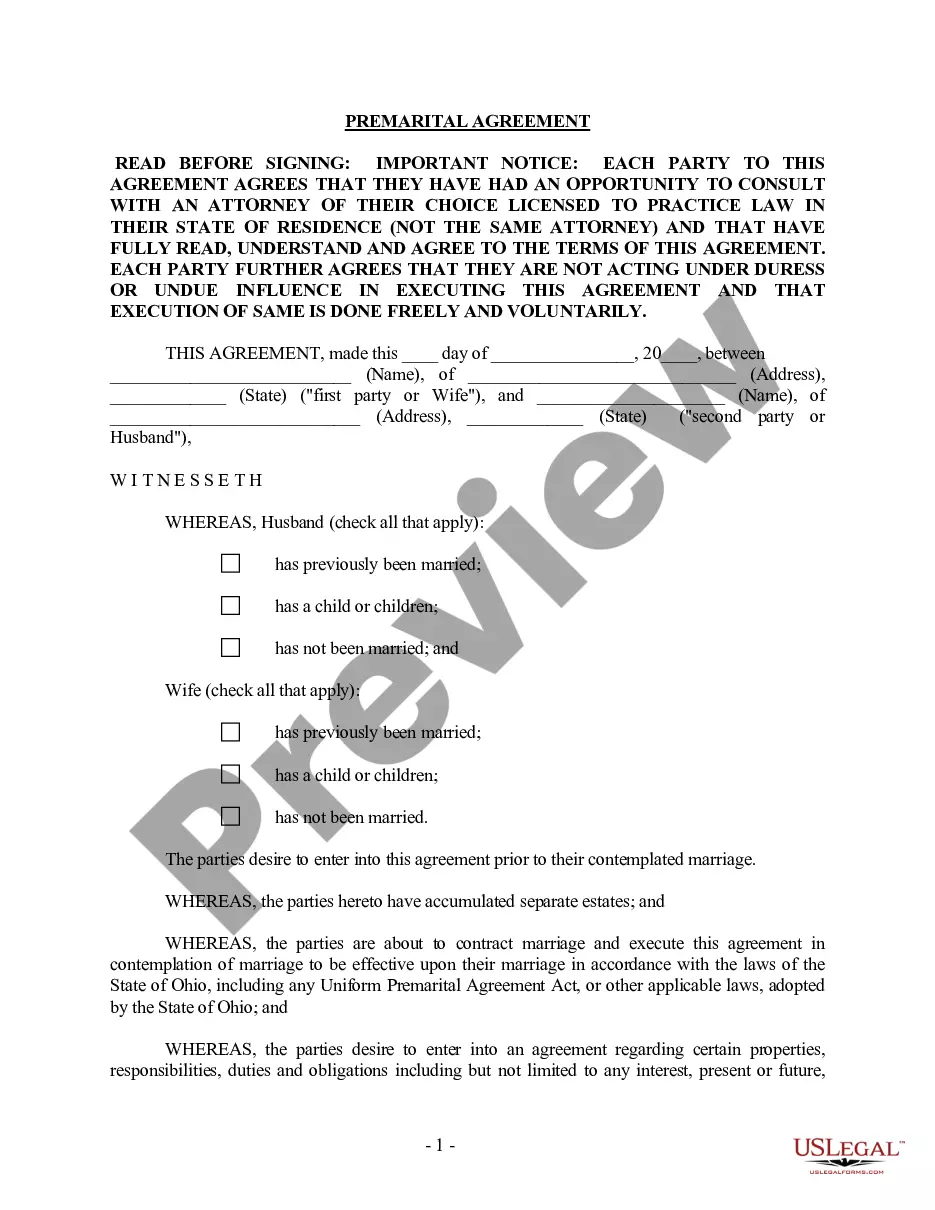

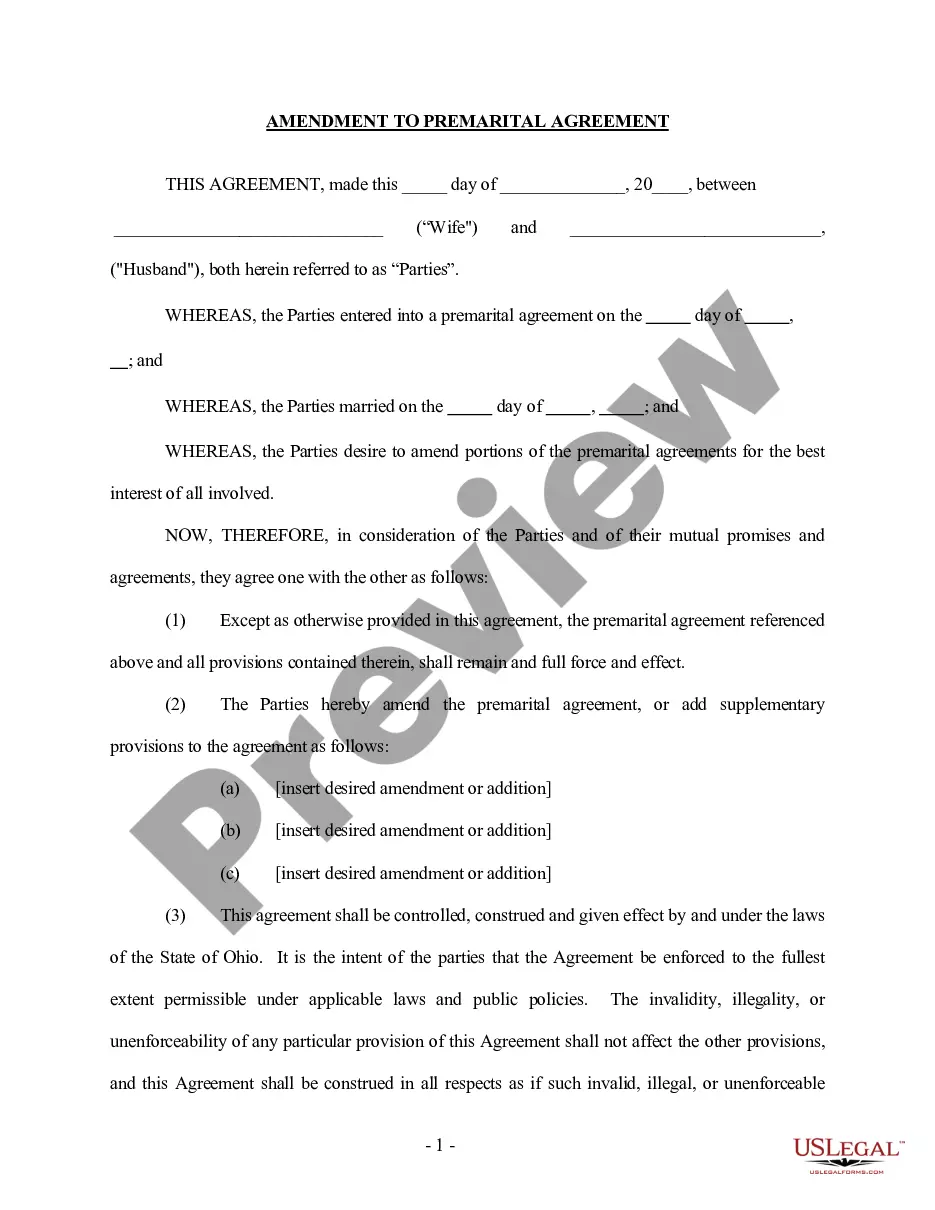

Columbus Ohio Financial Statements in connection with a prenuptial or premarital agreement refer to the comprehensive financial documents and reports required by individuals entering into a legal contract before their marriage. These statements aim to disclose the financial status, assets, liabilities, income, and debts of each party, ensuring full financial transparency between the spouses-to-be. When preparing a prenuptial agreement, the financial statements of both parties play a crucial role in determining the division of assets, debts, alimony, and other financial matters in case of divorce, separation, or death. These statements provide an accurate picture of each individual's financial standing, aiding in fair and equitable decision-making during the negotiation process. In Columbus, Ohio, there might be different types of financial statements used in connection with a prenuptial or premarital agreement, such as: 1. Personal Balance Sheet: This statement presents the individual's assets, including property, investments, bank accounts, retirement accounts, vehicles, and personal belongings, as well as their liabilities, such as mortgages, loans, and credit card debt. It offers a snapshot of one's net worth. 2. Income Statement: This statement showcases the individual's sources of income, including employment salaries, business profits, dividends, rental income, royalties, pensions, and any other means of earning. It also highlights expenses and financial commitments, helping to determine the financial contributions and potential maintenance obligations of each party. 3. Tax Returns: Individuals may be required to provide copies of their recent tax returns for a specific number of years. These documents substantiate the income declared, provide a record of previous financial dealings, and help gauge the taxable implications of certain assets. 4. Bank Statements: Providing bank statements demonstrates an individual's financial activities, account balances, and transactional history. It helps evaluate cash flow, spending patterns, and provides evidence for any financial claims made. 5. Investment Statements: Individuals may need to disclose their investment portfolios, including stocks, bonds, mutual funds, real estate portfolios, or any other investment holdings. These statements provide insight into the value, growth, and potential income derived from these investments. 6. Business Statements: If either party owns a business, financial statements related to the business, such as profit and loss statements, balance sheets, and cash flow statements, may be necessary to assess the business's value and potential income. It is essential to compile accurate and up-to-date financial statements as inconsistencies or incomplete information may potentially invalidate the prenuptial or premarital agreement. Seeking professional advice from lawyers or financial advisors experienced in family law and prenuptial agreements can help ensure compliance with Columbus, Ohio's requirements and guarantee the effectiveness of the financial statements in the legal context.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Columbus Ohio Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Columbus Ohio Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person with no law background to create such papers from scratch, mainly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our platform provides a huge collection with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Columbus Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Columbus Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement in minutes using our trustworthy platform. In case you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

However, in case you are new to our library, make sure to follow these steps before downloading the Columbus Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement:

- Be sure the form you have chosen is suitable for your area considering that the rules of one state or area do not work for another state or area.

- Preview the form and go through a brief outline (if provided) of cases the document can be used for.

- In case the form you picked doesn’t meet your needs, you can start again and search for the necessary form.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Columbus Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement as soon as the payment is done.

You’re all set! Now you can proceed to print out the form or complete it online. Should you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.